There are no uniform rules or formulae to determine the working capital requirements in a firm. ....

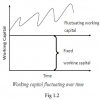

Working capital can be divided into two categories on the basis of time:....

There are two concepts of working capital namely Gross concepts and Net concepts: ....

Out of the two types of investments, investing in the current operations of the business is more difficult and is a continuous process with more compo....

Effective financial management is concerned with the efficient use of important economic resources, namely, capital funds. ....

Dividends have greater tax consequences than capital gains. Investors in high tax brackets may prefer capital gains, and thus a low payout ratio, to d....

Gordon, Myron, J’s model explicitly relates the market value of the firm to its dividend policy. It is based on the following hypotheses....

Prof. James E. Walter argues that the choice of dividend policies almost always affect the value of the firm. His model is based on the following assu....

Myron Gordon and John Lintner have argued that shareholders are generally risk averse and prefer a dividend today to the promise of the greater divide....

The M&M dividend irrelevance theory assumes that all investors have the same information regarding the firm’s future earnings. ....

A firm operating in a perfect or ideal capital market conditions, may many times face the following dilemmas with regard to payment of dividends....

One of the schools of thought, the residual theory, suggests that the dividend paid by a firm is viewed as a residual, i.e. the amount remaining or le....

According to the traditional theory put forward by Graham and Dodd, the capital market attaches considerable importance on dividends rather than on re....

Every year or half year or quarterly or on chosen special occasions, the Board of Directors of the firm will first meet and recommend on the quantum o....

Normally, a firm would be using its dividend policy to pursue its objective of maximizing its shareholders’ return so that the value of their invest....

Regular cash dividend – cash payments made directly to shareholders, usually every year. ....

Normally all countries prohibit companies from paying out as cash dividends any portion of the firm’s legal capital, which is measured by the par va....

Dividend policy and decision are critical and crucial areas of management. ....