Home | ARTS | Financial Management

|

What is the form in which dividends are paid? - DIVIDEND POLICIES

Financial Management - DIVIDEND POLICIES

What is the form in which dividends are paid? - DIVIDEND POLICIES

Posted On :

Regular cash dividend – cash payments made directly to shareholders, usually every year.

What is the form in which dividends are paid?

1. Regular cash dividend – cash payments made directly to shareholders, usually every year. If more than one dividend payment is made during a year, it will be normally referred to as interim dividends. The total dividend therefore would be the sum of such interim dividends and final dividend if any.

2. Extra cash dividend – indication that the “extra” amount may not be repeated in the future. For example, the firm may earn a bumper profit in a particular year and the firm may decide to declare extra cash dividend over and above the normal dividends.

3. Special cash dividend – similar to extra dividend, but definitely won’t be repeated. Some companies have declared such special dividends on the occasion of their silver or golden jubilee.

4. Liquidating dividend – some or all of the business has been sold. This will be a payout in lieu of the original investment made by the shareholders in case the firm is voluntarily decides to close its operation or if it is compelled by stakeholders other than equity shareholders. Such liquidating dividend may be paid in one lump sum or in stages, depending on the recovery of the free assets of the firm in stages.

Instead of declaring cash dividends, the firm may decide to issue additional shares of stock free of payment to the shareholders. In this, the firm’s number of outstanding shares would be increasing. In the case of cash dividends, the firm may not be able to recycle such earnings in its business. However, in the case of these stock dividends, such earnings are retained in the business. By this, the shareholders can expect to get increased earnings in the future years. This stock dividend is popularly known as bonus issue of shares in India. If such bonus issues are in the range or ratio up to 1:5 (a maximum of 20%), i.e. one share for every five shares held, it is treated as small stock dividend. In case the stock dividend exceeds 20%, then it is called large stock dividend.

Let us examine this with an example

If a firm declares 1:10 (10%) bonus, i.e. one share for every ten shares held, If the initial balance sheet was

Following are some of the facts in the share dividends (bonus shares or issues)

1. shareholders’ funds remain unaffected (prior to the bonus issue, the earnings were in the reserves and surplus account and after the bonus issue, the face value of the bonus shares issued is transferred from the reserves and surplus account to share issued account – virtually no change in the shareholders funds)

2. it is costly (the firm has to make certain statutory payments like stamp duty, exchange fees, etc on the bonus share issued and naturally they will have to be paid out of the earnings of the firm only)

From shareholders’ perspective, a stock split has the same effect as a stock dividend. From the firm’s perspective, the change in the balance sheet will be different. A three-for-two stock split, for example, corresponds to a 50% stock dividend. A 10% stock dividend is then equivalent to a eleven-for-ten stock split.

Share repurchase is also otherwise known as repurchase of its own shares by a firm. Only recently the share repurchase by firms in India was permitted under Section 77 of the Indian Companies Act. The following conditions are to be adhered by Indian firms in case they decide to pursue share repurchase option

1. a firm buying back its own shares will not issue fresh capital, except bonus issue, for the next one year

2. the firm will state the amount to be used for the buyback of shares and seek prior approval of the shareholders

3. the buyback of the shares can be effected only by utilizing the free reserves, i.e. reserves not specifically earmarked for some other purpose or provision

4. the firm will not borrow funds to buyback shares

5. the shares bought under the buyback schemes will have to be extinguished and they cannot be reissued

There are several justifications for share repurchase. A repurchase often represents a worth while investment proposition for the company. When companies purchase their own stock, they often find it easy to acquire more value than the value invested for the purchase. Stock repurchase can check extravagant managerial tendencies. Companies having surplus cash may expand or diversity un-economically. Prudent managements recognize and check their tendencies to waste cash. Stock markets appreciate these repurchase decisions with an increase in the share prices. Through such repurchases, the management can demonstrate its commitment to enhance shareholder value.

Share prices tend to fluctuate a great deal in response to changing market conditions and periodic boom and bust conditions. If a company were to repurchase its shares when the market price looks depressed to

Such repurchases result in capital gains for the investors and these capital gains are taxed at a lower rate when compared with dividend distribution

The share repurchases can be used as an instrument to increase the insider control in the companies. Normally insiders do not tender their shares when a company decides to share repurchase. They end up holding a larger proportion of the reduced equity of the company and thereby have greater control

Repurchase announcements are viewed as positive signals by investors. Stockholders have a choice when a firm repurchases stocks: They can sell or not sell. Dividends are sticky in the short-run because reducing them may negatively affect the stock price. Extra cash may then be distributed through stock repurchases.

Stockholders may not be indifferent between dividends and capital gains. The selling stockholders may not be fully aware of all the implications of a repurchase. The corporation may pay too much for the repurchased stocks.

Some companies offer DRIPs, whereby shareholders can use the dividend received to purchase additional shares (even fractional) of the company without brokerage cost. These companies that offer DRIPs also offer share repurchase plans (SRP), which allow shareholders to make optional cash contributions that are eventually used to purchase shares. Though this practice is not in vogue in India, in developed countries this is very common. However, we can find another variant to this ‘dividend reinvestment plans’ in the mutual funds sector. Some of the mutual funds offer growth plans through such ‘dividend reinvestment plans’

1. Cash dividend

1. Regular cash dividend – cash payments made directly to shareholders, usually every year. If more than one dividend payment is made during a year, it will be normally referred to as interim dividends. The total dividend therefore would be the sum of such interim dividends and final dividend if any.

2. Extra cash dividend – indication that the “extra” amount may not be repeated in the future. For example, the firm may earn a bumper profit in a particular year and the firm may decide to declare extra cash dividend over and above the normal dividends.

3. Special cash dividend – similar to extra dividend, but definitely won’t be repeated. Some companies have declared such special dividends on the occasion of their silver or golden jubilee.

4. Liquidating dividend – some or all of the business has been sold. This will be a payout in lieu of the original investment made by the shareholders in case the firm is voluntarily decides to close its operation or if it is compelled by stakeholders other than equity shareholders. Such liquidating dividend may be paid in one lump sum or in stages, depending on the recovery of the free assets of the firm in stages.

2. Share Dividends

Instead of declaring cash dividends, the firm may decide to issue additional shares of stock free of payment to the shareholders. In this, the firm’s number of outstanding shares would be increasing. In the case of cash dividends, the firm may not be able to recycle such earnings in its business. However, in the case of these stock dividends, such earnings are retained in the business. By this, the shareholders can expect to get increased earnings in the future years. This stock dividend is popularly known as bonus issue of shares in India. If such bonus issues are in the range or ratio up to 1:5 (a maximum of 20%), i.e. one share for every five shares held, it is treated as small stock dividend. In case the stock dividend exceeds 20%, then it is called large stock dividend.

Let us examine this with an example

If a firm declares 1:10 (10%) bonus, i.e. one share for every ten shares held, If the initial balance sheet was

Common

stock (100,000 shares) | 1000,000 |

Retained

Earnings | 800,000 |

Total

Equity | 1,800,000 |

After

the bonus issue, the new balance sheet would be | |

Common

stock (110,000 shares) | 1100,000 |

Retained

Earnings | 700,000 |

Total

Equity | 1,800,000 |

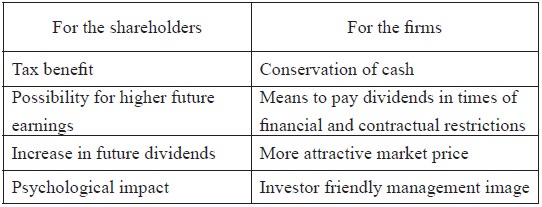

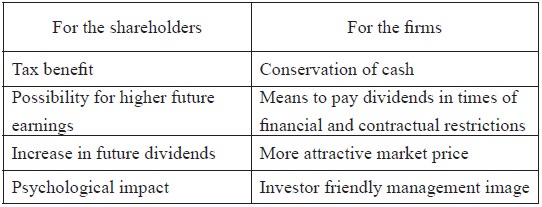

Advantages

of share dividends |

|

Following are some of the facts in the share dividends (bonus shares or issues)

1. shareholders’ funds remain unaffected (prior to the bonus issue, the earnings were in the reserves and surplus account and after the bonus issue, the face value of the bonus shares issued is transferred from the reserves and surplus account to share issued account – virtually no change in the shareholders funds)

2. it is costly (the firm has to make certain statutory payments like stamp duty, exchange fees, etc on the bonus share issued and naturally they will have to be paid out of the earnings of the firm only)

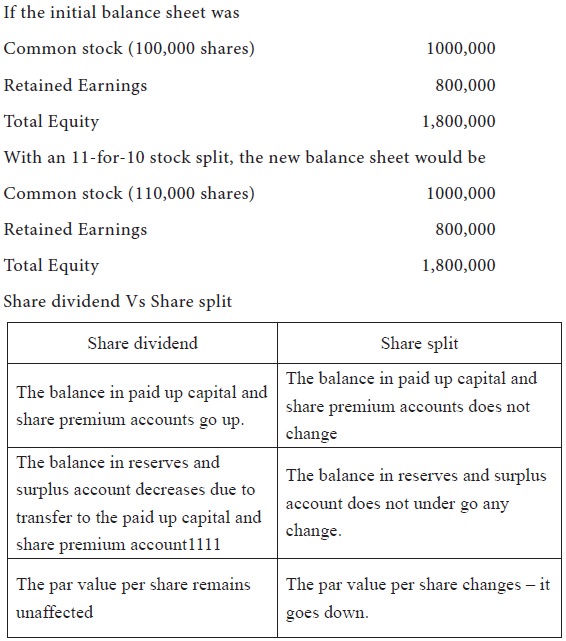

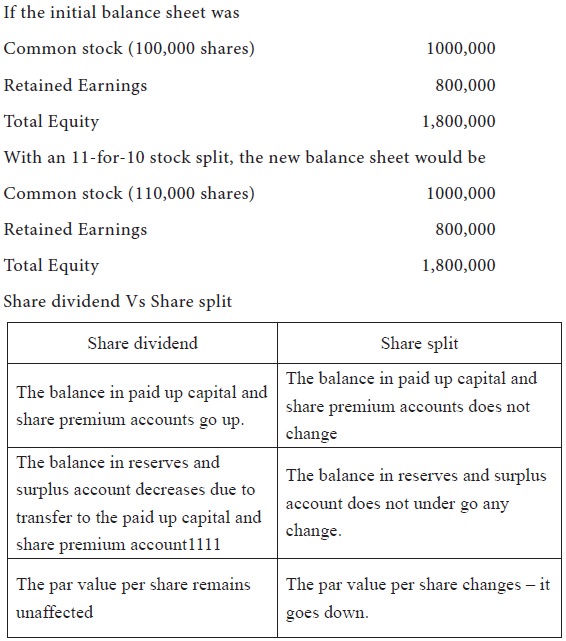

3. Stock split

From shareholders’ perspective, a stock split has the same effect as a stock dividend. From the firm’s perspective, the change in the balance sheet will be different. A three-for-two stock split, for example, corresponds to a 50% stock dividend. A 10% stock dividend is then equivalent to a eleven-for-ten stock split.

However, in both cases – share

dividend and share split – the total value of the shareholders’ funds remains

unaffected.

4. Share repurchase

Share repurchase is also otherwise known as repurchase of its own shares by a firm. Only recently the share repurchase by firms in India was permitted under Section 77 of the Indian Companies Act. The following conditions are to be adhered by Indian firms in case they decide to pursue share repurchase option

1. a firm buying back its own shares will not issue fresh capital, except bonus issue, for the next one year

2. the firm will state the amount to be used for the buyback of shares and seek prior approval of the shareholders

3. the buyback of the shares can be effected only by utilizing the free reserves, i.e. reserves not specifically earmarked for some other purpose or provision

4. the firm will not borrow funds to buyback shares

5. the shares bought under the buyback schemes will have to be extinguished and they cannot be reissued

Rationale

There are several justifications for share repurchase. A repurchase often represents a worth while investment proposition for the company. When companies purchase their own stock, they often find it easy to acquire more value than the value invested for the purchase. Stock repurchase can check extravagant managerial tendencies. Companies having surplus cash may expand or diversity un-economically. Prudent managements recognize and check their tendencies to waste cash. Stock markets appreciate these repurchase decisions with an increase in the share prices. Through such repurchases, the management can demonstrate its commitment to enhance shareholder value.

Price stability

Share prices tend to fluctuate a great deal in response to changing market conditions and periodic boom and bust conditions. If a company were to repurchase its shares when the market price looks depressed to

Tax advantage

Such repurchases result in capital gains for the investors and these capital gains are taxed at a lower rate when compared with dividend distribution

Management control

The share repurchases can be used as an instrument to increase the insider control in the companies. Normally insiders do not tender their shares when a company decides to share repurchase. They end up holding a larger proportion of the reduced equity of the company and thereby have greater control

Advantages

Repurchase announcements are viewed as positive signals by investors. Stockholders have a choice when a firm repurchases stocks: They can sell or not sell. Dividends are sticky in the short-run because reducing them may negatively affect the stock price. Extra cash may then be distributed through stock repurchases.

Disadvantages

Stockholders may not be indifferent between dividends and capital gains. The selling stockholders may not be fully aware of all the implications of a repurchase. The corporation may pay too much for the repurchased stocks.

5. Dividend Reinvestment Plans (DRIPs)

Some companies offer DRIPs, whereby shareholders can use the dividend received to purchase additional shares (even fractional) of the company without brokerage cost. These companies that offer DRIPs also offer share repurchase plans (SRP), which allow shareholders to make optional cash contributions that are eventually used to purchase shares. Though this practice is not in vogue in India, in developed countries this is very common. However, we can find another variant to this ‘dividend reinvestment plans’ in the mutual funds sector. Some of the mutual funds offer growth plans through such ‘dividend reinvestment plans’

Tags : Financial Management - DIVIDEND POLICIES

Last 30 days 766 views