Financial Management - WORKING CAPITAL MANAGEMENT

Concepts of Working Capital - WORKING CAPITAL MANAGEMENT

Posted On :

There are two concepts of working capital namely Gross concepts and Net concepts:

Concepts of Working Capital

There are two concepts of working capital namely Gross concepts and Net concepts:

According to this concept, whatever funds are invested are only in the current assets. This concept expresses that working capital is an aggregate of current assets. The amount of current liabilities is not deducted from the total current assets. This concept is also referred to as “Current Capital” or “Circulating Capital”.

What is net working capital? The term net working capital can be defined in two ways: (1) The most common definition of net working capital is the capital required for running day-to-day operations of a business. It may be expressed as excess of current assets over current liabilities. 2) Net working capital can alternatively be defined as a part of the current assets, which are financed with long-term funds. For example, if the current asset is Rs. 100 and current liabilities is Rs. 75, and then it implies Rs. 25 worth of current assets is financed by long-term funds such as capital, reserves and surplus, term loans, debentures, etc. On the other hand, if the current liability is Rs. 100 and current assets is Rs. 75, and then it implies Rs. 25 worth of short-terms funds is used for investing in the fixed assets. This is known as negative working capital situation. This is not a favourable financial position. When the current assets are equal to current liabilities, it implies that there is no net working capital. This means no current asset is being financed by long-term funds.

Net

Working Capital = Current assets – Current liabilities.

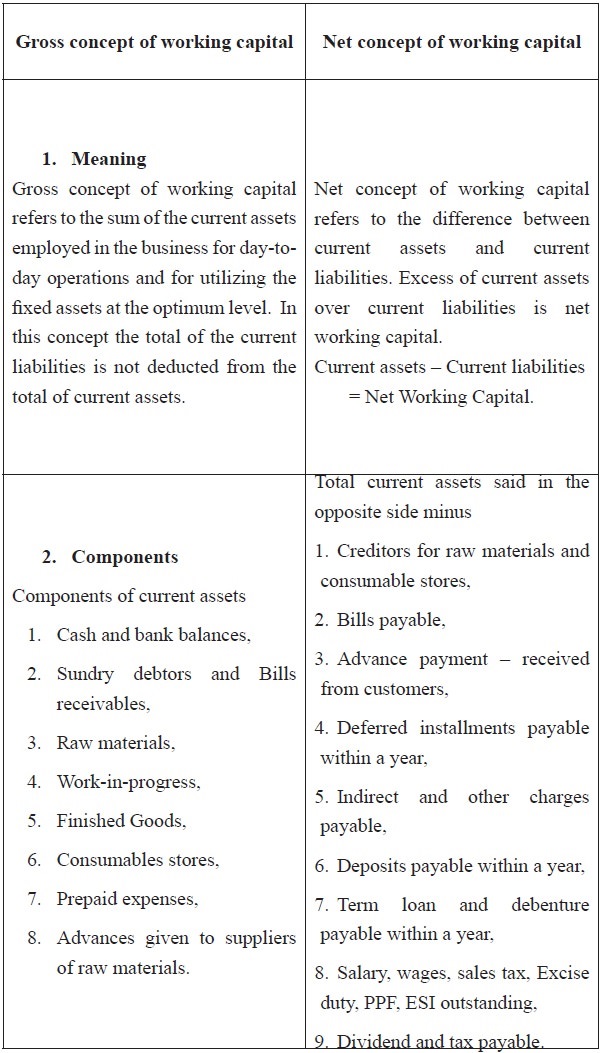

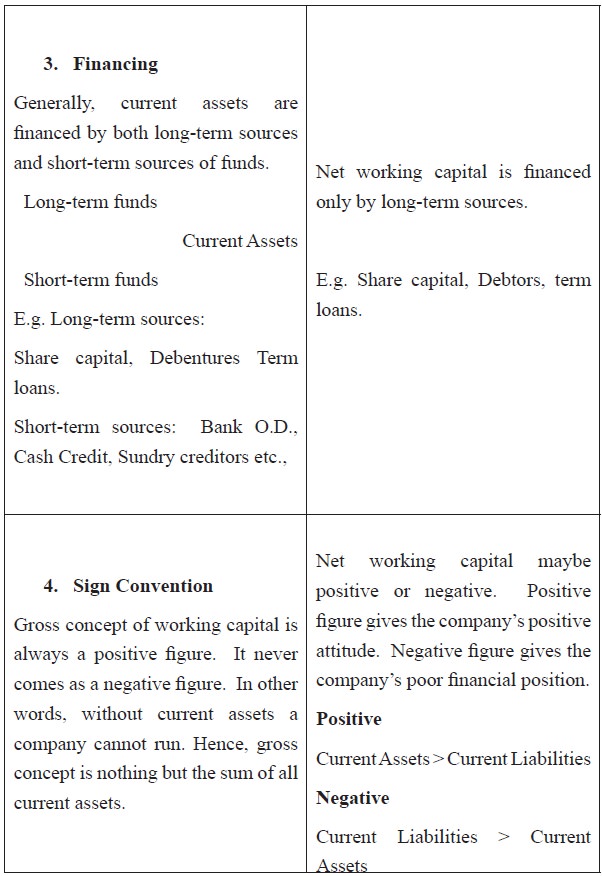

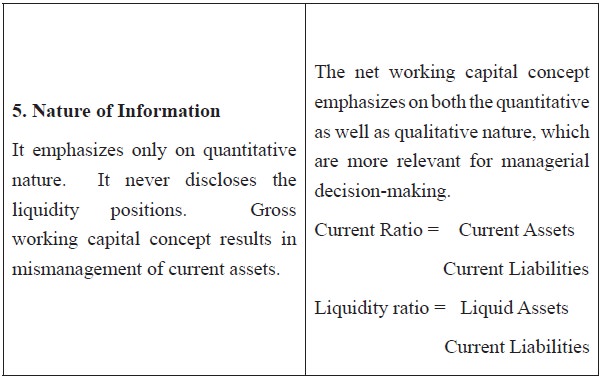

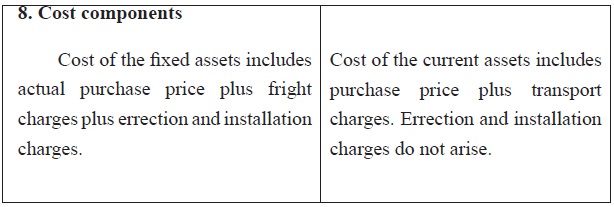

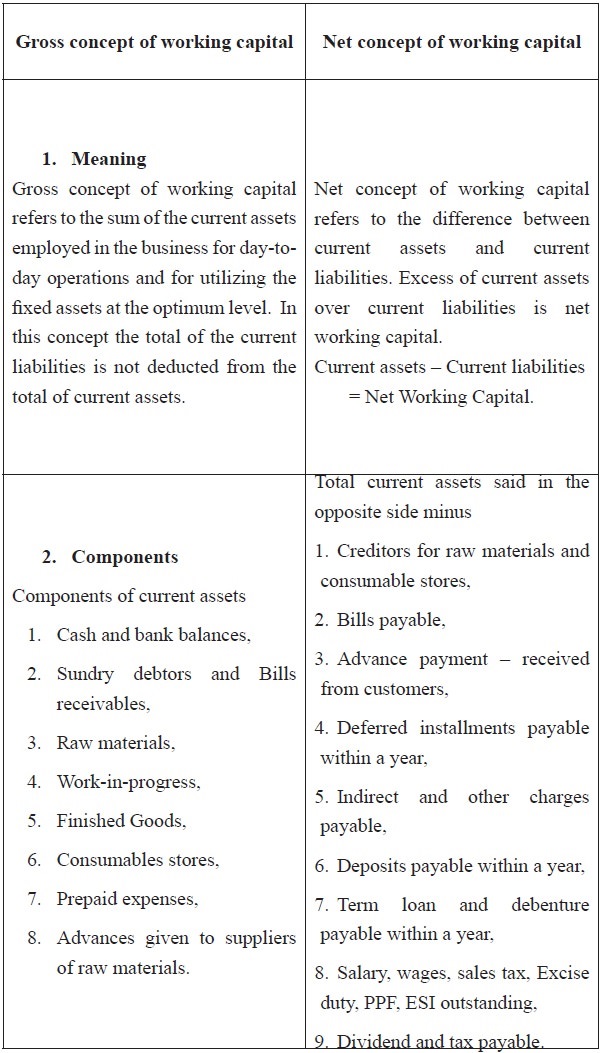

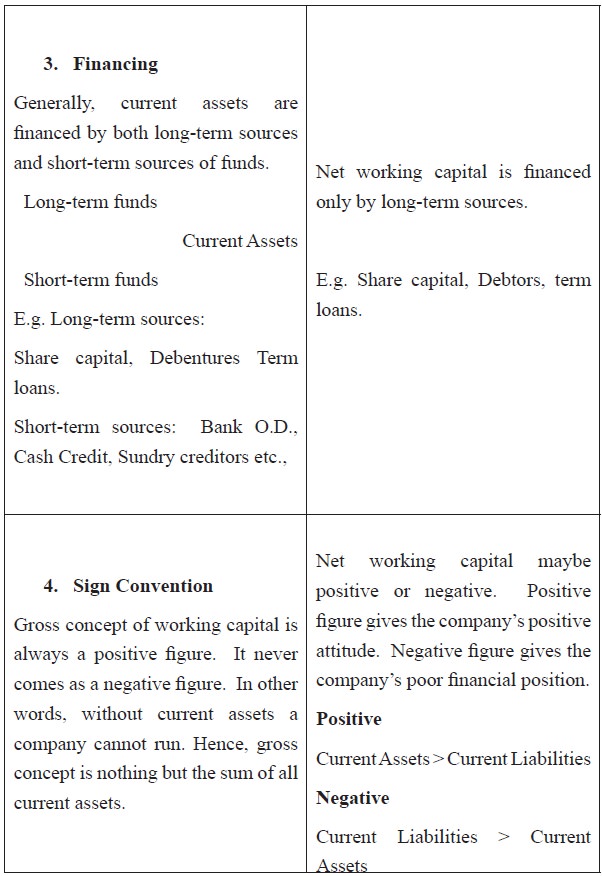

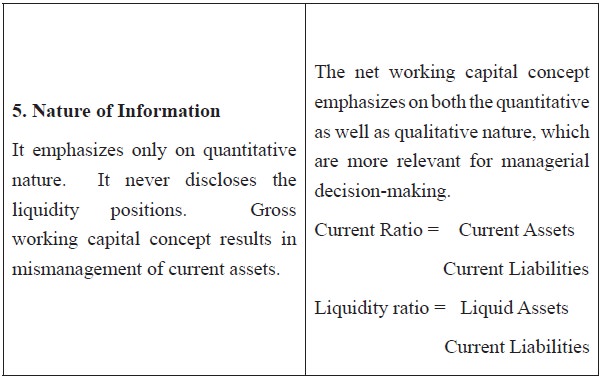

Table 1.1 Difference between gross and net working capital

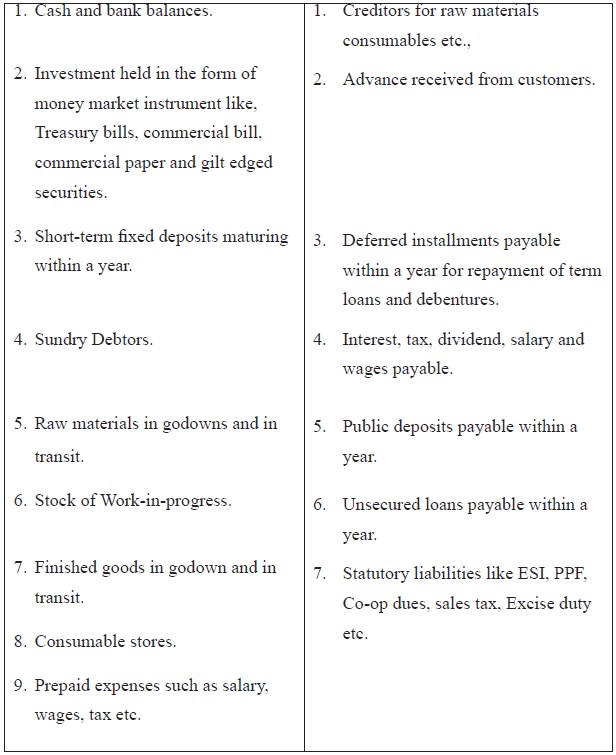

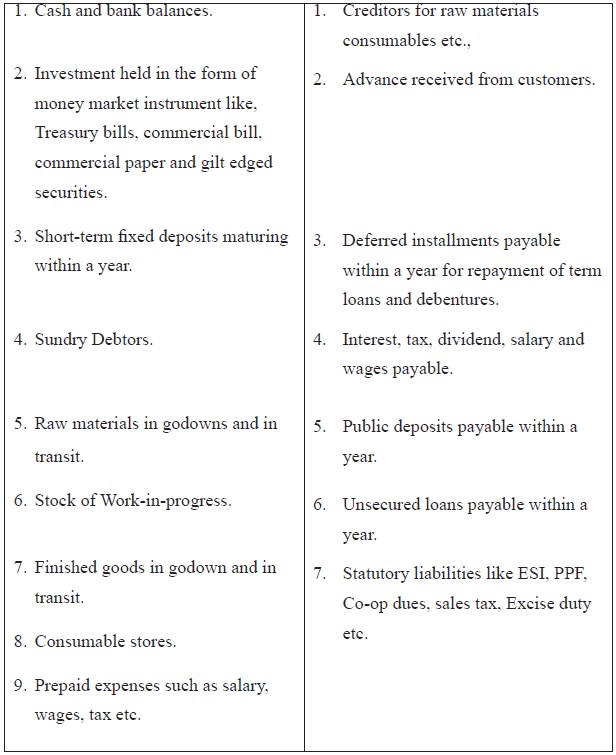

Assets, which can normally be converted into cash within a year or within the operating cycle, are grouped as current assets. In other words, current assets are resources that are in cash or will soon be converted into cash in ‘the ordinary course of businesses. The current asset components are assets like cash, temporary investments, raw materials, work in progress, accounts receivables (sundry debtors/ trade receivables/ bills receivables) and prepaid expenses.

Liabilities, which are due for payment in the short-run, are classified as current liabilities. In other words, these liabilities are due within the accounting period or the operating cycle of the business. Most of such liabilities are incurred in the acquisition of materials or services forming part of the current assets. Current liabilities are commitments, which will soon require cash settlement in ‘the ordinary course of business’. The current liability components are liabilities like accounts payable (sundry creditors/ bills payables/ trade payables), accrued liabilities (wages, salary, and rents), and estimated liabilities (income tax payable and dividend payable).

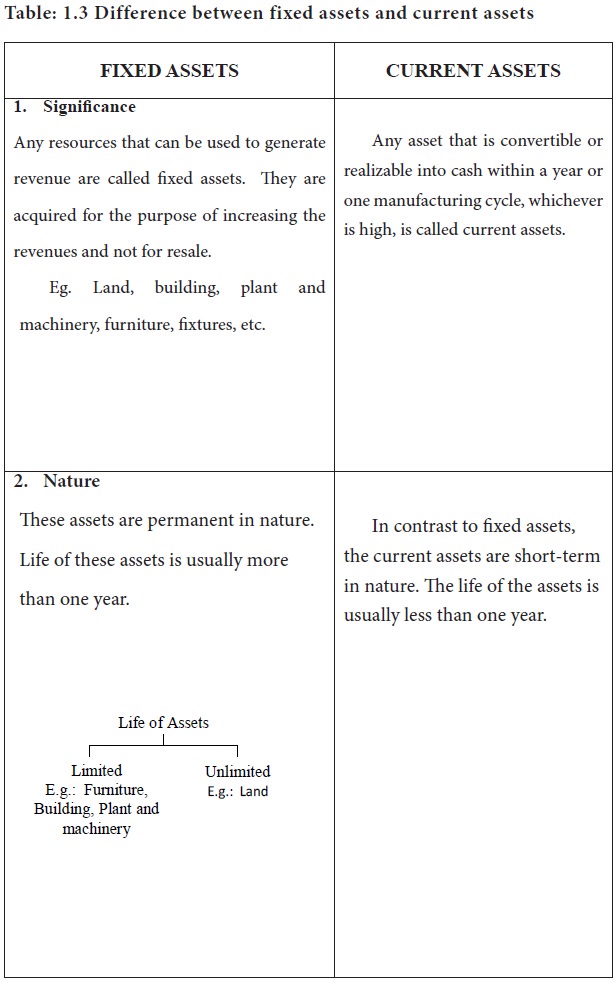

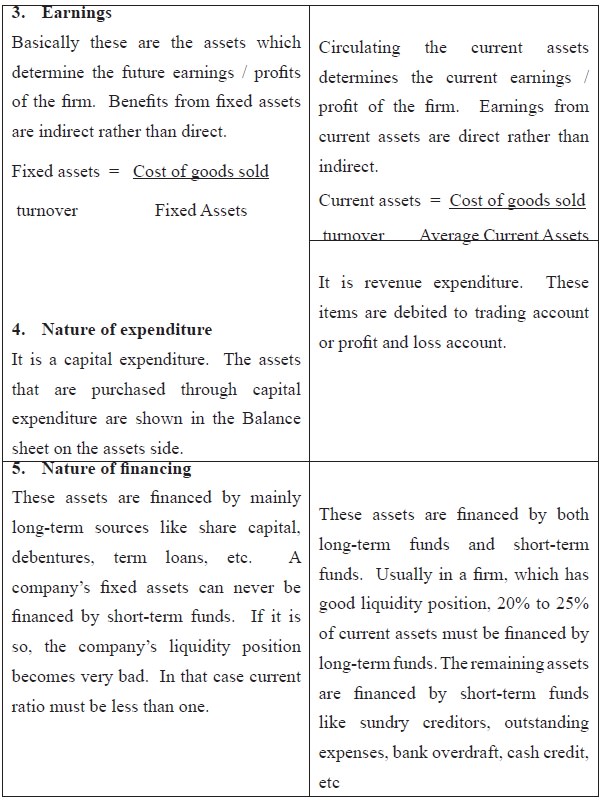

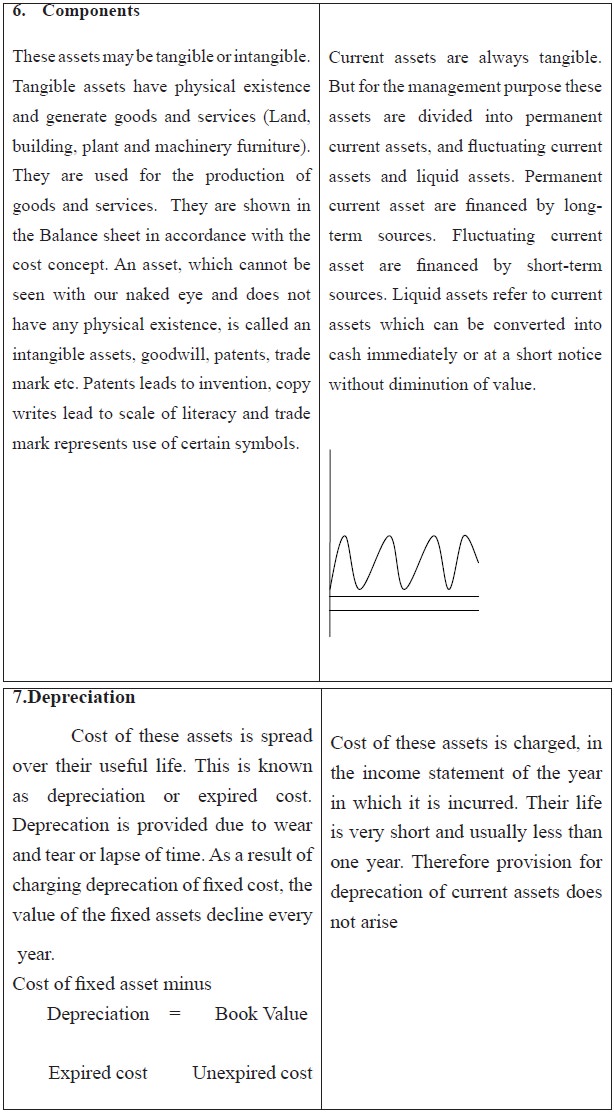

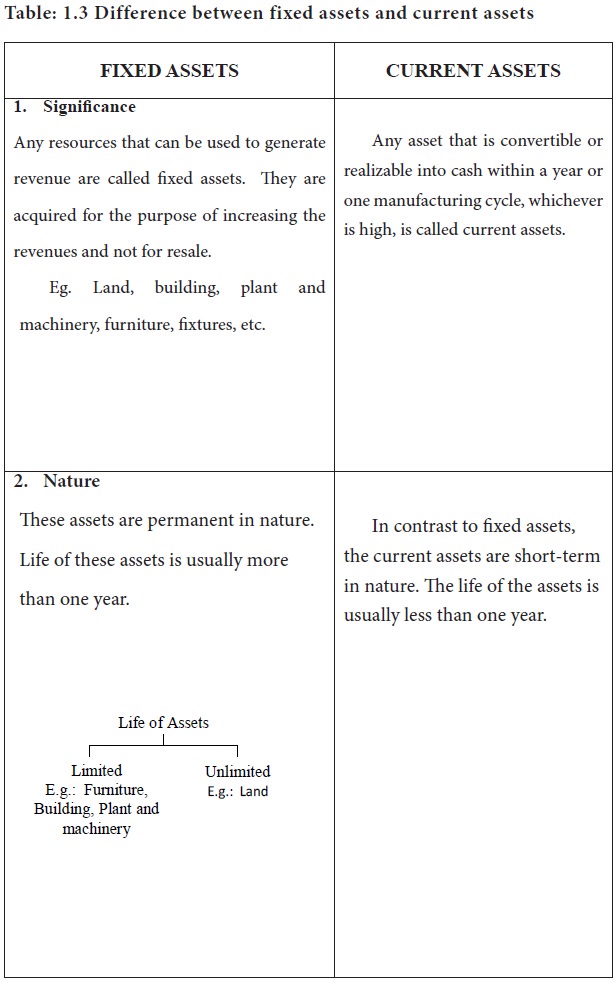

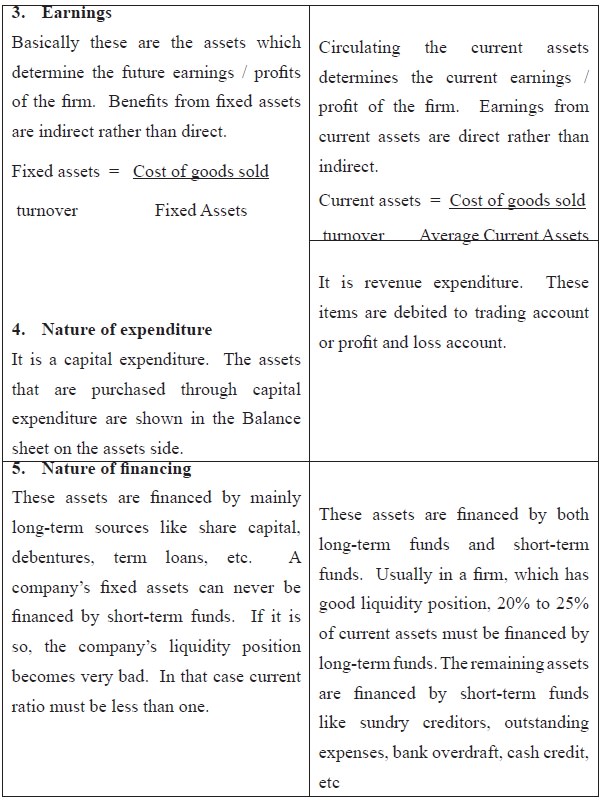

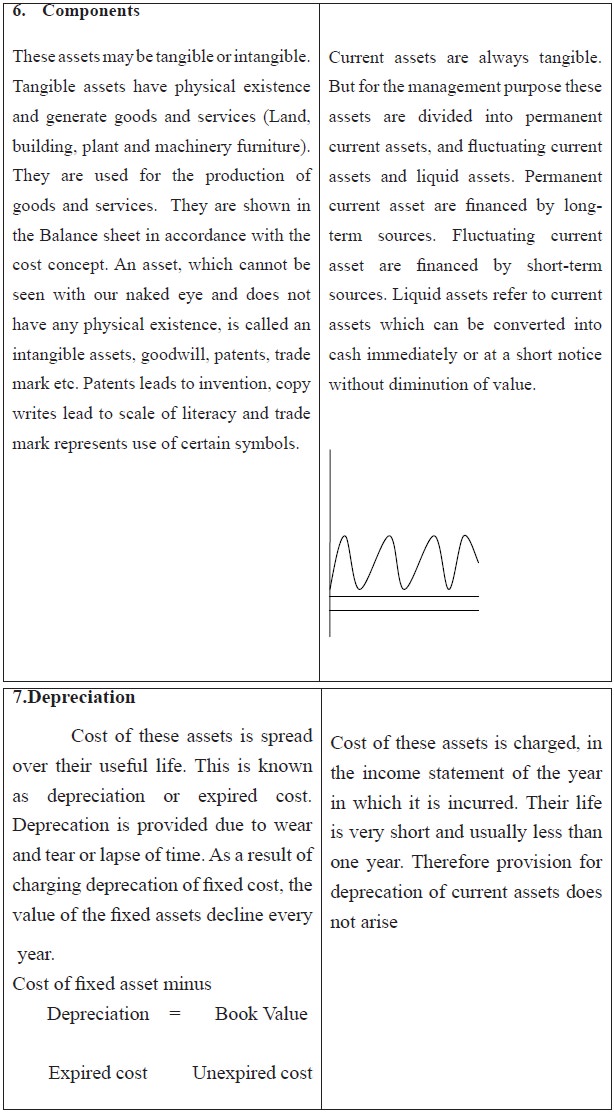

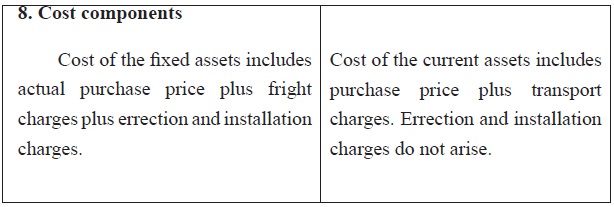

In order to study in detail about current assets, let us compare it with fixed assets.

There are two concepts of working capital namely Gross concepts and Net concepts:

Gross Working Capital

According to this concept, whatever funds are invested are only in the current assets. This concept expresses that working capital is an aggregate of current assets. The amount of current liabilities is not deducted from the total current assets. This concept is also referred to as “Current Capital” or “Circulating Capital”.

Net Working Capital

What is net working capital? The term net working capital can be defined in two ways: (1) The most common definition of net working capital is the capital required for running day-to-day operations of a business. It may be expressed as excess of current assets over current liabilities. 2) Net working capital can alternatively be defined as a part of the current assets, which are financed with long-term funds. For example, if the current asset is Rs. 100 and current liabilities is Rs. 75, and then it implies Rs. 25 worth of current assets is financed by long-term funds such as capital, reserves and surplus, term loans, debentures, etc. On the other hand, if the current liability is Rs. 100 and current assets is Rs. 75, and then it implies Rs. 25 worth of short-terms funds is used for investing in the fixed assets. This is known as negative working capital situation. This is not a favourable financial position. When the current assets are equal to current liabilities, it implies that there is no net working capital. This means no current asset is being financed by long-term funds.

Table 1.1 Difference between gross and net working capital

What are Current Assets?

Assets, which can normally be converted into cash within a year or within the operating cycle, are grouped as current assets. In other words, current assets are resources that are in cash or will soon be converted into cash in ‘the ordinary course of businesses. The current asset components are assets like cash, temporary investments, raw materials, work in progress, accounts receivables (sundry debtors/ trade receivables/ bills receivables) and prepaid expenses.

What are Current Liabilities?

Liabilities, which are due for payment in the short-run, are classified as current liabilities. In other words, these liabilities are due within the accounting period or the operating cycle of the business. Most of such liabilities are incurred in the acquisition of materials or services forming part of the current assets. Current liabilities are commitments, which will soon require cash settlement in ‘the ordinary course of business’. The current liability components are liabilities like accounts payable (sundry creditors/ bills payables/ trade payables), accrued liabilities (wages, salary, and rents), and estimated liabilities (income tax payable and dividend payable).

In order to study in detail about current assets, let us compare it with fixed assets.

Tags : Financial Management - WORKING CAPITAL MANAGEMENT

Last 30 days 1492 views