Home | ARTS | Financial Management

|

Fixed Asset Investments Vs Current Asset Investments - WORKING CAPITAL MANAGEMENT

Financial Management - WORKING CAPITAL MANAGEMENT

Fixed Asset Investments Vs Current Asset Investments - WORKING CAPITAL MANAGEMENT

Posted On :

Out of the two types of investments, investing in the current operations of the business is more difficult and is a continuous process with more components of assets rather than the first case where the investment is one time or long-term in the business process.

Fixed

Asset Investments Vs Current Asset Investments

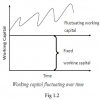

Out of the two types of investments, investing in the current operations of the business is more difficult and is a continuous process with more components of assets rather than the first case where the investment is one time or long-term in the business process. Further, purchase of fixed assets can only be by long-term sources of funds. But both long-term as well as short-term sources of funds are used to finance current assets. If so, what is the ratio of both long-term and short-term sources? Even if we decide the ratio, is it a fixed one? The answer is no. It is flexible on the basis of season like operational cycle, production policy, credit term, growth and expansion, price level changes, etc. Improper working capital management can lead to business failure. Many profitable companies fail because their management team fails to manage the working capital properly. They may be profitable, but they are not able to pay the bills. Therefore management of working capital is not very easy and the financial manager takes very important role in it. Hence, the following guidelines regarding concepts, components, types and determinants will be very useful to a financial manager.

Out of the two types of investments, investing in the current operations of the business is more difficult and is a continuous process with more components of assets rather than the first case where the investment is one time or long-term in the business process. Further, purchase of fixed assets can only be by long-term sources of funds. But both long-term as well as short-term sources of funds are used to finance current assets. If so, what is the ratio of both long-term and short-term sources? Even if we decide the ratio, is it a fixed one? The answer is no. It is flexible on the basis of season like operational cycle, production policy, credit term, growth and expansion, price level changes, etc. Improper working capital management can lead to business failure. Many profitable companies fail because their management team fails to manage the working capital properly. They may be profitable, but they are not able to pay the bills. Therefore management of working capital is not very easy and the financial manager takes very important role in it. Hence, the following guidelines regarding concepts, components, types and determinants will be very useful to a financial manager.

Tags : Financial Management - WORKING CAPITAL MANAGEMENT

Last 30 days 518 views