Financial Management - DIVIDEND POLICIES

The Residual Theory of Dividends - DIVIDEND POLICIES

Posted On :

One of the schools of thought, the residual theory, suggests that the dividend paid by a firm is viewed as a residual, i.e. the amount remaining or leftover after all acceptable investment opportunities have been considered and undertaken.

The Residual Theory of Dividends

One of the schools of thought, the residual theory, suggests that the dividend paid by a firm is viewed as a residual, i.e. the amount remaining or leftover after all acceptable investment opportunities have been considered and undertaken.

In this approach, the dividend decision is done in stages as under:

1. First the optimal level of capital expenditures is determined

2. Then the total amount of equity financing needed to support the expenditure is estimated

3. Reinvested profits is utilized to meet the equity requirement.

One of the schools of thought, the residual theory, suggests that the dividend paid by a firm is viewed as a residual, i.e. the amount remaining or leftover after all acceptable investment opportunities have been considered and undertaken.

In this approach, the dividend decision is done in stages as under:

1. First the optimal level of capital expenditures is determined

2. Then the total amount of equity financing needed to support the expenditure is estimated

3. Reinvested profits is utilized to meet the equity requirement.

4. After this, if there is a surplus available in reinvested profits after meeting this equity need, then the surplus, the residual, is distributed to shareholders as dividends.

Thus, under this theory,

Dividend = Net income – Additional equity needed.

Let us examine this with an example

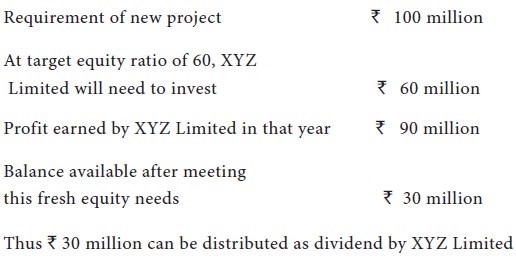

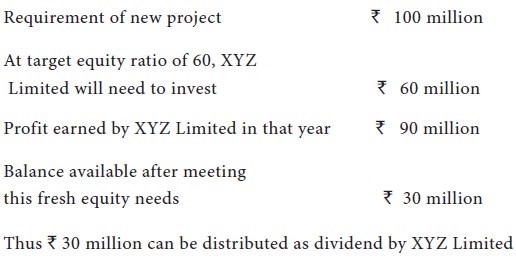

Suppose our XYZ Limited plans to invest Rs.100 million in a new project and it has finalized the target equity ratio at 60% and decided to meet this fresh equity through internal accruals. Suppose in that particular year, our firm earns Rs.90 million as profits. The amount that can be distributed as dividend by XYZ Limited would be

Thus, under the residual dividend model, the better the firm’s investment opportunities, the lower the dividend paid. Following the residual dividend policy rigidly would lead to fluctuating dividends, something investors don’t like to satisfy shareholders’ taste for stable dividends, firms should

Thus, under this theory,

Dividend = Net income – Additional equity needed.

Let us examine this with an example

Suppose our XYZ Limited plans to invest Rs.100 million in a new project and it has finalized the target equity ratio at 60% and decided to meet this fresh equity through internal accruals. Suppose in that particular year, our firm earns Rs.90 million as profits. The amount that can be distributed as dividend by XYZ Limited would be

Thus, under the residual dividend model, the better the firm’s investment opportunities, the lower the dividend paid. Following the residual dividend policy rigidly would lead to fluctuating dividends, something investors don’t like to satisfy shareholders’ taste for stable dividends, firms should

1. Estimate earnings and investment opportunities, on average over the next five to ten years;

2. Use this information to find out the average residual payout ratio;

3. Set a target payout ratio.

Tags : Financial Management - DIVIDEND POLICIES

Last 30 days 3412 views