Home | ARTS | Financial Management

|

Determination of working capital requirements - WORKING CAPITAL MANAGEMENT

Financial Management - WORKING CAPITAL MANAGEMENT

Determination of working capital requirements - WORKING CAPITAL MANAGEMENT

Posted On :

There are no uniform rules or formulae to determine the working capital requirements in a firm.

Determination of working

capital requirements

There are no uniform rules or formulae to determine the working

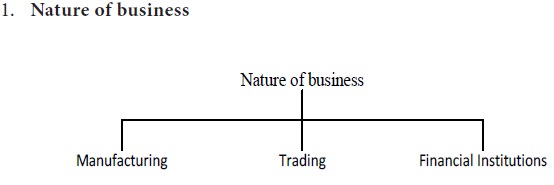

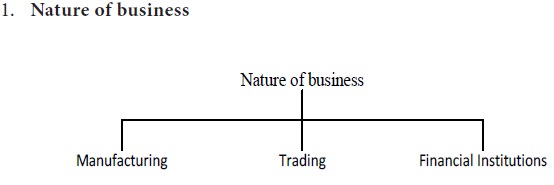

The working capital requirements of an organization are basically influenced by the nature of its business. The trading and financial institutions require more working capital rather than fixed assets because these firms usually keep more varieties of stock to satisfy the varied demands of their customers. The public utility service organisations require more fixed assets rather than working capital because they have cash sales only and they supply only services and not products. Thus, the amounts tied up with stock and debtors are almost zero. Generally, manufacturing business needs, more fixed assets rather than working capital. Further, the working capital requirements also depend on the seasonal products.

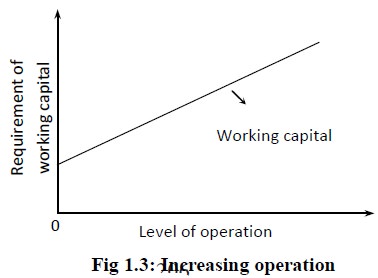

Another important factor is the size of the business. Size of the business means scale of operation. If the operation is on a large scale, it will need more working capital than a firm that has a small-scale operation.

The term “production cycle” or “manufacturing cycle” refers to the time involvement from cash to purchase of raw materials and completion of finished goods and receipt of cash from sales. If the operating cycle requires a longer time span between cash to cash, the requirement of working capital will be more because of larger tie up of funds in all the processes. If there is any delay in a particular process of sales or collection there will be further increase in the working capital requirements. A distillery is to make a relatively heavy investment in working capital. A bakery will have a low working capital.

O= (R+W+F+D) – C

Where

O = Duration of operating cycle

R = Raw material average storage period

C = Creditors payment period

The requirements of working capital are also determined by production policy. When the demand for the product is seasonal, inventory must be accumulated during the off-season period and this leads to more cost and risks. These firms, which manufacture variety of goods, will have advantages of keeping low working capital by adjusting the production according to season.

The speed of working capital is also influenced by the requirements of working capital. If the turnover is high, the requirement of working capital is low and vice versa.

Working Capital Turnover = Cost of goods sold Working capital

The level of working capital is also determined by credit terms, which is granted to customers as well as available from its creditors. More credit period allowed to debtors will result in high book debts, which leads to high working capital and more bad debts. On the other hand liberal credit terms available from creditors will lead to less working capital.

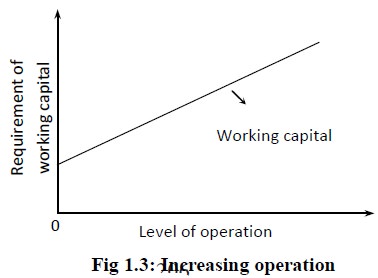

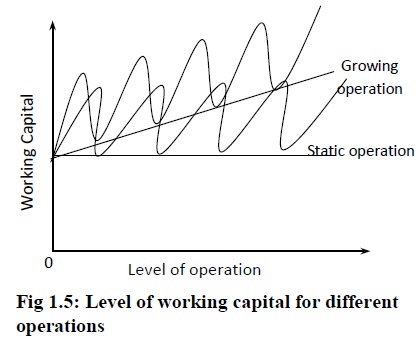

As a company grows and expands logically, it requires a larger amount of working capital. Other things remaining same, growing industries need more working capital than those that are static.

Rising prices would necessitate the organization to have more funds for maintaining the same level of activities. Raising the prices in material, labour and expenses without proportionate changes in selling price will require more working capital. When a company raises its selling prices proportionally there will be no serious problem in the working capital.

Though the company cannot control the rising price in material, labour and expenses, it can make use of the assets at a maximum utilisation with reduced wastage and better coordination so that the requirement of working capital is minimised.

Level of taxes: In this respect the management has no option. If the government increases the tax liability very often, taxes have to be paid in advance on the basis of the profit on the current year and this will need more working capital.

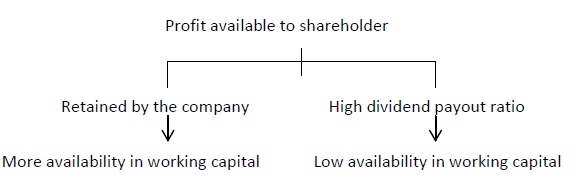

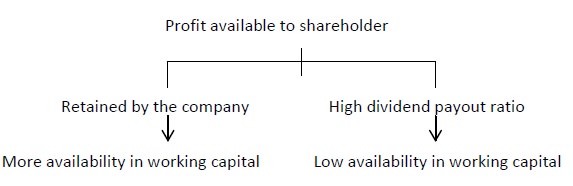

Dividend policy: Availability of working capital will decrease if it has a high dividend payout ratio. Conversely, if the firm retains all the profits without dividend, the availability of working capital will increase. In practice, although many firms earn profit, they do not declare dividend to augment the working capital.

There are no uniform rules or formulae to determine the working

The working capital requirements of an organization are basically influenced by the nature of its business. The trading and financial institutions require more working capital rather than fixed assets because these firms usually keep more varieties of stock to satisfy the varied demands of their customers. The public utility service organisations require more fixed assets rather than working capital because they have cash sales only and they supply only services and not products. Thus, the amounts tied up with stock and debtors are almost zero. Generally, manufacturing business needs, more fixed assets rather than working capital. Further, the working capital requirements also depend on the seasonal products.

2. Size of the business

Another important factor is the size of the business. Size of the business means scale of operation. If the operation is on a large scale, it will need more working capital than a firm that has a small-scale operation.

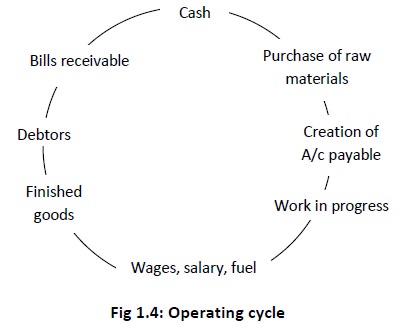

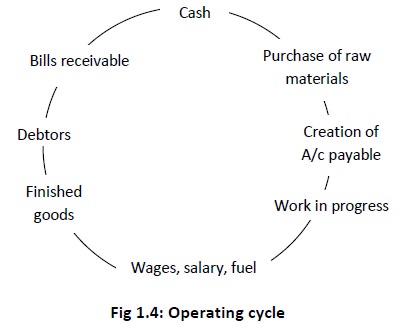

3. Operating cycle

The term “production cycle” or “manufacturing cycle” refers to the time involvement from cash to purchase of raw materials and completion of finished goods and receipt of cash from sales. If the operating cycle requires a longer time span between cash to cash, the requirement of working capital will be more because of larger tie up of funds in all the processes. If there is any delay in a particular process of sales or collection there will be further increase in the working capital requirements. A distillery is to make a relatively heavy investment in working capital. A bakery will have a low working capital.

O= (R+W+F+D) – C

Where

O = Duration of operating cycle

R = Raw material average storage period

W = Average period of work-in-progress

F = Finished goods average storage period

D = Debtors Collection period

C = Creditors payment period

Production policy

The requirements of working capital are also determined by production policy. When the demand for the product is seasonal, inventory must be accumulated during the off-season period and this leads to more cost and risks. These firms, which manufacture variety of goods, will have advantages of keeping low working capital by adjusting the production according to season.

5. Turnover of Working capital

The speed of working capital is also influenced by the requirements of working capital. If the turnover is high, the requirement of working capital is low and vice versa.

Working Capital Turnover = Cost of goods sold Working capital

6. Credit Terms

The level of working capital is also determined by credit terms, which is granted to customers as well as available from its creditors. More credit period allowed to debtors will result in high book debts, which leads to high working capital and more bad debts. On the other hand liberal credit terms available from creditors will lead to less working capital.

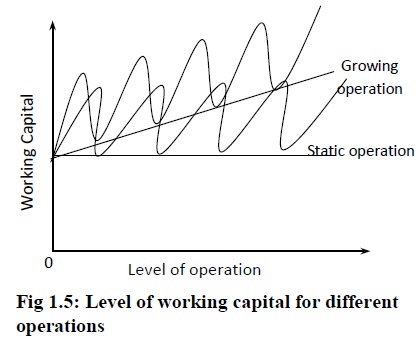

7. Growth and Expansion

As a company grows and expands logically, it requires a larger amount of working capital. Other things remaining same, growing industries need more working capital than those that are static.

8. Price level changes

Rising prices would necessitate the organization to have more funds for maintaining the same level of activities. Raising the prices in material, labour and expenses without proportionate changes in selling price will require more working capital. When a company raises its selling prices proportionally there will be no serious problem in the working capital.

9. Operating efficiency

Though the company cannot control the rising price in material, labour and expenses, it can make use of the assets at a maximum utilisation with reduced wastage and better coordination so that the requirement of working capital is minimised.

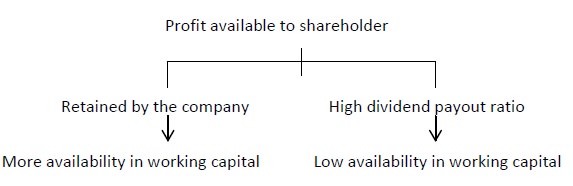

10. Other factors

Level of taxes: In this respect the management has no option. If the government increases the tax liability very often, taxes have to be paid in advance on the basis of the profit on the current year and this will need more working capital.

Dividend policy: Availability of working capital will decrease if it has a high dividend payout ratio. Conversely, if the firm retains all the profits without dividend, the availability of working capital will increase. In practice, although many firms earn profit, they do not declare dividend to augment the working capital.

Tags : Financial Management - WORKING CAPITAL MANAGEMENT

Last 30 days 766 views