Financial Management - DIVIDEND POLICIES

Issues in dividend policy

Posted On :

Normally, a firm would be using its dividend policy to pursue its objective of maximizing its shareholders’ return so that the value of their investment is maximized.

Issues in dividend policy

Normally, a firm would be using its dividend policy to pursue its objective of maximizing its shareholders’ return so that the value of their investment is maximized. Shareholders return consists of dividends and capital gains. Dividend policy directly influences these two components of return. Even if dividends are not declared but retained in the firm, the shareholders’ wealth or return would go up.

We shall examine various ratios which impact our firm’s dividend policy:

It is defined as dividend as a percentage of earnings. It is an important concept in the dividend policy. A firm may decide to distribute almost its entire earnings. Another firm may decide to distribute only a portion of its earnings. Initially it may appear, the former firm declares maximum dividends. However in the long run, the latter firm which declares only a portion of its earnings may overtake our former high pay out firm.

Let us now look at this with an example.

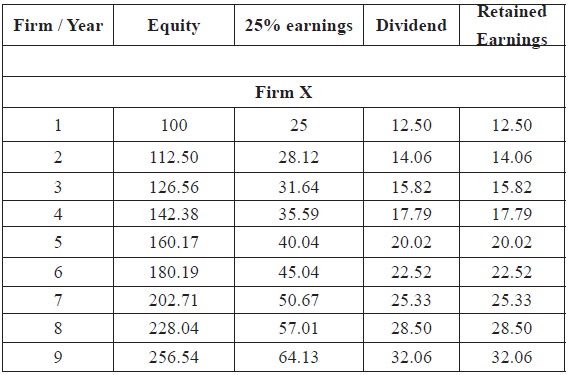

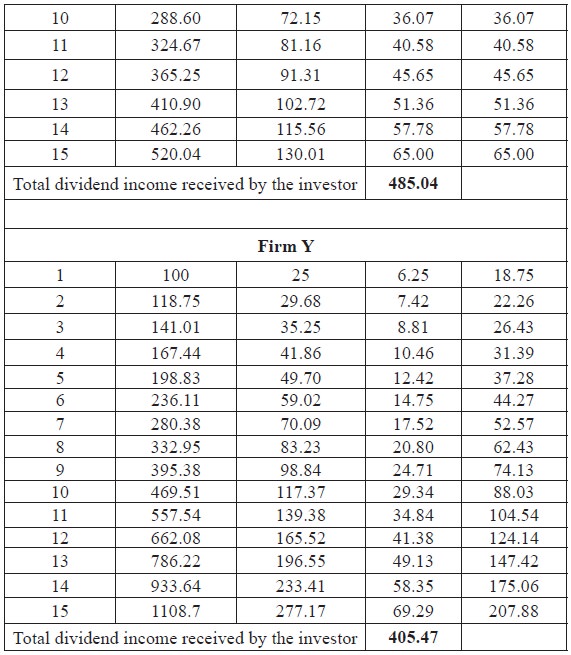

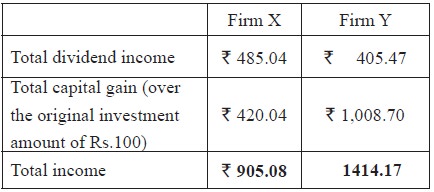

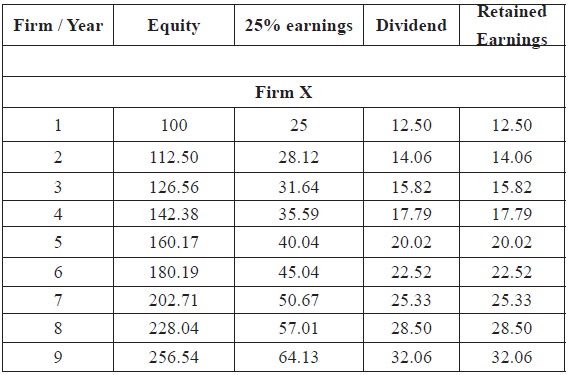

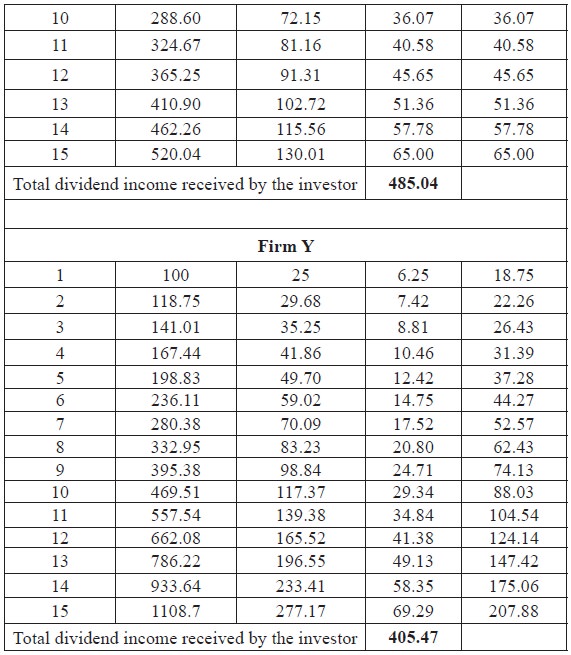

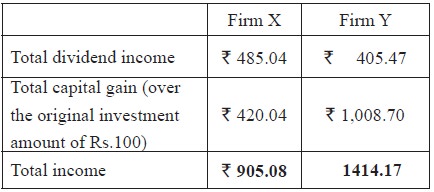

Firms X and Y have equity capital of Rs.100. Let us assume both the firms generate 25% earnings every year. Let us assume that Firm X declares 50% dividend every year and firm Y declares only 25% dividend every year.

If you look at the returns* to the investors of firms X and Y at the end of 15 years, the following position will emerge on Rs.100 invested in each firm

overlooking the interest on the dividend received by way of cash.

In the case of low dividend pay out company, in fact from the year 14 onwards, the quantum of dividend paid has actually overtaken the high dividend pay out company.

If you look at the market value, a low pay out firm will result in a higher share price in the market because it increases earnings growth.

Uncertainty surrounding future company profitability leads certain investors to prefer the certainty of current dividends. Investors prefer “large” dividends. Investors do not like to manufacture “homemade” dividends, but prefer the company to distribute them directly.

Capital gains taxes are deferred until the actual sale of stock. This creates a timing option. Capital gains are preferred to dividends, everything else equal. Thus, high dividend yielding stocks should sell at a discount to generate a higher before-tax rate of return. Certain institutional investors pay no tax.

Dividends are taxed more heavily than capital gains, so before-tax returns should be higher for high dividend - paying firms. Empirical results are mixed -- recently the evidence is largely consistent with dividend neutrality.

If x is pay out ratio, then the retention ratio is 100 minus x. That is retention ratio is just the reverse of the pay out ratio. As we have seen above, a low pay out (and hence a high retention) policy will produce a possible higher dividend announcement (and thereby higher share price in the secondary market leading to huge capital gains) because it increases earnings growth.

Investors of growth companies will realize their return mostly in the form of capital gains. Normally such growth companies will have increasing earnings year after year but their pay out ratio may not be very high. Their retention ratio will therefore be higher. Investors in such companies will reap capital gains in the later years. However, the impact of dividend policy (high or low pay out with low or high retention ratio) is not very simple. Such capital gains will result in the distant future and hence many investors may consider them as uncertain.

The dividend yield is the dividends per share divided by the market value per share. The dividend yield furnishes the shareholders’ return in relation to the market value of the share.

Normally, a firm would be using its dividend policy to pursue its objective of maximizing its shareholders’ return so that the value of their investment is maximized. Shareholders return consists of dividends and capital gains. Dividend policy directly influences these two components of return. Even if dividends are not declared but retained in the firm, the shareholders’ wealth or return would go up.

We shall examine various ratios which impact our firm’s dividend policy:

1. Pay out ratio

It is defined as dividend as a percentage of earnings. It is an important concept in the dividend policy. A firm may decide to distribute almost its entire earnings. Another firm may decide to distribute only a portion of its earnings. Initially it may appear, the former firm declares maximum dividends. However in the long run, the latter firm which declares only a portion of its earnings may overtake our former high pay out firm.

Let us now look at this with an example.

Firms X and Y have equity capital of Rs.100. Let us assume both the firms generate 25% earnings every year. Let us assume that Firm X declares 50% dividend every year and firm Y declares only 25% dividend every year.

If you look at the returns* to the investors of firms X and Y at the end of 15 years, the following position will emerge on Rs.100 invested in each firm

overlooking the interest on the dividend received by way of cash.

In the case of low dividend pay out company, in fact from the year 14 onwards, the quantum of dividend paid has actually overtaken the high dividend pay out company.

If you look at the market value, a low pay out firm will result in a higher share price in the market because it increases earnings growth.

Uncertainty surrounding future company profitability leads certain investors to prefer the certainty of current dividends. Investors prefer “large” dividends. Investors do not like to manufacture “homemade” dividends, but prefer the company to distribute them directly.

Capital gains taxes are deferred until the actual sale of stock. This creates a timing option. Capital gains are preferred to dividends, everything else equal. Thus, high dividend yielding stocks should sell at a discount to generate a higher before-tax rate of return. Certain institutional investors pay no tax.

Dividends are taxed more heavily than capital gains, so before-tax returns should be higher for high dividend - paying firms. Empirical results are mixed -- recently the evidence is largely consistent with dividend neutrality.

2. Retention ratio

If x is pay out ratio, then the retention ratio is 100 minus x. That is retention ratio is just the reverse of the pay out ratio. As we have seen above, a low pay out (and hence a high retention) policy will produce a possible higher dividend announcement (and thereby higher share price in the secondary market leading to huge capital gains) because it increases earnings growth.

3. Capital gains

Investors of growth companies will realize their return mostly in the form of capital gains. Normally such growth companies will have increasing earnings year after year but their pay out ratio may not be very high. Their retention ratio will therefore be higher. Investors in such companies will reap capital gains in the later years. However, the impact of dividend policy (high or low pay out with low or high retention ratio) is not very simple. Such capital gains will result in the distant future and hence many investors may consider them as uncertain.

4. Dividend yield

The dividend yield is the dividends per share divided by the market value per share. The dividend yield furnishes the shareholders’ return in relation to the market value of the share.

Tags : Financial Management - DIVIDEND POLICIES

Last 30 days 3803 views