Financial Management - WORKING CAPITAL MANAGEMENT

Working Capital Management Under Inflation

Posted On :

One of the most important areas in the day-to-day management of working capital includes all the short term assets (current assets) used in daily operations.

Working

Capital Management Under Inflation

One of the most important areas in the day-to-day management of working capital includes all the short term assets (current assets) used in daily operations. Such management will have more significance during the time of inflation. The following measures can be applied to control the working capital during the period of inflation.

Cost control aims at maintaining the costs in accordance with the predetermined cost. According to this concept, the management aims at material, labour and other expenses.

Cost reduction aims at exploring the possibilities of using alternative raw materials without affecting the quality of the products by adoptions of new technology for the improved quality of products and reducing the cost.

Within the given capacities the management can increase the productivity by proper cost control strategy. Increased price due to inflation may compensate with reduction in fixed cost when production is increased.

Since management cost is a fixed, period cost, the maximum

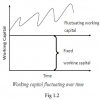

The time gap between purchase of inventory and converting the material into cash is known as operating cycle. The management attempts to decrease the duration of operating cycle during inflation.

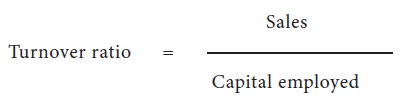

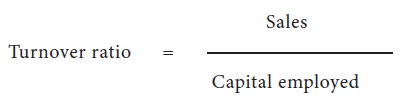

Turnover ratio indicates how the capitals are effectively used in order to increase the sales during the purchase period. By increasing the rate of rotation there will be an increase in sales which in turn will increase the profit.

Improvement of turnover includes improvement in fixed assets turnover ratio and working capital turnover ratio, which are elements of the capital employed.

Capital employed = Fixed assets + working capital.

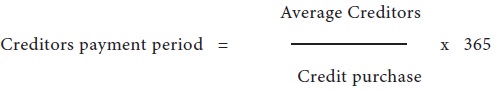

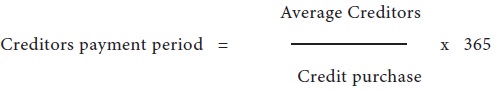

It indicates the speed with which the payments are made to credit purchases. This can be computed as follows:

Higher creditors’ turnover ratio with a lower payment period shows that the creditors are paid promptly or even earlier. During inflation the company with help of bargaining power and good relation they can ask to increase the payment period, trade discount, cash discount, etc.

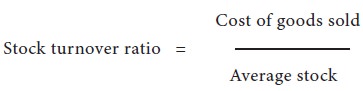

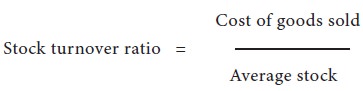

A low stock turnover ratio may indicate a slow moving inventory suffering from low sales force. On the contrary, higher stock turnover

This should be more during inflation than the ordinary period.

Debtors constitute an important component of the working capital and therefore the quality of debtors to a great extent determines the liquidity position during inflation. A higher ratio gives a lower collection period and a low ratio gives a longer collection period. During inflation, the management tries to keep a high turnover ratio.

The management can try to decrease the overhead expenses like administrative, selling and distributing expenses. Further the management should be very careful in sanctioning any new expenditure belonging to the cost areas. The managers should match the cash inflow with cash outflow for future period through cash budgeting.

Negative working capital is where the organization uses supplier credit or customer prepayment to fund their day-to-day needs. Organization with negative working capital uses the money from their customer with which to invest and to pay suppliers. Banks and financial services, retailers, distributors, industries with cash sales or advance payments on signature of contract are some of the firms which may have low or negative working capital / sales % figures. Competition is fiercest among industries with low or negative working capital / sales figures. Financial entry barriers are lower and these industries are easier to expand. However, profit margins are often lower because of the competition (but not always!) and the failure rate among such industries in developed countries is usually higher. Banks are attracted to industries with low or negative working capital/ sales % figure s cash and profits are more quickly. Entrepreneurs are attracted to industries with low or negative working capital % figures. The customers, suppliers and authors of books publishers also want to operate to a low or negative working capital/ sales %.

One of the most important areas in the day-to-day management of working capital includes all the short term assets (current assets) used in daily operations. Such management will have more significance during the time of inflation. The following measures can be applied to control the working capital during the period of inflation.

Cost Control

Cost control aims at maintaining the costs in accordance with the predetermined cost. According to this concept, the management aims at material, labour and other expenses.

Cost Reduction

Cost reduction aims at exploring the possibilities of using alternative raw materials without affecting the quality of the products by adoptions of new technology for the improved quality of products and reducing the cost.

Large-Scale Production

Within the given capacities the management can increase the productivity by proper cost control strategy. Increased price due to inflation may compensate with reduction in fixed cost when production is increased.

Management Cost

Since management cost is a fixed, period cost, the maximum

Operating Cycle

The time gap between purchase of inventory and converting the material into cash is known as operating cycle. The management attempts to decrease the duration of operating cycle during inflation.

Turnover

Turnover ratio indicates how the capitals are effectively used in order to increase the sales during the purchase period. By increasing the rate of rotation there will be an increase in sales which in turn will increase the profit.

Improvement of turnover includes improvement in fixed assets turnover ratio and working capital turnover ratio, which are elements of the capital employed.

Capital employed = Fixed assets + working capital.

Creditors’ Turnover Ratio

It indicates the speed with which the payments are made to credit purchases. This can be computed as follows:

Higher creditors’ turnover ratio with a lower payment period shows that the creditors are paid promptly or even earlier. During inflation the company with help of bargaining power and good relation they can ask to increase the payment period, trade discount, cash discount, etc.

Stock turnover ratio

A low stock turnover ratio may indicate a slow moving inventory suffering from low sales force. On the contrary, higher stock turnover

Debtors’ Turnover

Debtors constitute an important component of the working capital and therefore the quality of debtors to a great extent determines the liquidity position during inflation. A higher ratio gives a lower collection period and a low ratio gives a longer collection period. During inflation, the management tries to keep a high turnover ratio.

Other Factors

The management can try to decrease the overhead expenses like administrative, selling and distributing expenses. Further the management should be very careful in sanctioning any new expenditure belonging to the cost areas. The managers should match the cash inflow with cash outflow for future period through cash budgeting.

What is negative working capital and how it arises?

Negative working capital is where the organization uses supplier credit or customer prepayment to fund their day-to-day needs. Organization with negative working capital uses the money from their customer with which to invest and to pay suppliers. Banks and financial services, retailers, distributors, industries with cash sales or advance payments on signature of contract are some of the firms which may have low or negative working capital / sales % figures. Competition is fiercest among industries with low or negative working capital / sales figures. Financial entry barriers are lower and these industries are easier to expand. However, profit margins are often lower because of the competition (but not always!) and the failure rate among such industries in developed countries is usually higher. Banks are attracted to industries with low or negative working capital/ sales % figure s cash and profits are more quickly. Entrepreneurs are attracted to industries with low or negative working capital % figures. The customers, suppliers and authors of books publishers also want to operate to a low or negative working capital/ sales %.

Tags : Financial Management - WORKING CAPITAL MANAGEMENT

Last 30 days 1048 views