Financial Management - WORKING CAPITAL MANAGEMENT

Significance of Working Capital - WORKING CAPITAL MANAGEMENT

Posted On :

The basic objective of financial management is to maximize the shareholders’ wealth.

Significance of Working

Capital

The basic objective of financial management is to maximize the shareholders’ wealth. This is possible only when the company increases the profit. Higher profits are possible only by way of increasing sales. However sales do not convert into cash instantaneously. So some amount of funds is required to meet the time gap arrangement in order to sustain the sales activity, which is known as working capital. In case adequate

Proper management of working capital is very important for the success of an enterprise. It should be neither large nor small, but at the optimum level. In case of inadequate working capital, a business may suffer the following problems.

Availing the cash discount from the suppliers (creditors) or on favourable credit terms may not be available from creditors due to shortage of funds. For e.g. This situation arises when the suppliers supply the goods on two months credit allowing 5% cash discount, if it is payable within the 30 days.

In the above situation, if a person buys material for Rs. 10,000 by availing the cash discount, he has to pay only Rs 9500 [10,000 – 500]. This is possible only with the help of adequate working capital.

When the financial crisis continues due to shortage of funds [working capital], the credit worthiness of the company may be lost, resulting in poor credit rating. E.g. a company is having the liquid assets of Rs 20,000, current assets of Rs 30,000 and current liabilities of Rs 40,000. From the above data we can determine the short-term solvency with the help of the following ratios 1. Liquid ratio 0.50 and 2. Current ratio 0.75.

The standard ratios are 1:1 and 2:1 for liquidity ratio and current ratio respectively. But seeing the above ratios, it shows that the short-term solvency is very poor. This clearly shows that the company is not in a position to repay the short-term debt. This is due to inadequate working capital.

Due to lack of adequate working capital, the company is not in a position to avail business opportunity during boom period by increasing the production. This will result in loss of opportunity profit. E.g. During boom or seasonal period, generally the company will be getting more contribution per unit by accepting special orders or by increasing the production, matching with high demand. This opportunity can be availed only if it is having sufficient amount of working capital.

The duration of operating cycle is to be extended due to inadequate working capital. E.g. If the company’s duration of operating cycle is 45 days when a company is having sufficient amount of working capital, due to delay in getting the material from the suppliers and delay in the production process, it will have to extend the duration of operating cycle. Consequently, this results in low turnover and low profit.

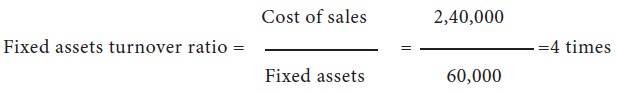

Due to lack of adequate working capital, plant and machinery and fixed assets cannot be repaired, renovated, maintained or modernized in an appropriate time. This results in non-utilisation of fixed assets. Moreover, inadequate cash and bank balances will curtail production facilities. Consequently, it leads to low fixed assets turnover ratio. E.g. Cost of goods sold is Rs 2,40,000 fixed assets is Rs 60,000 and average industrial fixed assets turnover ratio is 10 times.

When industrial average ratio is 10 times and the actual turnover ratio is 4 times, it is understood that the fixed assets are not utilized to the maximum.

In order to account for the emergency working capital fund, the company has to pay higher rate of interest for arranging either short-term or long-term loans.

Inadequate working capital will reduce the working capital turnover, which results in low return on investment.

Inadequate working capital may result in stock out of cost, reduced sales, loss of future sales, loss of customers, and loss of goodwill, down time cost, idle labour, idle production and finally results in lower profitability.

A study of dividend policy cannot be possible unless and otherwise the organization has sufficient available funds.

The basic objective of financial management is to maximize the shareholders’ wealth. This is possible only when the company increases the profit. Higher profits are possible only by way of increasing sales. However sales do not convert into cash instantaneously. So some amount of funds is required to meet the time gap arrangement in order to sustain the sales activity, which is known as working capital. In case adequate

Problems of inadequate working capital

Proper management of working capital is very important for the success of an enterprise. It should be neither large nor small, but at the optimum level. In case of inadequate working capital, a business may suffer the following problems.

1. Purchase of Raw Materials

Availing the cash discount from the suppliers (creditors) or on favourable credit terms may not be available from creditors due to shortage of funds. For e.g. This situation arises when the suppliers supply the goods on two months credit allowing 5% cash discount, if it is payable within the 30 days.

In the above situation, if a person buys material for Rs. 10,000 by availing the cash discount, he has to pay only Rs 9500 [10,000 – 500]. This is possible only with the help of adequate working capital.

2. Credit Rating

When the financial crisis continues due to shortage of funds [working capital], the credit worthiness of the company may be lost, resulting in poor credit rating. E.g. a company is having the liquid assets of Rs 20,000, current assets of Rs 30,000 and current liabilities of Rs 40,000. From the above data we can determine the short-term solvency with the help of the following ratios 1. Liquid ratio 0.50 and 2. Current ratio 0.75.

The standard ratios are 1:1 and 2:1 for liquidity ratio and current ratio respectively. But seeing the above ratios, it shows that the short-term solvency is very poor. This clearly shows that the company is not in a position to repay the short-term debt. This is due to inadequate working capital.

3. Seizing Business Opportunity

Due to lack of adequate working capital, the company is not in a position to avail business opportunity during boom period by increasing the production. This will result in loss of opportunity profit. E.g. During boom or seasonal period, generally the company will be getting more contribution per unit by accepting special orders or by increasing the production, matching with high demand. This opportunity can be availed only if it is having sufficient amount of working capital.

4. Duration of Operating Cycle

The duration of operating cycle is to be extended due to inadequate working capital. E.g. If the company’s duration of operating cycle is 45 days when a company is having sufficient amount of working capital, due to delay in getting the material from the suppliers and delay in the production process, it will have to extend the duration of operating cycle. Consequently, this results in low turnover and low profit.

5. Maintenance of plant and machinery

Due to lack of adequate working capital, plant and machinery and fixed assets cannot be repaired, renovated, maintained or modernized in an appropriate time. This results in non-utilisation of fixed assets. Moreover, inadequate cash and bank balances will curtail production facilities. Consequently, it leads to low fixed assets turnover ratio. E.g. Cost of goods sold is Rs 2,40,000 fixed assets is Rs 60,000 and average industrial fixed assets turnover ratio is 10 times.

When industrial average ratio is 10 times and the actual turnover ratio is 4 times, it is understood that the fixed assets are not utilized to the maximum.

6. Higher Interest

In order to account for the emergency working capital fund, the company has to pay higher rate of interest for arranging either short-term or long-term loans.

7. Low Return on Investment (ROI)

Inadequate working capital will reduce the working capital turnover, which results in low return on investment.

8. Liquidity verses profitability

Inadequate working capital may result in stock out of cost, reduced sales, loss of future sales, loss of customers, and loss of goodwill, down time cost, idle labour, idle production and finally results in lower profitability.

9. Dividend policy

A study of dividend policy cannot be possible unless and otherwise the organization has sufficient available funds.

In the absence of proper planning and control, the company’s inadequate working capital will cause the above said problems.

Tags : Financial Management - WORKING CAPITAL MANAGEMENT

Last 30 days 9329 views