Financial Management - WORKING CAPITAL MANAGEMENT

Introduction of Sources Of Working Capital

Posted On :

Once the financial manager has estimated to invest in current assets like raw material, working-in-progress, finished goods, debtors etc.

Introduction

Once the financial manager has estimated to invest in current assets like raw material, working-in-progress, finished goods, debtors etc. the next step is, he must arrange for funds for working capital.

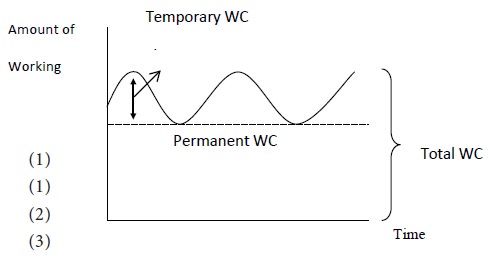

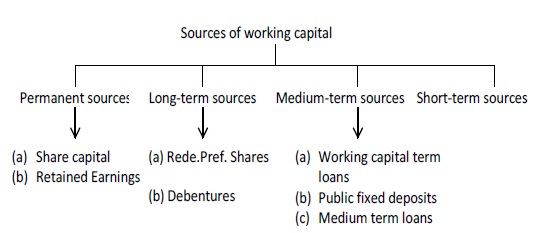

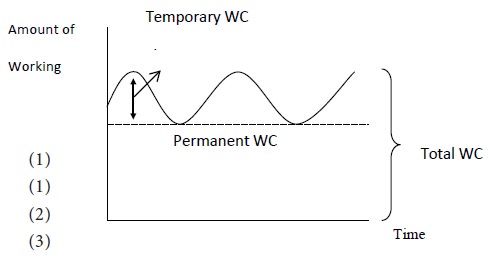

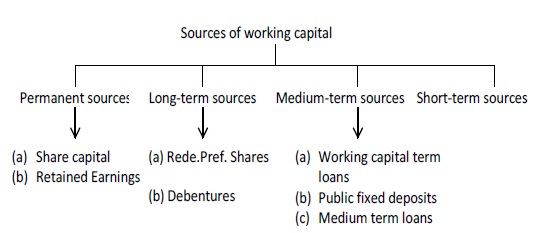

Working capital management refers not only to estimating working capital requirement but also includes the process of bifurcating the total working capital requirement into permanent working capital and temporary working capital. The permanent working capital should be financed by arranging funds from long-term sources such as issue of shares, debentures and long-term loans. Financing of working capital from long term resources provide the following benefits:

The temporary working capital requirement should be financed from short-term sources such as borrowing loan from banks, creditors, factoring etc. The financing of working capital through short-term sources of funds has the benefit of lower cost and establishing close relationship with the banks.

The finance manager has to make use of both long-term and short-term sources of funds in a way that the overall cost of working capital is the lowest and the funds are available on time and for the period they are really needed. Before going to see in detail about working capital finance, first let us see what the different sources of finance available are for the company and also see what are the sources particularly available to working capital.

Once the financial manager has estimated to invest in current assets like raw material, working-in-progress, finished goods, debtors etc. the next step is, he must arrange for funds for working capital.

Working capital management refers not only to estimating working capital requirement but also includes the process of bifurcating the total working capital requirement into permanent working capital and temporary working capital. The permanent working capital should be financed by arranging funds from long-term sources such as issue of shares, debentures and long-term loans. Financing of working capital from long term resources provide the following benefits:

The temporary working capital requirement should be financed from short-term sources such as borrowing loan from banks, creditors, factoring etc. The financing of working capital through short-term sources of funds has the benefit of lower cost and establishing close relationship with the banks.

The finance manager has to make use of both long-term and short-term sources of funds in a way that the overall cost of working capital is the lowest and the funds are available on time and for the period they are really needed. Before going to see in detail about working capital finance, first let us see what the different sources of finance available are for the company and also see what are the sources particularly available to working capital.

Tags : Financial Management - WORKING CAPITAL MANAGEMENT

Last 30 days 1005 views