Home | ARTS | Financial Management

|

Manufacturing Cycle - Operating Cycle and Estimation of Working Capital

Financial Management - WORKING CAPITAL MANAGEMENT

Manufacturing Cycle - Operating Cycle and Estimation of Working Capital

Posted On :

In the case of manufacturing company the operating cycle refers to the time involvement from cash through the following events and again leading to collection of cash.

Manufacturing

Cycle

In the case of manufacturing company the operating cycle refers to the time involvement from cash through the following events and again leading to collection of cash.

Cash Purchase of raw materials Work-in-progress

Finished goods Debtors Bills receivable Cash

Operating cycle of a manufacturing concern starts from cash to purchase of raw materials, conversion of work in progress into finished goods, conversion of finished goods into Bills Receivable and conversion of Bills Receivable into cash. In the other words the operating cycle is the number of days from cash to inventory to accounts receivable back to cash. The operating cycle denotes how long cash is tied up in inventories and receivables. If the operating cycle requires a longer time span between cash to cash, the requirement of working capital will be more because of the huge funds required in all the process. If there is any delay in a particular process there will be further increase in the working capital requirement. A long operating cycle means that less cash is available to meet short-term allegations. A distillery has to make a heavy investment in working capital rather than a bakery, which has a low working capital.

Forecasting/estimate of working capital requirement

“Working capital is the life-blood and the controlling nerve centre of a business”. No business can run successfully without an adequate amount of working capital. To avoid the shortage in working capital, an estimate of working capital requirements should be made in advance so that arrangements can be made to procure adequate working capital.

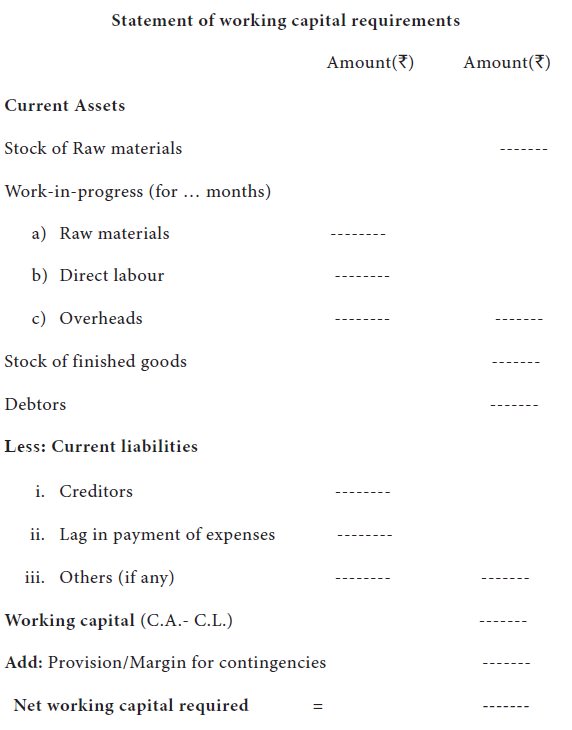

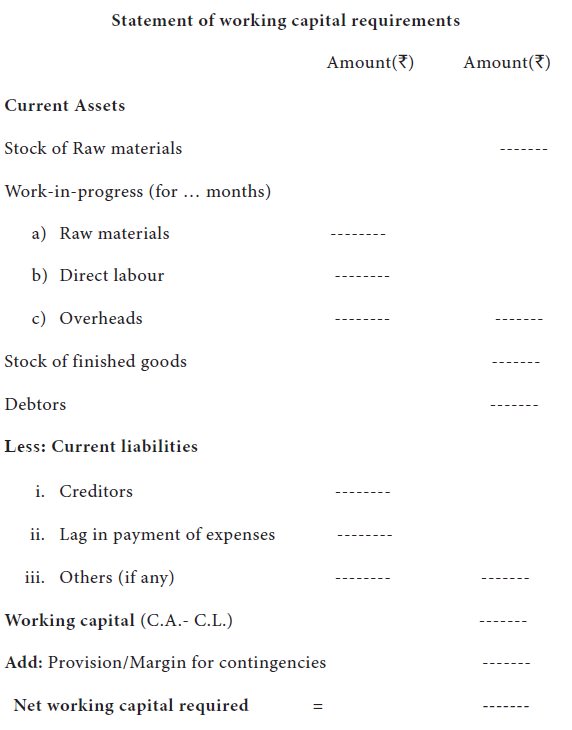

Suggested proforma for estimation of working capital requirements are given below:

Notes:

Profits should be ignored while calculating working capital requirements for the following reasons:

Assumptions: Debtors are taken at cost price not at selling price.

Working Capital Requirement

(The above calculations are made on the basis of Tandon Committee. Please refer lesson 4)

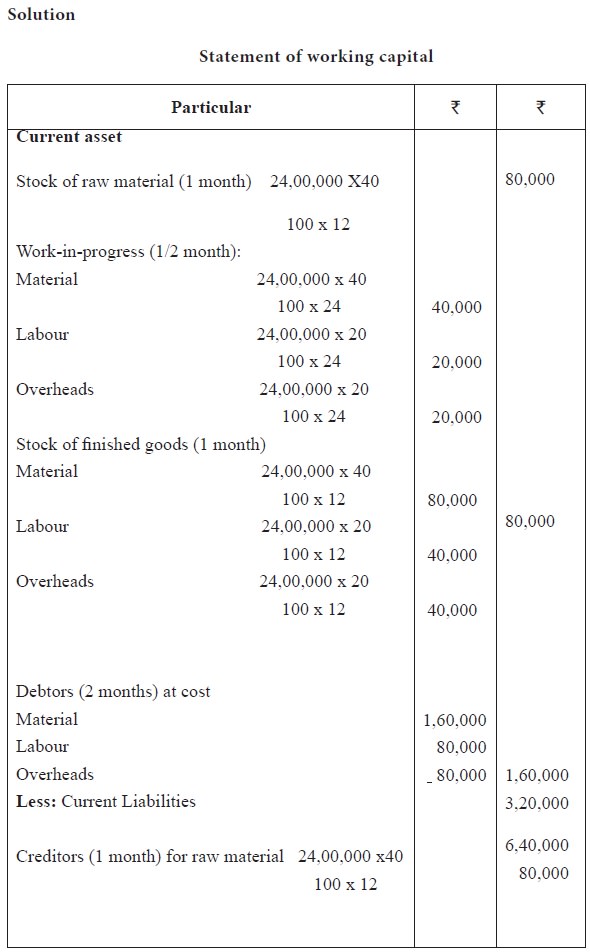

Example 5

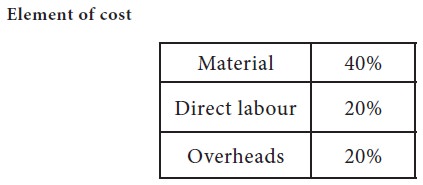

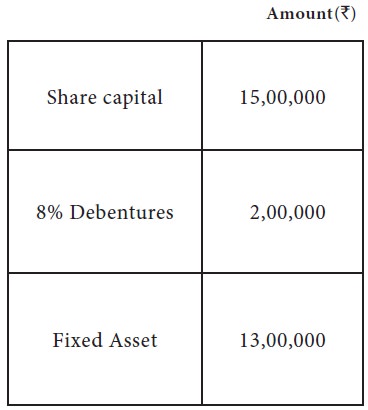

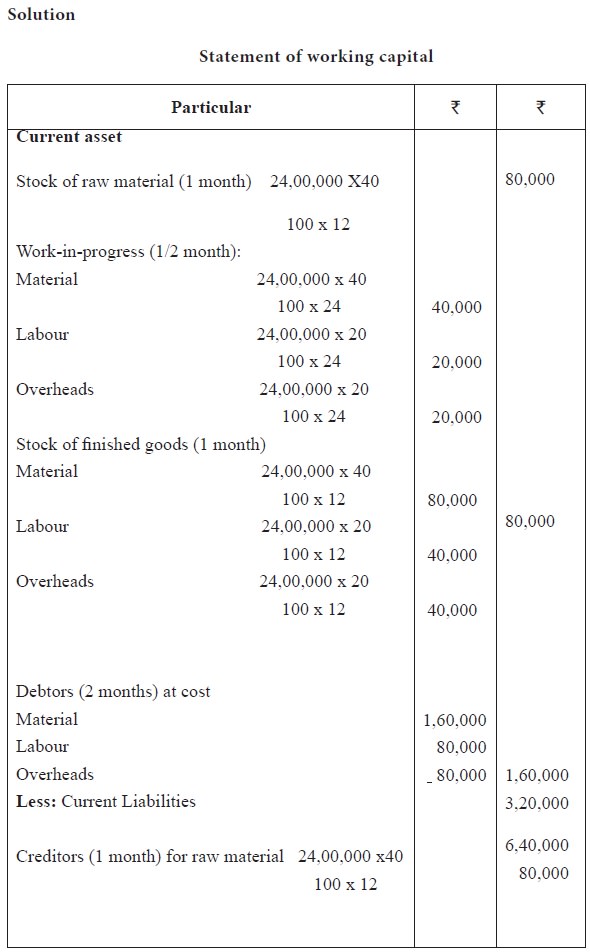

A proforma cost sheet of a company provides the following particular

The following further particular are available

a. It is proposed to maintain a level of activity of 2,00,000 Units

b. Selling price is Rs. 12 per unit.

c. Raw material are expected to remain in stores for an average period of one month

d. Materials will be in process, on an average for half a month.

e. Finished goods are required to be in stock for an average period of one month.

f. Credit allowed to debtors is two months

g. Credit allowed by suppliers is one month.

You may assume that sales and production follow a consistent pattern.

You are required to prepare a statement of working capital requirement, a forecast profit and loss account and balance sheet of the company assuming that:

In the case of manufacturing company the operating cycle refers to the time involvement from cash through the following events and again leading to collection of cash.

Cash Purchase of raw materials Work-in-progress

Finished goods Debtors Bills receivable Cash

Operating cycle of a manufacturing concern starts from cash to purchase of raw materials, conversion of work in progress into finished goods, conversion of finished goods into Bills Receivable and conversion of Bills Receivable into cash. In the other words the operating cycle is the number of days from cash to inventory to accounts receivable back to cash. The operating cycle denotes how long cash is tied up in inventories and receivables. If the operating cycle requires a longer time span between cash to cash, the requirement of working capital will be more because of the huge funds required in all the process. If there is any delay in a particular process there will be further increase in the working capital requirement. A long operating cycle means that less cash is available to meet short-term allegations. A distillery has to make a heavy investment in working capital rather than a bakery, which has a low working capital.

Forecasting/estimate of working capital requirement

“Working capital is the life-blood and the controlling nerve centre of a business”. No business can run successfully without an adequate amount of working capital. To avoid the shortage in working capital, an estimate of working capital requirements should be made in advance so that arrangements can be made to procure adequate working capital.

Suggested proforma for estimation of working capital requirements are given below:

Notes:

Profits should be ignored while calculating working capital requirements for the following reasons:

1. Profits may or may not be used as working capital.

2. Even if profits are to be used for working capital it has to be reduced by the amount of income tax, drawings, dividends paid etc.

3. Calculation of work-in progress depends upon its degree of completion as regards to material, labour and overheads. However, if nothing is given in a question as regards to the degree of completion, we suggest the students to take 100% cost of material, labour and overheads.

4. Calculation for stocks of finished goods and debtors should be made at cost unless otherwise asked in the question.

Example 4

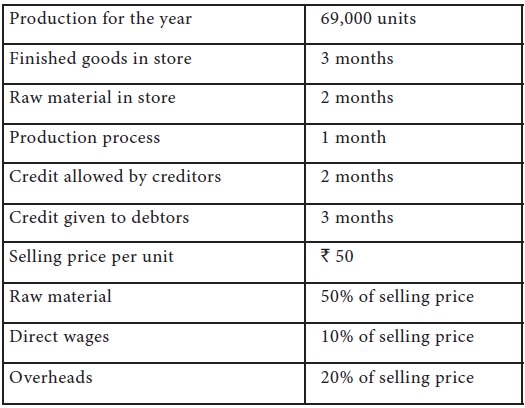

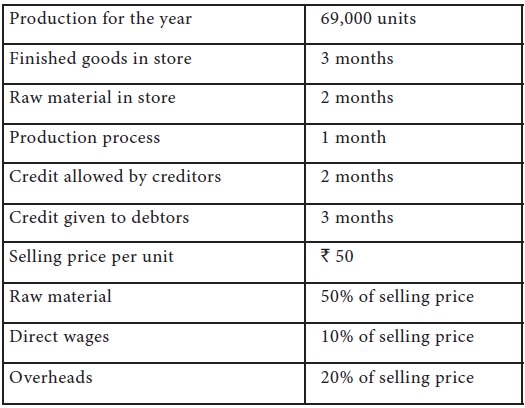

You are provided with the following information in respect of XYZ Ltd.

For the ensuing year:

There is a regular production and sales cycle and wages and overheads accrue evenly. Wages are paid in the next month of accrual. Material is introduced in the beginning of production cycle.

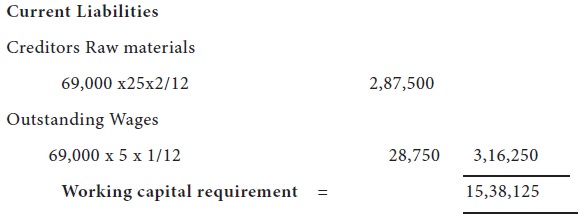

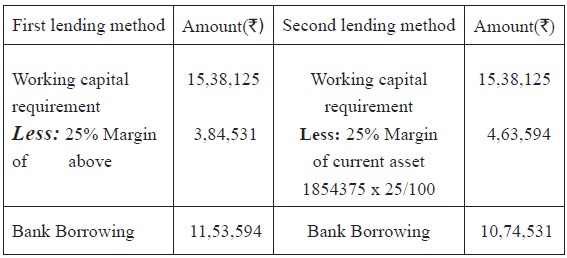

You are required to find out

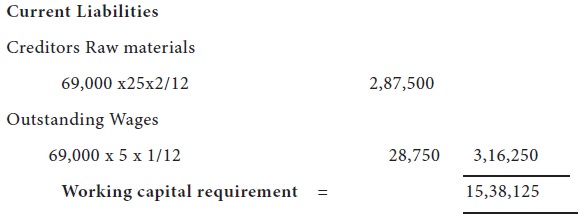

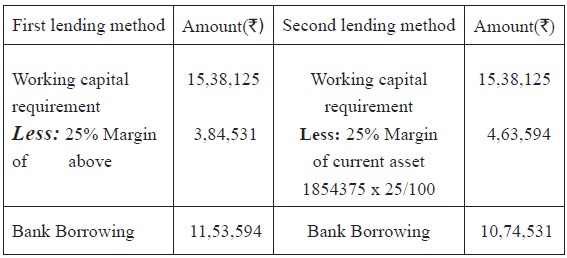

1. Its working capital requirement

2. Its permissible bank borrowing as per 1st and 2nd method of lending. (Please refer lesson 4 unit 5)

2. Even if profits are to be used for working capital it has to be reduced by the amount of income tax, drawings, dividends paid etc.

3. Calculation of work-in progress depends upon its degree of completion as regards to material, labour and overheads. However, if nothing is given in a question as regards to the degree of completion, we suggest the students to take 100% cost of material, labour and overheads.

4. Calculation for stocks of finished goods and debtors should be made at cost unless otherwise asked in the question.

Example 4

You are provided with the following information in respect of XYZ Ltd.

For the ensuing year:

There is a regular production and sales cycle and wages and overheads accrue evenly. Wages are paid in the next month of accrual. Material is introduced in the beginning of production cycle.

You are required to find out

1. Its working capital requirement

2. Its permissible bank borrowing as per 1st and 2nd method of lending. (Please refer lesson 4 unit 5)

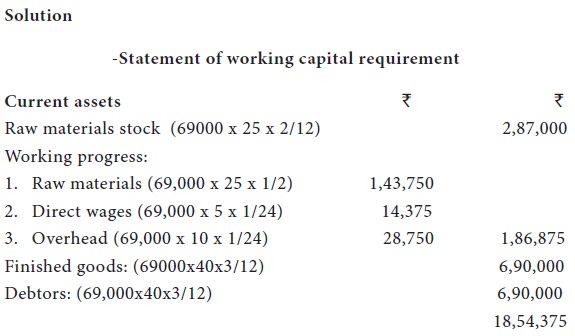

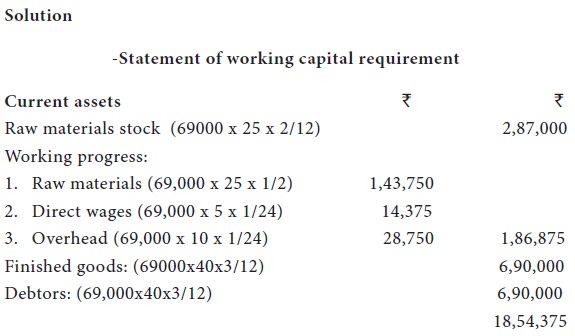

Assumptions: Debtors are taken at cost price not at selling price.

Working Capital Requirement

(The above calculations are made on the basis of Tandon Committee. Please refer lesson 4)

Example 5

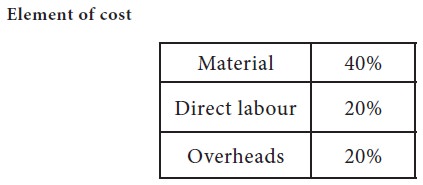

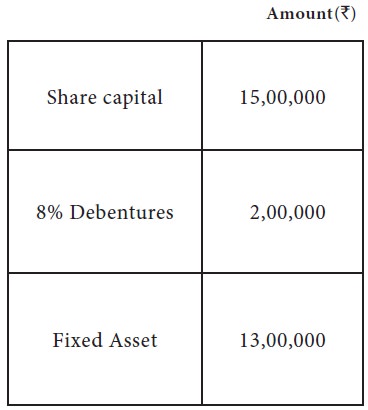

A proforma cost sheet of a company provides the following particular

The following further particular are available

a. It is proposed to maintain a level of activity of 2,00,000 Units

b. Selling price is Rs. 12 per unit.

c. Raw material are expected to remain in stores for an average period of one month

d. Materials will be in process, on an average for half a month.

e. Finished goods are required to be in stock for an average period of one month.

f. Credit allowed to debtors is two months

g. Credit allowed by suppliers is one month.

You may assume that sales and production follow a consistent pattern.

You are required to prepare a statement of working capital requirement, a forecast profit and loss account and balance sheet of the company assuming that:

Tags : Financial Management - WORKING CAPITAL MANAGEMENT

Last 30 days 2441 views