Accounting For Managers - Management Accounting-Marginal Costing

Pricing Decisions-Application Of Marginal Costing

Posted On :

Marginal costing techniques help a firm to decide about the prices of various products in a fairly easy manner. Let’s examine the following cases:

Pricing

Decisions

Marginal costing techniques help a firm to decide about the prices of various products in a fairly easy manner. Let’s examine the following cases:

P/V Ratio Is 60% and the marginal cost of the product is Rs.50. What will be the selling price?

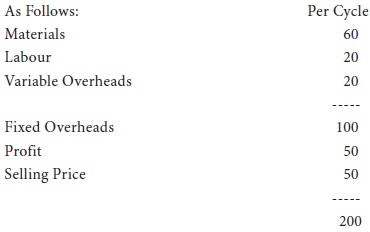

The Price Structure Of A Cycle Made By The Visu Cycle Co. Ltd. Is

(a) the selling price is reduced by 10%?

(b) the selling price is reduced by 20%?

(a) Selling price is reduced by 10% and to get the existing profit of rs.50 lakhs.

Are to be obtained and sold to earn the existing profit of rs.5,00,000.

(b) Selling price reduced by 20% and to get the existing profit of rs.5,00,000.

= ------------------------------------------

60

= 1,66,667 cycles are to be produced

and sold to earn the existing profit of rs.50 Lakhs.

SSA company is working well below normal capacity due to recession. The directors of the company have been approached with an enquiry for special job. The costing department estimated the following in respect of the job.

Direct Materials Rs.10,000

Direct Labour 500 Hours @ Rs.2 Per Hour

Overhead Costs: Normal Recovery Rates

Variable Re.0.50 Per Hour

Fixed Re.1.00 Per Hour

The directors ask you to advise them on the minimum price to be charged.

Assume that there are no production difficulties regarding the job.

Marginal costing techniques help a firm to decide about the prices of various products in a fairly easy manner. Let’s examine the following cases:

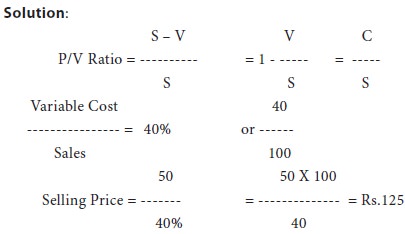

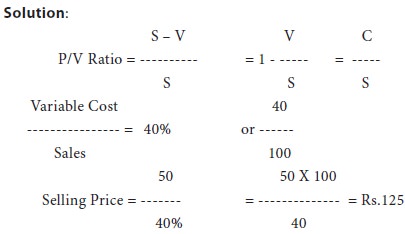

(I) Fixation of Selling Price

Illustration 12:

P/V Ratio Is 60% and the marginal cost of the product is Rs.50. What will be the selling price?

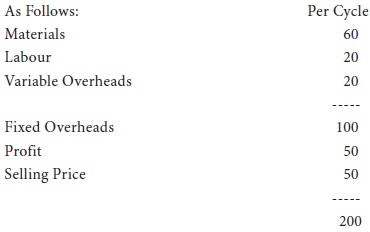

(ii) Reducing Selling Price

Illustration 13:

The Price Structure Of A Cycle Made By The Visu Cycle Co. Ltd. Is

(a) the selling price is reduced by 10%?

(b) the selling price is reduced by 20%?

Solution: | ||||

(Rs.) | (Rs.) | |||

Existing

profit | = | 1,00,000

x 50 | = | 50,00,000 |

Total

fixed overheads | = | 1,00,000

x 50 | = | 50,00,000 |

(a) Selling price is reduced by 10% and to get the existing profit of rs.50 lakhs.

New

Selling Price | = | 200 | – 10%

Of Rs.200 |

= | 200 | – 20

=Rs.180 | |

New

Contribution | = | 180 | – 100

=Rs.80 Per Unit |

Total

Sales (Units) | = | F +

P/Contribution Per Unit | |

5,00,000

+ 5,00,000 | |||

= | --------------------------- | ||

80 | |||

= | 1,25,000

Cycles | ||

Are to be obtained and sold to earn the existing profit of rs.5,00,000.

(b) Selling price reduced by 20% and to get the existing profit of rs.5,00,000.

New

Selling Price | = | 200 | – 20%

Of Rs.200 |

= | 200 | – 40 =

Rs.160 | |

New

Contribution | = | S – V | |

= | 160 | – 100 =

Rs.80 Per Unit | |

Total

Sales (Units) | = | F +

P/Contribution Per Unit | |

5,00,000

+ 5,00,000 | |||

= ------------------------------------------

60

= 1,66,667 cycles are to be produced

and sold to earn the existing profit of rs.50 Lakhs.

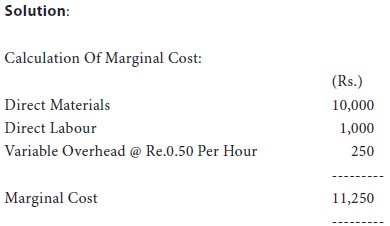

(iii) Pricing During Recession:

Illustration 14:

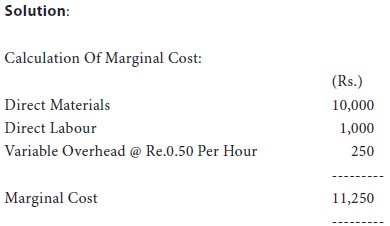

SSA company is working well below normal capacity due to recession. The directors of the company have been approached with an enquiry for special job. The costing department estimated the following in respect of the job.

Direct Materials Rs.10,000

Direct Labour 500 Hours @ Rs.2 Per Hour

Overhead Costs: Normal Recovery Rates

Variable Re.0.50 Per Hour

Fixed Re.1.00 Per Hour

The directors ask you to advise them on the minimum price to be charged.

Assume that there are no production difficulties regarding the job.

Commentary:

Here the minimum price to be quoted is Rs.11,250 which is the marginal

cost. By quoting so, the company is sacrificing the recovery of the profit and

the fixed-costs. The fixed costs will continue to be incurred even if the

company does not accept the offer. So any price above Rs.11,250 is welcome.

Tags : Accounting For Managers - Management Accounting-Marginal Costing

Last 30 days 2052 views