Accounting For Managers - Management Accounting-Marginal Costing

Level Of Activity Planning-Application Of Marginal Costing

Posted On :

Marginal costing is of great help while planning the level of activity. Maximum contribution at a particular level of activity will show the position of maximum profitability.

Level Of

Activity Planning

Marginal costing is of great help while planning the level of activity. Maximum contribution at a particular level of activity will show the position of maximum profitability.

Illustration 6:

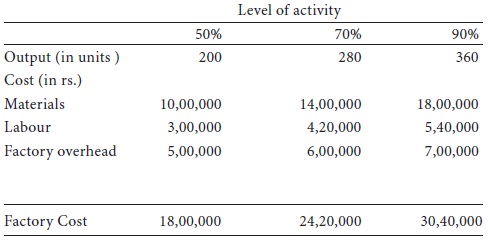

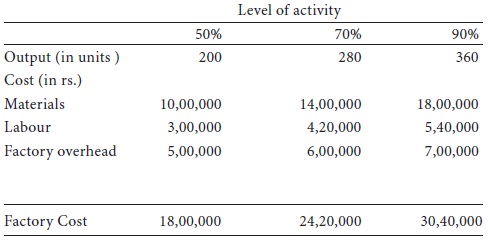

Following is the cost structure of sundaram corporation, pondicherry, manufacturers of colour tvs.

In view of the fact that there will be no increase in fixed costs and import license for the picture tubes required in the manufacture of its tvs has been obtained, the corporation is considering an increase in production to its full installed capacity.

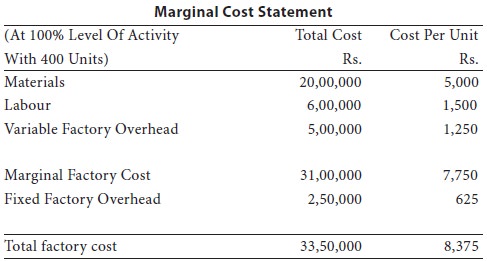

The management requires a statement showing all details of production costs at 100% level of activity.

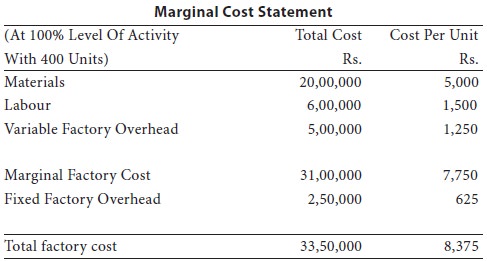

Solution:

Thus, the marginal factory cost per unit is rs.7,750 and the total production cost per unit is rs.8,375.

Commentary:

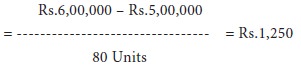

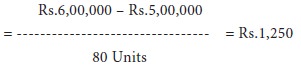

(I) Calculation Of Variable Factory Overheads Per Unit:

(II) Calculation Of Fixed Factory Overheads:

Factory Overheads – (No. Of Units At Certain Level Of Activity X Variable Factory Overheads Per Unit).

Therefore Rs.5,00,000 – (200 Units X 1,250)

Marginal costing is of great help while planning the level of activity. Maximum contribution at a particular level of activity will show the position of maximum profitability.

Illustration 6:

Following is the cost structure of sundaram corporation, pondicherry, manufacturers of colour tvs.

In view of the fact that there will be no increase in fixed costs and import license for the picture tubes required in the manufacture of its tvs has been obtained, the corporation is considering an increase in production to its full installed capacity.

The management requires a statement showing all details of production costs at 100% level of activity.

Solution:

Thus, the marginal factory cost per unit is rs.7,750 and the total production cost per unit is rs.8,375.

Commentary:

(I) Calculation Of Variable Factory Overheads Per Unit:

(II) Calculation Of Fixed Factory Overheads:

Factory Overheads – (No. Of Units At Certain Level Of Activity X Variable Factory Overheads Per Unit).

Therefore Rs.5,00,000 – (200 Units X 1,250)

Therefore Rs.5,00,000 –

Rs.2,50,000 = Rs.2,50,000

The Amount Can Be Verified By Making Calculation At Any Other Level Of Activity.

(III) Variable Factory Overheads At 100% Level Of Activity:

The Amount Can Be Verified By Making Calculation At Any Other Level Of Activity.

(III) Variable Factory Overheads At 100% Level Of Activity:

400 Units X 1,250 = Rs.5,00,000

Tags : Accounting For Managers - Management Accounting-Marginal Costing

Last 30 days 1317 views