Accounting For Managers - Management Accounting-Marginal Costing

Make Or Buy Decisions-Application Of Marginal Costing

Posted On :

A company might be having unused capacity which may be utilized for making component parts or similar items instead of buying them from the market.

Make Or Buy Decisions

A company might be having unused capacity which may be utilized for making component parts or similar items instead of buying them from the market. In arriving at such a `make or buy’ decision, the cost of manufacturing component parts should be compared with price quoted in the market. If the variable costs are lower than the purchase price, the component parts should be manufactured in the factory itself. Fixed costs are excluded on the assumption that they have been already incurred, and the manufacturing of components involves only variable cost. However, if there is an increase in fixed costs and any limiting factor is operating while producing components etc. That should also be taken into account. Consider the following illustration, throwing light on these aspects.

You are the management accountant of XYZ CO. Ltd. The Managing director of the company seeks your advice on the following problem: the company produces a variety of products each having a number of computer parts. Product “B” takes 5 hours to produce on machine no.99

Solution:

In this problem the cost of new product plus contribution lost during the time for manufacturing “A-10” should be compared with the supplier’s price to arrive at a decision.

Solution:

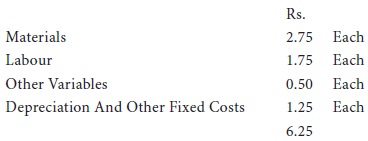

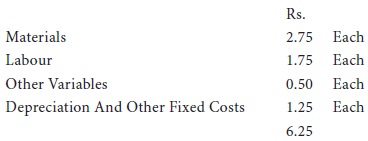

Variable cost of manufacturing is Rs.5; (Rs.6.25 – Rs.1.25) but the market price is Rs.4.85. If the fixed cost of Rs.1.25 is also added, it is not profitable to make the component. Because there is a saving of Rs.0.15 even in variable cost, it is profitable to procure from outside.

A company might be having unused capacity which may be utilized for making component parts or similar items instead of buying them from the market. In arriving at such a `make or buy’ decision, the cost of manufacturing component parts should be compared with price quoted in the market. If the variable costs are lower than the purchase price, the component parts should be manufactured in the factory itself. Fixed costs are excluded on the assumption that they have been already incurred, and the manufacturing of components involves only variable cost. However, if there is an increase in fixed costs and any limiting factor is operating while producing components etc. That should also be taken into account. Consider the following illustration, throwing light on these aspects.

Illustrations 8:

You are the management accountant of XYZ CO. Ltd. The Managing director of the company seeks your advice on the following problem: the company produces a variety of products each having a number of computer parts. Product “B” takes 5 hours to produce on machine no.99

Solution:

In this problem the cost of new product plus contribution lost during the time for manufacturing “A-10” should be compared with the supplier’s price to arrive at a decision.

It takes

5 hours to produce one unit of “B.

Therefore, contribution earned per hour on machine no.99 is Rs.20/5 = Rs.4. “A-10” takes two hours to be manufactured on machine which is producing “B”. Real cost of “A-10” to the company = marginal cost of “aA-10” plus contribution lost for using the machine for “A-10”.

Rs.5 + Rs.8 = Rs.13

This is more than the seller’s price of rs.12.50 and so it is advisable for the company to buy the product from outside.

A t.V. Manufacturing company finds that while it costs Rs.6.25 To make each component X, the same is available in the market at Rs.4.85 Each, with an assurance of continued supply. The break down of cost is:

Therefore, contribution earned per hour on machine no.99 is Rs.20/5 = Rs.4. “A-10” takes two hours to be manufactured on machine which is producing “B”. Real cost of “A-10” to the company = marginal cost of “aA-10” plus contribution lost for using the machine for “A-10”.

Rs.5 + Rs.8 = Rs.13

This is more than the seller’s price of rs.12.50 and so it is advisable for the company to buy the product from outside.

Illustration 9:

A t.V. Manufacturing company finds that while it costs Rs.6.25 To make each component X, the same is available in the market at Rs.4.85 Each, with an assurance of continued supply. The break down of cost is:

Should you make or buy?

Solution:

Variable cost of manufacturing is Rs.5; (Rs.6.25 – Rs.1.25) but the market price is Rs.4.85. If the fixed cost of Rs.1.25 is also added, it is not profitable to make the component. Because there is a saving of Rs.0.15 even in variable cost, it is profitable to procure from outside.

Tags : Accounting For Managers - Management Accounting-Marginal Costing

Last 30 days 4334 views