Accounting For Managers - Management Accounting-Marginal Costing

Additional Illustrations-Marginal Costing

Posted On :

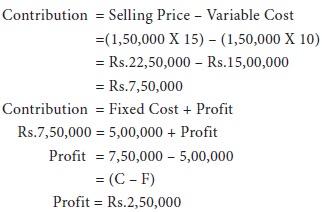

From the following information, find out the amount of profit earned during the year, using marginal cost equation:

Additional Illustrations

from the following information, find out the amount of profit earned during the year, using marginal cost equation:

Fixed Cost Rs.5,00,000

Variable Cost Rs.10 Per Unit

Selling Price Rs.15 Per Unit

Output Level 1,50,000 Units

Solution:

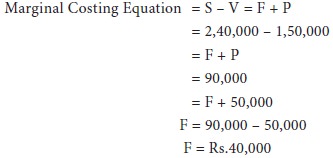

Determine the amount of fixed costs from the following details, using the marginal cost equation.

Solution:

Sales 10,000 Units @ Rs.25 Per Unit

Variable Cost Rs.15 Per Unit

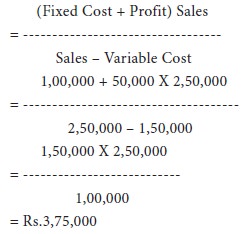

Fixed Costs Rs.1,00,000

Find Out The Sales For Earning A Profit Of Rs.50,000

Solution:

Sales To Earn A Profit Of Rs.50,000

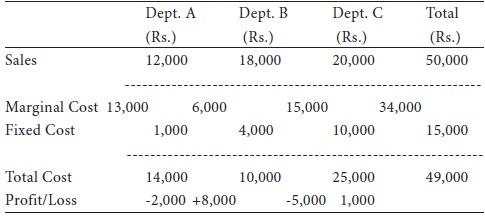

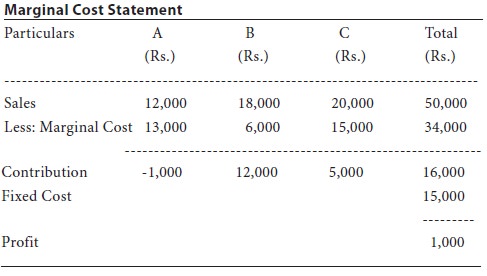

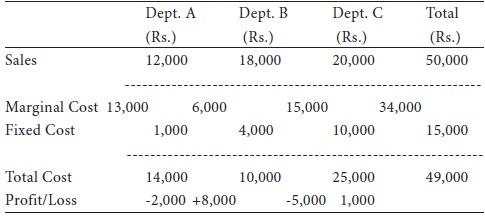

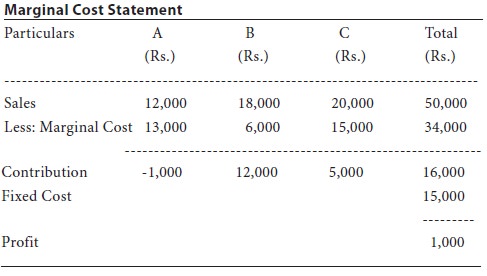

The records of ram ltd., Which has three departments give the following figures:

The management wants to discontinue product c immediately as it gives the maximum loss. How would you advise the management?

Solution:

Here department A gives negative contribution, and as such it can be given up. Department C gives a contribution of Rs.5,000. If department C is closed, then it may lead to further loss. Therefore, C should be continued.

Illustration 16:

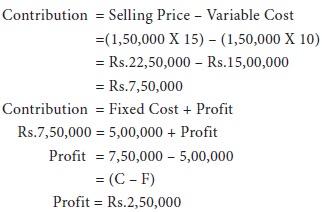

from the following information, find out the amount of profit earned during the year, using marginal cost equation:

Fixed Cost Rs.5,00,000

Variable Cost Rs.10 Per Unit

Selling Price Rs.15 Per Unit

Output Level 1,50,000 Units

Solution:

Illustration 17:

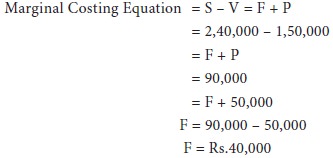

Determine the amount of fixed costs from the following details, using the marginal cost equation.

Sales | Rs.2,40,000 | |

Direct

Materials | Rs. | 80,000 |

Direct

Labour | Rs. | 50,000 |

Variable

Overheads | Rs. | 20,000 |

Profit | Rs. | 50,000 |

Solution:

Illustration 18:

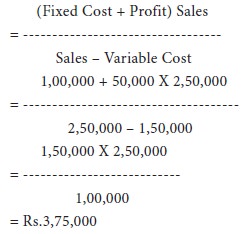

Sales 10,000 Units @ Rs.25 Per Unit

Variable Cost Rs.15 Per Unit

Fixed Costs Rs.1,00,000

Find Out The Sales For Earning A Profit Of Rs.50,000

Solution:

Sales To Earn A Profit Of Rs.50,000

Illustration 19:

The records of ram ltd., Which has three departments give the following figures:

The management wants to discontinue product c immediately as it gives the maximum loss. How would you advise the management?

Solution:

Here department A gives negative contribution, and as such it can be given up. Department C gives a contribution of Rs.5,000. If department C is closed, then it may lead to further loss. Therefore, C should be continued.

Tags : Accounting For Managers - Management Accounting-Marginal Costing

Last 30 days 1445 views