Accounting For Managers - Management Accounting-Marginal Costing

Margin of Safety-Marginal Costing

Posted On :

Margin of Safety

Margin

of Safety

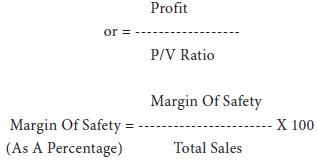

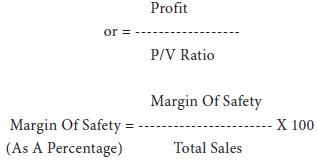

Total sales minus the sales at break-even point is known as the margin of safety. Lower break-even point means a higher margin of safety. Margin of safety can also be expressed as a percentage of total sales. The formula is:

Margin Of Safety = Total Sales – Sales At B.E.P.

Higher margin of safety shows that the business is sound and when sales substantially come down, (but not below break even sales) profit might be earned by the business. Lower margin of safety, as pointed out earlier, means that when sales come down slightly profit position might be affected adversely. Thus, margin of safety can be used to test the soundness of a business. In order to improve the margin of safety a business can increase selling prices (without affecting demand, of course) reducing fixed or variable costs and replacing unprofitable products with profitable one.

Illustration 1: beta manufacturers ltd. Has supplied you the following information in respect of one of its products:

Find out (a) contribution per unit, (b) break-even point, (c) margin of safety, (d) profit, and (e) volume of sales to earn a profit of rs.24,000.

Solution:

Let us assume that the contribution per unit at B.E.P. Sales of 9,000 is X.

Fixed Cost

B.E.P. = ------------------------------

Contribution Per Unit

Contribution per unit is not known. Therefore,

Total sales minus the sales at break-even point is known as the margin of safety. Lower break-even point means a higher margin of safety. Margin of safety can also be expressed as a percentage of total sales. The formula is:

Margin Of Safety = Total Sales – Sales At B.E.P.

Higher margin of safety shows that the business is sound and when sales substantially come down, (but not below break even sales) profit might be earned by the business. Lower margin of safety, as pointed out earlier, means that when sales come down slightly profit position might be affected adversely. Thus, margin of safety can be used to test the soundness of a business. In order to improve the margin of safety a business can increase selling prices (without affecting demand, of course) reducing fixed or variable costs and replacing unprofitable products with profitable one.

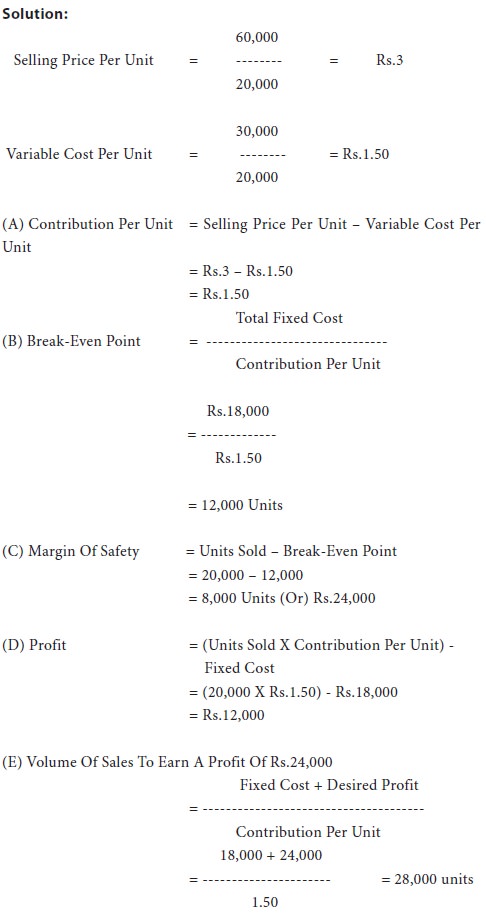

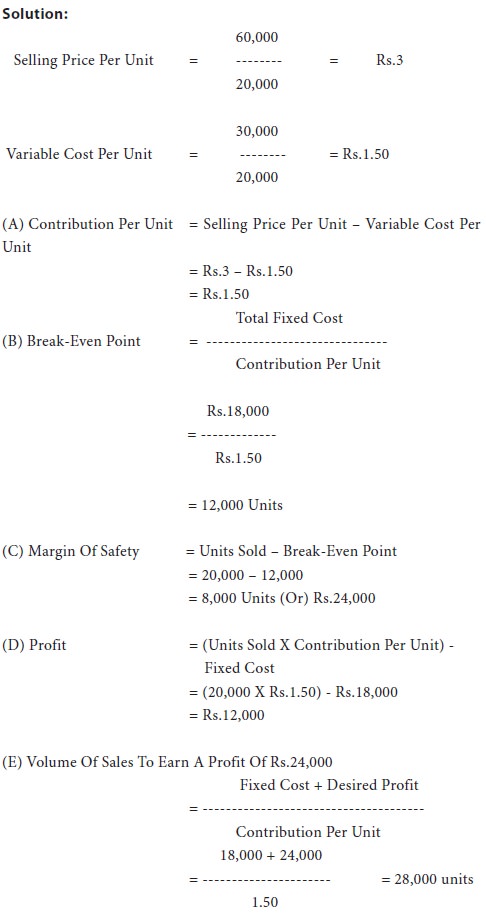

Illustration 1: beta manufacturers ltd. Has supplied you the following information in respect of one of its products:

Total

Fixed Costs | 18,000 |

Total

Variable Costs | 30,000 |

Total

Sales | 60,000 |

Units

Sold | 20,000 |

Find out (a) contribution per unit, (b) break-even point, (c) margin of safety, (d) profit, and (e) volume of sales to earn a profit of rs.24,000.

Illustration

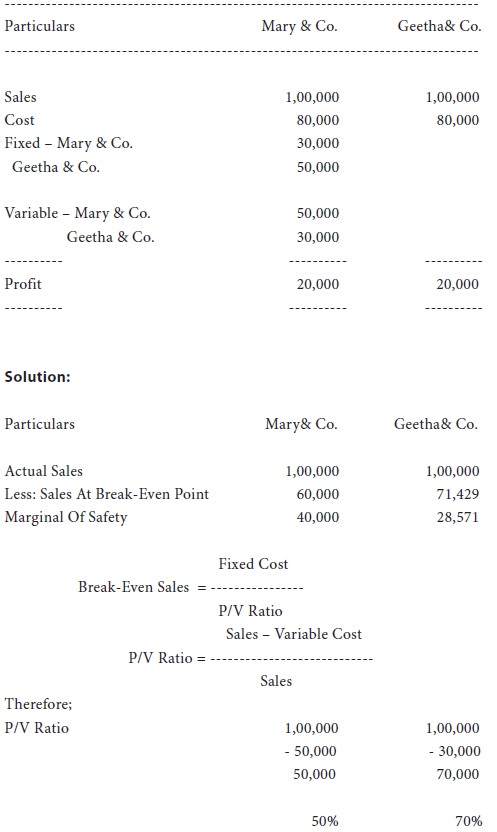

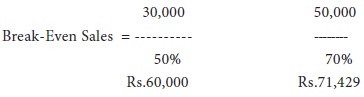

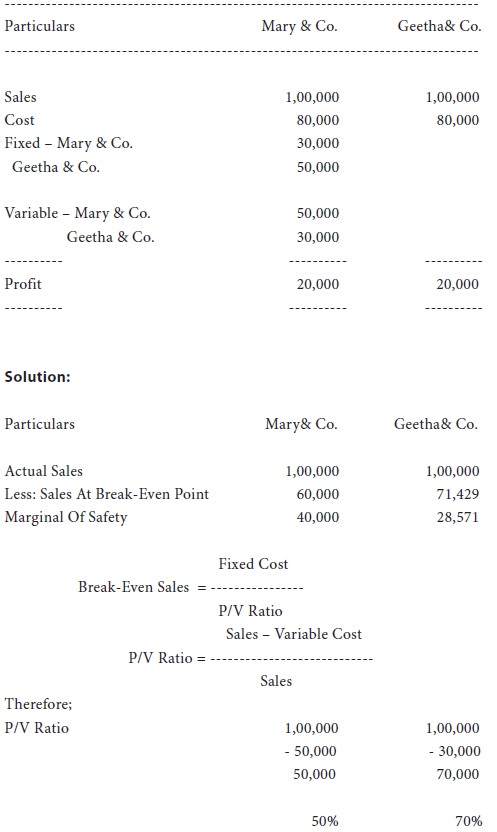

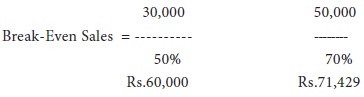

2: Calculate `Margin Of Safety’ from the following

data:

Illustration 3:

From the following particulars, find out the selling price per unit if b.E.P. Is to be brought down to 9,000 units.

Variable

Cost Per Unit Rs.75

|

Fixed

Expenses |

Rs.2,70,000 |

|

Selling

Price Per Unit |

Rs.100 |

Let us assume that the contribution per unit at B.E.P. Sales of 9,000 is X.

Fixed Cost

B.E.P. = ------------------------------

Contribution Per Unit

Contribution per unit is not known. Therefore,

2,70,000

9,000 Units = -------------

X

9,000 X = 2,70,000

X = 30

Contribution Is Rs.30 Per Unit, In Place Of Rs.25. So, The Selling Price Should Be Rs.105, I.E. Rs.75 + Rs.30.

9,000 Units = -------------

X

9,000 X = 2,70,000

X = 30

Contribution Is Rs.30 Per Unit, In Place Of Rs.25. So, The Selling Price Should Be Rs.105, I.E. Rs.75 + Rs.30.

Tags : Accounting For Managers - Management Accounting-Marginal Costing

Last 30 days 3039 views