Home | ARTS | Financial Management

|

Operating Cycle - Operating Cycle and Estimation of Working Capital

Financial Management - WORKING CAPITAL MANAGEMENT

Operating Cycle - Operating Cycle and Estimation of Working Capital

Posted On :

This is the chronological sequence of events in a manufacturing company in regard to working capital.

Operating

Cycle

This is the chronological sequence of events in a manufacturing company in regard to working capital. We know that working capital is the excess of current assets over current liabilities. In reality such excess of current assets over current liabilities may be either more or less than the working capital requirement of the company. Accordingly it is necessary to calculate the working capital of the company. This is illustrated with an example. Such computation of working capital requirement may also be necessary for planning increase of sales from existing level.

The operating cycle is the length

of time for a company to acquire materials, produce the products, sell the

products, and collect the proceeds from customers. The normal operating cycle is

the average length of time for a company to acquire materials, produce the

products and collect the proceeds from customers.

From the above it is very clear that the working capital is required to meet the time-gap between the raw materials and actual realisation of stocks. This time gap is technically termed as operating cycle or working capital cycle. The operating cycle can be sub-divided into two on the basis of the nature of the business namely trading cycle and manufacturing cycle.

Trading business does not involve any manufacturing activities. Their activities are limited to buying finished goods and selling the same to consumers. Therefore operating cycle requires a short time span behaviour cash to cash, the requirement of working capital will be low because very less number of processes in the operation is given below:

Cash Inventories Debtors Bills Receivable Cash

In the case of trading firm the operating cycle includes time required to convert

1. Cash into inventories

2. Inventories into debtors

3. Debtors into cash.

In the case of financing firm, the operating cycle is still less when compared to trading business. Its operating cycle includes time taken for

1. Conversion of cash into suitable borrowers and

2. Borrowers into cash.

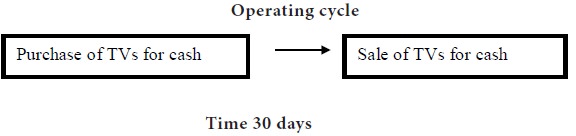

You have invested Rs.50,000 in your company on 1.1.2006 for buying and selling of color TVs assuming:

1. Inventory costing Rs. 50,000 is purchased at the beginning of each month.

2. All of the TVs were sold at the end of each month on cash for Rs. 60,000

1. What is the operating cycle of the company?

The answer is 30 days

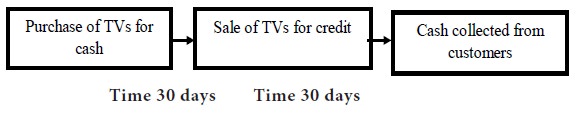

2. If the sales are made on account (credit) of 30 days terms what is the operating cycle of the company?

The answer is 60 days

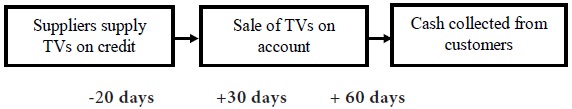

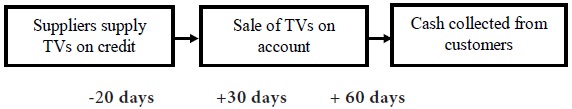

3. Suppose when the suppliers allow 20 days term and sales are made an account of 60 days’ term. What is the operating cycle of the company?

The answer is 70 days (30+60-20)

In the above all cases one could see how much retained earnings are available for dividends.

If a company can shorten the operating cycle, cash can accumulate more quickly, and due to the time value of money, there should be a positive impact on the share value. Holding everything else constant, an investor would prefer a company with a short operating cycle to a similar company with a longer operational cycle.

The formula to calculate operating cycle

Operating cycle = Age of inventory + collection period

Net operating cycle = Age of inventory + collection period – deferred payments

For calculating net operating cycle, various conversion periods may be calculated as follows:

Raw material cycle period (RMCP)= (Average Raw material stock/Total raw material Consumable) x 365

Working progress cycle period (WPCP) = (Average work in progress/ Total cost of Production) x 365

Finished goods cycle period (FGCP) = (Average finished goods/Total cost of goods Sold) x 365

Accounts receivable cycle period (ARCP) = (Average Account receivable/Total of sales) x 365

Accounts payable cycle period (APCP) = (Average account payable/ Total credit purchase) x 365

where,

Total credit purchase = cost of goods sold + ending inventory – beginning of inventory

For above calculations, the following points are essential

1. The average value is the average of opening balance and closing balance of the respective items. In case the opening balance is not available, only the closing balance is taken as the average.

2. The figure 365 represents number of days in a year. Sometimes even 360 days are considered.

3. The calculation of RMCP, WPCP and FGCP the denomination is taken as the total cost raw material consumable, total cost of production total, cost of goods sold respectively since they form respective end products.

On the basis of the above, the operating cycle period:

Total operating cycle period (TOCP) = RMCP + WPCP + FGCP + ARCP

Net operating cycle period(NOCP) = TOCP-DP(deferred payment) (APCP)

The operating cycle for individual components are not constant in the growth of the business. They keep on changing from time to time, particularly the Receivable Cycle Period and the Deferred Payment. But the company tries to retain the Net Operating Cycle Period as constant or even less by applying some requirements such as inventory control and latest technology in production. Therefore regular attention on the firm’s operating cycle for a period with the previous period and with that of the industrial average cycle period may help in maintaining and controlling the length of the operating cycle.

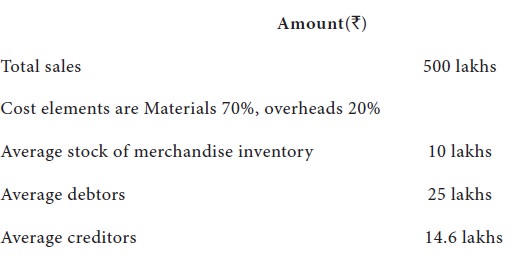

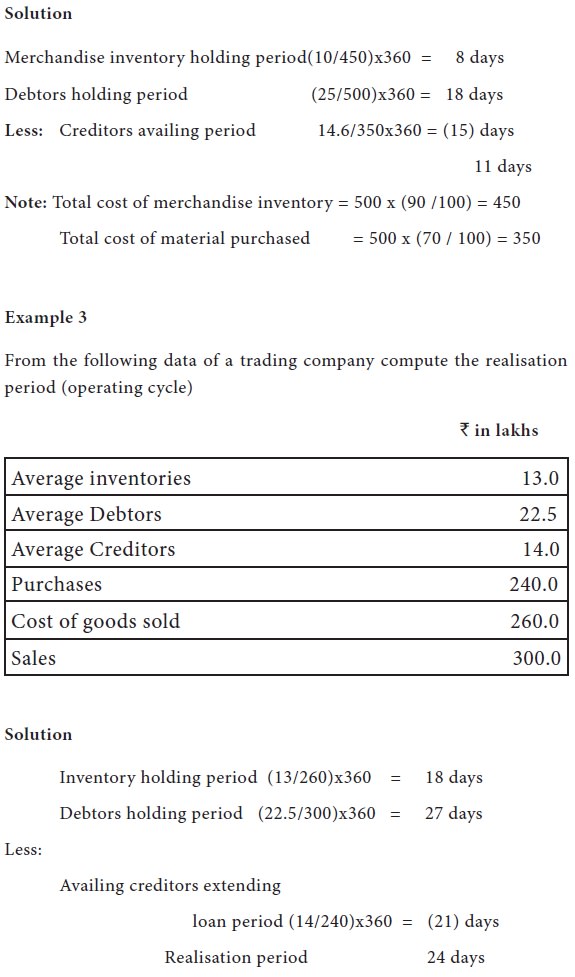

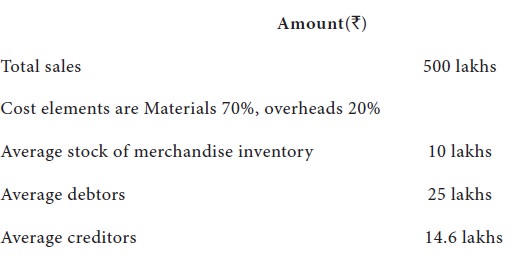

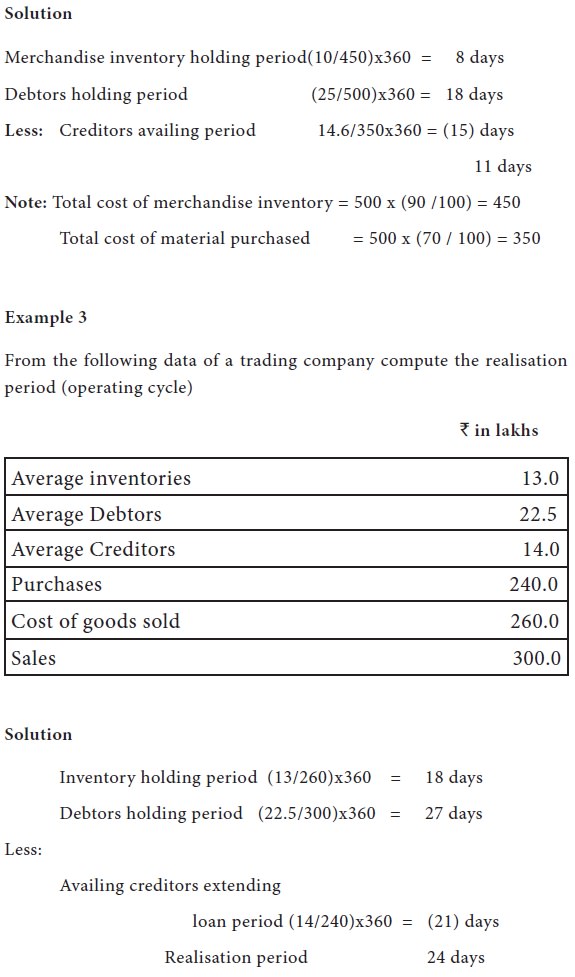

Example 2

Gee Pee, a trading organization has supplied the following information. Calculate the operating period.

This is the chronological sequence of events in a manufacturing company in regard to working capital. We know that working capital is the excess of current assets over current liabilities. In reality such excess of current assets over current liabilities may be either more or less than the working capital requirement of the company. Accordingly it is necessary to calculate the working capital of the company. This is illustrated with an example. Such computation of working capital requirement may also be necessary for planning increase of sales from existing level.

From the above it is very clear that the working capital is required to meet the time-gap between the raw materials and actual realisation of stocks. This time gap is technically termed as operating cycle or working capital cycle. The operating cycle can be sub-divided into two on the basis of the nature of the business namely trading cycle and manufacturing cycle.

Trading Cycle

Trading business does not involve any manufacturing activities. Their activities are limited to buying finished goods and selling the same to consumers. Therefore operating cycle requires a short time span behaviour cash to cash, the requirement of working capital will be low because very less number of processes in the operation is given below:

Cash Inventories Debtors Bills Receivable Cash

In the case of trading firm the operating cycle includes time required to convert

1. Cash into inventories

2. Inventories into debtors

3. Debtors into cash.

In the case of financing firm, the operating cycle is still less when compared to trading business. Its operating cycle includes time taken for

1. Conversion of cash into suitable borrowers and

2. Borrowers into cash.

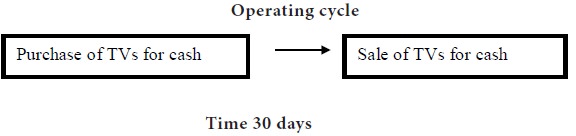

Example 1

You have invested Rs.50,000 in your company on 1.1.2006 for buying and selling of color TVs assuming:

1. Inventory costing Rs. 50,000 is purchased at the beginning of each month.

2. All of the TVs were sold at the end of each month on cash for Rs. 60,000

1. What is the operating cycle of the company?

The answer is 30 days

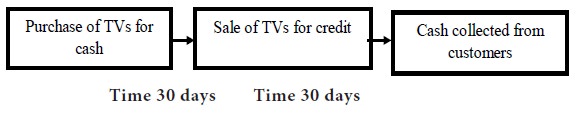

2. If the sales are made on account (credit) of 30 days terms what is the operating cycle of the company?

The answer is 60 days

3. Suppose when the suppliers allow 20 days term and sales are made an account of 60 days’ term. What is the operating cycle of the company?

The answer is 70 days (30+60-20)

In the above all cases one could see how much retained earnings are available for dividends.

Importance of operating cycle

If a company can shorten the operating cycle, cash can accumulate more quickly, and due to the time value of money, there should be a positive impact on the share value. Holding everything else constant, an investor would prefer a company with a short operating cycle to a similar company with a longer operational cycle.

The formula to calculate operating cycle

Operating cycle = Age of inventory + collection period

Net operating cycle = Age of inventory + collection period – deferred payments

For calculating net operating cycle, various conversion periods may be calculated as follows:

Raw material cycle period (RMCP)= (Average Raw material stock/Total raw material Consumable) x 365

Working progress cycle period (WPCP) = (Average work in progress/ Total cost of Production) x 365

Finished goods cycle period (FGCP) = (Average finished goods/Total cost of goods Sold) x 365

Accounts receivable cycle period (ARCP) = (Average Account receivable/Total of sales) x 365

Accounts payable cycle period (APCP) = (Average account payable/ Total credit purchase) x 365

where,

Total credit purchase = cost of goods sold + ending inventory – beginning of inventory

For above calculations, the following points are essential

1. The average value is the average of opening balance and closing balance of the respective items. In case the opening balance is not available, only the closing balance is taken as the average.

2. The figure 365 represents number of days in a year. Sometimes even 360 days are considered.

3. The calculation of RMCP, WPCP and FGCP the denomination is taken as the total cost raw material consumable, total cost of production total, cost of goods sold respectively since they form respective end products.

On the basis of the above, the operating cycle period:

Total operating cycle period (TOCP) = RMCP + WPCP + FGCP + ARCP

Net operating cycle period(NOCP) = TOCP-DP(deferred payment) (APCP)

The operating cycle for individual components are not constant in the growth of the business. They keep on changing from time to time, particularly the Receivable Cycle Period and the Deferred Payment. But the company tries to retain the Net Operating Cycle Period as constant or even less by applying some requirements such as inventory control and latest technology in production. Therefore regular attention on the firm’s operating cycle for a period with the previous period and with that of the industrial average cycle period may help in maintaining and controlling the length of the operating cycle.

Example 2

Gee Pee, a trading organization has supplied the following information. Calculate the operating period.

Tags : Financial Management - WORKING CAPITAL MANAGEMENT

Last 30 days 1639 views