Financial Management - CAPITAL STRUCTURE THEORIES

Taxes and capital structure - CAPITAL STRUCTURE THEORIES

Posted On :

The tax provisions provide for deduction of interest paid on debt and therefore the debt capital can increase the company’s after tax free cash flows.

Taxes

and capital structure

The tax provisions provide for deduction of interest paid on debt and therefore the debt capital can increase the company’s after tax free cash flows. Therefore, this interest shield increases the value of the company.

This tax advantage of debt implies that companies will employ more debt to reduce tax liabilities and increase value. In practice this is not always true as is evidenced from many empirical studies.

Companies also have non debt tax shields like depreciation, carry forward losses, etc. This implies that companies that have larger non debt tax shields would employ low debt as they may not have sufficient taxable profit to have the benefit of interest deductibility.

However, there is a link between non debt tax shields and the debt tax shields because companies with higher depreciation would tend to have higher fixed assets, which serve as collateral against debt.

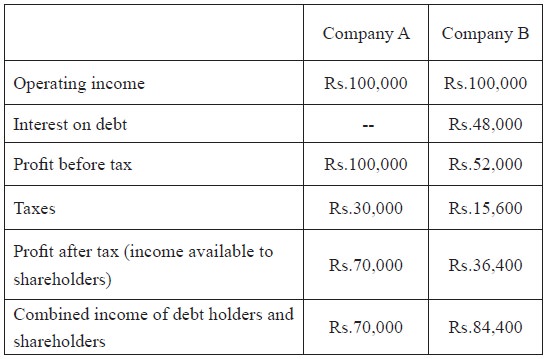

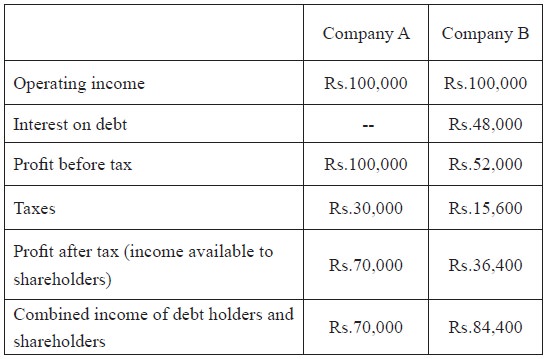

Let us consider two companies each having operating income of Rs.100,000 and which are similar in all respects. However the degree of leverage employed by them differs. Company A employs no debt capital whereas Company B has Rs.400,000 in debt capital on which it pays 12 per cent interest.

The corporate tax rate applicable to both the companies is 30%. The income to the share holders of these two companies is shown in the table.

Thus it is clear that combined income of debt holders and shareholders of the leveraged firm is higher than that of the unlevered firm

This can be explained by the tax shield available to the levered firm – it is equal to the interest on debt capital multiplied by the applicable tax rate. In this case, it is Rs.48,000 X 30% = Rs.14,400. Only this tax shield amount is the reason for the difference in the combined income of debt holders and shareholders of the companies A and B

Hence one may arrive at

1. Interest is tax deductible and, therefore, creates an interest tax subsidy.

2. The greater the firm’s marginal tax rate the greater the value of the interest tax shield.

3. The value of the interest tax subsidy depends on the firm’s ability to generate taxable income.

4. The more a firm borrows the less the expected realized value of the interest tax shield.

5. Given that there are other ways to shield income from taxes, the greater these alternative tax reducing opportunities the lower the value of the interest tax shield.

6. Equity investors have a tax advantage relative to debt investors, which offset the tax advantage of debt at the corporate level.

The tax provisions provide for deduction of interest paid on debt and therefore the debt capital can increase the company’s after tax free cash flows. Therefore, this interest shield increases the value of the company.

This tax advantage of debt implies that companies will employ more debt to reduce tax liabilities and increase value. In practice this is not always true as is evidenced from many empirical studies.

Companies also have non debt tax shields like depreciation, carry forward losses, etc. This implies that companies that have larger non debt tax shields would employ low debt as they may not have sufficient taxable profit to have the benefit of interest deductibility.

However, there is a link between non debt tax shields and the debt tax shields because companies with higher depreciation would tend to have higher fixed assets, which serve as collateral against debt.

Let us examine this with an example

Let us consider two companies each having operating income of Rs.100,000 and which are similar in all respects. However the degree of leverage employed by them differs. Company A employs no debt capital whereas Company B has Rs.400,000 in debt capital on which it pays 12 per cent interest.

The corporate tax rate applicable to both the companies is 30%. The income to the share holders of these two companies is shown in the table.

Thus it is clear that combined income of debt holders and shareholders of the leveraged firm is higher than that of the unlevered firm

This can be explained by the tax shield available to the levered firm – it is equal to the interest on debt capital multiplied by the applicable tax rate. In this case, it is Rs.48,000 X 30% = Rs.14,400. Only this tax shield amount is the reason for the difference in the combined income of debt holders and shareholders of the companies A and B

Hence one may arrive at

1. Interest is tax deductible and, therefore, creates an interest tax subsidy.

2. The greater the firm’s marginal tax rate the greater the value of the interest tax shield.

3. The value of the interest tax subsidy depends on the firm’s ability to generate taxable income.

4. The more a firm borrows the less the expected realized value of the interest tax shield.

5. Given that there are other ways to shield income from taxes, the greater these alternative tax reducing opportunities the lower the value of the interest tax shield.

6. Equity investors have a tax advantage relative to debt investors, which offset the tax advantage of debt at the corporate level.

7. Hence there is a moderate tax

advantage to debt if you can use the tax shields.

However, taxes cannot be the only factor because we

do not see companies with 100% debt.

Tags : Financial Management - CAPITAL STRUCTURE THEORIES

Last 30 days 678 views