Home | ARTS | Financial Management

|

Modigliani and Miller’s Proposition - CAPITAL STRUCTURE THEORIES

Financial Management - CAPITAL STRUCTURE THEORIES

Modigliani and Miller’s Proposition - CAPITAL STRUCTURE THEORIES

Posted On :

Modigliani-Miller theorem (of Franco Modigliani, Merton Miller) forms the basis for modern thinking on capital structure.

Modigliani

and Miller’s Proposition

Modigliani-Miller theorem (of Franco Modigliani, Merton Miller) forms the basis for modern thinking on capital structure. The basic theorem states that, in the absence of taxes, bankruptcy costs, and asymmetric information, and in an efficient market, the value of a firm is unaffected by how that firm is financed. It does not matter if the firm’s capital is raised by issuing stock or selling debt. It does not matter what the firm’s dividend policy is. The theorem is made up of two propositions which can also be extended to a situation with taxes.

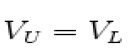

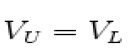

Consider two firms which are identical except for their financial structures. The first (Firm U) is unleveraged: that is, it is financed by equity only. The other (Firm L) is leveraged: it is financed partly by equity, and partly by debt. The Modigliani-Miller theorem states that the value the two firms is the same

where VU is the value of an unlevered firm = price of buying all the firm’s equity, and VL is the value of a levered firm = price of buying all the firm’s equity, plus all its debt

To see why this should be true, suppose a capitalist is considering buy one of the two firms U or L. Instead of purchasing the shares of the leveraged firm L, he could purchase the shares of firm U and borrow the same amount of money B that firm L does. The eventual returns to either of these investments would be the same. Therefore the price of L must be the same as the price of U minus the money borrowed B, which is the value of L’s debt

This discussion also clarifies the role of some of the theorem’s assumptions. We have implicitly assumed that the capitalist’s cost of borrowing money is the same as that of the firm, which need not be true under asymmetric information or in the absence of efficient markets

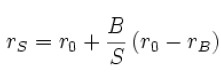

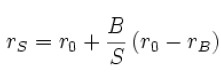

rS is the cost of equity

r0 is the cost of capital for an all equity firm

rB is the cost of debt

B / S is the debt-to-equity ratio

This proposition states that the cost of equity is a linear function of the firm´s debt to equity ratio. A higher debt-to-equity ratio leads to a higher required return on equity, because of the higher risk involved for equity-holders in a companies with debt. The formula is derived from the theory of weighted average cost of capital.

These propositions are true assuming

1. no taxes exist

2. no transaction costs exist

3. individuals and corporations borrow at the same rates

These results might seem irrelevant (after all, none of the conditions are met in the real world), but the theorem is still taught and studied because it tells us something very important. That is, if capital structure matters, it is precisely because one or more of the assumptions is violated. It tells us where to look for determinants of optimal capital structure and how those factors might affect optimal capital structure.

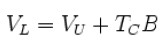

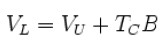

VL is the value of a levered firm

VU is the value of an unlevered firm

TCB is the tax rate (T_C) x the value of debt (B)

This means that there are advantages for firms to be levered, since corporations can deduct interest payments. Therefore leverage lowers tax payments. Dividend payments are non-deductible

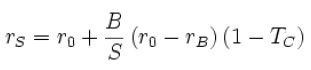

rS is the cost of equity

r0 is the cost of capital for an all equity firm

rB is the cost of debt

B / S is the debt-to-equity ratio

Information is freely available and there is no problem of asymmetric information; transactions are costless; there are no

Investors rationally choose a combination of risk and return that is most advantageous to them. Managers act in the interest of the shareholders.

Investors hold uniform or identical expectations about future operating earnings.

Companies can be easily classified and grouped into equivalent risk classes on the basis of their business risk.

It is assumed there is no tax levied by the respective governments on the companies and also in future there won’t be any such tax levies on the companies.

The financial leverage irrelevance proposition of Modigliani and Miller is valid only if perfect market assumptions underlying their analysis are fulfilled and satisfied. In the real world, however, such assumptions are not present and the markets are characterized by various imperfections

Modigliani-Miller theorem (of Franco Modigliani, Merton Miller) forms the basis for modern thinking on capital structure. The basic theorem states that, in the absence of taxes, bankruptcy costs, and asymmetric information, and in an efficient market, the value of a firm is unaffected by how that firm is financed. It does not matter if the firm’s capital is raised by issuing stock or selling debt. It does not matter what the firm’s dividend policy is. The theorem is made up of two propositions which can also be extended to a situation with taxes.

Propositions Modigliani-Miller theorem (1958) (without taxes)

Consider two firms which are identical except for their financial structures. The first (Firm U) is unleveraged: that is, it is financed by equity only. The other (Firm L) is leveraged: it is financed partly by equity, and partly by debt. The Modigliani-Miller theorem states that the value the two firms is the same

Proposition I

where VU is the value of an unlevered firm = price of buying all the firm’s equity, and VL is the value of a levered firm = price of buying all the firm’s equity, plus all its debt

To see why this should be true, suppose a capitalist is considering buy one of the two firms U or L. Instead of purchasing the shares of the leveraged firm L, he could purchase the shares of firm U and borrow the same amount of money B that firm L does. The eventual returns to either of these investments would be the same. Therefore the price of L must be the same as the price of U minus the money borrowed B, which is the value of L’s debt

This discussion also clarifies the role of some of the theorem’s assumptions. We have implicitly assumed that the capitalist’s cost of borrowing money is the same as that of the firm, which need not be true under asymmetric information or in the absence of efficient markets

Proposition II

rS is the cost of equity

r0 is the cost of capital for an all equity firm

rB is the cost of debt

B / S is the debt-to-equity ratio

This proposition states that the cost of equity is a linear function of the firm´s debt to equity ratio. A higher debt-to-equity ratio leads to a higher required return on equity, because of the higher risk involved for equity-holders in a companies with debt. The formula is derived from the theory of weighted average cost of capital.

These propositions are true assuming

1. no taxes exist

2. no transaction costs exist

3. individuals and corporations borrow at the same rates

These results might seem irrelevant (after all, none of the conditions are met in the real world), but the theorem is still taught and studied because it tells us something very important. That is, if capital structure matters, it is precisely because one or more of the assumptions is violated. It tells us where to look for determinants of optimal capital structure and how those factors might affect optimal capital structure.

Propositions Modigliani-Miller theorem (1963) (with taxes)

Proposition I

VL is the value of a levered firm

VU is the value of an unlevered firm

TCB is the tax rate (T_C) x the value of debt (B)

This means that there are advantages for firms to be levered, since corporations can deduct interest payments. Therefore leverage lowers tax payments. Dividend payments are non-deductible

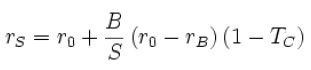

Proposition II

rS is the cost of equity

r0 is the cost of capital for an all equity firm

rB is the cost of debt

B / S is the debt-to-equity ratio

Tc is the tax rate

The same relationship as earlier described stating that the cost of equity rises with leverage, because the risk to equity rises, still holds. The formula however has implications for the difference with the WACC

Assumptions made in the propositions with taxes are

1. Corporations are taxed at the rate T_C, on earnings after interest

2. No transaction cost exist

3. Individuals and corporations borrow at the same rate

Miller and Modigliani published a number of follow-up papers discussing some of these issues. The theorem first appeared in: F. Modigliani and M. Miller, “The Cost of Capital, Corporation Finance and the Theory of Investment,” American Economic Review (June 1958)

The same relationship as earlier described stating that the cost of equity rises with leverage, because the risk to equity rises, still holds. The formula however has implications for the difference with the WACC

Assumptions made in the propositions with taxes are

1. Corporations are taxed at the rate T_C, on earnings after interest

2. No transaction cost exist

3. Individuals and corporations borrow at the same rate

Miller and Modigliani published a number of follow-up papers discussing some of these issues. The theorem first appeared in: F. Modigliani and M. Miller, “The Cost of Capital, Corporation Finance and the Theory of Investment,” American Economic Review (June 1958)

Assumptions of Modigliani and Miller’s Proposition

Perfect capital market

Information is freely available and there is no problem of asymmetric information; transactions are costless; there are no

Rational investors and managers

Investors rationally choose a combination of risk and return that is most advantageous to them. Managers act in the interest of the shareholders.

Homogenous expectations

Investors hold uniform or identical expectations about future operating earnings.

Equivalent risk classes

Companies can be easily classified and grouped into equivalent risk classes on the basis of their business risk.

Absence of tax

It is assumed there is no tax levied by the respective governments on the companies and also in future there won’t be any such tax levies on the companies.

Criticisms of Modigliani and Miller’s proposition

The financial leverage irrelevance proposition of Modigliani and Miller is valid only if perfect market assumptions underlying their analysis are fulfilled and satisfied. In the real world, however, such assumptions are not present and the markets are characterized by various imperfections

1. Companies are liable to pay taxes on their income. (corporate taxes)

2. In some countries investors who receive returns from their investments in companies (by way of dividend income) are subject to taxes at a personal level (personal income tax) (In India, such dividends were earlier taxed in the hands of the investors but now removed from the scope of personal income tax. However, the companies which declare dividends are required to pay dividend tax on such dividend distribution in addition to corporate tax)

3. Agency costs exist because of the conflict of interest between managers and shareholders and between shareholders and creditors

2. In some countries investors who receive returns from their investments in companies (by way of dividend income) are subject to taxes at a personal level (personal income tax) (In India, such dividends were earlier taxed in the hands of the investors but now removed from the scope of personal income tax. However, the companies which declare dividends are required to pay dividend tax on such dividend distribution in addition to corporate tax)

3. Agency costs exist because of the conflict of interest between managers and shareholders and between shareholders and creditors

4. Managers seem to have a

preference for certain sequence of financing

5. Informational asymmetry exists because managers are better informed than the investors at all times

6. Personal leverage and corporate leverage are not in the same platform and there fore they are not perfect substitutes

5. Informational asymmetry exists because managers are better informed than the investors at all times

6. Personal leverage and corporate leverage are not in the same platform and there fore they are not perfect substitutes

Tags : Financial Management - CAPITAL STRUCTURE THEORIES

Last 30 days 903 views