Home | ARTS | Strategic Management

|

Analysis for Developing a Competitive Strategy - Competitive Analysis

Strategic Management - Environmental Analysis and Diagnosis

Analysis for Developing a Competitive Strategy - Competitive Analysis

Posted On :

Every business has a competitive strategy. However, some strategies are implicit, having evolved over time, rather than having been explicit (evolved by deliberate planning process).

Analysis for Developing a

Competitive Strategy

Every business has a competitive strategy. However, some strategies are implicit, having evolved over time, rather than having been explicit (evolved by deliberate planning process). Implicit strategies lack focus, produce inconsistent decisions, and unknowingly become obsolete. Without a well-defined strategy, organizations will be driven by current operational issues rather than by a planned future vision. The broad considerations in an effective competitive strategy can be extended into a generalized approach to the formulation of strategy. In order to do this, the organization must be in a position to answer the following questions:

What is the current strategy, implicit or explicit?

What assumptions have to hold for the current strategy to be viable?

What is happening in the industry, with our competitors, and in general?

What are our growth, size, and profitability goals?

What products and services will we offer?

To what customers or users?

How will the selling/buying decisions be made?

How will we distribute our products and services?

What technologies will we employ?

What

capabilities and capacities will we require?

Which ones are core?

What will we make, what will we buy, and what will we acquire through alliance?

What are our options?

On what basis will be compete?

We will now discuss three analytical procedures given by Porter, Mckinsey and Ohmae in that order.

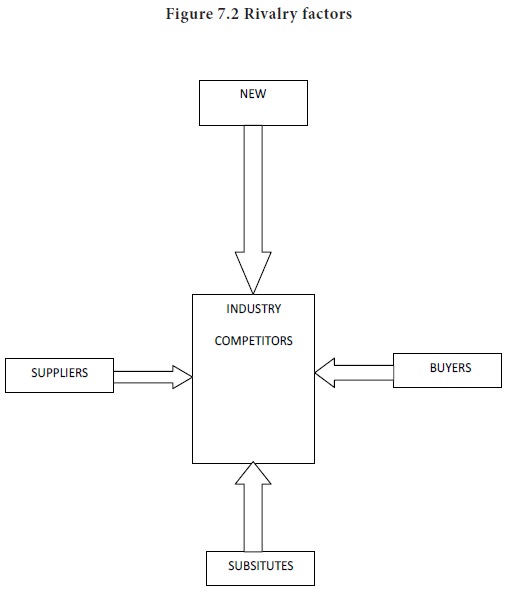

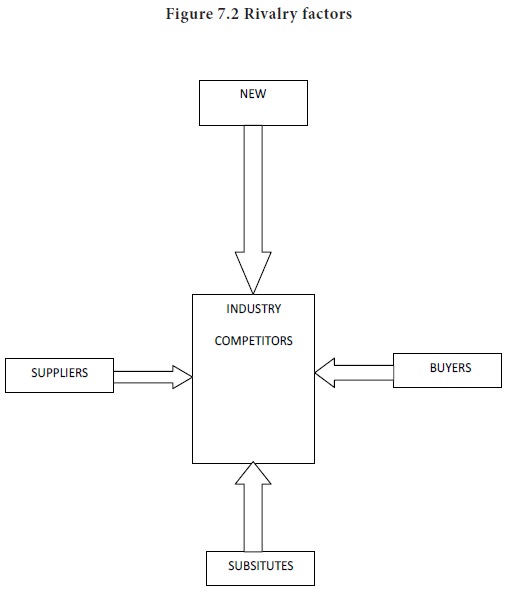

A useful approach to formulating business strategies is based on Michael Porter’s “competitive analysis”. Porter’s model provides a process to make your competitive strategy explicit so it can be examined for focus, consistency, and comprehensive. Porter’s approach is based on the analysis of five competitive forces (see Figure 7-2).

Threat of new entrants,

Bargaining power of suppliers,

Bargaining power of buyers,

Threat of substitute products,

Rivalry among existing firms.

Firms entering an industry bring new capacity and a desire to gain market share and profits, but whether new firms enter an industry depends on the barriers to entry. ( A number of these are shown in Figure7-2). In addition, established firms in an industry may benefit from “experience curve” effects. That is, their cumulative experience in producing and marketing a product often reduces their per-unit costs below those of inexperienced firms. Is general, the higher the entry barriers, the less likely outside firms are to enter the industry.

Suppliers can be a competitive threat in an industry because they can raise the price of raw material or reduce their quality. Powerful suppliers can reduce the profitability of an industry if companies in the industry cannot pay higher prices to cover price increases that the supplier imposes. Some determinants of supplier power are listed in Figure7-2

Buyers compete with the industry by forcing prices down, bargaining for higher quality or more services, and playing competitors off against each other all at the expense of industry profitability. Some determinants of buyer power are shown in Figure 7-2

In a broad sense, all firms in an industry are competing with industries producing substitute products. Substitutes limit the potential return in an industry by placing a ceiling on the prices that firms in the industry can profitably chare. The more attractive the price-performance alternative offered by substitutes, the tighter the lid on industry profits. For example, the price of candy, such as Raisinettes chocolate-covered raisins, may limit the price Del Monte can charge for “healthy snacks,” such as Strawberry Yogurt Raisins. Some determinants of the degree of substitution threat are shown in Figure 7-2

Rivalry determinants include industry growth, product differences and barriers. This is the conventional type of competition in which firms try to take customers from one another. Strategies such as price competition, advertising battles, new product introductions, and increased customer service are commonly used to attract customers from competitors. The factors influencing intensity of rivalry are shown in Figure 7-2.

Every business has a competitive strategy. However, some strategies are implicit, having evolved over time, rather than having been explicit (evolved by deliberate planning process). Implicit strategies lack focus, produce inconsistent decisions, and unknowingly become obsolete. Without a well-defined strategy, organizations will be driven by current operational issues rather than by a planned future vision. The broad considerations in an effective competitive strategy can be extended into a generalized approach to the formulation of strategy. In order to do this, the organization must be in a position to answer the following questions:

What is the current strategy, implicit or explicit?

What assumptions have to hold for the current strategy to be viable?

What is happening in the industry, with our competitors, and in general?

What are our growth, size, and profitability goals?

What products and services will we offer?

To what customers or users?

How will the selling/buying decisions be made?

How will we distribute our products and services?

What technologies will we employ?

Which ones are core?

What will we make, what will we buy, and what will we acquire through alliance?

What are our options?

On what basis will be compete?

We will now discuss three analytical procedures given by Porter, Mckinsey and Ohmae in that order.

Porter’s five forces analysis of competition

A useful approach to formulating business strategies is based on Michael Porter’s “competitive analysis”. Porter’s model provides a process to make your competitive strategy explicit so it can be examined for focus, consistency, and comprehensive. Porter’s approach is based on the analysis of five competitive forces (see Figure 7-2).

Threat of new entrants,

Bargaining power of suppliers,

Bargaining power of buyers,

Threat of substitute products,

Rivalry among existing firms.

Threat of New Entrants

Firms entering an industry bring new capacity and a desire to gain market share and profits, but whether new firms enter an industry depends on the barriers to entry. ( A number of these are shown in Figure7-2). In addition, established firms in an industry may benefit from “experience curve” effects. That is, their cumulative experience in producing and marketing a product often reduces their per-unit costs below those of inexperienced firms. Is general, the higher the entry barriers, the less likely outside firms are to enter the industry.

Bargaining Power of Suppliers

Suppliers can be a competitive threat in an industry because they can raise the price of raw material or reduce their quality. Powerful suppliers can reduce the profitability of an industry if companies in the industry cannot pay higher prices to cover price increases that the supplier imposes. Some determinants of supplier power are listed in

Bargaining Power Buyers

Buyers compete with the industry by forcing prices down, bargaining for higher quality or more services, and playing competitors off against each other all at the expense of industry profitability. Some determinants of buyer power are shown in Figure 7-2

Threat of Substitute Products

In a broad sense, all firms in an industry are competing with industries producing substitute products. Substitutes limit the potential return in an industry by placing a ceiling on the prices that firms in the industry can profitably chare. The more attractive the price-performance alternative offered by substitutes, the tighter the lid on industry profits. For example, the price of candy, such as Raisinettes chocolate-covered raisins, may limit the price Del Monte can charge for “healthy snacks,” such as Strawberry Yogurt Raisins. Some determinants of the degree of substitution threat are shown in Figure 7-2

Rivalry Among Existing Competitors

Rivalry determinants include industry growth, product differences and barriers. This is the conventional type of competition in which firms try to take customers from one another. Strategies such as price competition, advertising battles, new product introductions, and increased customer service are commonly used to attract customers from competitors. The factors influencing intensity of rivalry are shown in Figure 7-2.

Tags : Strategic Management - Environmental Analysis and Diagnosis

Last 30 days 622 views