Financial Management - DIVIDEND POLICIES

Some Important Dates in Dividend - DIVIDEND POLICIES

Posted On :

Every year or half year or quarterly or on chosen special occasions, the Board of Directors of the firm will first meet and recommend on the quantum of dividend and it becomes a liability of the company.

Some Important Dates in Dividend Payments

Every year or half year or quarterly or on chosen special occasions, the Board of Directors of the firm will first meet and recommend on the quantum of dividend and it becomes a liability of the company. Therefore declaration date is the date at which the company announces it will pay a dividend.

This record date is the declared by the firm while announcing the dividend payment and only those shareholders who are on the record of the firm on this date will receive the dividend payment. It is therefore the date at which the list of shareholders who will receive the dividend is made.

This occurs two business days before date of record. If one were to buy stock or share on or after this date, he or she will not eligible to receive the dividend. Hence naturally the stock or share price generally drops by about the amount of the dividend on or after this date. Therefore the convention is that the right to the dividend remains with the stock until two business days before the holder-of-record date. Whoever buys the stock on or after the ex-dividend date does not receive the dividend.

This is the date on which the dividend payment cheques are made out and mailed. Since many firms follow the electronic clearing system for crediting the dividends to the shareholders’ accounts, the date of payment is the date on which such ECS instructions are issued to the banks. In this ECS method of payment, there is no paper work involved

– cheques need not be made out mailed and mailed – enormous savings in expenditure in the cheque book costs and also in the dispatch.

Let us examine these different dates with an example:

Suppose our firm XYZ Limited announces on 10th June 2005 that it would pay a dividend of 20% to all their shareholders on record at close of business on June 30th 2004.

The declaration date is 10th June 2005

The record date is 30th June 2005

Ex dividend date is 28th June 2005

(while reckoning the ex dividend date all Saturdays, Sundays and other holidays – the days the stock exchange does not work – should be excluded)

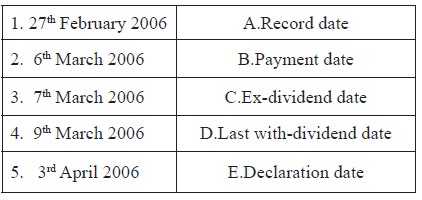

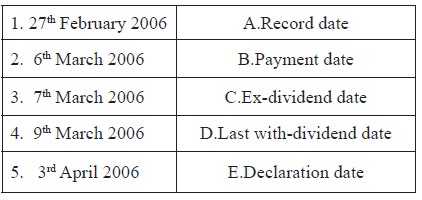

1.ABC Limited, a Public Sector Undertaking, has paid 75% interim dividend during the fourth quarter of the financial year 2005-06. Match the following sets of dates

1. Declaration Date

Every year or half year or quarterly or on chosen special occasions, the Board of Directors of the firm will first meet and recommend on the quantum of dividend and it becomes a liability of the company. Therefore declaration date is the date at which the company announces it will pay a dividend.

2. Date of Record

This record date is the declared by the firm while announcing the dividend payment and only those shareholders who are on the record of the firm on this date will receive the dividend payment. It is therefore the date at which the list of shareholders who will receive the dividend is made.

3. Ex-dividend Date

This occurs two business days before date of record. If one were to buy stock or share on or after this date, he or she will not eligible to receive the dividend. Hence naturally the stock or share price generally drops by about the amount of the dividend on or after this date. Therefore the convention is that the right to the dividend remains with the stock until two business days before the holder-of-record date. Whoever buys the stock on or after the ex-dividend date does not receive the dividend.

4. Date of Payment

This is the date on which the dividend payment cheques are made out and mailed. Since many firms follow the electronic clearing system for crediting the dividends to the shareholders’ accounts, the date of payment is the date on which such ECS instructions are issued to the banks. In this ECS method of payment, there is no paper work involved

– cheques need not be made out mailed and mailed – enormous savings in expenditure in the cheque book costs and also in the dispatch.

Let us examine these different dates with an example:

Suppose our firm XYZ Limited announces on 10th June 2005 that it would pay a dividend of 20% to all their shareholders on record at close of business on June 30th 2004.

The declaration date is 10th June 2005

The record date is 30th June 2005

Ex dividend date is 28th June 2005

(while reckoning the ex dividend date all Saturdays, Sundays and other holidays – the days the stock exchange does not work – should be excluded)

Check your progress

1.ABC Limited, a Public Sector Undertaking, has paid 75% interim dividend during the fourth quarter of the financial year 2005-06. Match the following sets of dates

Tags : Financial Management - DIVIDEND POLICIES

Last 30 days 636 views