Accounting For Managers - Accounting Process

Debit And Credit

Posted On :

The left-hand side of any account is called the debit side and the right-hand side is called the credit side. Amounts entered on the left hand side of an account, regardless of the tile of the account are called debits and the amounts entered on the right hand side of an account are called credits. To debit (dr) an account means to make an entry on the left-hand side of an account and to credit (cr) an account means to make an entry on the right-hand side. The words debit and credit have no other meaning in accounting, though in common parlance; debit has a negative connotation, while credit has a positive connotation.

Double entry system of recording business transactions is universally followed. In this system for each transaction the debit amount must equal the credit amount. If not, the recording of transactions is incorrect. The equality of debits and credits is maintained in accounting simply by specifying that the left side of asset accounts is to be used for recording increases and the right side to be used for recording decreases; the right side of a liability and capital accounts is to be used to record increases and the left side to be used for recording decreases. The account balances when they are totaled, will then conform to the two equations:

1. Assets = liabilities + owners’ equity

2. Debits = credits

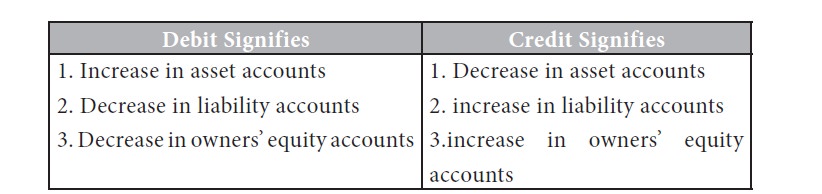

From the above arrangement we can state that the rules of debits and credits are as follows:

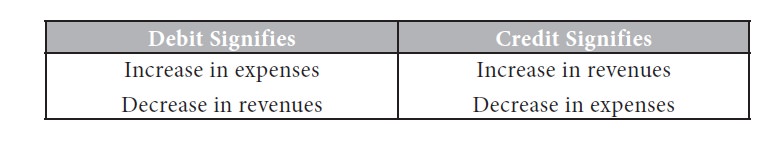

From the rule that credit signifies increase in owners’ equity and debit

signifies decrease in it, the rules of revenue accounts and expense accounts

can be derived. While explaining the dual aspect of the concept in the

preceding lesson, we have seen that revenues increase the owners’ equity as

they belong to the owners. Since owners’ equity accounts increason

the credit side, revenue must be credits. So, if the revenue accounts are to be

increased they must be credited and if they are to be decreased they must be

debited. Similarly we have seen that expenses decrease the owners’ equity. As

owners’ equity account decreases on the debit side expenses must be debits.

Hence to increase the expense accounts, they must be debited and to decrease

it, they must be credited. From the above we can arrive at the rules for

revenues and expenses as follows:

Tags : Accounting For Managers - Accounting Process

Last 30 days 1346 views