Accounting For Managers - Accounting Process

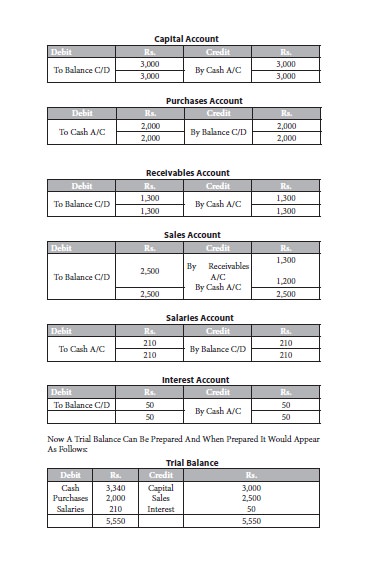

The Trial Balance

The trial balance is simply a list of the account names and their balance as of a given moment of time with debit balances in one column and credit balances in another column. It is prepared to ensure that the mechanics of the recording and posting of the transaction have been carried out accurately. If the recording and posting have been accurate then the debit total and credit total in the trial balance must tally thereby evidencing that an equality of debits and credits has been maintained. In this connection it is but proper to caution that mere agreement of the debt and credit total in the trial balance is not conclusive proof of correct recording and posting. There are many errors which may not affect the agreement of trial balance like total omission of a transaction, posting the right amount on the right side but of a wrong account etc.

The points which we have discussed so far can very well be explained

with the help of the following simple illustration.

Illustration

2:

January 1

- started business with rs.3,000

January 2

- bought goods worth rs.2,000

January 9 - received order for half of the goods from ‘g’ January 12 -

delivered the goods, g invoiced rs.1,300

January

15 - received order for remaining half of the total goods purchased

January

21 - delivered goods and received cash rs.1,200

January

30 - g makes payment

January

31 - paid salaries rs.210

-

received interest rs.50

Let us

now analyze the transactions one by one.

January 1

– Started Business With Rs.3,000:

The two accounts involved are cash and owners’ equity. Cash, an asset

increases and hence it has to be debited. Owners’ equity, a liability also

increases and hence it has to be credited.

January 2

– Bought Goods Worth Rs.2,000:

The two accounts affected by this transaction are cash and goods

(purchases). Cash balance decreases and hence it is credited and goods on hand,

an asset, increases and hence it is to be debited.

January 9

– Received Order For Half Of The Goods From ‘G’:

No entry is required as realization of revenue will take place only when

goods are delivered (realization concept).

January

12 – Delivered The Goods, `G’ Invoiced Rs.1,300:

This transaction affects two accounts – goods (sales) a/c and

receivables a/c. Since it is a credit transaction, receivables increase (asset) and hence it is to be debited. Sales decreases goods

on hand and hence goods (sales) a/c is to be credited. Since the term ‘goods’

is used to mean purchase of goods and sale of goods, to avoid confusion,

purchase of goods is simply shown as purchases a/c and sale of goods as sales

a/c.

January

15 – Received Order For Remaining Half Of Goods:

No entry.

January

21 – Delivered Goods And Received Cash Rs.1,200:

This transaction affects cash a/c. Since cash is realized, the cash

balance will increase and hence cash account is to be debited. Since the stock

of goods becomes nil due to sale, sales a/c is to be credited (as asset in the

form of goods on hand has reduced due to sales).

January

30 - `G’ Makes Payment:

Both the accounts affected by this transaction are asset accounts – cash

and receivables. Cash balance increases and hence it is to be debited.

Receivables balance decreases and hence it is to be credited.

January

31 – Paid Salaries Rs.210:

Because of payment of salaries cash balance decreases and hence cash

account is to be credited. Salary is an expense and since expense has the

effect of reducing owners’ equity and as owners’ equity account decreases on

the debit side, expenses account is to be debited.

January

31 – Received Interest Rs.50:

The receipt of interest increases cash balance and hence cash a/c is to

be debited. Interest being revenue which has the effect of increasing the

owners’ equity, it has to be credited as owners’ equity account increases on

the credit side.

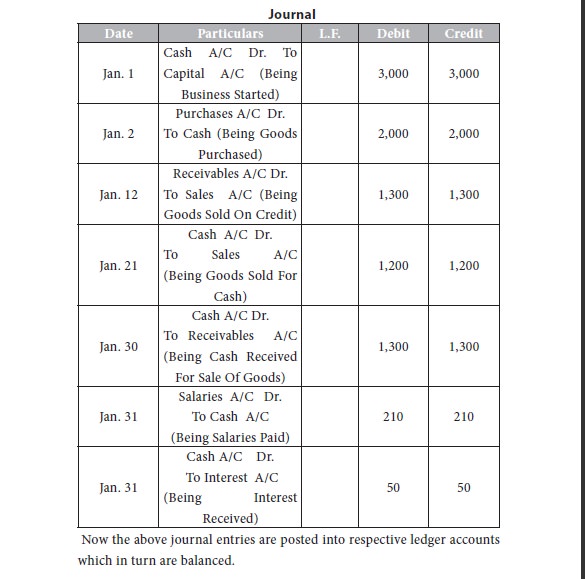

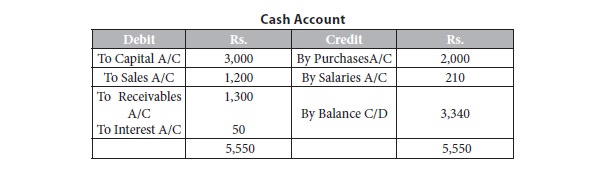

When journal entries for the above transactions are passed, they would

be as follows: