Accounting For Managers - Management Accounting-Marginal Costing

Summary and Case Analysis-Marginal Costing

Posted On :

Marginal costing is an important technique of costing where only variable costs are considered while calculating the cost of the product.

Summary

Marginal costing is an important technique of costing where only variable costs are considered while calculating the cost of the product. It is a technique of presenting cost information and can be used with other methods of costing (such as job costing, contract costing, etc). This technique can be applied while taking decisions relating to profit planning, introducing a new product, level of activity planning, allocating scarce factors to profitable channels, make or buy decisions, suitable production/ sales mix, fixing prices for products, etc. However this technique is not without limitations.

Case Analysis

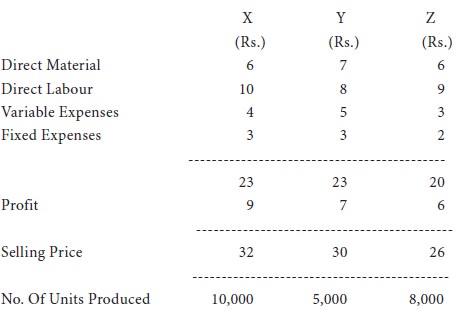

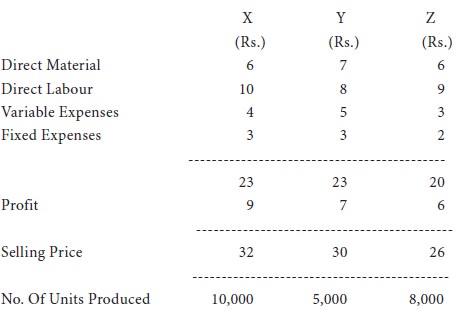

The cost per unit of the three products x, y and z of a concern is

As follows:

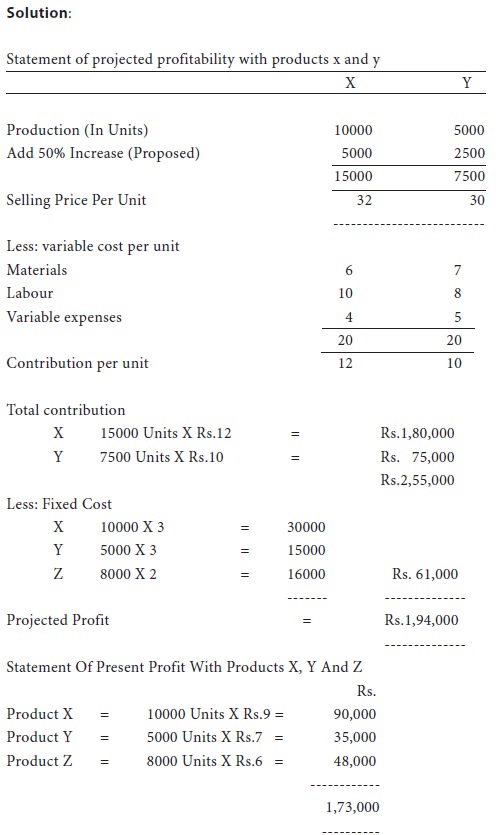

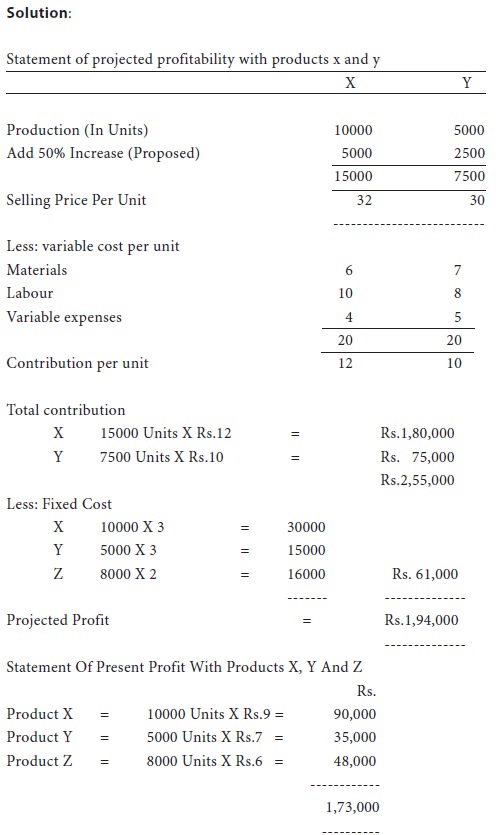

Production arrangements are such that if one product is given up, the production of the others can be raised by 50%. The directors propose that z should be given up because the contribution in that case is the lowest. Analyse the case and give your opinion.

Marginal costing is an important technique of costing where only variable costs are considered while calculating the cost of the product. It is a technique of presenting cost information and can be used with other methods of costing (such as job costing, contract costing, etc). This technique can be applied while taking decisions relating to profit planning, introducing a new product, level of activity planning, allocating scarce factors to profitable channels, make or buy decisions, suitable production/ sales mix, fixing prices for products, etc. However this technique is not without limitations.

Case Analysis

The cost per unit of the three products x, y and z of a concern is

As follows:

Production arrangements are such that if one product is given up, the production of the others can be raised by 50%. The directors propose that z should be given up because the contribution in that case is the lowest. Analyse the case and give your opinion.

Since by discontinuing product z and increasing the

production of products X andY the profit increases from Rs.1,73,000 to

Rs.1,94,000. The directors proposal may be implemented.

Tags : Accounting For Managers - Management Accounting-Marginal Costing

Last 30 days 858 views