Strategic Management - Environmental Analysis and Diagnosis

Resource Audit - Internal Analysis

Posted On :

This audit reviews the resources of an organization for the purpose of assessing the inherent strengths of those resources.

Resource Audit

This audit reviews the resources of an organization for the purpose of assessing the inherent strengths of those resources. Resources include physical, financial, human and intangible assets of an organization, “a Resource is an asset, competency, process, skill or knowledge controlled by an organization”. It can be a positive strength if competitors do not possess it or negative when a firm has lesser strength than competitors”.

Physical Resources The physical resources include plant and machinery, land and building, vehicles, stock, etc. Their numbers and book values are not as important as their expected benefits are. Therefore an assessment is made in terms of their potential benefits by examining their age, condition, location, capabilities, etc.

Financial Resources Financial resources include cash, bank, debtors, marketable securities, etc. In assessing the financial resources, the various sources of finance like equity shares, debentures, retained earnings, long – term and short term loans are considered. Their cost of capital, availability and their effect on the overall liquidity and solvency of the firm is examined.

Human Resources Human resources are the most valuable assets of the organization, especially in the present business scenarios – where we find people competing than corporations. Traditionally top management were grand strategists, junior managers were implementers and middle the administrators of the strategy. Now the trend has been changed. Top managers are creators of vision for the organization and expect others to deliver. Therefore emphasis has shifted from ‘strategy, structure and systems’ model towards ‘purpose process and people’ model. To implement the second model you must have a lot of faith in your people. Companies like Asea Braun Boveri, General Electric, Intel, 3M or even Infosys have made that shift.

Therefore the human resources audit is done to assess the quality of human resources. Their individual qualities like knowledge, capabilities, learning skill, etc. as well as their loyalty and commitment to organization are assessed.

Source: McKinsey & Co.. adapted from Business World, 9-22 November – 6 December, 1998).

This audit reviews the resources of an organization for the purpose of assessing the inherent strengths of those resources. Resources include physical, financial, human and intangible assets of an organization, “a Resource is an asset, competency, process, skill or knowledge controlled by an organization”. It can be a positive strength if competitors do not possess it or negative when a firm has lesser strength than competitors”.

Physical Resources The physical resources include plant and machinery, land and building, vehicles, stock, etc. Their numbers and book values are not as important as their expected benefits are. Therefore an assessment is made in terms of their potential benefits by examining their age, condition, location, capabilities, etc.

Financial Resources Financial resources include cash, bank, debtors, marketable securities, etc. In assessing the financial resources, the various sources of finance like equity shares, debentures, retained earnings, long – term and short term loans are considered. Their cost of capital, availability and their effect on the overall liquidity and solvency of the firm is examined.

Human Resources Human resources are the most valuable assets of the organization, especially in the present business scenarios – where we find people competing than corporations. Traditionally top management were grand strategists, junior managers were implementers and middle the administrators of the strategy. Now the trend has been changed. Top managers are creators of vision for the organization and expect others to deliver. Therefore emphasis has shifted from ‘strategy, structure and systems’ model towards ‘purpose process and people’ model. To implement the second model you must have a lot of faith in your people. Companies like Asea Braun Boveri, General Electric, Intel, 3M or even Infosys have made that shift.

Sumantra Ghoshal remarks

Therefore the human resources audit is done to assess the quality of human resources. Their individual qualities like knowledge, capabilities, learning skill, etc. as well as their loyalty and commitment to organization are assessed.

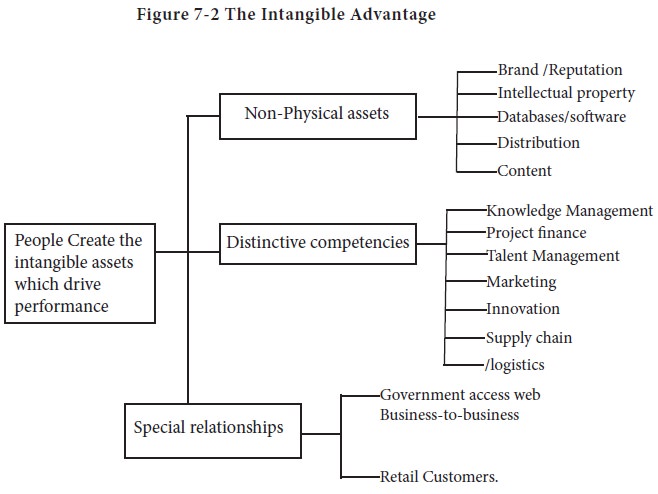

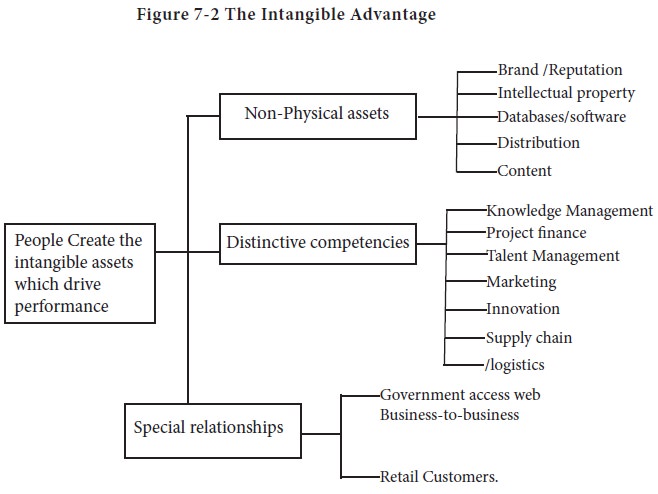

1. Intangible Assets In the contemporary business

world, organizations stress on building intangible assets such as brand,

customer relationship, intellectual property, etc. Why so? Earlier capital,

technology etc., are scarce and are difficult to obtain. Therefore, they were

considered as competitive advantage. Now hey are available and tradable.

Something is of competitive advantage is to be hence created. It should be not

openly available; not easily leverageable across businesses and not easily

substitutable. Intangible assets meet all the three requirements, for example

employee commitment or relationships are difficult to imitate.”

Look at the tangible assets like machinery in a factory. If company has required capital, it can buy. Look at money which was considered as competitive advantage, is now easily available at inexpensive rates from any where on the globe. Globalization and deregulation of markets have facilitated their easy and cheap accessibility. Only non-replicable and unique competitive advantages of the company are its intangible assets. That is why companies like Reliance, BPL, Krebs Biochemical’s, etc. are reporting about their intangible assets. Consider the aspects in Figure 7-2

Look at the tangible assets like machinery in a factory. If company has required capital, it can buy. Look at money which was considered as competitive advantage, is now easily available at inexpensive rates from any where on the globe. Globalization and deregulation of markets have facilitated their easy and cheap accessibility. Only non-replicable and unique competitive advantages of the company are its intangible assets. That is why companies like Reliance, BPL, Krebs Biochemical’s, etc. are reporting about their intangible assets. Consider the aspects in Figure 7-2

Source: McKinsey & Co.. adapted from Business World, 9-22 November – 6 December, 1998).

Tags : Strategic Management - Environmental Analysis and Diagnosis

Last 30 days 2243 views