Strategic Management - Environmental Analysis and Diagnosis

Techniques of Scanning - Environmental Scanning Techniques

Posted On :

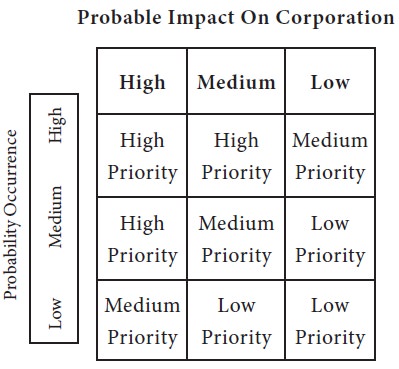

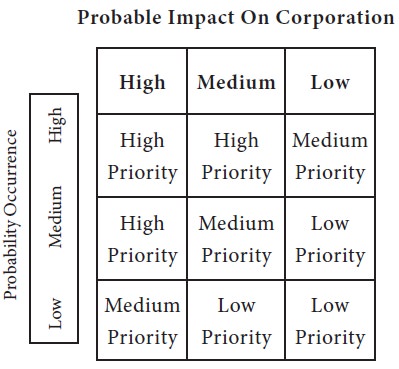

One way to identify and analyze developments in the external environment is to use the issues priority matrix (Figure 8-1) as follows:

Techniques of Scanning

There are various scanning techniques used by organizations

1. Issues Priority matrix

2. Environmental Threats and opportunities Profile (ETOP)

3. Strategic advantage profile (SAP)

4. Functional – area profile and resource deployment matrix

5. SWOT Analysis

6. The opportunity and Threat matrices

7. The Impact Matrix

8. The Impact scale

9. Gap Analysis

10. Balanced Score card

One way to identify and analyze developments in the external environment is to use the issues priority matrix (Figure 8-1) as follows:

1. Identify a number of likely trends emerging in the societal and task environments. These are strategic environmental issues – those important trends that, if they occur, determine what the industry or the world will look like in the near future.

2. Assess the probability of these trends actually occurring from low to high.

3. Attempt to ascertain the likely impact (from low to high) of each of these trends on the corporation being examined.

Figure 8-1s

Issues Priority Matrix

Source: L. L. Lederman, “Foresight Activities in the U.S.A: Time for a Re-Assessment?” Long – Range Planning (June 1984), p-46.

A corporation’s External Strategic Factors are those key environmental trends that are judged to have both a medium to high probability of occurrence and a medium to high probability of impact on the corporation. The issues priority matrix can then be used to help managers decide which environmental trends should be merely scanned (low priority) and which should be monitored as strategic factors (high priority). Those environmental trends judged to be a corporation’s strategic factors are then categorized as opportunities and threats and are included in strategy formulation.

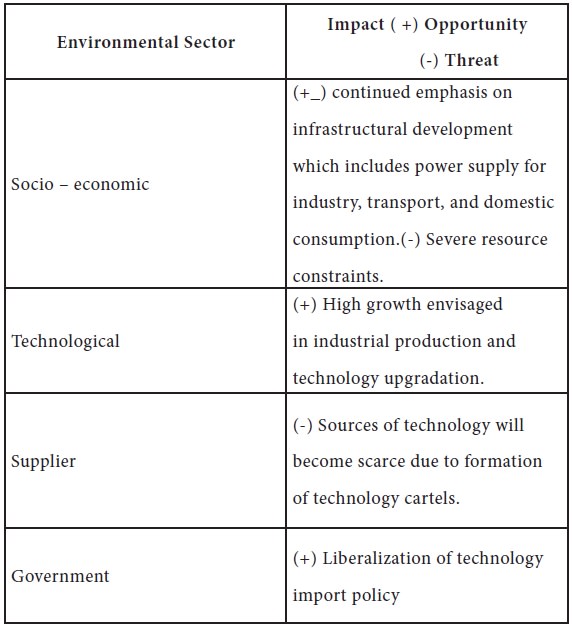

Assessment of the environmental information and determining the relative significance of threats and opportunities require a systematic evaluation of the information developed in the course of environmental

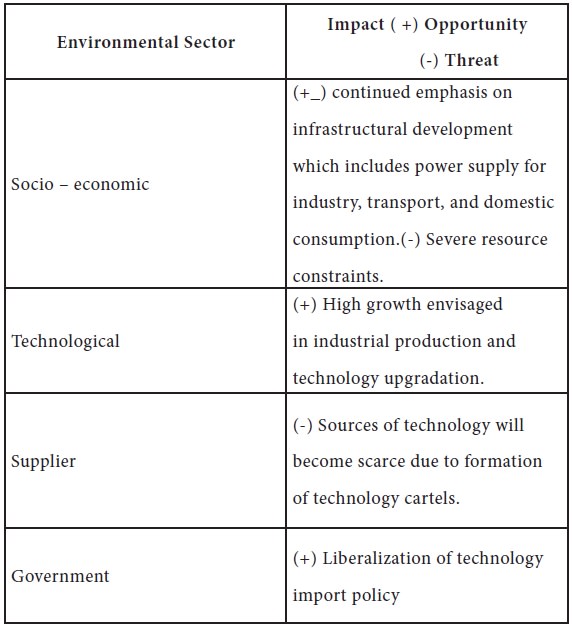

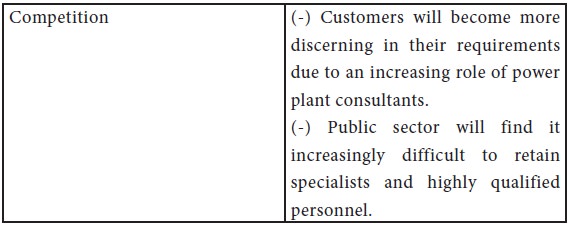

An illustrative profile is given in Figure 8-2 on the basic of environmental analysis carried out by Bharat Heavy Electricals Ltd.

BHEL: ENVIRONMENTAL THREAT AND OPPORTUNI-TY PROFILE (ETOP)

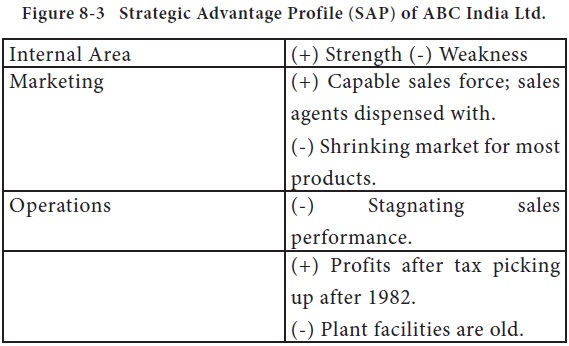

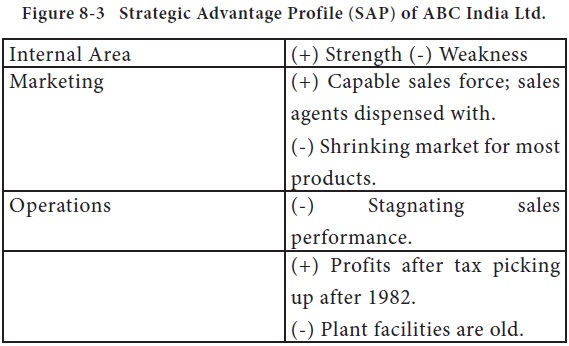

A Profile of strategic advantages (SAP) is a summary statement, which provides an overview of the advantages and disadvantages in key areas likely to affect future operations of the firm. It is a tool for making a systematic evaluation of the strategic advantage factors, which are significant for the company in its environment. The preparation of such a profile presupposes detailed analysis and diagnosis of the factors in each of the functional areas (Marketing, Production, Finance and Accounting, Personnel and Human Resources, R& D). The relevant data for the critical areas may go as a supplement to the profile. The following Strategic Advantage Profile relates to a food processing company in India.

Since the Strategic Advantage Profile is a summary statement of corporate capabilities, in summarizing the func-tional competencies a comparative view needs to be taken in the light of external conditions and the time horizon of pro-jections. For example, while comparing the level of inventory holding, one may find it to be relatively higher than that of competing firms; as such it should be regarded as a weakness. But if the market demand shows an increasing trend, apparent weakness should be considered strength.

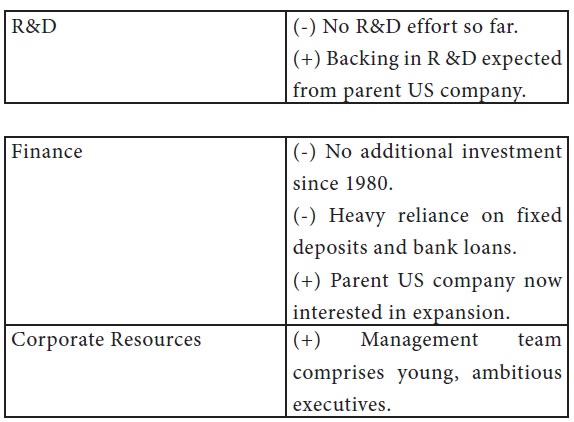

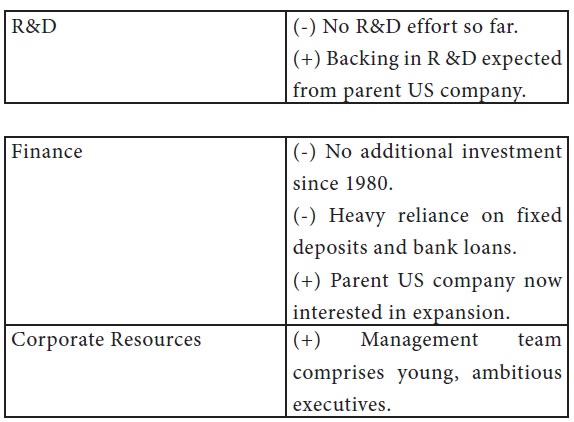

Developed by Hofer and Schendel, this method requires the preparation of a matrix of functional areas with characteristics common to each, e.g., focus of financial outlay, physical resource position, organizational system, and technological capability. The functional area profile of a manufacturing company is given by way of illustration. Following this exercise, it is required that the resource outlay and focus of efforts over time in the respective functional areas be presented also in the form of a matrix. Figure 8-4 Functional – Area Resource – Deployment Matrix

SWOT is an acronym for the internal Strengths and Weaknesses of a business and environmental Opportunities and Threats facing that business. SWOT analysis is a systematic identification of these factors and the strategy that reflects the best match between them. It is based on the logic that an effective strategy maximizes a business’s strengths and opportunities but at the same time minimizes its weaknesses and threats. This simple assumption, if accurately applied, has powerful implications for successfully choosing and designing an effective strategy.

An opportunity is a major favorable situation in the firm’s environment. Key trends represent one source of opportunity. Identification of a previously overlooked market segment, changes in competitive or regulatory circumstances, technological changes, and improved buyer or supplier relationships could represent opportunities for the firm.

A threat is a major unfavorable situation in the firm’s environment. It is a key impediment to the firm’s current and / or desired future position. The entrance of a new competitor, slow market growth, increased bargaining power of key buyers or supplier, major technologies change, and changing regulations could represent major threats to a firm’s future success.

The second fundamental focus in SWOT analysis is identifying key strengths and weakness based on examination of the company profile. Strengths and weaknesses can be defined as follows:

A strength is a resource, skill, or other advantage relative to competitors and the needs of markets a firm serves or anticipates serving. a strength is a distinctive competence that gives the firm a comparative advantage in the marketplace. Financial resources, image, market leadership, and buyer / supplier relations are examples.

A weakness is a limitation (or) deficiency in resources, skills, and capabilities that seriously impedes effective performance. Facilities, financial resources, management capabilities, marketing skills, and brand image could be sources of weaknesses. Sheer size and level of customer acceptance proved to be key strengths around which IBM built its successful strategy in the personal computer market.

Understanding the key strengths and weaknesses of the firm further aids in narrowing the choice of alternatives and selecting a

SWOT analysis can be used in at least three in strategic choice decisions. The most common application provides a logical framework guiding systematic discussions of the business’s situation, alternative strategies, and ultimately, the choice of strategy. What one manager sees as an opportunity, another may see as a potential threat.

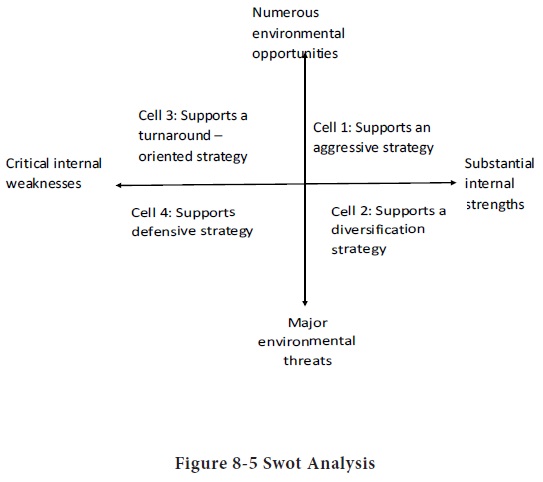

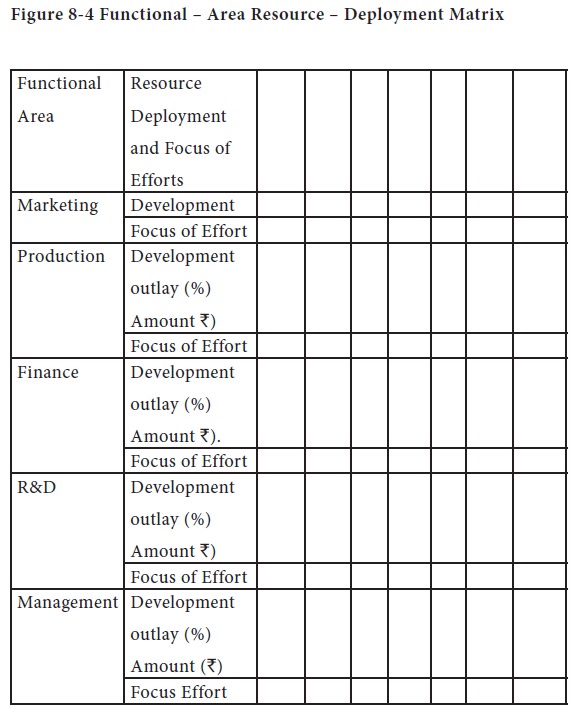

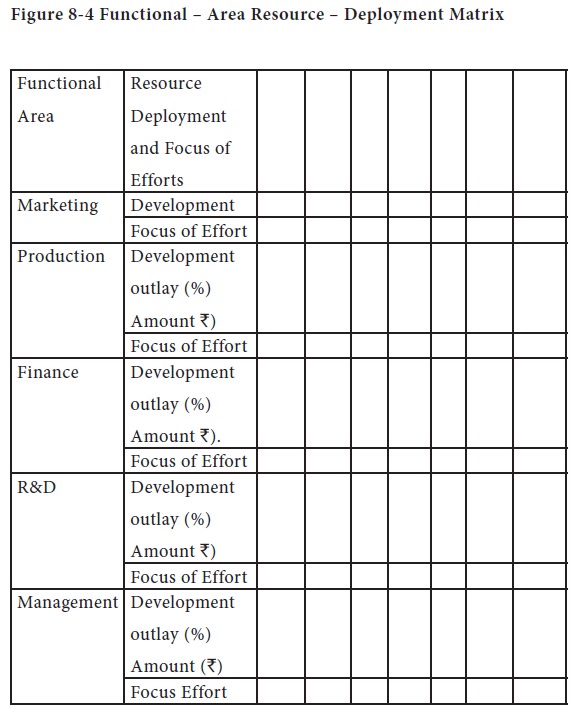

A second application of SWOT analysis is illustrated in Figure.8-5. Key external opportunities and threats are systematically compared to internal strengths and weaknesses in a structured approach. The objective is identification of one of four distinct patterns in the match between the firm’s internal and external situation. The four cells in Figure 8-5 represent these patterns.

1. Cell 1 is the most favorable situation; the firm faces several environmental opportunities and has numerous strengths that encourage pursuit of such opportunities. This condition suggests growth – oriented strategies to exploit the favorable match. IBM’s intensive market development strategy in the personal computer market was the result of a favorable match between strengths in reputation and resources and the opportunity for impressive market growth.

2. Cell 2, a firm with key strengths faces an unfavorable environment. In this situation, strategies would use current strengths to build long – term opportunities in other products/ markets.

3. Cell 3 faces impressive market opportunity but is constrained by several internal weaknesses. Businesses in this predicament are like the question marks in the BCG matrix. The focus of strategy for such firms is eliminating internal weaknesses to more effectively pursue market opportunity.

4. Cell 4 is the least favorable situation, with the firm facing major environmental threats from a position of relative weakness. This condition clearly calls for strategies that reduce or redirect involvement in the products markets examined using SWOT analysis.

SWOT analysis helps resolve one fundamental concern in selecting a strategy: What will be the principal purpose of the grand strategy? Is it to take advantage of a strong position or to overcome a weak one? SWOT analysis provides a means of answering this fundamental question. And this answer is input to one dimension in a second, more specific tool for selecting grand strategies: the grand strategy selection matrix.

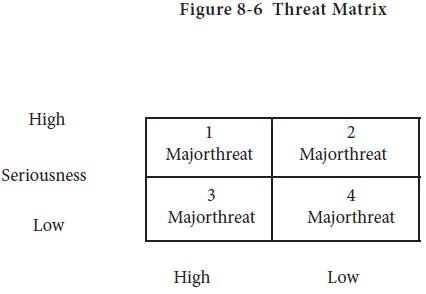

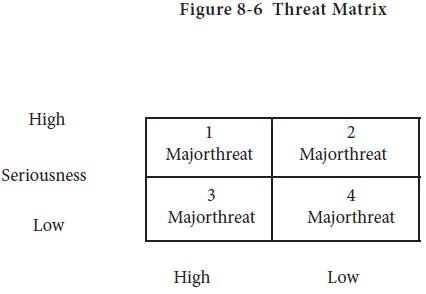

A company, after identifying the threats, can use judgment to place the threats in any of the four cells shown in Figure 8-6

For an aluminum plant erratic and high cost of power can became a threat if the probability of occurrence is high (cell.1). There is a need to set up captive plant or shifting the plant to another location.

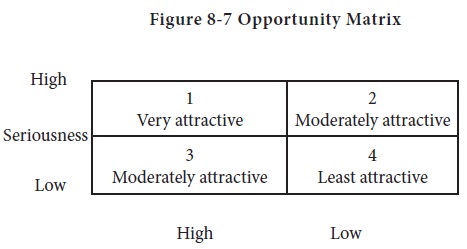

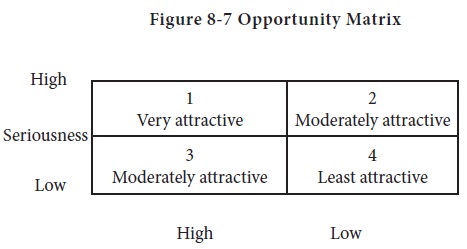

A company’s success probability with a particular opportunity depends on whether to strength (distinctive competence) matches the success requirement of the industry.

Ex: - Entry into LCVs is an attractive opportunity for TELCO.

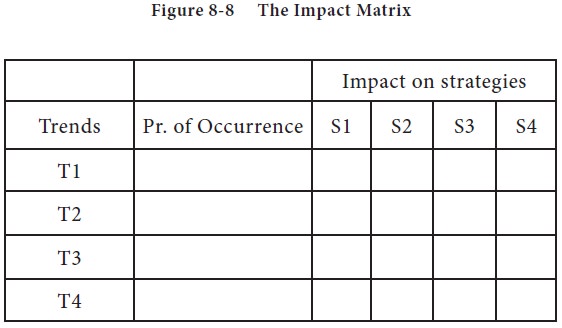

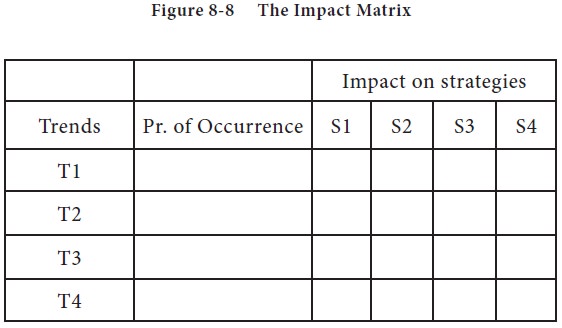

The impact of various strategies (opportunities and threats) is examined with the help of impact matrix. After identifying the trends in mega, micro and relevant environments the degree of impact can be measured on an impact scale. The impact matrix can be for a specific business unit or to overall company Eg. Diversified company.

A futuristic orientation and an ability to synthesize are two critical requirements for strategic decisions. On studying the environmental issues, the major trends can be identified and examine for the degree of impact they make on the business. A ‘five point ‘ scale can be used to assess the ‘degree’ and ‘quality’ of impact of each trend on different strategies. The scoring pattern can be:

For each trend probabilities of occurrences can be assigned.

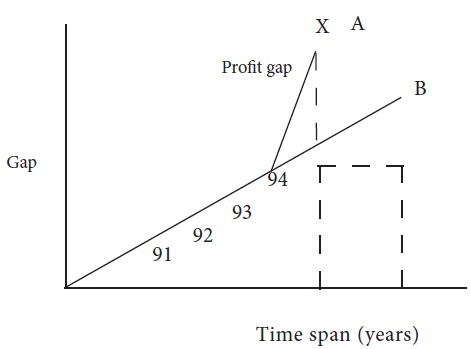

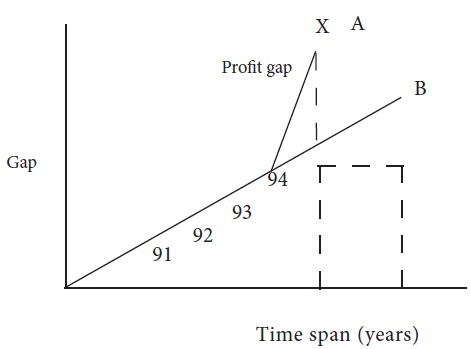

It is a useful method to describe the process involved in deciding what course of action should be taken to remove any potential profit or sales gap or risk gap.

Figure 8-9 Gap analysis

1. Profit Gap: Gap between profit for the past few years and profit projection based on freehand projection, linear regression coefficient or exponential smoothing.

2. Sales Gap: Gap between planned & actual sales.

3. Product gap: Difference between what a firm offers in terms of product items and what the industry provides in terms of product line.

4. Risk gap: Gap between anticipated risk with strategic decision and the actual happening.

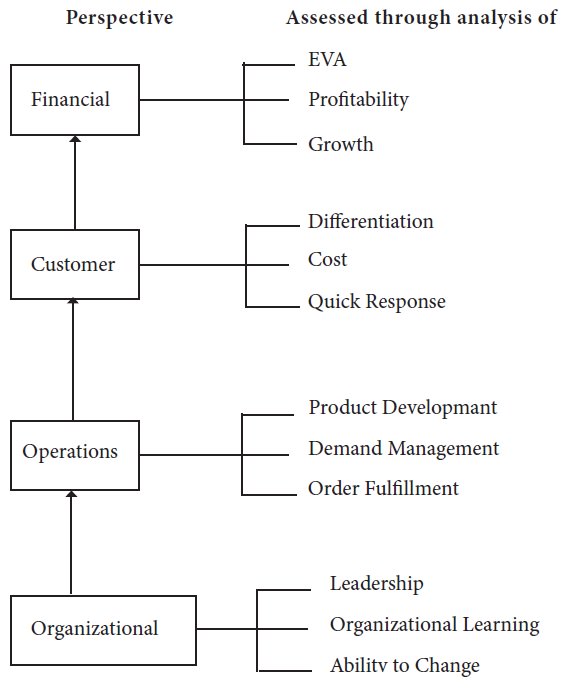

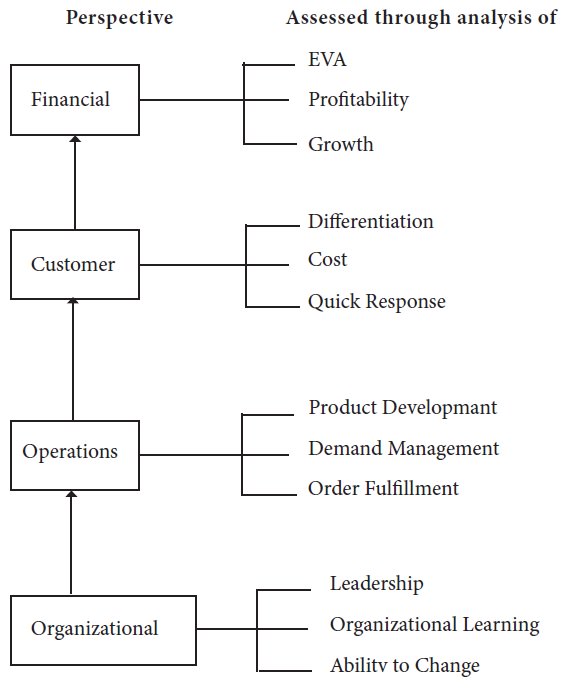

Balanced Scorecard is another useful tool to assess the internal strength and weakness of a company. This Balanced Scorecard attempts to examine firm’s strengths and weaknesses from different perspective, instead of focusing on a narrow set of criteria. This Balanced Scorecard does not out weigh one perspective and underscores other, rather it balances all of them.

To generate superior return for shareholders, company should have competitive advantage that depends upon its ability to provide certain values to customers. These values can be provided by offering them better, cheaper and faster products or services. For this company requires development of operations that supports product development and responsiveness to fulfill orders. To facilitate quality operations, company needs organization with required creativity, skill and learning. Thus financial score board is dependent upon many dimensions which contribute to the strength and success of the company. It requires to delve deeper to those perspective (beyond financial perspective) to have balanced insight of the company’s internal analysis.

Therefore we consider these four perspectives of the Balanced Scorecard: financial, Customer, Operations and Organizational.

Source: Alex Miller and Gregory G. Dess, Strategic Management, McGraw Hill, New York, 1996, Page 117.

This balanced scorecard, as a tool of internal analysis, provides definite advantages to the company.

First, it evaluates the strengths and weaknesses of a company by providing equal and balanced weight to different factors.

Second it “reflects the idea of a hierarchy of intent with elements linked in a series of means – ends relationship” (Alex Milles and Gregory G. Dess,1996).

Third, it explicitly cites competitive advantage as the core element for the success of a strategy.

There are various scanning techniques used by organizations

1. Issues Priority matrix

2. Environmental Threats and opportunities Profile (ETOP)

3. Strategic advantage profile (SAP)

4. Functional – area profile and resource deployment matrix

5. SWOT Analysis

6. The opportunity and Threat matrices

7. The Impact Matrix

8. The Impact scale

9. Gap Analysis

10. Balanced Score card

Issues Priority Matrix (IPM)

One way to identify and analyze developments in the external environment is to use the issues priority matrix (Figure 8-1) as follows:

1. Identify a number of likely trends emerging in the societal and task environments. These are strategic environmental issues – those important trends that, if they occur, determine what the industry or the world will look like in the near future.

2. Assess the probability of these trends actually occurring from low to high.

3. Attempt to ascertain the likely impact (from low to high) of each of these trends on the corporation being examined.

Figure 8-1s

Issues Priority Matrix

Source: L. L. Lederman, “Foresight Activities in the U.S.A: Time for a Re-Assessment?” Long – Range Planning (June 1984), p-46.

A corporation’s External Strategic Factors are those key environmental trends that are judged to have both a medium to high probability of occurrence and a medium to high probability of impact on the corporation. The issues priority matrix can then be used to help managers decide which environmental trends should be merely scanned (low priority) and which should be monitored as strategic factors (high priority). Those environmental trends judged to be a corporation’s strategic factors are then categorized as opportunities and threats and are included in strategy formulation.

Environmental Threats and Opportunities Profile (Etop )

Assessment of the environmental information and determining the relative significance of threats and opportunities require a systematic evaluation of the information developed in the course of environmental

An illustrative profile is given in Figure 8-2 on the basic of environmental analysis carried out by Bharat Heavy Electricals Ltd.

BHEL: ENVIRONMENTAL THREAT AND OPPORTUNI-TY PROFILE (ETOP)

Strategic Advantage Profile

A Profile of strategic advantages (SAP) is a summary statement, which provides an overview of the advantages and disadvantages in key areas likely to affect future operations of the firm. It is a tool for making a systematic evaluation of the strategic advantage factors, which are significant for the company in its environment. The preparation of such a profile presupposes detailed analysis and diagnosis of the factors in each of the functional areas (Marketing, Production, Finance and Accounting, Personnel and Human Resources, R& D). The relevant data for the critical areas may go as a supplement to the profile. The following Strategic Advantage Profile relates to a food processing company in India.

Since the Strategic Advantage Profile is a summary statement of corporate capabilities, in summarizing the func-tional competencies a comparative view needs to be taken in the light of external conditions and the time horizon of pro-jections. For example, while comparing the level of inventory holding, one may find it to be relatively higher than that of competing firms; as such it should be regarded as a weakness. But if the market demand shows an increasing trend, apparent weakness should be considered strength.

Functional – area profile and resource deployment matrix.

Developed by Hofer and Schendel, this method requires the preparation of a matrix of functional areas with characteristics common to each, e.g., focus of financial outlay, physical resource position, organizational system, and technological capability. The functional area profile of a manufacturing company is given by way of illustration. Following this exercise, it is required that the resource outlay and focus of efforts over time in the respective functional areas be presented also in the form of a matrix. Figure 8-4 Functional – Area Resource – Deployment Matrix

SWOT Analysis

SWOT is an acronym for the internal Strengths and Weaknesses of a business and environmental Opportunities and Threats facing that business. SWOT analysis is a systematic identification of these factors and the strategy that reflects the best match between them. It is based on the logic that an effective strategy maximizes a business’s strengths and opportunities but at the same time minimizes its weaknesses and threats. This simple assumption, if accurately applied, has powerful implications for successfully choosing and designing an effective strategy.

Opportunities

An opportunity is a major favorable situation in the firm’s environment. Key trends represent one source of opportunity. Identification of a previously overlooked market segment, changes in competitive or regulatory circumstances, technological changes, and improved buyer or supplier relationships could represent opportunities for the firm.

Threats

A threat is a major unfavorable situation in the firm’s environment. It is a key impediment to the firm’s current and / or desired future position. The entrance of a new competitor, slow market growth, increased bargaining power of key buyers or supplier, major technologies change, and changing regulations could represent major threats to a firm’s future success.

The second fundamental focus in SWOT analysis is identifying key strengths and weakness based on examination of the company profile. Strengths and weaknesses can be defined as follows:

Strengths

A strength is a resource, skill, or other advantage relative to competitors and the needs of markets a firm serves or anticipates serving. a strength is a distinctive competence that gives the firm a comparative advantage in the marketplace. Financial resources, image, market leadership, and buyer / supplier relations are examples.

Weaknesses

A weakness is a limitation (or) deficiency in resources, skills, and capabilities that seriously impedes effective performance. Facilities, financial resources, management capabilities, marketing skills, and brand image could be sources of weaknesses. Sheer size and level of customer acceptance proved to be key strengths around which IBM built its successful strategy in the personal computer market.

How is it useful?

Understanding the key strengths and weaknesses of the firm further aids in narrowing the choice of alternatives and selecting a

SWOT analysis can be used in at least three in strategic choice decisions. The most common application provides a logical framework guiding systematic discussions of the business’s situation, alternative strategies, and ultimately, the choice of strategy. What one manager sees as an opportunity, another may see as a potential threat.

A second application of SWOT analysis is illustrated in Figure.8-5. Key external opportunities and threats are systematically compared to internal strengths and weaknesses in a structured approach. The objective is identification of one of four distinct patterns in the match between the firm’s internal and external situation. The four cells in Figure 8-5 represent these patterns.

1. Cell 1 is the most favorable situation; the firm faces several environmental opportunities and has numerous strengths that encourage pursuit of such opportunities. This condition suggests growth – oriented strategies to exploit the favorable match. IBM’s intensive market development strategy in the personal computer market was the result of a favorable match between strengths in reputation and resources and the opportunity for impressive market growth.

2. Cell 2, a firm with key strengths faces an unfavorable environment. In this situation, strategies would use current strengths to build long – term opportunities in other products/ markets.

3. Cell 3 faces impressive market opportunity but is constrained by several internal weaknesses. Businesses in this predicament are like the question marks in the BCG matrix. The focus of strategy for such firms is eliminating internal weaknesses to more effectively pursue market opportunity.

4. Cell 4 is the least favorable situation, with the firm facing major environmental threats from a position of relative weakness. This condition clearly calls for strategies that reduce or redirect involvement in the products markets examined using SWOT analysis.

SWOT analysis helps resolve one fundamental concern in selecting a strategy: What will be the principal purpose of the grand strategy? Is it to take advantage of a strong position or to overcome a weak one? SWOT analysis provides a means of answering this fundamental question. And this answer is input to one dimension in a second, more specific tool for selecting grand strategies: the grand strategy selection matrix.

The Opportunity and Threat Matrices

A company, after identifying the threats, can use judgment to place the threats in any of the four cells shown in Figure 8-6

Probability of Occurrence

For an aluminum plant erratic and high cost of power can became a threat if the probability of occurrence is high (cell.1). There is a need to set up captive plant or shifting the plant to another location.

Probability of Occurrence

A company’s success probability with a particular opportunity depends on whether to strength (distinctive competence) matches the success requirement of the industry.

Ex: - Entry into LCVs is an attractive opportunity for TELCO.

The Impact Matrix

The impact of various strategies (opportunities and threats) is examined with the help of impact matrix. After identifying the trends in mega, micro and relevant environments the degree of impact can be measured on an impact scale. The impact matrix can be for a specific business unit or to overall company Eg. Diversified company.

The Impact Scale

A futuristic orientation and an ability to synthesize are two critical requirements for strategic decisions. On studying the environmental issues, the major trends can be identified and examine for the degree of impact they make on the business. A ‘five point ‘ scale can be used to assess the ‘degree’ and ‘quality’ of impact of each trend on different strategies. The scoring pattern can be:

+ 2 | - | Extremely favorable impact |

+1 | - | Moderately favorable impact |

0 | - | No impact favorable impact |

-1 | - | Moderately unfavorable impact |

-2 | - | Extremely unfavorable impact |

For each trend probabilities of occurrences can be assigned.

Gap Analysis

It is a useful method to describe the process involved in deciding what course of action should be taken to remove any potential profit or sales gap or risk gap.

Figure 8-9 Gap analysis

1. Profit Gap: Gap between profit for the past few years and profit projection based on freehand projection, linear regression coefficient or exponential smoothing.

2. Sales Gap: Gap between planned & actual sales.

3. Product gap: Difference between what a firm offers in terms of product items and what the industry provides in terms of product line.

4. Risk gap: Gap between anticipated risk with strategic decision and the actual happening.

Balanced Score Card

Balanced Scorecard is another useful tool to assess the internal strength and weakness of a company. This Balanced Scorecard attempts to examine firm’s strengths and weaknesses from different perspective, instead of focusing on a narrow set of criteria. This Balanced Scorecard does not out weigh one perspective and underscores other, rather it balances all of them.

To generate superior return for shareholders, company should have competitive advantage that depends upon its ability to provide certain values to customers. These values can be provided by offering them better, cheaper and faster products or services. For this company requires development of operations that supports product development and responsiveness to fulfill orders. To facilitate quality operations, company needs organization with required creativity, skill and learning. Thus financial score board is dependent upon many dimensions which contribute to the strength and success of the company. It requires to delve deeper to those perspective (beyond financial perspective) to have balanced insight of the company’s internal analysis.

Therefore we consider these four perspectives of the Balanced Scorecard: financial, Customer, Operations and Organizational.

Source: Alex Miller and Gregory G. Dess, Strategic Management, McGraw Hill, New York, 1996, Page 117.

This balanced scorecard, as a tool of internal analysis, provides definite advantages to the company.

First, it evaluates the strengths and weaknesses of a company by providing equal and balanced weight to different factors.

Second it “reflects the idea of a hierarchy of intent with elements linked in a series of means – ends relationship” (Alex Milles and Gregory G. Dess,1996).

Third, it explicitly cites competitive advantage as the core element for the success of a strategy.

Tags : Strategic Management - Environmental Analysis and Diagnosis

Last 30 days 13572 views