Financial Management - Capital Budgeting – A Conceptual Framework

Weighted Average Cost of Capital

Posted On :

Cost of capital does not refer to the cost of some specific source in the financial decision-making.

Weighted Average Cost of

Capital

Cost of capital does not refer to the cost of some specific source in the financial decision-making. It should be the over- all cost of all sources and we should consider the weighted cost of capital. Weights are given in proportion to each source of funds in the capital structure; then weighted average cost of capital is calculated.

For calculating the weighted average cost of capital, we should know the capital structure of the company. Let us assume that the proposed capital structure of a company after new financing would be as follows:

Cost of capital does not refer to the cost of some specific source in the financial decision-making. It should be the over- all cost of all sources and we should consider the weighted cost of capital. Weights are given in proportion to each source of funds in the capital structure; then weighted average cost of capital is calculated.

For calculating the weighted average cost of capital, we should know the capital structure of the company. Let us assume that the proposed capital structure of a company after new financing would be as follows:

Secondly, we should calculate the cost of different types of capital

stated above, before-tax in the manner in which we studied so far.

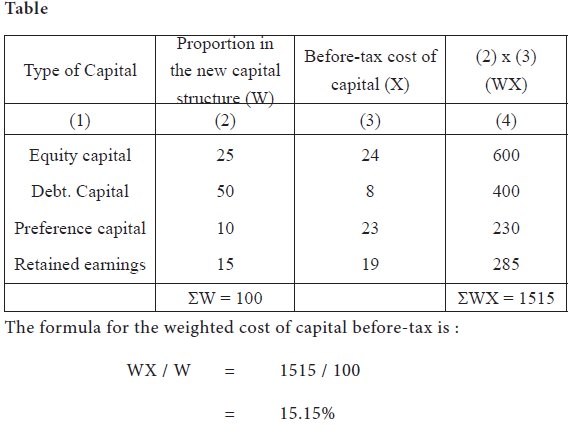

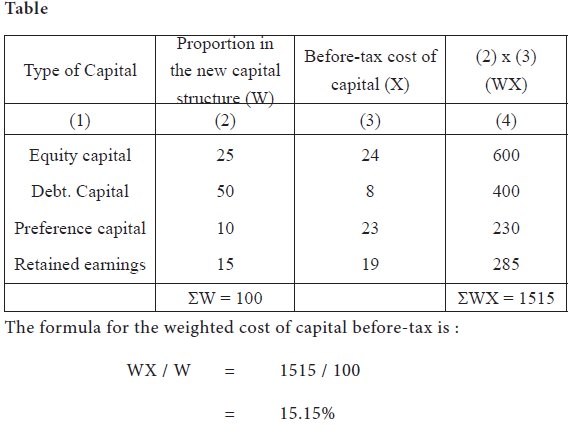

with these figures, the weighted average cost of

capital is calculated for the company as shown in the following Table.

The weighted average cost of capital in the above

imaginary illustration is 15.12 per cent, before-tax.

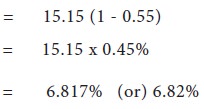

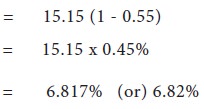

After-tax cost of capital = Before-tax cost (1 —

tax-rate). Assuming the tax-rate as 55% after-tax cost of capital

comes to :

This average cost of capital

provides us a measure of the minimum rate of return which the proposed

investment must earn to turn out to be acceptable.

Tags : Financial Management - Capital Budgeting – A Conceptual Framework

Last 30 days 1144 views