Financial Management - Capital Budgeting – A Conceptual Framework

Cost of Retained Earnings - Cost Of Capital

Posted On :

The part of income which a firm is left with after paying interest on debt capital and dividend to its shareholders is called retained earnings.

Cost of

Retained Earnings

The part of income which a firm is left with after paying interest on debt capital and dividend to its shareholders is called retained earnings. These also involve cost in the sense that by withholding the distribution of part of income to shareholders the firms is denying them the opportunity to invest these funds elsewhere and earn income. In this sense the cost of retained earnings is the opportunity cost.

It must be noted that retaining the earnings is equal to forcing the shareholders to increase their equity position in the firm by that amount. But retained earnings are cheaper when it is realised that shareholders would have to pay personal tax on the additional dividends, if distributed. Retained earnings avoid the payment of personal income tax on dividends and the brokerage fee connected with any reinvestment. However, the amount to be paid as personal income tax differs from shareholder to shareholder, depending upon the tax bracket to which he belongs. Thus, before-tax cost of retained earnings (Cre) and before-tax cost of equity capital (Ce) are equal; but once the impact of tax is also included then the cost of retained earnings is less than the cost of equity capital, the difference being the personal income tax. For example,

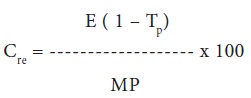

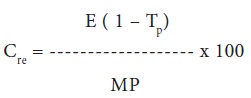

Though the cost of retained earnings is always lower than cost of equity capital, a company can depend upon this source of finance only to the extent of availability of funds and willingness of shareholders. The cost of retained earnings can be stated with the help of the following formula:

The part of income which a firm is left with after paying interest on debt capital and dividend to its shareholders is called retained earnings. These also involve cost in the sense that by withholding the distribution of part of income to shareholders the firms is denying them the opportunity to invest these funds elsewhere and earn income. In this sense the cost of retained earnings is the opportunity cost.

It must be noted that retaining the earnings is equal to forcing the shareholders to increase their equity position in the firm by that amount. But retained earnings are cheaper when it is realised that shareholders would have to pay personal tax on the additional dividends, if distributed. Retained earnings avoid the payment of personal income tax on dividends and the brokerage fee connected with any reinvestment. However, the amount to be paid as personal income tax differs from shareholder to shareholder, depending upon the tax bracket to which he belongs. Thus, before-tax cost of retained earnings (Cre) and before-tax cost of equity capital (Ce) are equal; but once the impact of tax is also included then the cost of retained earnings is less than the cost of equity capital, the difference being the personal income tax. For example,

Though the cost of retained earnings is always lower than cost of equity capital, a company can depend upon this source of finance only to the extent of availability of funds and willingness of shareholders. The cost of retained earnings can be stated with the help of the following formula:

Where, Cre is

the cost of retained earnings; E is

the earnings per equity; Tp is

the personal income tax; and MP is the market price of the share.

Tags : Financial Management - Capital Budgeting – A Conceptual Framework

Last 30 days 1075 views