Financial Management - Capital Budgeting – A Conceptual Framework

Cost of Preference Share Capital - Cost Of Capital

Posted On :

A security sold in a market place promising a fixed rupee return per period is known as a preference share or preferred stock. Dividends on preferred stock are cumulative in the sense that if the firm is unable to pay when promised by it, then these keep on getting accumulated until paid, and these must be paid before dividends are paid to ordinary shareholders.

Cost of

Preference Share Capital

A security sold in a market place promising a fixed rupee return

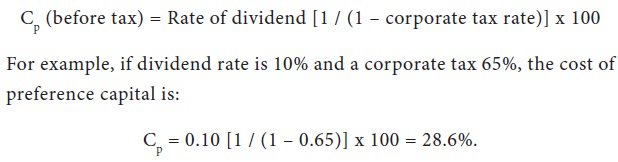

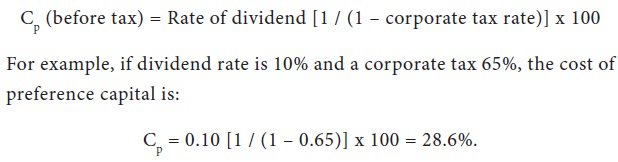

The important difference in the true cost of debentures and preference shares must be noted. Interest on debentures is considered as an expense by tax authorities and is, therefore, deducted from company’s income for tax purposes. That is why the true cost of debentures is the after tax cost. On the other hand, the dividends are paid to preference shareholders after the company has paid tax on its income (including that portion of income which is to be paid to preference shareholders). Therefore, the true cost of preference capital is the before tax cost which may be found as:

A security sold in a market place promising a fixed rupee return

The important difference in the true cost of debentures and preference shares must be noted. Interest on debentures is considered as an expense by tax authorities and is, therefore, deducted from company’s income for tax purposes. That is why the true cost of debentures is the after tax cost. On the other hand, the dividends are paid to preference shareholders after the company has paid tax on its income (including that portion of income which is to be paid to preference shareholders). Therefore, the true cost of preference capital is the before tax cost which may be found as:

Tags : Financial Management - Capital Budgeting – A Conceptual Framework

Last 30 days 774 views