Home | ARTS | Strategic Management

|

Typology of Strategic Alliances - Strategic Alliances And Joint Ventures

Strategic Management - Strategy Formulation

Typology of Strategic Alliances - Strategic Alliances And Joint Ventures

Posted On :

Several typologies of strategic alliances are available in business literature.

Typology of Strategic

Alliances

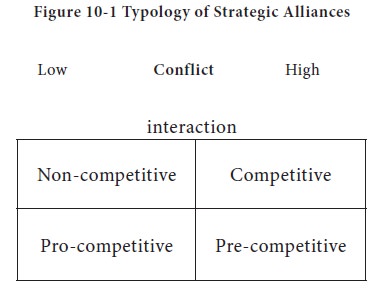

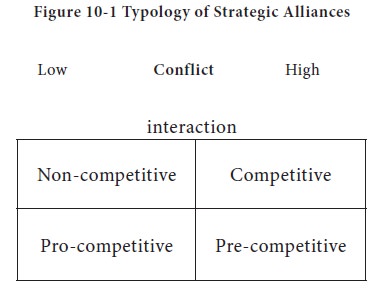

Several typologies of strategic alliances are available in business literature. One such classification is by Yoshino and Rangan. This is a two-dimensional model with the two dimensions being, the extent of organizational interaction and conflict potential between alliance patterns. The classification is shown in Figure 10-1.

These are generally alliances within the industry exemplified by vertical value-chain relationships between manufactures and their suppliers and distributors. Such relationships are advantageous to both parties. Supplier and buyer organizations entering upon long-term contracts constitute pro-competitive alliances.

These are partnerships within the industry. Such alliances are entered upon by organizations that operate in the some industry yet do not perceive each other’s as rivals. This can be because their areas of activity do not coincide and/or their products and services are sufficiently dissimilar to prevent competition. Organizations that have carved out distinct areas in the industry geographically or otherwise, adopt the noncompetitive alliances. For example, a number of automotive manufacturers in Europe have entered into a strategic alliance for engine development.

These are relationships that bring rival organizations in a cooperative arrangement. These alliances may be intra –industry or inter-industry.

For example Coca-Cola entered into an agreement with Parle Products, the manufacturers of Thumps Up their main competitors in western India.

These partnerships bring two organizations from different, often unrelated industries to work on well-defined activities. This is often seen in activities such as, mass awareness campaigns or environmental and social issues. Sometimes inter industry and inter disciplinary cooperation is necessary for development.

For example, Intel has pre-competitive alliances with software, hardware and other manufacturers.

The types of alliances range from mutual consortia to value chain partnerships as described below.

1. Mutual service consortia- A mutual service consortium is a partnership of similar companies in similar industries who pool their resources to gain a benefit that is too expensive to develop alone, such as access to advanced technology. For example, IBM of the United States, Toshiba of Japan, and Siemens of Germany formed a consortium to develop new generations of computer chips.

2. Joint venture – A joint venture is a “cooperative business activity formed by 2 or more separate organizations for strategic purposes, that creates an independent business entity and allocates ownership, operational responsibilities, and financial risks and rewards to each member, while preserving their separate identity autonomy.

3. Licensing arrangement – A licensing arrangement is an agreement in which the licensing firm grants rights to another firm in another country or market to produce and / or sell a product. The licensee

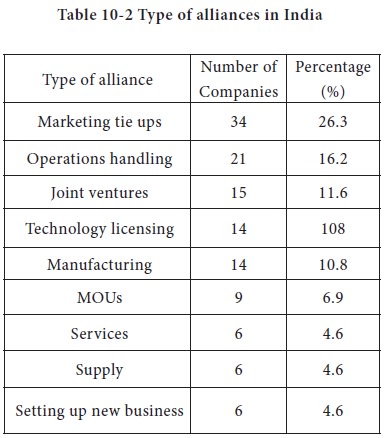

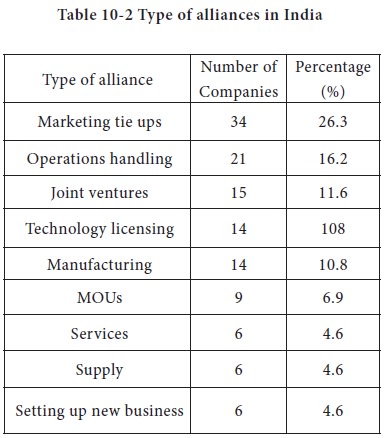

A statistical sample of different strategic alliances in India with number of companies in different alliances and their percentage is listed in Table 10-2.

After liberalization, JVs are less since MMCs can

set up a 100% subsidiary after 1991. Therefore Indian market is witnessing

breaking up of joint ventures. On the other hand, Indian firms are going for JV

abroad for reasons like.

1. Source of learning and development

2. Access to better infrastructure

3. Access to

greater market share

4. Availability of raw materials

Delta Industries took over Netherlands Jute Industries (NJI) in 1994 which led to cost effective production in the country with advanced technology. Several alliances such as TVS-Sujuki, Mahindra-Ford, BPL-Sanyo and Videocon- Sansui have withstood the test of the time. Ranbaxy went into a strategic alliance with Eli Lilly of the US to realize its mission of becoming a research based international and pharmaceutical company.

The opening up of infrastructure sector in India led to forming of a number of alliances.

1. The telecommunications sector has witnessed the coming together of several local and global firms such as Crompton Greaves and Millicom, the SPIC group and Telstra, Max (GSM) and Brtisih Telecom, Usha Martin and Telecom Malaysia, among several others.

2. The roads and highways sector has created conditions for several global giants joining hands with reputed Indian companies like the alliances of Unitech and Hyndai, Engineering and Constructions, THC India and Trafalgar House International, Tarmat and Samsung, and others.

Liberalization and globalization have spurred the growth of strategic alliances. A good example of synergetic benefits arising out of a strategic alliance is that of Taj Hotels and British Airways, where both create advantages for each other through complementarities of airline and hotel services.

Besides this, other reasons, which lead to strategic alliances, are the availability of professional management expertise, international reputation, global brand name and brand equity, and confidence to gain a foothold in the international markets.

Alliances are often used by not- for- profit organization as a way to enhance their capacity to serve clients or to acquire resources while still enabling them to keep their identity services can be provided efficiently through cooperation with other organizations them if they are done alone.

Several typologies of strategic alliances are available in business literature. One such classification is by Yoshino and Rangan. This is a two-dimensional model with the two dimensions being, the extent of organizational interaction and conflict potential between alliance patterns. The classification is shown in Figure 10-1.

Pro-Competitive Alliances

These are generally alliances within the industry exemplified by vertical value-chain relationships between manufactures and their suppliers and distributors. Such relationships are advantageous to both parties. Supplier and buyer organizations entering upon long-term contracts constitute pro-competitive alliances.

Noncompetitive Alliances

These are partnerships within the industry. Such alliances are entered upon by organizations that operate in the some industry yet do not perceive each other’s as rivals. This can be because their areas of activity do not coincide and/or their products and services are sufficiently dissimilar to prevent competition. Organizations that have carved out distinct areas in the industry geographically or otherwise, adopt the noncompetitive alliances. For example, a number of automotive manufacturers in Europe have entered into a strategic alliance for engine development.

Competitive Alliances

These are relationships that bring rival organizations in a cooperative arrangement. These alliances may be intra –industry or inter-industry.

For example Coca-Cola entered into an agreement with Parle Products, the manufacturers of Thumps Up their main competitors in western India.

Pre-competitive Alliances

These partnerships bring two organizations from different, often unrelated industries to work on well-defined activities. This is often seen in activities such as, mass awareness campaigns or environmental and social issues. Sometimes inter industry and inter disciplinary cooperation is necessary for development.

For example, Intel has pre-competitive alliances with software, hardware and other manufacturers.

Continuum of Alliances

The types of alliances range from mutual consortia to value chain partnerships as described below.

1. Mutual service consortia- A mutual service consortium is a partnership of similar companies in similar industries who pool their resources to gain a benefit that is too expensive to develop alone, such as access to advanced technology. For example, IBM of the United States, Toshiba of Japan, and Siemens of Germany formed a consortium to develop new generations of computer chips.

2. Joint venture – A joint venture is a “cooperative business activity formed by 2 or more separate organizations for strategic purposes, that creates an independent business entity and allocates ownership, operational responsibilities, and financial risks and rewards to each member, while preserving their separate identity autonomy.

3. Licensing arrangement – A licensing arrangement is an agreement in which the licensing firm grants rights to another firm in another country or market to produce and / or sell a product. The licensee

4. Value-chain partnership – The Value-chain

partnership is a strong and close alliance in which one company or unit forms a

long-term arrangement with a key supplier or distributor for mutual advantage.

Forms of Alliances in India

A statistical sample of different strategic alliances in India with number of companies in different alliances and their percentage is listed in Table 10-2.

1. Source of learning and development

2. Access to better infrastructure

4. Availability of raw materials

Delta Industries took over Netherlands Jute Industries (NJI) in 1994 which led to cost effective production in the country with advanced technology. Several alliances such as TVS-Sujuki, Mahindra-Ford, BPL-Sanyo and Videocon- Sansui have withstood the test of the time. Ranbaxy went into a strategic alliance with Eli Lilly of the US to realize its mission of becoming a research based international and pharmaceutical company.

The opening up of infrastructure sector in India led to forming of a number of alliances.

1. The telecommunications sector has witnessed the coming together of several local and global firms such as Crompton Greaves and Millicom, the SPIC group and Telstra, Max (GSM) and Brtisih Telecom, Usha Martin and Telecom Malaysia, among several others.

2. The roads and highways sector has created conditions for several global giants joining hands with reputed Indian companies like the alliances of Unitech and Hyndai, Engineering and Constructions, THC India and Trafalgar House International, Tarmat and Samsung, and others.

Liberalization and globalization have spurred the growth of strategic alliances. A good example of synergetic benefits arising out of a strategic alliance is that of Taj Hotels and British Airways, where both create advantages for each other through complementarities of airline and hotel services.

Besides this, other reasons, which lead to strategic alliances, are the availability of professional management expertise, international reputation, global brand name and brand equity, and confidence to gain a foothold in the international markets.

Alliances are often used by not- for- profit organization as a way to enhance their capacity to serve clients or to acquire resources while still enabling them to keep their identity services can be provided efficiently through cooperation with other organizations them if they are done alone.

Four Ohio

Universities agreed to start a new school of international business at a cost

of $ 30 million. This cannot be done singly.

Tags : Strategic Management - Strategy Formulation

Last 30 days 1540 views