MARKETING MANAGEMENT - Pricing Methods

Price-adjustments - Pricing Methods

Posted On :

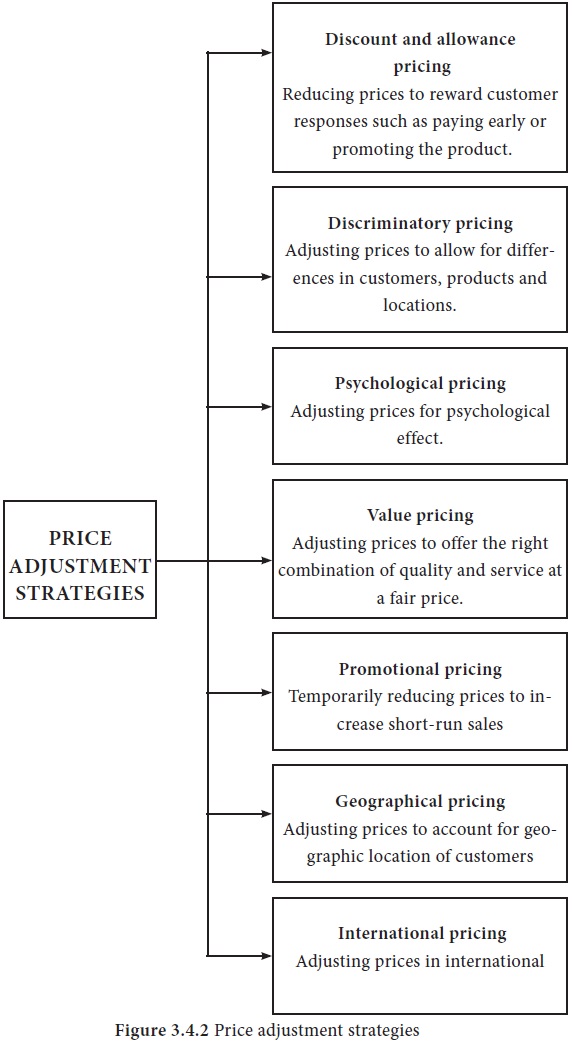

Firms usually adjust their basic prices to account for various customer differences and changing situations. Figure 3.4.2 summarizes seven price-adjustment strategies.

Price-adjustments

Firms usually adjust their basic

prices to account for various customer differences and changing situations.

Figure 3.4.2 summarizes seven price-adjustment strategies.

Most firms adjust their basic price to reward customers for certain responses, such as cash payment, early payment of bills, volume purchases and off-season buying. Some of those adjustments are described below:

1. Cash discounts – A cash discount is a price reduction to buyers who pay their bills promptly. The discount must be granted to all buyers meeting these terms. Such discounts are customary in many industries and help to improve the sellers’ cash situation and reduce bad debts and credit collection costs.

2. Quantity discounts – A quantity discount is a price reduction to buyers who buy large volumes. It must be offered to all customers and must not exceed the seller’s cost savings associated with selling large quantities. These savings include lower selling, inventory and transportation expenses. Discounts provide an incentive to the customer to buy more from one given seller, rather than from many different sources.

3. Functional discounts – A functional discount (also called trade discount) is offered by the seller to trade channel members who perform certain functions, such as selling, storing and record keeping. Manufacturers may offer different functional discounts to different trade channels because of the varying services they perform, but manufacturers must offer the same functional discounts within each trade channel.

4. Seasonal discounts – A seasonal discount is a price reduction to buyers who buy out of season. It allows the seller to keep productions steady during the entire year.

5. Allowances – They are another type of reductions from the list price. Trade-in allowances are price reductions given for turning in an old item when buying a new one. Promotional allowances are payments or price reductions to reward dealers for participating in advertising and sales-support programs.

Firms will often adjust their basic prices to allow for differences in customers, products and locations. In discriminatory pricing, the firm sells a product or service at two or more prices, even though the difference in prices is not based on differences in costs. Discriminatory pricing takes many forms as indicated below:

1. Customer-segment pricing – Different customers pay different prices for the same product or service. Electricity power tariffs are different to industrial and domestic consumers.

2. Product-form pricing - Different versions of the product are priced differently, but not according to differences in their costs. Book publishers offer same book at different prices- hard bound at high prices and paper packs at low prices.

3. Location pricing – Different locations are priced differently, even though the cost of offering in each location is the same. Hotel chains charge tourists differently at different locations for the same type of accommodation

4. Time pricing - Prices vary by the season, month, day and even hour. Museums and parks charge higher prices on Sundays and lower prices on week days.

It applies the belief that certain prices or price ranges make products more appealing to buyers than others. In using psychological pricing, sellers consider the psychology of prices and not simply the economics.

1. Pricing based on perceptions – The relationship between price and quality perceptions indicate that consumers perceive higher-priced products as having higher quality. When consumers cannot judge quality because they lack the information or skill, prices becomes an important quality signal. In case of cloth, if

2. Reference pricing – Reference prices are those prices that buyers carry in their minds and refer to when looking at a given product. It might be formed by noting current prices, remembering past prices or assessing the buying situation. Sellers can influence or use these consumers’ reference prices when setting price. Colour TVs are supposed to be higher in price with reference to black and white TVs. Consumers will judge the price by finding how much high it is when compared to B-W TV.

3. Odd pricing – In odd pricing, marketers set prices at odd numbers just under round numbers. An odd ending conveys the notion of a discount or bargain to the customer. Bata pricing is famous for this. Instead of pricing at Rs 1000/- they price it as Rs. 999.99

During slow-growth times, many firms adjust their prices to bring them into line with economic conditions and with the resulting fundamental shift in consumer attitudes toward quality and value. Value pricing is offering just the right combination of quality and good service at a fair price. In many cases, value pricing has involved redesigning existing brands in order to offer more quality for a given price or the same quality for less.

Bajaj Auto Ltd has its slogan which reads: Value for money, indicating that their products are budget sensitive.

In promotional pricing, a lower-than-normal price is used as a temporary ingredient in a firm’s selling strategy. Some promotional pricing arrangements form part of recurrent marketing initiatives. Some may be to introduce a promotional model or brand with special pricing to begin competing in a new market. Promotional pricing takes several forms and some of them are described below.

1. Loss-leader pricing – It happens when retailers drop price on well-known brands to stimulate store traffic in the hope that customers will buy other items also, at normal mark-ups.

2. Special-event pricing – Sellers use special-event pricing in certain seasons to draw in more customers. The seasonal need of the customers is capitalized on by the sellers using this pricing strategy. Festivals, new year days, and national celebrations and sports events form the occasions. At the time of Olympics, TVs and mobile phones are offered at lower prices to stimulate demand.

3. Cash rebates – Manufacturers will sometimes offer cash rebates to consumers who buy the product from dealers within a specified time. Cash rebates during festival seasons are common in case of clothing especially the Khadi products.

4. Low-interest financing, longer payment times, longer warranties – all these represent the promotional incentives offered by the sellers to the buyers. Since they provide some flexibility and also bring down the perceived risks (in case of longer warranties), buyers are motivated to make the buying decision. Automobile companies arrange 0% interest financing in India to their buyers. .

5. Psychological discounting – The seller may simply offer discounts from normal prices to increase sales and reduce inventories. For the buyer, the motivation to buy below normal prices may be compelling. Super markets show two prices on the label. –list price and the retail shop price with discount.

Geographical considerations strongly influence prices when costs must cover shipping heavy, bulky, low-unit-cost materials. Buyers and sellers can distribute transportation expenses in several ways: (1) The buyer pays all transportation charges; (2) The seller pays all transportation charges; or (3) the buyer and the seller share the charges. This choice has particularly important effects for a firm seeking to expand its geographic coverage to distant markets. The seller’s pricing can implement several alternatives for handling transportation costs.

1. FOB-origin pricing – It means that the goods are placed free on board (FOB) a carrier, at which point the title and responsibility pass to the customer, who pays the freight from the factory to the destination. Though it looks fair, the disadvantage is that the firm will be a high-cost firm to distant customers.

2. Uniform delivered pricing – It is the exact opposite of FOB pricing. The company charges the same price plus freight to all customers, regardless of their location. An advantage is that it is fairly easy to administer and it lets the firm advertise its price nationally.

3. Zone pricing – It falls between FOB-origin pricing and uniform delivered pricing. The company sets up two or more zones. All customers within a given zone pay a single total price; the more distant the zone, the higher the price.

4. Basing-point pricing – The seller selects a given city as a ‘basing point’ and charges all customers the freight cost from that city to the customer location, regardless of the city from which the goods actually are shipped.

5. Freight-absorption pricing – The seller who is anxious to do business with a certain customer or geographical area might use freight-absorption pricing. This strategy involves absorbing all or part of the actual freight charges in order to get the desired business. It is used for market penetration and to hold on to increasingly competitive markets.

A wide variety of internal and external conditions can affect a marketer’s global pricing strategies. Internal influences include the firm’s goals and marketing strategies, the costs of developing, producing and marketing its products, the nature of the products and the firm’s competitive strengths. External influences include general conditions in international markets, especially those in the firm’s target markets, regulatory limitations, trade restrictions, competitors’ actions, economic events, customer characteristics and the global status of the industry. In

1. Standard worldwide price – Exporters often set standard worldwide prices, regardless of their target markets. This strategy can succeed if foreign marketing costs remain low enough that they do not impact overall costs, or if their prices reflect average unit costs. A firm that implements a standard pricing program must monitor the international marketplace carefully, however, to make sure that domestic competitors do not undercut its prices.

2. Dual pricing – It distinguishes prices for domestic and export sales. Some exporters practice cost-plus pricing to establish dual prices that fully allocate their true domestic and foreign costs to product sales in those markets. Others opt for flexible cost-plus pricing schemes that allow marketers to grant discounts or change prices according to shifts in the competitive environment or fluctuations in the international exchange rate.

3. Market-differentiated pricing – It makes even more flexible arrangements to set prices according to local marketplace conditions. Effective market-differentiated pricing depends on access to quick, accurate market information.

Discount and allowance pricing

Most firms adjust their basic price to reward customers for certain responses, such as cash payment, early payment of bills, volume purchases and off-season buying. Some of those adjustments are described below:

1. Cash discounts – A cash discount is a price reduction to buyers who pay their bills promptly. The discount must be granted to all buyers meeting these terms. Such discounts are customary in many industries and help to improve the sellers’ cash situation and reduce bad debts and credit collection costs.

2. Quantity discounts – A quantity discount is a price reduction to buyers who buy large volumes. It must be offered to all customers and must not exceed the seller’s cost savings associated with selling large quantities. These savings include lower selling, inventory and transportation expenses. Discounts provide an incentive to the customer to buy more from one given seller, rather than from many different sources.

3. Functional discounts – A functional discount (also called trade discount) is offered by the seller to trade channel members who perform certain functions, such as selling, storing and record keeping. Manufacturers may offer different functional discounts to different trade channels because of the varying services they perform, but manufacturers must offer the same functional discounts within each trade channel.

4. Seasonal discounts – A seasonal discount is a price reduction to buyers who buy out of season. It allows the seller to keep productions steady during the entire year.

5. Allowances – They are another type of reductions from the list price. Trade-in allowances are price reductions given for turning in an old item when buying a new one. Promotional allowances are payments or price reductions to reward dealers for participating in advertising and sales-support programs.

Discriminatory pricing

Firms will often adjust their basic prices to allow for differences in customers, products and locations. In discriminatory pricing, the firm sells a product or service at two or more prices, even though the difference in prices is not based on differences in costs. Discriminatory pricing takes many forms as indicated below:

1. Customer-segment pricing – Different customers pay different prices for the same product or service. Electricity power tariffs are different to industrial and domestic consumers.

2. Product-form pricing - Different versions of the product are priced differently, but not according to differences in their costs. Book publishers offer same book at different prices- hard bound at high prices and paper packs at low prices.

3. Location pricing – Different locations are priced differently, even though the cost of offering in each location is the same. Hotel chains charge tourists differently at different locations for the same type of accommodation

4. Time pricing - Prices vary by the season, month, day and even hour. Museums and parks charge higher prices on Sundays and lower prices on week days.

Psychological pricing

It applies the belief that certain prices or price ranges make products more appealing to buyers than others. In using psychological pricing, sellers consider the psychology of prices and not simply the economics.

1. Pricing based on perceptions – The relationship between price and quality perceptions indicate that consumers perceive higher-priced products as having higher quality. When consumers cannot judge quality because they lack the information or skill, prices becomes an important quality signal. In case of cloth, if

2. Reference pricing – Reference prices are those prices that buyers carry in their minds and refer to when looking at a given product. It might be formed by noting current prices, remembering past prices or assessing the buying situation. Sellers can influence or use these consumers’ reference prices when setting price. Colour TVs are supposed to be higher in price with reference to black and white TVs. Consumers will judge the price by finding how much high it is when compared to B-W TV.

3. Odd pricing – In odd pricing, marketers set prices at odd numbers just under round numbers. An odd ending conveys the notion of a discount or bargain to the customer. Bata pricing is famous for this. Instead of pricing at Rs 1000/- they price it as Rs. 999.99

Value pricing

During slow-growth times, many firms adjust their prices to bring them into line with economic conditions and with the resulting fundamental shift in consumer attitudes toward quality and value. Value pricing is offering just the right combination of quality and good service at a fair price. In many cases, value pricing has involved redesigning existing brands in order to offer more quality for a given price or the same quality for less.

Bajaj Auto Ltd has its slogan which reads: Value for money, indicating that their products are budget sensitive.

Promotional pricing

In promotional pricing, a lower-than-normal price is used as a temporary ingredient in a firm’s selling strategy. Some promotional pricing arrangements form part of recurrent marketing initiatives. Some may be to introduce a promotional model or brand with special pricing to begin competing in a new market. Promotional pricing takes several forms and some of them are described below.

1. Loss-leader pricing – It happens when retailers drop price on well-known brands to stimulate store traffic in the hope that customers will buy other items also, at normal mark-ups.

2. Special-event pricing – Sellers use special-event pricing in certain seasons to draw in more customers. The seasonal need of the customers is capitalized on by the sellers using this pricing strategy. Festivals, new year days, and national celebrations and sports events form the occasions. At the time of Olympics, TVs and mobile phones are offered at lower prices to stimulate demand.

3. Cash rebates – Manufacturers will sometimes offer cash rebates to consumers who buy the product from dealers within a specified time. Cash rebates during festival seasons are common in case of clothing especially the Khadi products.

4. Low-interest financing, longer payment times, longer warranties – all these represent the promotional incentives offered by the sellers to the buyers. Since they provide some flexibility and also bring down the perceived risks (in case of longer warranties), buyers are motivated to make the buying decision. Automobile companies arrange 0% interest financing in India to their buyers. .

5. Psychological discounting – The seller may simply offer discounts from normal prices to increase sales and reduce inventories. For the buyer, the motivation to buy below normal prices may be compelling. Super markets show two prices on the label. –list price and the retail shop price with discount.

Geographical pricing

Geographical considerations strongly influence prices when costs must cover shipping heavy, bulky, low-unit-cost materials. Buyers and sellers can distribute transportation expenses in several ways: (1) The buyer pays all transportation charges; (2) The seller pays all transportation charges; or (3) the buyer and the seller share the charges. This choice has particularly important effects for a firm seeking to expand its geographic coverage to distant markets. The seller’s pricing can implement several alternatives for handling transportation costs.

1. FOB-origin pricing – It means that the goods are placed free on board (FOB) a carrier, at which point the title and responsibility pass to the customer, who pays the freight from the factory to the destination. Though it looks fair, the disadvantage is that the firm will be a high-cost firm to distant customers.

2. Uniform delivered pricing – It is the exact opposite of FOB pricing. The company charges the same price plus freight to all customers, regardless of their location. An advantage is that it is fairly easy to administer and it lets the firm advertise its price nationally.

3. Zone pricing – It falls between FOB-origin pricing and uniform delivered pricing. The company sets up two or more zones. All customers within a given zone pay a single total price; the more distant the zone, the higher the price.

4. Basing-point pricing – The seller selects a given city as a ‘basing point’ and charges all customers the freight cost from that city to the customer location, regardless of the city from which the goods actually are shipped.

5. Freight-absorption pricing – The seller who is anxious to do business with a certain customer or geographical area might use freight-absorption pricing. This strategy involves absorbing all or part of the actual freight charges in order to get the desired business. It is used for market penetration and to hold on to increasingly competitive markets.

International pricing

A wide variety of internal and external conditions can affect a marketer’s global pricing strategies. Internal influences include the firm’s goals and marketing strategies, the costs of developing, producing and marketing its products, the nature of the products and the firm’s competitive strengths. External influences include general conditions in international markets, especially those in the firm’s target markets, regulatory limitations, trade restrictions, competitors’ actions, economic events, customer characteristics and the global status of the industry. In

1. Standard worldwide price – Exporters often set standard worldwide prices, regardless of their target markets. This strategy can succeed if foreign marketing costs remain low enough that they do not impact overall costs, or if their prices reflect average unit costs. A firm that implements a standard pricing program must monitor the international marketplace carefully, however, to make sure that domestic competitors do not undercut its prices.

2. Dual pricing – It distinguishes prices for domestic and export sales. Some exporters practice cost-plus pricing to establish dual prices that fully allocate their true domestic and foreign costs to product sales in those markets. Others opt for flexible cost-plus pricing schemes that allow marketers to grant discounts or change prices according to shifts in the competitive environment or fluctuations in the international exchange rate.

3. Market-differentiated pricing – It makes even more flexible arrangements to set prices according to local marketplace conditions. Effective market-differentiated pricing depends on access to quick, accurate market information.

Tags : MARKETING MANAGEMENT - Pricing Methods

Last 30 days 1343 views