Home | ARTS | Marketing Management

|

Procedure for a pricing policy - Pricing Policies and Constraints

MARKETING MANAGEMENT - Pricing Policies and Constraints

Procedure for a pricing policy - Pricing Policies and Constraints

Posted On :

A firm must set a price for the first time when it develops a new product, when it introduces its regular product into a new distribution channel or geographical area, and when it enters bids on new contract work.

Procedure for a pricing policy

A firm must set a price for the first time when it develops a new product, when it introduces its regular product into a new distribution channel or geographical area, and when it enters bids on new contract work. The firm has to consider several factors in setting its pricing policy. A useful 6-step procedure to develop the pricing policy is discussed below.

The firm first decides where it wants to position its market offering. The clearer a firm’s objectives, the easier it is to set price. A firm can pursue any of the objectives classified under four major groups, viz. profitability objectives, volume objectives, meeting competition objectives and prestige objectives. This was discussed in the previous lesson.

Each price will lead to a different level of demand and therefore have a different impact on a firm’s marketing objectives. The relation between alternative prices and the resulting current demand is captured in a demand curve. In the normal case, demand and price are inversely related: the higher the price, the lower the demand. In the case of prestige

They are less price sensitive to low cost items or items they buy infrequently. They are also less price sensitive when price is only a small part of the total cost of obtaining, operating and servicing the product over its lifetime. Firms, of course, prefer customers who are less price sensitive. The following is a list of factors leading to less price sensitivity, as identified by Nagle and Holden.

1. The product is more distinctive

2. Buyers are less aware of substitutes

3. Buyers cannot easily compare the quality of substitutes

4. The expenditure is a smaller part of the buyer’s total income

5. The expenditure is small compared to the total cost of the end product

6. Part of the cost is borne by another party

7. The product is used in conjunction with assets previously bought

8. The product is assumed to have more quality, prestige or exclusiveness

9. Buyers cannot store the product

Most firms make some attempt to measure their demand curves using methods like statistical analysis, price experiments and surveys. In measuring the price-demand relationship, the marketer must control for various factors that will influence demand. The competitor’s response will make a difference. Also, if the company changes other marketing mix factors besides price, the effect of the price change itself will be hard to isolate and measure.

In the earlier discussion on costs, it was noted that demand sets a ceiling on the price, whereas costs set the floor. Also, the types of costs and the impact of economies of scale and learning curve on pricing was explained. To price intelligently, management needs to know how its costs vary with different levels of production. It is important to be aware of the risks presented by pricing based on the experience/learning curve. It assumes that competitors are weak followers.

It leads the company into building more plants to meet the demand, while a competitor may be innovating a lower-cost technology. Then the market leader will be stuck with the old technology. Today’s firms try to adapt their offers and terms to different buyers. A manufacturer may negotiate different terms with different retail chains. One retailer may want daily delivery (to keep inventory lower) while another may accept twice-a-week delivery in order to get a lower price.

The manufacturer’s cost will differ with each chain and so will its profits. To estimate the real profitability of dealing with different customers with differing requirements, the manufacturer needs to use activity-based cost (ABC) accounting instead of standard cost accounting. ABC accounting tries to identify the real costs associated with serving each customer. It allocates indirect costs like clerical costs, office expenses, supplies and so on, to the activities that use them, rather than in some proportion to direct costs. Both variable and overhead costs are tagged back to each customer. Another interesting costing concept is target costing.

Costs change with production scale and experience. They can also change as a result of a concentrated effort by designers, engineers and purchasing agents to reduce them through target costing. Market research is used to establish a new product’s desired functions and the price at which the product will sell, given its appeal and competitors’ prices. Deducting the desired profit margin from this price leaves the target cost that must be achieved. Each cost element - design, engineering, manufacturing, sales – must be examined and different ways to bring down costs must be considered.

The objective is to bring the final cost projections into the target cost range. If this is not possible, it may be necessary to stop developing the product because it could not sell for the target price and make the target profit.

Within the range of possible prices determined by market demand and company costs, the firm must take competitors’ costs, prices and possible price reactions into account. The firm should first consider the nearest competitor’s price. If the firm’s offer contains features not offered by the nearest competitor, their worth to the customer should be evaluated and added to the competitor’s price.

If the competitor’s offer contains some features not offered by the firm, their worth to the customer should be evaluated and subtracted from the firm’s price. Now the firm can decide whether it can charge more, the same or less than the competitor. But competition can change their prices in reaction to the price set by the firm.

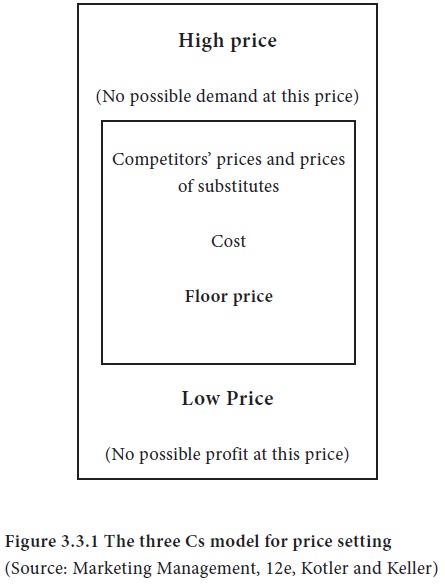

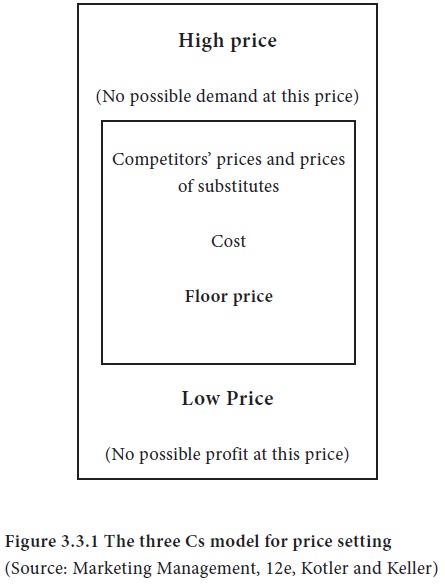

Given the three Cs – the Customer’s demand schedule, the cost function and the competitors’ prices – the firm is now ready to select a price. Figure 3.3.1 summarizes the three major considerations in price setting. Costs set a floor to the price. Competitors’ price and the price of substitutes provide an orienting point.

Customers’ assessment of unique features establishes the price ceiling. Firms select a pricing approach that includes one or more of these three considerations. The pricing approaches are cost-based or buyer-based or competition-based. These approaches were discussed at length in the previous lesson.

Pricing methods narrow the range from which the company must select its final price. In selecting that price, the company must consider additional factors, including the impact of other marketing activities, company pricing guidelines, gain-and-risk-sharing pricing and the impact of price on other parties. The final price must take into account the brand’s quality and advertising relative to the competition.

The price must be consistent with the firm’s pricing guidelines. When a firm establishes pricing penalties, it must be done judiciously so as not to unnecessarily alienate customers. Sometimes, buyers may resist accepting a seller’s proposal because of a high perceived level of risk. The seller has the option of offering to absorb part or all of the risk if it does not deliver the full promised value.

Management must also consider the reactions of other parties to the contemplated price. For instance, the reaction of marketing intermediaries must be thought about. The reaction of the sales force must be taken note since they will be the ones to sell at that price in the marketplace. All these reactions might hold clues to fine tune the final price.

A firm must set a price for the first time when it develops a new product, when it introduces its regular product into a new distribution channel or geographical area, and when it enters bids on new contract work. The firm has to consider several factors in setting its pricing policy. A useful 6-step procedure to develop the pricing policy is discussed below.

Selecting the pricing objective

The firm first decides where it wants to position its market offering. The clearer a firm’s objectives, the easier it is to set price. A firm can pursue any of the objectives classified under four major groups, viz. profitability objectives, volume objectives, meeting competition objectives and prestige objectives. This was discussed in the previous lesson.

Determining demand

Each price will lead to a different level of demand and therefore have a different impact on a firm’s marketing objectives. The relation between alternative prices and the resulting current demand is captured in a demand curve. In the normal case, demand and price are inversely related: the higher the price, the lower the demand. In the case of prestige

They are less price sensitive to low cost items or items they buy infrequently. They are also less price sensitive when price is only a small part of the total cost of obtaining, operating and servicing the product over its lifetime. Firms, of course, prefer customers who are less price sensitive. The following is a list of factors leading to less price sensitivity, as identified by Nagle and Holden.

1. The product is more distinctive

2. Buyers are less aware of substitutes

3. Buyers cannot easily compare the quality of substitutes

4. The expenditure is a smaller part of the buyer’s total income

5. The expenditure is small compared to the total cost of the end product

6. Part of the cost is borne by another party

7. The product is used in conjunction with assets previously bought

8. The product is assumed to have more quality, prestige or exclusiveness

9. Buyers cannot store the product

Most firms make some attempt to measure their demand curves using methods like statistical analysis, price experiments and surveys. In measuring the price-demand relationship, the marketer must control for various factors that will influence demand. The competitor’s response will make a difference. Also, if the company changes other marketing mix factors besides price, the effect of the price change itself will be hard to isolate and measure.

Estimating costs

In the earlier discussion on costs, it was noted that demand sets a ceiling on the price, whereas costs set the floor. Also, the types of costs and the impact of economies of scale and learning curve on pricing was explained. To price intelligently, management needs to know how its costs vary with different levels of production. It is important to be aware of the risks presented by pricing based on the experience/learning curve. It assumes that competitors are weak followers.

It leads the company into building more plants to meet the demand, while a competitor may be innovating a lower-cost technology. Then the market leader will be stuck with the old technology. Today’s firms try to adapt their offers and terms to different buyers. A manufacturer may negotiate different terms with different retail chains. One retailer may want daily delivery (to keep inventory lower) while another may accept twice-a-week delivery in order to get a lower price.

The manufacturer’s cost will differ with each chain and so will its profits. To estimate the real profitability of dealing with different customers with differing requirements, the manufacturer needs to use activity-based cost (ABC) accounting instead of standard cost accounting. ABC accounting tries to identify the real costs associated with serving each customer. It allocates indirect costs like clerical costs, office expenses, supplies and so on, to the activities that use them, rather than in some proportion to direct costs. Both variable and overhead costs are tagged back to each customer. Another interesting costing concept is target costing.

Costs change with production scale and experience. They can also change as a result of a concentrated effort by designers, engineers and purchasing agents to reduce them through target costing. Market research is used to establish a new product’s desired functions and the price at which the product will sell, given its appeal and competitors’ prices. Deducting the desired profit margin from this price leaves the target cost that must be achieved. Each cost element - design, engineering, manufacturing, sales – must be examined and different ways to bring down costs must be considered.

The objective is to bring the final cost projections into the target cost range. If this is not possible, it may be necessary to stop developing the product because it could not sell for the target price and make the target profit.

Analysing competitors’ costs, prices and offers

Within the range of possible prices determined by market demand and company costs, the firm must take competitors’ costs, prices and possible price reactions into account. The firm should first consider the nearest competitor’s price. If the firm’s offer contains features not offered by the nearest competitor, their worth to the customer should be evaluated and added to the competitor’s price.

If the competitor’s offer contains some features not offered by the firm, their worth to the customer should be evaluated and subtracted from the firm’s price. Now the firm can decide whether it can charge more, the same or less than the competitor. But competition can change their prices in reaction to the price set by the firm.

Selecting a pricing approach

Given the three Cs – the Customer’s demand schedule, the cost function and the competitors’ prices – the firm is now ready to select a price. Figure 3.3.1 summarizes the three major considerations in price setting. Costs set a floor to the price. Competitors’ price and the price of substitutes provide an orienting point.

Customers’ assessment of unique features establishes the price ceiling. Firms select a pricing approach that includes one or more of these three considerations. The pricing approaches are cost-based or buyer-based or competition-based. These approaches were discussed at length in the previous lesson.

Selecting the final price

Pricing methods narrow the range from which the company must select its final price. In selecting that price, the company must consider additional factors, including the impact of other marketing activities, company pricing guidelines, gain-and-risk-sharing pricing and the impact of price on other parties. The final price must take into account the brand’s quality and advertising relative to the competition.

The price must be consistent with the firm’s pricing guidelines. When a firm establishes pricing penalties, it must be done judiciously so as not to unnecessarily alienate customers. Sometimes, buyers may resist accepting a seller’s proposal because of a high perceived level of risk. The seller has the option of offering to absorb part or all of the risk if it does not deliver the full promised value.

Management must also consider the reactions of other parties to the contemplated price. For instance, the reaction of marketing intermediaries must be thought about. The reaction of the sales force must be taken note since they will be the ones to sell at that price in the marketplace. All these reactions might hold clues to fine tune the final price.

Tags : MARKETING MANAGEMENT - Pricing Policies and Constraints

Last 30 days 1544 views