Strategic Management - Strategy Formulation

Planned Diversification - Diversification Strategies

Posted On :

The one best way of diversifying an organization is to carry the work through systematic planning.

Planned Diversification

The one best way of diversifying an organization is to carry the work through systematic planning. Though many organizations have

In this process, it is preferable to constitute a tasks force, which is entrusted with the total work of diversification because it requires separate emphasis on some aspects at least for some period of time. When this task force is created, it can move in the direction of thinking about possible diversification. The work of the task force becomes easier if it has the full support of top management. The role of this task force may be to collect and analyze relevant information, which helps in arriving at diversification decision.

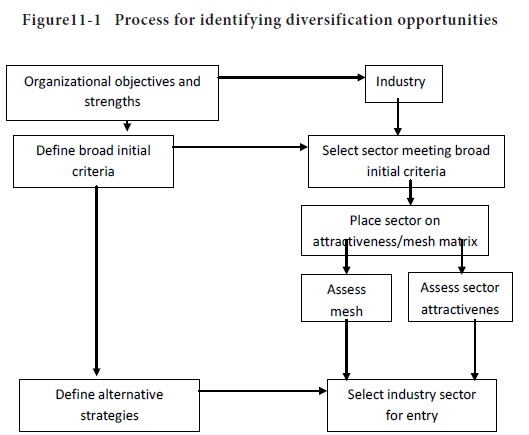

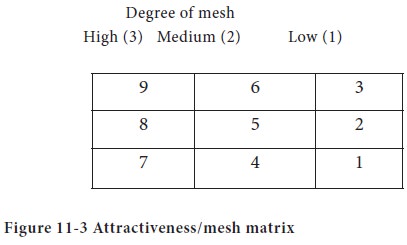

The basic problem in a diversification strategy is to identify the suitable industry sector, which meets basic criteria of diversification. Figure 11-1 presents a process thorough which identification of diversification opportunities becomes systematic. The process provides the facility for assessing and measuring each business sector against a number of different criteria so that judgment can be reached on two separate factors .

1. Attractiveness of the sector as an investment in its own right and

2. The extent to which the qualities required for success in the sector match the own strengths of the organization.

There are basically three major measurements involved in this process.

1. Measurements of industry attractiveness,

2. Measurement of mesh, and

Combination of attractiveness and mesh to arrive at some strategic alternatives

At the initial stage, various sectors of the industry can be taken for identifying diversification opportunities. Such criteria may be in the form of:

1. Acceptable product groups or functions,

2. Minimum sales volume within a specified period of time, say five years or so,

3. Minimum

projected growth rate in the market

4. Minimum profitability criteria,

5. Maximum and minimum investment required in the project, and so on.

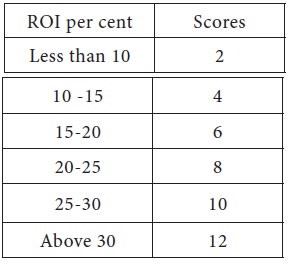

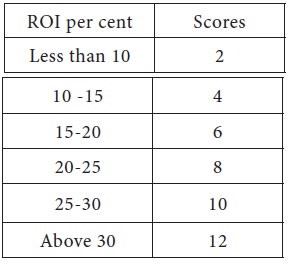

These criteria may be used in weeding out the industry sectors which cannot be considered. The assessment of the attractiveness of a sector as an area for potential investment is based on its profitability and maturity. The profitability of a sector is measured in terms of return on investment (ROI) of the principal companies within the sector. The profitability ratio may be assigned scores. Scoring pattern may differ from organization to organization depending on manager’s preference and interpretation. For example, following scores may be given to various levels of profitability:

Business Policy: Strategic Management

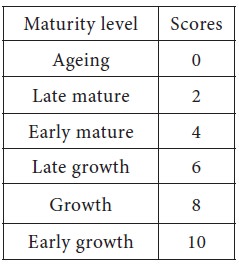

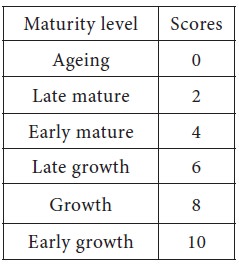

The maturity of industry is taken on the basis of level of growth and future potential. Thus industry sectors can be classified into growing, maturing, ageing. In growing sector, the rate of growth is more than the rate of gross national product; in maturing industry, the rate of growth is almost similar to gross national product; while in ageing sector, the rate of growth is lower than the rate of gross national product. These stages can further be classified on the basis of time taken by a sector to move from one stage to another and scores can be assigned in the following way.

Adding the scores for profitability to the sector

maturity arrives at the scoring for over all attractiveness of each sector.

Degree of mesh suggests the extent to which a particular organization can match the requirements of an industry sector. It is assess on the basis of organizational strengths and critical success factors (CSFs) required for success in the industry sector. CSFs are those

1. In growth sector, high market share at the time of entry is not crucial because opportunities exist for rationalization and consolidation. Further investment is normally needed.

2. In mature sector, high market share at the time of entry is critical; cost cutting and control is important and further investment is generally not appropriate.

3. In ageing sector, a high market share at the time of entry is critical. Little or no further investment is desirable.

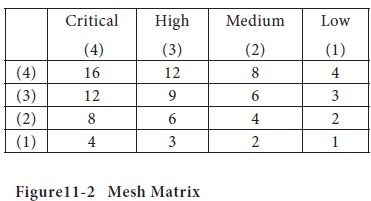

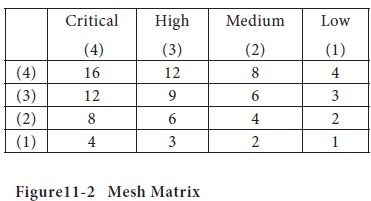

Taking both the factors-organizational strengths and CSFs, mesh matrix can be constructed as depicted in Figure 11-2.

High score in the matrix will increase the upside potential of investment because

1. The organization can add something to the operation of the new business, and

2. Will decrease the downside risk because the management will have experience of the sort of problems that are likely to occur.

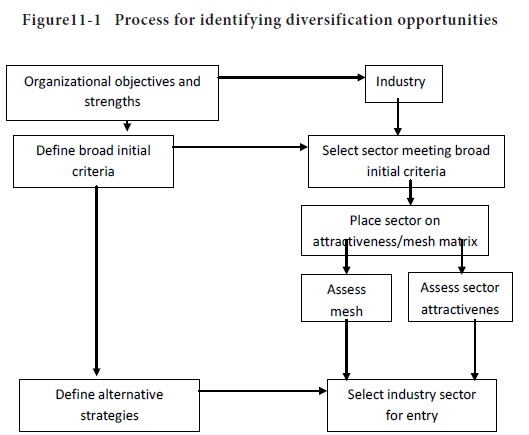

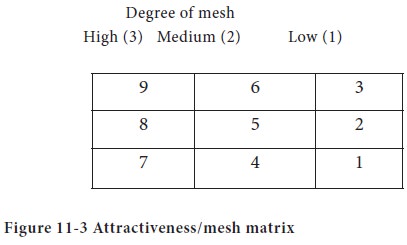

Having rated each sector’s attractiveness and mesh,

we can combine both to form another matrix. Because two measures are

independent of each other, we can expect some sectors to score high on

attractiveness but low on mesh whereas other sectors score low on

attractiveness and high on mesh. The attractiveness/mesh matrix has been

presented in Figure 11-3 below

According to this matrix, best diversification opportunities are those that score high on both characteristics having score of 9; least proffered is with low degree of both characteristics having score of 1. The selection of sectors from elsewhere depends on the strategy the organization selects.

The one best way of diversifying an organization is to carry the work through systematic planning. Though many organizations have

In this process, it is preferable to constitute a tasks force, which is entrusted with the total work of diversification because it requires separate emphasis on some aspects at least for some period of time. When this task force is created, it can move in the direction of thinking about possible diversification. The work of the task force becomes easier if it has the full support of top management. The role of this task force may be to collect and analyze relevant information, which helps in arriving at diversification decision.

The basic problem in a diversification strategy is to identify the suitable industry sector, which meets basic criteria of diversification. Figure 11-1 presents a process thorough which identification of diversification opportunities becomes systematic. The process provides the facility for assessing and measuring each business sector against a number of different criteria so that judgment can be reached on two separate factors .

1. Attractiveness of the sector as an investment in its own right and

2. The extent to which the qualities required for success in the sector match the own strengths of the organization.

There are basically three major measurements involved in this process.

1. Measurements of industry attractiveness,

2. Measurement of mesh, and

Combination of attractiveness and mesh to arrive at some strategic alternatives

(i) Assessment of Industry Attractiveness

At the initial stage, various sectors of the industry can be taken for identifying diversification opportunities. Such criteria may be in the form of:

1. Acceptable product groups or functions,

2. Minimum sales volume within a specified period of time, say five years or so,

4. Minimum profitability criteria,

5. Maximum and minimum investment required in the project, and so on.

These criteria may be used in weeding out the industry sectors which cannot be considered. The assessment of the attractiveness of a sector as an area for potential investment is based on its profitability and maturity. The profitability of a sector is measured in terms of return on investment (ROI) of the principal companies within the sector. The profitability ratio may be assigned scores. Scoring pattern may differ from organization to organization depending on manager’s preference and interpretation. For example, following scores may be given to various levels of profitability:

Business Policy: Strategic Management

The maturity of industry is taken on the basis of level of growth and future potential. Thus industry sectors can be classified into growing, maturing, ageing. In growing sector, the rate of growth is more than the rate of gross national product; in maturing industry, the rate of growth is almost similar to gross national product; while in ageing sector, the rate of growth is lower than the rate of gross national product. These stages can further be classified on the basis of time taken by a sector to move from one stage to another and scores can be assigned in the following way.

(ii) Assessment of Degree Mesh

Degree of mesh suggests the extent to which a particular organization can match the requirements of an industry sector. It is assess on the basis of organizational strengths and critical success factors (CSFs) required for success in the industry sector. CSFs are those

1. In growth sector, high market share at the time of entry is not crucial because opportunities exist for rationalization and consolidation. Further investment is normally needed.

2. In mature sector, high market share at the time of entry is critical; cost cutting and control is important and further investment is generally not appropriate.

3. In ageing sector, a high market share at the time of entry is critical. Little or no further investment is desirable.

Taking both the factors-organizational strengths and CSFs, mesh matrix can be constructed as depicted in Figure 11-2.

High score in the matrix will increase the upside potential of investment because

1. The organization can add something to the operation of the new business, and

2. Will decrease the downside risk because the management will have experience of the sort of problems that are likely to occur.

Combination of Attractiveness and Mesh

According to this matrix, best diversification opportunities are those that score high on both characteristics having score of 9; least proffered is with low degree of both characteristics having score of 1. The selection of sectors from elsewhere depends on the strategy the organization selects.

1. If it

wishes to go for growth and earnings, pays low regard to the relationship which

a sector has with the organizational strengths may select the alternatives in

order of sectors failing in 6,3,8,5,7 and 4 in that preference order. In such a

case, the rate of growth and profitability may be high but the risk involved is

also high.

2. If the organization wishes to minimize mesh risk and pursues business in those sectors which mesh high with its own strengths, it would select sectors in the order of 8,7,6,5,4,3 and 2. These strategies are low-risk ones for the organization.

3. If the organization wishes to select business on the basis of both measures, it would select in the order of 9,6,8(6 and 8 equal) 5.

4. In the remaining sector, the preference would be in the order of 3,7 (equal) and 2,4 (equal). The strategies in the third alternatives would be balanced ones.

2. If the organization wishes to minimize mesh risk and pursues business in those sectors which mesh high with its own strengths, it would select sectors in the order of 8,7,6,5,4,3 and 2. These strategies are low-risk ones for the organization.

3. If the organization wishes to select business on the basis of both measures, it would select in the order of 9,6,8(6 and 8 equal) 5.

4. In the remaining sector, the preference would be in the order of 3,7 (equal) and 2,4 (equal). The strategies in the third alternatives would be balanced ones.

Tags : Strategic Management - Strategy Formulation

Last 30 days 634 views