Accounting For Managers - Funds Flow Analysis And Cash Flow Analysis

Flow Of Funds - Sources And Application Of Funds

The term `flow’ means change and therefore, the term `flow of funds’ means `change in funds’ or `change in working capital’. According to manmohan and goyal, “the flow of funds” refers to movement of funds described in terms of the flow in and out of the working capital area. In short, any increase or decrease in working capital means `flow of funds’. Many transactions which take place in a business enterprise may increase its working capital, may decrease it or may not effect any change in it. Let us consider the following examples.

(i) Purchased Machinery For

Rs.3,00,000:

The effect of this transaction is that working capital decreases by 3,00,000 as cash balance is reduced. This change (decrease) in working capital is called as application of funds. Here the accounts involved are current assets (cash a/c) and fixed asset (machinery a/c).

(ii) Issue Of Share Capital

Of Rs.10,00,000:

This

transaction will increase the working capital as cash balance increases. This

change (increase) in working capital is called as source of funds. Here the two

accounts involved are current assets (cash a/c) and long-term liability (share

capital a/c).

(iii) Sold Plant For

Rs.3,00,000:

This

transaction will have the effect of increasing the working capital by

rs.3,00,000 as the cash balance increases by rs.3,00,000. It is a source of

funds. Here the accounts involved are current assets (cash a/c) and fixed

assets (plant a/c).

iv) Redeemed Debentures

Worth Rs.1,00,000:

This

transaction has the effect of reducing the working capital, as the redemption

of debentures results in reduction in cash balance. Hence this is an example of

application of funds. The two accounts affected by this transaction are current

assets (cash a/c) and long-term liability (debenture a/c).

(v) Purchased Inventory

Worth Rs.10,000:

This

transaction results in decrease in cash by rs.10,000 and increase in stock by

rs.10,000 thereby keeping the total current assets at the same figure. Hence

there will be no change in the working capital (there is no flow of funds in

this transaction). Both the accounts affected are current assets.

(vi) Notes Payable Drawn By

Creditors Accepted For Rs.30,000:

The

effect of this transaction on working capital is nil as it results in increase in

notes payable (a current liability) and decreases the creditors (another

current liability). Since there is no change in total current liabilities there

is no flow of funds.

(vii) Building

Purchased For Rs.30,00,000 And Payment Is Made By Shares:

This

transaction will not have any impact on working capital as it does not result

in any change either in the current asset or in the current liability. Hence

there is no flow of funds. The two accounts affected are fixed assets (building

a/c) and long term liabilities (capital a/c).

From the

above series of examples, we arrive at the following rules on flow of funds:

I. There

Will Be Flow Of Funds Only When There Is A Cross-Transaction I.E., Only When

The Transaction Involves:

ՖՖ Current Assets And Fixed Assets E.G., Purchase Of Machinery For Cash (Application Of Funds) Or Sale Of Plant For A Cash (Source Of Funds). Current Assets And Capital, E.G., Issue Of Shares (Source Of Funds).

ՖՖ Current

Assets And Long Term Liabilities, E.G., Redemption Of Debentures In Cash (Application

Of Funds).

ՖՖ Current

Liabilities And Long-Term Liabilities, E.G., Creditors Paid Off In Debentures

Or Shares (Source Of Funds).

ՖՖ Current

Liabilities And Fixed Assets, E.G., Building Transferred To Creditors In

Satisfaction Of Their Claims (Source Of Funds).

Ii. There

Will Be No Flow Of Funds When There Is No Cross Transaction I.E., When The

Transaction Involves:

ՖՖ Current Assets And Current Assets, E.G., Inventory Purchased For Cash.

ՖՖ Current Liabilities And Current Liabilities, E.G., Notes Payable Issued To Creditors.

ՖՖ Current Assets And Current Liabilities, E.G., Payments Made To Creditors.

ՖՖ Fixed

Assets And Long Term Liabilities, E.G., Building Purchased And Payment Made In

Shares Or Debentures.

(a) Sources And Application Of Funds: the following are the main sources of funds:

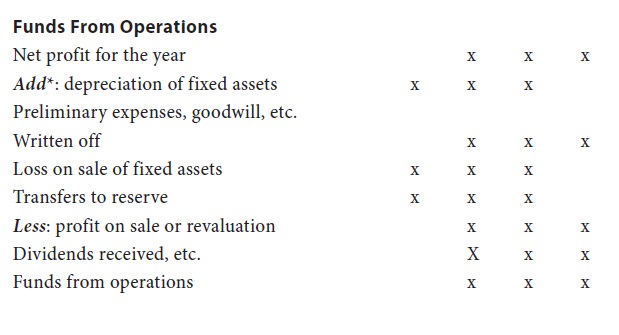

(i) Funds From Operations: the operations of the business generate revenue and entail expenses. Revenues augment working capital and expenses other than depreciation and other amortizations. The following adjustments will be required in the figures of net profit for finding out the real funds from operations:

* these items are added as they do not result in outflow of funds. In case of `net loss’ for the year these items will be deducted.

(ii) Issue Of Share Capital: an issue of share capital results in an inflow of funds.

(iii) Long-Term Borrowings: when a long-term loan is taken, there is an increase in working capital because of cash inflow. A short term loan, however, does not increase the working capital because a short-term loan increases the current assets (cash) and the current liability (short term loan) by the same amount, leaving the size of working capital unchanged.

(iv) Sale Of Non-Current Assets: when a fixed asset or a long-term investment or any other non-current asset is sold, there will be inflow represented by cash or short-term receivables.

(b) Uses Of Funds: the following are the main uses of funds:

(i) Payment Of Dividend: the transaction results in decrease in working capital owing to outflow of cash.

(ii) Repayment Of Long-Term Liability:

The repayment of long-term loan involves cash outflow and hence it is used for working capital. The repayment of a current liability does not affect the amount of working capital because it entails an equal reduction in current liabilities and current assets.

(iii) Purchase Of Non-Current Assets:

when a firm purchases fixed assets or other non-current assets, and if it pays cash or incurs a short-term debt, its working capital decreases. Hence it is a use of funds.