Home | ARTS | Accounting For Managers

|

Ratio Analysis-Illustrations - Ratios From Shareholders’ Point Of View - Full Calculation

Accounting For Managers - Ratio Analysis

Ratio Analysis-Illustrations - Ratios From Shareholders’ Point Of View - Full Calculation

Posted On :

Ratios From Shareholders’ Point Of View

(Refer Previous article for the introduction)

Illustrations

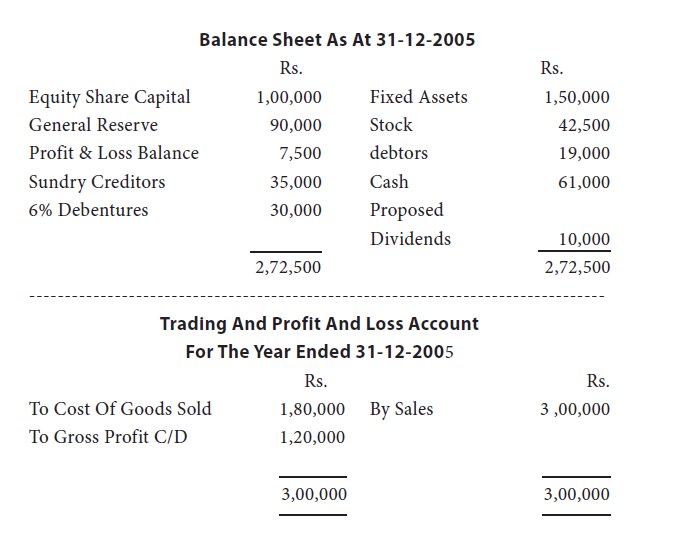

Illustration 4: the following are the financial statements of yesye limited for the year 2005.

To Expenses 1,00,000 By Gross Profit B/D 1,20,000

To Net Profit 20,000

1,20,000 1,20,000

You are required to compute the following:

1) Current Ratio

2) Acid Test Ratio

3) Gross Profit Ratio

4) Debtors’ Turnover Ratio

5) Fixed Assets To Net Tangible Worth

6) Turnover To Fixed Assets

Solution:

Current Assets

1) Current Ratio = ---------------------

Current Liabilities

1,22,500

= ----------- = 2.7:1.

45,000

Quick Assets

2) Acid Test Ratio = -------------------

Quick Liabilities

80,000

= ----------- = 1.8:1.

45,000

Gross Profit

3) Gross Profit Ratio = ---------------------- X 100

Sales

1,20,000

= ------------- X 100 = 40%

3,00,000

Net Sales

4) Debtors’ Turnover Ratio = ---------------------

Average Debtors

3,00,000

= ------------- = 15.78 Times.

19,000

No. Of Days In The Year

Collection Period = -----------------------------

Debtors’ Turnover

365

= ----------- = 23 Days

15.78

Fixed Asset To Fixed Assets

5)Net Tangible Worth = ----------------------- X 100

Proprietor’s Fund

1,50,000

= ------------- X 100 = 76%

1,97,500

Net Sales

6) Turnover To Fixed Assets = ------------------

Fixed Assets

3,00,000

= ----------- = 2 Times

1,50,000

Illustration 5: from the following details prepare a statement of proprietary fund with as many details as possible.

1) Stock Velocity 6

2) Capital Turnover Ratio 2

3) Fixed Assets Turnover Ratio 4

4) Gross Profit Turnover Ratio 20%

5) Debtors’ Velocity 2 Months

6) creditors’ velocity 73 days

Gross profit was rs.60,000. Reserves and surplus amount to 20,000. Closing stock was rs.5,000 in excess of opening stock.

Solution:

1. Calculation Of Sales

Gross Profit

Gross Profit Ratio = --------------- X 100 = 20%

Sales

Rs.60,000 20

= --------------- = --------

Sales 100

1

= ---

5

Sales: Rs.3,00,000

2. Calculation Of Sundry Debtors

Debtors

Debtors’ Velocity = ------------ X 12 Months

Sales

Let Debtors Be X

X

2 = ----------- X 12

3,00,000

X 1

------------- = ---

3,00,000 6

X = Rs.50,000

Debtors: Rs.50,000

It Is Assumed That All Sales Are Credit Sales.

3. Calculation Of Stock

Cost Of Goods Sold

Stock Turnover Ratio = --------------------------- = 6

= Average Stock

Cost Of Goods Sold = Sales – Gross Profit

= Rs.3,00,000 – Rs.60,000

= Rs.2,40,000

Rs.2,40,000

------------------ = 6

Average Stock

Rs.2,40,000

Average Stock = --------------- = Rs.40,000

6

Opening Stock + Closing Stock

Average Stock = --------------------------------------

2

Let Opening Stock Be Rs.X.

Then Closing Stock Will Be X + 5,000

X + X + 5,000

---------------- = 40,000

2

2X + 5,000

-------------- = 40,000

2

Cross Multiplying

2X + 5,000 = 80,000

2X = 80,000 – 5,000

= 75,000

X = 37,500

4. Calculation Of Creditors

Total Creditors

Creditors’ Velocity = ------------------------------ X 365

Days Credit Purchases

= 73 Days

Purchase = Cost Of Goods + Closing Stock – Opening Stock

= Rs.2,40,000 + 42,500 – 37,500

= Rs.2,45,000

Let The Creditors Be X

X

-------------- X 365 = 73

2,45,000

132

365 X = 2,45,000 X 73

2,45,000 X 73

X = ----------------

365

Creditors = Rs.49,000

5. Calculation Of Fixed Assets

Costs Of Goods Sold

Fixed Assets Turnover Ratio = ----------------------------- = 4

Fixed Assets

Let Fixed Assets Be X

2,40,000

---------- = 4

X

X = 60,000

Fixed Assets = Rs.60,000

6. Shareholders’ Fund

Cost Of Goods Sold

Capital Turnover Ratio = ----------------------- = 2

Proprietary Fund

2,40,000

--------------------- = 2

Proprietary Fund

Proprietary Fund = Rs.1,20,000

Shareholders’ Fund Includes Share Capital, Profit & Reserve.

Share Capital = Shareholders’ Fund – (Profit + Reserve)

= Rs.1,20,000 – Rs.80,000

= Rs.40,000

7. Calculation Of Bank Balance

Shareholders’ Fund + Current Liabilities = Fixed Assets + Current Assets

Rs.1,20,000 + 49,000 = Rs.60,000 + Current Assets

Current Assets = Rs.1,09,000

Current Assets = Stock + Debtors + Bank

Bank Balance = Current Assets – (Stock +

Debtors)

= Rs.1,09,000– (42,500 + 50,000)

= Rs.1,09,000 – 92,500

= Rs.16,500

Balance Sheet As On …

---------------------------------------------------------------------------------

Liabilities Rs. Assets Rs.

---------------------------------------------------------------------------------

Share Capital 40,000 Fixed Assets 60,000

Reserves & Surplus 20,000 Current Assets:

Profit 60,000 Stock 42,500

Current Liabilities 49,000 Debtors 50,000

Bank 16,500 ---------- ------------

1,69,000 1,69,000

---------------------------------------------------------------------------------

Illustration 6:

The Following Data Is Furnished:

A) Working Capital Rs.45,000

B) Current Ratio 2.5

C) Liquidity Ratio 1.5

D) Proprietary Ratio – (Fixed Assets To Proprietary Funds) 0.75

E) Overdraft Rs.10,000

F) Retained Earnings Rs.30,000

There Are No Long Term Loans And Fictitious Assets.

Find Out:

1) Current Assets

2) Current Liabilities

3) Fixed Assets

4) Quick Assets

5) Quick Liabilities

6) Stock

7) Equity

Solution:

Current Assets

Current Assets 2.5

Current Liability 1.0

---

Working Capital 1.5

If Working Capital Is 1.5, Current Asset Will Be 2.5.

If Working Capital Is Rs.45,000, Current Assets Will Be Rs.75,000

Current Assets = Rs.75,000

Current Liability

Current Liability = Current Assets – Working Capital

= Rs.75,000 – Rs.45,000

= Rs.30,000

Fixed Assets

Shareholders’ Fund+ Current Liabilities = Fixed Assets + Current Assets

Shareholders’ Fund=Fixed Assets + Current Assets – Current Liabilities

= Fix

ed Assets + Rs.75,000 – Rs.30,000

= Fix

ed Assets + Rs.45,000

Let The Shareholders’ Fund Be X, Fixed Assets Will Be ¾ X

X = Rs. ¾ X + Rs.45,000

¼ X = Rs.45,000

X = Rs.1,80,000

¾ X = Rs.1,35,000

Fixed Assets = Rs.1,35,000

Shareholders Funds = Rs.1,35,000 + Rs.45,000

= Rs.1,80,000

Stock

Quick Assets

Liquid Ratio = -------------------

Quick Liabilities

Quick Assets = Current Assets – Stock

Quick Liabilities = Current Liabilities – Bank Overdraft

Let The Value Of Stock Be X.

Quick Assets Rs.75,000 – X

-------------------- = ---------------------

Quick Liabilities 30,000 – 10,000

75,000 - X

= ------------- = 1.5

20,000

Cross Multiplying

75,000 – X = 20,000 X 1.5

75,000 – X = 30,000

X

= 45,000

Stock = Rs.45,000

Quick Assets = Rs.75,000 – Rs.45,000

= Rs.30,000

Quick Liabilities = Rs.20,000

Equity

Shareholders’ Fund = Equity + Retained Earnings

Shareholders’ Fund = Rs.1,80,000 (As Calculated)

Retained Earnings = Rs.30,000 (As Given)

Equity = Rs.1,50,000

Illustration 7:

From the following balance sheet of dinesh limited calculate (i) current ratio (ii) liquid ratio (iii) debt-equity ratio (iv) proprietary ratio, and (v) capital gearing ratio.

Balance Sheet Of Dinesh Limited As On 31-12-2005

---------------------------------------------------------------------------------

Liabilities Rs. Assets Rs.

---------------------------------------------------------------------------------

Equity share capital 10,00,000 goodwill 5,00,000

6% preference capita l 5,00,000 plant & machinery 6,00,000

Reserves 1,00,000 land & buildings 7,00,000

Profit & loss a/c 4,00,000 furniture 1,00,000

Tax provision 1,76,000 stock 6,00,000

Bills payable 1,24,000 bills receivables 30,000

Bank overdraft 20,000 sundry debtors 1,50,000

Sundry creditors 80,000 bank account 2,00,000

12% debentures 5,00,000 short term investment 20,000

------------ ---------

29,00,000 29,00,000

---------------------------------------------------------------------------------

Current Assets

(I) Current = ------------------------

Ratio Current Liabilities

Stock + Bills Receivables + Debtors + Bank + S.T. Investments

= ----------------------------------------------------------------

S.Creditors + Bills Payable + Bank O.D. + Tax Provision

10,00,000

= ------------ = 2.5 : 1.

4,00,000

Interpretation:

The current ratio in the said firm is 2.5:1 against a standard ratio of 2:1. It is a good sign of liquidity. However, the stock is found occupying 60 percent of current assets which may not be easily realisable.

Current Assets – Stocks

(II) Liquid Ratio = --------------------------------

Current Liabilities

Liquid Assets

= ------------------------

Current Liabilities

4,00,000

= ----------

4,00,000

= 1:1.

Interpretation:

The standard for quick ratio is 1:1. The calculated ratio in case of dinesh limited is also 1:1. The above two ratios show the safety in respect of liquidity in the said firm.

Long Term Debt

(III) Debt Equity Ratio = -------------------------------------

Equity Shareholders’ Fund

Debentures

= ---------------------------------------------------------------------------

Equity Capital + Preference Capital + Reserves + Profit & Loss A/C

5,00,000

= -------------------------------------------------------

10,00,000 + 5,00,000 + 1,00,000 + 4,00,000

= 1:4.

Interpretation:

Debt-equity ratio indicates the firm’s long term solvency. It can be observed that the firm’s long term loans are constituting 25 percent to that of the owners’ fund. Although such a low ratio indicates better long term solvency, the less use of debt in capital structure may not enable the firm to gain from the full stream of leverage effects.

Proprietors’ Funds

(IV) Proprietary Ratio = ---------------------------

Total Assets

20,00,000

= ------------ = 20:29

29,00,000

Interpretation:

Out of total assets, seven-tenths are found financed by owners’ funds. In other words a large majority of long term funds are well invested in various long term assets in the firm.

Owners’ Resources

(V) Capital Gearing Ratio = -------------------------------------------

Fixed-Interest Bearing Resources

Equity Share Capital + Reserves + P&L A/C

= -----------------------------------------------

Preference Capital + Debentures

10,00,000 + 1,00,000 + 4,00,000

= --------------------------------------------

5,00,000 + 5,00,000

15,00,000

= --------------- = 1.5:1.

10,00,000

Interpretation:

Keeping rs.15 lakhs of equity funds as security, the firm is found to have mobilised rs.10 lakhs from fixed interest bearing sources. It indicates that the capital structure is low geared.

Illustration 8:

The following are the balance sheet and profit and loss account of sundara products limited as on 31st december 2005.

Profit And Loss Account

To Opening Stock 1,00,000 By Sales 8,50,000

Purchases 5,50,000 Closing Stock 1,50,000

Direct Expenses 15,000

Gross Profit 3,35,000

------------ ------------

10,00,000 10,00,000

------------ ------------

To Admn. Expenses 50,000 By Gross Profit 3,35,000

Office Establishment 1,50,000 Non-Operating

Income 15,000

Financial Expenses 50,000

Non-Operating

Expenses/Losses 50,000

Net Profit 50,000

-----------

-----------

3,50,000 3,50,000

---------------------------------------------------------------------------------

Balance Sheet

Liabilities Rs. Assets Rs.

Equity Share Capital Land & Buildings 1,50,000

(2000 @ 100) 2,00,000 Plant & Machinery 1,00,000

Reserves 1,50,000 Stock In Trade 1,50,000

Current Liabilities 1,50,000 Sundry Debtors 1,00,000

P&L A/C Balance 50,000 Cash & Bank 50,000

----------

----------

5,50,000 5,50,000

---------------------------------------------------------------------------------

Calculate Turnover Ratios.

Solution:

(I) Share Capital To Turnover Ratio

Sales

= ----------------------------------

Total Capital Employed

Sales

= ------------------------------------------------

Equity + Reserve + P & L A/C Balance

8,50,000

= ----------

4,00,000

= 2.13 Times.

Interpretation:

This turnover ratio indicates that the firm has actually converted its share capital into sales for about 2.13 times. This ratio indicates the efficiency in use of capital resources and a high turnover ratio ensures good profitability on operations on an enterprise.

(ii) fixed asset’s turnover ratio

Sales

= ---------------------------

Total fixed assets

Sales

= ------------------------------------

Land + Plant & Machinery

8,50,000

= ------------

2,50,000

= 3.4 times.

Interpretation:

Although fixed assets are not directly involved in the process of generating sales, these are said to back up the production process. A ratio of 3.4 times indicates the efficient utilisation of various fixed assets in this organisation.

(iii) Net working capital turnover:

Sales

= ----------------------------

Net Working Capital

Sales

= --------------------------------------------

Current Assets – Current Liabilities

8,50,000

= -----------------------

3,00,000 – 1,50,000

= 5.67 Times.

Interpretation:

Net working capital indicates the excess of current assets financed by permanent sources of capital. An efficient utilisation of such funds is of prime importance to ensure sufficient profitability along with greater liquidity. A turnover ratio of 5.7 times is really appreciable.

(iv) Average Collection Period:

Credit Sales

Debtor’s Turnover = -----------------------

Average Debtors

Assuming that 80% of the sales of 8,50,000 as credit sales:

6,80,000

= ------------

1,00,000

= 6.8 times

Average collection period

360 Days

= -------------------------

Debtors’ Turnover

360

= -------

6.8

= 53 Days

Interpretation:

Average collection period indicates the time taken by a firm in collecting its debts. The calculated ratio shows that the realisation of cash on credit sales is taking an average period of 53 days. A period of roughly two months indicate that the credit policy is liberal and needs a correction.

(v) Stock Turnover Ratio

Cost Of Goods Sold

= ---------------------------

Average Stock

Sales – Gross Profit

= ------------------------------------------------

(Opening Stock + Closing Stock) + 2

5,15,000

= ----------

1,25,000

= 4.12 times.

Interpretation:

Stock velocity indicates the firm’s efficiency and profitability. The stock turnover ratio shows that on an average inventory balances are cleared once in 3 months. Since there is no standard for this ratio, the period of operating cycle of this firm is to be compared with the industry average for better interpretation.

Illustration 9:

Comment on the performance of arasu limited from the ratios given below:

Industry average Ratios of

Ratios Arasu ltd.

1. Current ratio 2:1 2.5:1

2. Debt-equity ratio 2:1 1:1

3. Stock turnover ratio 9.5 3.5

4. Net profit margin ratio 23.5% 15.1%

Solution:

(i) Current Ratio:

This ratio indicates the liquidity position of a firm. The ability of a firm in meeting its current liabilities could be understood by this ratio. The calculated results show that the liquidity in arasu limited is even greater than industry average, showing the safety. However, excess liquidity locks up the capital in unnecessary current assets.

(ii) Debt-Equity Ratio:

It is an indicator of a firm’s solvency in terms of its ability to repay long term loans in time. The calculated ratio shows better solvency of 1:1 indicating that for every one rupee of debt capital, to repay one rupee of equity base exists in arasu ltd. However, this ratio is not likely to ensure the leverage benefits that a firm gains by using higher dose of debt.

(iii) Stock Turnover Ratio:

Stock velocity is an indicator of a firm’s activeness. It directly influences the profitability of a firm. The calculated ratio for arasu ltd. Is very poor when compared to industry average. This poor ratio indicates the inefficient use of capacities, consequently, the likely low profitability.

(iv) Net Profit Margin Ratio:

Although the firms in a particular industry could sell the product more or less at same price, the net profits differ among firms due to their cost of production, excessive administrative and establishment expenses etc. This picture is found true in case of arasu ltd. A poor profitability of 15.1% compared to an industry average of 23.5% may be due to low stock turnover, inefficiency in management, excess overhead cost and excessive interest burdens.

Tags : Accounting For Managers - Ratio Analysis

Last 30 days 4508 views