Accounting For Managers - Ratio Analysis

Ratios From Shareholders’ Point Of View

Shareholders’ Point Of View

1.

Preference dividend cover: this

ratio expresses net profit after tax as so many times of preference dividend

payable. This is calculated as:

Net Profit After Tax

-------------------------

Preference Dividend

2.

Equity Dividend Cover: this

ratio gives information about net profit available to equity

shareholders. This ratio expresses profit as number of times of equity dividend

payable. This ratio is calculated using the following

formula:

Net Profit After Tax – Preference

Dividend

-------------------------------------------------

Equity Dividend

3. Dividend

Yield On Equity Shares Or Yield Ratio: this ratio interprets dividend

as a percentage of market price per share. It is calculated as:

Dividend Per Share

--------------------------- X 100

Market Price Per Share

4. Price

Earning Ratio: this ratio tells how many times of earnings per share

is the market price of the share of a company. The formula to calculate this

ratio is:

Market Price Per Share

---------------------------

Earnings Per Share

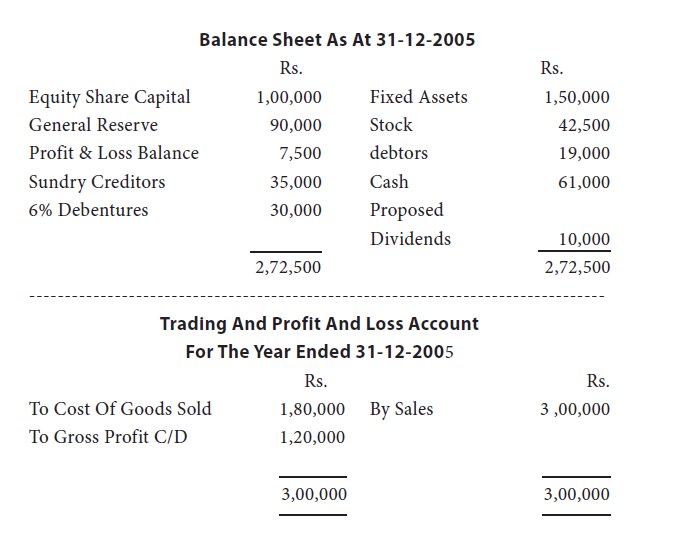

Illustrations