Home | ARTS | Strategic Management

|

Financial Strategy - Finance Marketing, Human Resource, Management Information Systems and logistics

Strategic Management - Functional Strategy

Financial Strategy - Finance Marketing, Human Resource, Management Information Systems and logistics

Posted On :

May types of financial analyses are used in strategic decision making these include ration analysis, break –even analysis and not present value analysis.

Financial Strategy

May types of financial analyses are used in strategic decision making these include ration analysis, break –even analysis and not present value analysis. Financial strategies are needed to

To raise capital with short-term debt, long-term debt, preferred stock, or common stock.

To lease or buy fixed assets.

To determine an appropriate dividend payout ration.

To use LIFO (Last –in, First –out), FIFO (First-in, First – out), or a market-value accounting approach.

To extend the time of accounts receivable.

To establish a certain percentage discount on accounts within a specified period of time.

To determine the amount of cash that should be kept on hand.

1. Ratio Analysis

Ration analysis has been accepted as an effective tool of financial analysis. The systematic use of ratios leads to interpreting financial statements of a business enterprise. Ration is expressed in terms of proportion or percentage relationship between two sets of phenomena. For instance, the proportion (ratio) of gross profit to sale.

Analysis of financial ratios as a tool of strategic analysis may be utilized in two ways: Firstly – an analyst may compare the present ratio with the past and the expected future. For instance, the current ratio i.e. the ratio of current assets to current liabilities – for the present year may be compared with current ratio of the preceding year to ascertain the level of improvement or deterioration.

This trend analysis may be the pace setter or the eye opener for future performance of the organization. Secondly – ratios may trend analysis may be the pace setter or the eye opener for future performance of the organization. Secondly – ratios may also be utilized to compare the performance of the firm with an identical firm in the same industry or the other industry. This comparison will provide the basis of assessing the strength and weaknesses of other competitors in the market.

Ratios may be classified under four broad heads:

Liquidity

Activity

Profitability

Capital structure / Leverage Ratio.

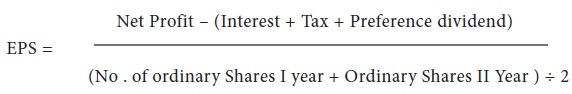

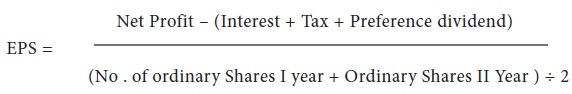

Earnings per Share (EPS)

Another way of computing the profitability of a company from share holder’s view point is the Earnings per share. It measures the profit available to equity holders. Profit available to equity holders are represented by the net profits after taxes and preference divided divided by the number of ordinary shares.

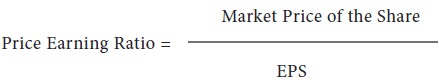

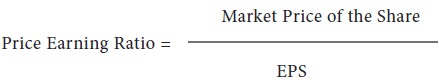

Price Earning Ratio

It may be worked out as follows:

2. Break – Even analysis – Case

May types of financial analyses are used in strategic decision making these include ration analysis, break –even analysis and not present value analysis. Financial strategies are needed to

To raise capital with short-term debt, long-term debt, preferred stock, or common stock.

To lease or buy fixed assets.

To determine an appropriate dividend payout ration.

To use LIFO (Last –in, First –out), FIFO (First-in, First – out), or a market-value accounting approach.

To extend the time of accounts receivable.

To establish a certain percentage discount on accounts within a specified period of time.

To determine the amount of cash that should be kept on hand.

1. Ratio Analysis

Ration analysis has been accepted as an effective tool of financial analysis. The systematic use of ratios leads to interpreting financial statements of a business enterprise. Ration is expressed in terms of proportion or percentage relationship between two sets of phenomena. For instance, the proportion (ratio) of gross profit to sale.

Analysis of financial ratios as a tool of strategic analysis may be utilized in two ways: Firstly – an analyst may compare the present ratio with the past and the expected future. For instance, the current ratio i.e. the ratio of current assets to current liabilities – for the present year may be compared with current ratio of the preceding year to ascertain the level of improvement or deterioration.

This trend analysis may be the pace setter or the eye opener for future performance of the organization. Secondly – ratios may trend analysis may be the pace setter or the eye opener for future performance of the organization. Secondly – ratios may also be utilized to compare the performance of the firm with an identical firm in the same industry or the other industry. This comparison will provide the basis of assessing the strength and weaknesses of other competitors in the market.

Ratios may be classified under four broad heads:

Liquidity

Activity

Profitability

Capital structure / Leverage Ratio.

i. Liquidity Ratios

Liquidity ratios seek to confirm the ability of the firm to fulfil its short term obligations. If the firm has greater liquidity than the commitments due for payment, it means the firm has unutilized surplus which may be invested or used in such a manner that the rate of return is optimal. The firm may also put the funds in the expansion of business or diversification of its activities to increase rate of return on investment.

The ratios which indicate the liquidity of the firm are: (i) Net working capital (current assets – current liabilities) (ii) Current ratio (current assets ÷ current liabilities (iii) Acid Test Ratio/ quick Ratio (iv) Super quick ratios (v) Turnover Ratios.

ii. Acid test ratio / quick ratio

Liquidity ratios seek to confirm the ability of the firm to fulfil its short term obligations. If the firm has greater liquidity than the commitments due for payment, it means the firm has unutilized surplus which may be invested or used in such a manner that the rate of return is optimal. The firm may also put the funds in the expansion of business or diversification of its activities to increase rate of return on investment.

The ratios which indicate the liquidity of the firm are: (i) Net working capital (current assets – current liabilities) (ii) Current ratio (current assets ÷ current liabilities (iii) Acid Test Ratio/ quick Ratio (iv) Super quick ratios (v) Turnover Ratios.

ii. Acid test ratio / quick ratio

= Current assets – (Inventories + Repayments) Current

liabilities

iii. Turnover Ratios /Activity Ratios

Another way to ascertain the liquidity is how quickly a certain current asset could be converted into cash. Ratios measuring its ability is known as turnover ratios. These ratios may be classified under three heads: (1) Total Assets Turnover Ratio (2) Accounts Receivable Turnover Ratio (3) Inventory Turnover Ratio.

Inventory / Turnover Ratio

Inventory / Turnover Ratio may be worked out in the following manner.

Cost of goods sold

(Inventory I year + Inventory II year) ÷ 2

Profitability Ratios

Profit is the end result of all business activities including the use of capital. Profit is an objective index of judging the efficiency of the business enterprise.

Profitability ratios may be of two kinds:

Return on sales (ROS) and

Return on Assets (ROA)

Return on Investment (ROI) is not different from Return on Assets (ROA). In a multi- product organization, a Return on Investment (ROI) is not different from Return on Assets (RoA). In a multi-product organization, a lower Return on Assets indicates a weak product or sub-optimal product or a few strong and more weaker products which lower down ROA or even ROI.

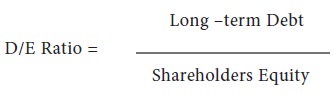

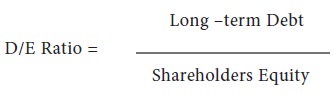

Capital Structure / Leverage Ratios

Financial solvency of the firm may be computed by establishing relationship between borrowed funds and owner’s capital. Debt /Equity ratio seeks to establish this relationship. “This ratio reflects the relative claims of creditors and shareholders against the assets of the firm”.

Another way to ascertain the liquidity is how quickly a certain current asset could be converted into cash. Ratios measuring its ability is known as turnover ratios. These ratios may be classified under three heads: (1) Total Assets Turnover Ratio (2) Accounts Receivable Turnover Ratio (3) Inventory Turnover Ratio.

Inventory / Turnover Ratio

Inventory / Turnover Ratio may be worked out in the following manner.

Cost of goods sold

(Inventory I year + Inventory II year) ÷ 2

Profitability Ratios

Profit is the end result of all business activities including the use of capital. Profit is an objective index of judging the efficiency of the business enterprise.

Profitability ratios may be of two kinds:

Return on sales (ROS) and

Return on Assets (ROA)

Return on Investment (ROI) is not different from Return on Assets (ROA). In a multi- product organization, a Return on Investment (ROI) is not different from Return on Assets (RoA). In a multi-product organization, a lower Return on Assets indicates a weak product or sub-optimal product or a few strong and more weaker products which lower down ROA or even ROI.

Capital Structure / Leverage Ratios

Financial solvency of the firm may be computed by establishing relationship between borrowed funds and owner’s capital. Debt /Equity ratio seeks to establish this relationship. “This ratio reflects the relative claims of creditors and shareholders against the assets of the firm”.

Earnings per Share (EPS)

Another way of computing the profitability of a company from share holder’s view point is the Earnings per share. It measures the profit available to equity holders. Profit available to equity holders are represented by the net profits after taxes and preference divided divided by the number of ordinary shares.

Price Earning Ratio

It may be worked out as follows:

2. Break – Even analysis – Case

3. Net Present Value (NPV) analysis.

This method involves calculation of the present value of estimated

This method involves calculation of the present value of estimated

Tags : Strategic Management - Functional Strategy

Last 30 days 639 views