Home | ARTS | Financial Management

|

Risk and Investment Proposals - Risk Analysis In Capital Budgeting

Financial Management - Capital Budgeting – A Conceptual Framework

Risk and Investment Proposals - Risk Analysis In Capital Budgeting

Posted On :

There are two measures of incorporating risk in the decision – making. They are: 1) The expected value and 2) The standard deviation.

Risk and

Investment Proposals

There are two measures of incorporating risk in the decision – making. They are: 1) The expected value and 2) The standard deviation.

There are two measures of incorporating risk in the decision – making. They are: 1) The expected value and 2) The standard deviation.

The Expected Value:

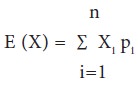

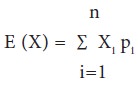

In a situation of certainty, any investment gives only one possible cash flow out in a risky situation several cash flows are possible, each with a given probability. By as certaining the average of all such possible outcomes (X)1 weighed by their respective probabilities (P) we can get a single value for the cash flows. The value is known as expected value E (X), whose generalized expression is

The Standard Deviation:

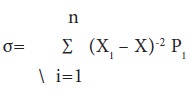

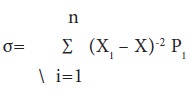

The statistical concept of standard deviation is used as a yard stick that reflects the variations of possible outcomes from its mean value. The standard deviation is calculated as:

Where, σ = standard deviation

X, X and P represent the same.

Note:

The combination of expected value and standard deviation helps in choosing between projects. However, if the two projects have identical expected values, the project with the minimum dispersion in returns i.e., lower standard deviation is preferred as it is less risky project.

Where, σ = standard deviation

X, X and P represent the same.

Note:

The combination of expected value and standard deviation helps in choosing between projects. However, if the two projects have identical expected values, the project with the minimum dispersion in returns i.e., lower standard deviation is preferred as it is less risky project.

Tags : Financial Management - Capital Budgeting – A Conceptual Framework

Last 30 days 828 views