Accounting For Managers - Management Accounting-Cost Volume Profit Analysis

Advantages And Limitations Of Break-Even Analysis

Posted On :

The break-even analysis is a simple tool employed to graphically represent accounting data.

Advantages And Limitations

Of Break-Even Analysis

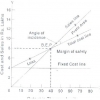

The break-even analysis is a simple tool employed to graphically represent accounting data. The data revealed by financial statements and reports are difficult to understand and interpret. But when the same are presented through break-even charts, it becomes easy to understand them. Break-even charts help in:

1. Determining total cost, variable cost and fixed cost at a given level of activity.

Despite these limitations, break-even analysis has

some practical utility in that it helps management in profit planning.

According to wheldon, `if the limitations are accepted, and the chart is considered

as being an instantaneous photograph of the present position and possible

trends, there are some very important conclusions to be drawn from such a chart’.

The break-even analysis is a simple tool employed to graphically represent accounting data. The data revealed by financial statements and reports are difficult to understand and interpret. But when the same are presented through break-even charts, it becomes easy to understand them. Break-even charts help in:

1. Determining total cost, variable cost and fixed cost at a given level of activity.

2. Finding

out break-even output or sales.

3. Understanding the cost, volume, profit relationship.

4. Making inter-firm comparisons.

5. Forecasting profits.

6. Selecting the best product mix.

7. Enforcing cost control.

On the negative side, break-even analysis suffers from the following limitations:

1.It is very difficult if not impossible to segregate costs into fixed and variable components. Further, fixed costs do not always remain constant. They have a tendency to rise to some extent after production reaches a certain level. Likewise, variable costs do not always vary proportionately. Another false assumption is regarding the sales revenue, which does not always change proportionately. As we all know selling prices are often lowered down with increased production in an attempt to boost up sales revenue. The break even analysis also does not take into account the changes in the stock position (it is assumed, erroneously though, that stock changes do not affect the income) and the conditions of growth and expansion in an organisation.

2.The application of break-even analysis to a multiproduct firm is very difficult. A lot of complicated calculations are involved.

3.The break-even point has only limited importance. At best it would help management to indulge in cost reduction in times of dull business. Normally, it is not the objective of business to break-even, because no business is carried on in order to break-even. Further the term

4.Break-even analysis is a short-run concept, and it has a limited application in the long range planning.

3. Understanding the cost, volume, profit relationship.

4. Making inter-firm comparisons.

5. Forecasting profits.

6. Selecting the best product mix.

7. Enforcing cost control.

On the negative side, break-even analysis suffers from the following limitations:

1.It is very difficult if not impossible to segregate costs into fixed and variable components. Further, fixed costs do not always remain constant. They have a tendency to rise to some extent after production reaches a certain level. Likewise, variable costs do not always vary proportionately. Another false assumption is regarding the sales revenue, which does not always change proportionately. As we all know selling prices are often lowered down with increased production in an attempt to boost up sales revenue. The break even analysis also does not take into account the changes in the stock position (it is assumed, erroneously though, that stock changes do not affect the income) and the conditions of growth and expansion in an organisation.

2.The application of break-even analysis to a multiproduct firm is very difficult. A lot of complicated calculations are involved.

3.The break-even point has only limited importance. At best it would help management to indulge in cost reduction in times of dull business. Normally, it is not the objective of business to break-even, because no business is carried on in order to break-even. Further the term

4.Break-even analysis is a short-run concept, and it has a limited application in the long range planning.

Tags : Accounting For Managers - Management Accounting-Cost Volume Profit Analysis

Last 30 days 1010 views