Home | ARTS | Accounting For Managers

|

Preparation Of Funds Flow Statement-Statement Or Schedule Of Changes In Working Capital & Statement Of Funds Flow

Accounting For Managers - Funds Flow Analysis And Cash Flow Analysis

Preparation Of Funds Flow Statement-Statement Or Schedule Of Changes In Working Capital & Statement Of Funds Flow

Posted On :

Two statements are involved in funds flow analysis. (I) Statement Or Schedule Of Changes In Working Capital (II) Statement Of Funds Flow

Two statements are involved in funds flow analysis.

(I) Statement Or Schedule Of Changes In Working Capital

(II) Statement Of Funds Flow

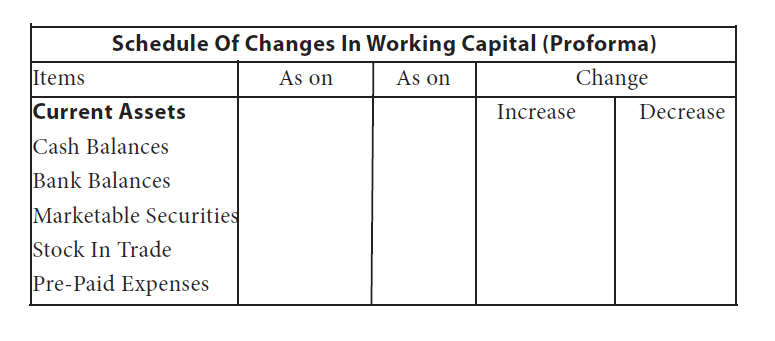

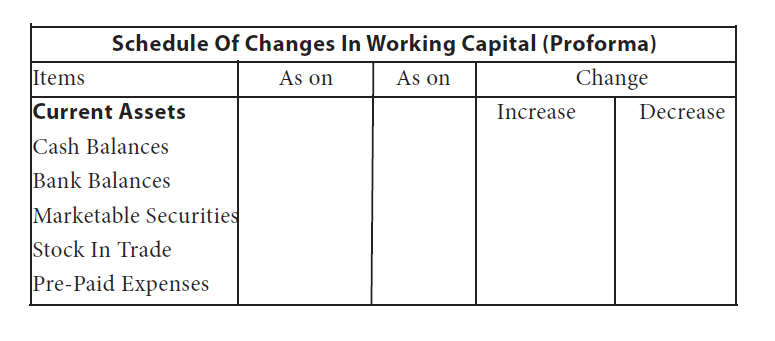

(a) Statement Of Changes In Working Capital:

This statement when prepared shows whether the working capital has increased or decreased during two balance sheet dates. But this does not give the reasons for increase or decrease in working capital. This statement is prepared by comparing the current assets and the current liabilities of two periods. It may be shown in the following form:

Any increase in current assets will result in increase in working capital and any decrease in current assets will result in decrease in working capital. Any increase in current liability will result in decrease in working capital and any decrease in current liability will result in increase in working capital.

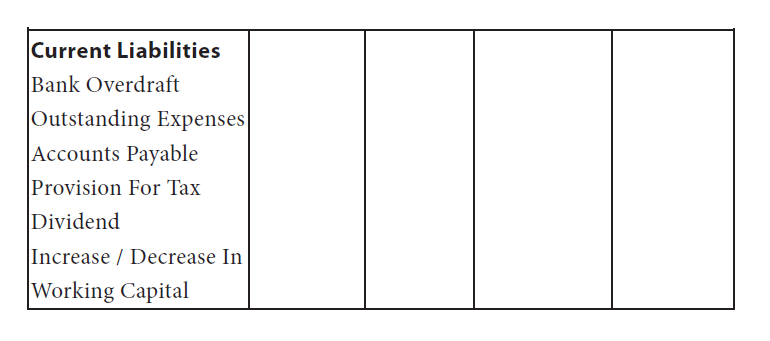

(b) Funds Flow Statement:

Funds flow statement is also called as statement of changes in financial position or statement of sources and applications of funds or where got, where gone statement. The purpose of the funds flow statement is to provide information about the enterprise’s investing and financing activities. The activities that the funds flow statement describes can be classified into two categories:

(i) activities that generate funds, called sources, and

(ii) activities that involve spending of funds, called uses.

When the funds generated are more than funds used, we get an increase in working capital and when funds generated are lesser than the funds used, we get decrease in working capital. The increase or decrease in working capital disclosed by the schedule of changes in working capital should tally with the increase or decrease disclosed by the funds flow statement.

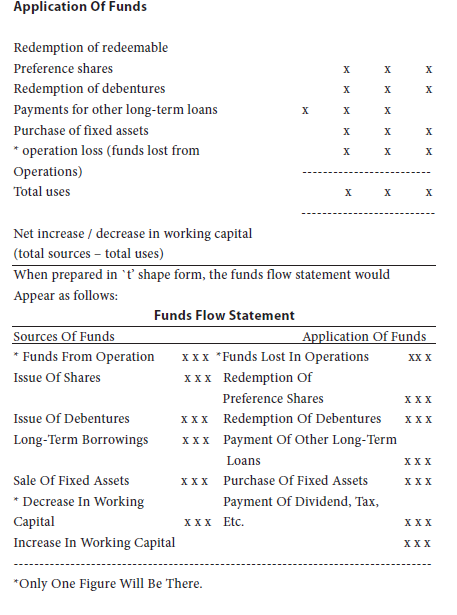

The funds flow statement may be prepared either in the form of a statement or in `t’ shape form. When prepared in the form of statement it would appear as follows:

It may be seen from the proforma that in the funds flow statement preparation, current assets and current liabilities are ignored. Attention is given only to change in fixed assets and fixed liabilities.

In this connection an important point about provision for taxation and proposed dividend is worth mentioning. These two may either be treated as current liability or long-term liability. When treated as current liabilities they will be taken to `schedule of changes in working capital’ and thereafter no adjustment is required anywhere. If they are treated as long-term liabilities there is no place for them in the schedule of changes in working capital. The amount of tax provided and dividend proposed during the current year will be added to net profits to find the funds from operations. The amount of actual tax and dividend paid will be shown as application of funds in the funds flow statement. In this lesson, we have taken them as current liabilities.

Tags : Accounting For Managers - Funds Flow Analysis And Cash Flow Analysis

Last 30 days 1358 views