Financial Management - Finance – An Introduction

Risk – Return Trade Off - Financial Decisions

Posted On :

Further where the company is desirous of mobilizing funds from outside sources, it is required to pay interest at fixed period.

Risk – Return Trade Off

Further where the company is desirous of mobilizing funds from outside sources, it is required to pay interest at fixed period. Hence liquidity is reduced. A successful finance manager has to ensure acceleration of cash receipts (cash inflows in to business) and deceleration of cash (cash outflows) from the firm. Thus forecasting cash flows and managing cash flows are one of the important functions a finance manager that will lead to liquidity. The finance manager is required to enhance his professionalism and intelligence to ensure that return is optimized.

Return = Risk-free rate + Risk premium

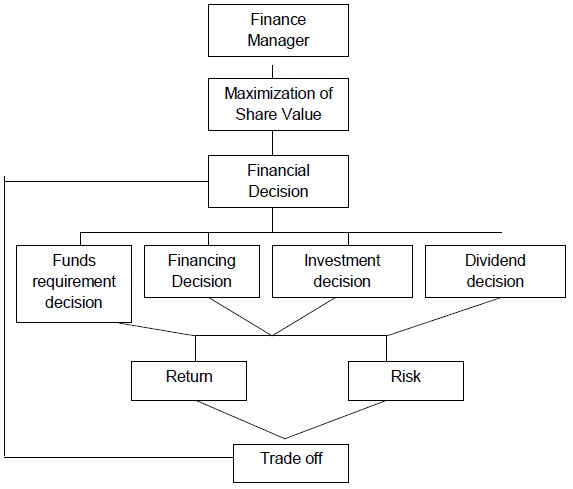

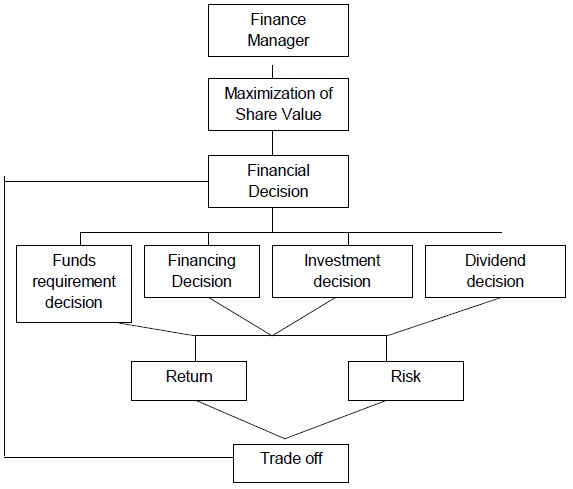

Risk free rate is a compensation for time and risk premium for risk. Higher the risk of an action, higher will be the risk premium leading to higher required return on that action. This levelling of return and risk is known as risk return trade off. At this level, the market value of the company’s shares should be the maximum. The diagram given below spells out the interrelationship between market value, financial decisions and risk-return trade off.

Interrelationship between market value, financial decisions and risk-return trade off

The finance manager tries to achieve the proper balance between, the basic considerations of ‘risk and return’ associated with various financial management decisions to maximise the market, value, of the firm.

It is well known that “higher the return other things being equal, higher the market value; higher the risk, other things being equal, lower

The financial manager is concerned with the optimum utilization of funds and their procurement in a manner that the risk, cost and control considerations are properly balanced in a given situation. Irrespective of nature of decisions, i.e. investment decisions, financing or capital structure decisions / dividend decisions all these decisions are interdependent. All these decisions are inter-related. All are intended to maximize the wealth of the shareholders. An efficient financial manager has to ensure optimal decision by evaluating each of the decision involved in relation to its effect on shareholders wealth.

Further where the company is desirous of mobilizing funds from outside sources, it is required to pay interest at fixed period. Hence liquidity is reduced. A successful finance manager has to ensure acceleration of cash receipts (cash inflows in to business) and deceleration of cash (cash outflows) from the firm. Thus forecasting cash flows and managing cash flows are one of the important functions a finance manager that will lead to liquidity. The finance manager is required to enhance his professionalism and intelligence to ensure that return is optimized.

Risk free rate is a compensation for time and risk premium for risk. Higher the risk of an action, higher will be the risk premium leading to higher required return on that action. This levelling of return and risk is known as risk return trade off. At this level, the market value of the company’s shares should be the maximum. The diagram given below spells out the interrelationship between market value, financial decisions and risk-return trade off.

Interrelationship between market value, financial decisions and risk-return trade off

Value of Firm – Risk Return

The finance manager tries to achieve the proper balance between, the basic considerations of ‘risk and return’ associated with various financial management decisions to maximise the market, value, of the firm.

It is well known that “higher the return other things being equal, higher the market value; higher the risk, other things being equal, lower

Relationship of Financial Decisions

The financial manager is concerned with the optimum utilization of funds and their procurement in a manner that the risk, cost and control considerations are properly balanced in a given situation. Irrespective of nature of decisions, i.e. investment decisions, financing or capital structure decisions / dividend decisions all these decisions are interdependent. All these decisions are inter-related. All are intended to maximize the wealth of the shareholders. An efficient financial manager has to ensure optimal decision by evaluating each of the decision involved in relation to its effect on shareholders wealth.

Tags : Financial Management - Finance – An Introduction

Last 30 days 1240 views