Financial Management - Finance – An Introduction

Wealth Maximisation - Financial Goals

Posted On :

Wealth Maximisation refers to all the efforts put in for maximizing the net present value (i.e. wealth) of any particular course of action which is just the difference between the gross present value of its benefits and the amount of investment required to achieve such benefits.

Wealth Maximisation

Wealth Maximisation refers to all the efforts put in for maximizing the net present value (i.e. wealth) of any particular course of action which is just the difference between the gross present value of its benefits and the amount of investment required to achieve such benefits.

Wealth maximisation principle is also consistent with the objective of ‘maximising the economic welfare of the proprietors of the firm’. This, in turn, calls for an all out bid to maximise the market value of shares of that firm which are held by its owners. As Van Horne aptly remarks, the market price of the shares of a company (firm) serves as a performance index or report card of its progress. It indicates how well management is doing on behalf of its share-holders.

The wealth maximization objective serves the interests of suppliers of loaned capital, employees, management and society. This objective not only serves shareholders interests by increasing the value of holding but also ensures security to lenders also. According to wealth maximization objective, the primary objective of any business is to maximize share holders wealth. It implies that maximizing the net present value of a course of action to shareholders.

According to Solomon, net, present – value or wealth of a course of action is the difference between the present value of its benefits and the present value of its costs. The objective of wealth maximization is

The Necessity of a Valuation Model portend has shown how the attainment of the objective of maximising the market value of the firm’s shares (i.e. wealth maximisation) requires an appropriate Valuation model to assess the value of the shares of the firm in Question. The Financial Manager should realise or at least assume the extent of influence various factors are capable of wielding upon the market price of his company’s shares. If not he may, not be able to maximise the value of such shares.

Financial management is concerned with mobilization of financial resources and their effective utilization towards achieving the organization its goals. Its main objective is to use funds in such a way that the earnings are maximized. Financial management provides a framework for selecting a proper course of action and deciding a viable commercial strategy. A business firm has a number of objectives. Peter Driven has outlined the possible objectives of a firm as follows.

1. Market standing

2. Innovation

3. Productivity

4. Economical use of physical and financial resources

5. Increasing the profitability

6. Improved performance

7. Development of worker’s performance and co-operatives

8. Public responsibility

The wealth maximizing criterion is based on the concept of cash flows generated by the decision rather than according profit which is the basis of the measurement of benefits in the case of profit maximization criterion. Measuring benefits in terms of cash flows avoids the ambiguity associated with accounting profits.

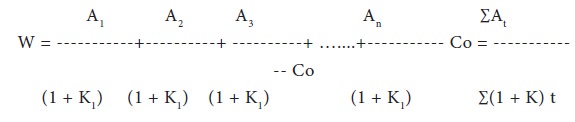

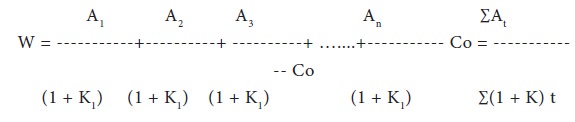

Presently, maximisation of present value (or wealth) of a course of action is considered appropriate operationally flexible goal for financial decision-making in an organisation. The net present value or wealth can be defined more explicitly in the following way:

Where A1 and A2 represent the stream of benefits expected to occur if a course of action is adopted. Co is the cost of that action and K is the appropriate discount rate, and W is the Net present worth or wealth which is the difference between the present worth or wealth of the stream of benefits and the initial cost.

The management of an organisation maximises the present value not only for shareholders but for all including employees, customers, suppliers and community at large. This goal for the maximum present value is generally justified on the following grounds:

i. It is consistent with the object of maximising owners’ economic welfare.

ii. It focuses on the long run picture.

iii. It considers risk.

iv. It recognises the value of regular dividend payments.

v. It takes into account time value of money.

vi. It maintains market price of its shares

vii. It seeks growth is sales and earnings.

Maximizing the shareholders’ economic welfare is equivalent to maximizing the utility of their consumption every time. With their wealth maximized, shareholders can afford their cash flows in such a way as to optimize their consumption. From the shareholders point of view, the wealth created by a company through the actions is reflected in the market value of the company’s shares.

Wealth Maximisation refers to all the efforts put in for maximizing the net present value (i.e. wealth) of any particular course of action which is just the difference between the gross present value of its benefits and the amount of investment required to achieve such benefits.

Wealth maximisation principle is also consistent with the objective of ‘maximising the economic welfare of the proprietors of the firm’. This, in turn, calls for an all out bid to maximise the market value of shares of that firm which are held by its owners. As Van Horne aptly remarks, the market price of the shares of a company (firm) serves as a performance index or report card of its progress. It indicates how well management is doing on behalf of its share-holders.

The wealth maximization objective serves the interests of suppliers of loaned capital, employees, management and society. This objective not only serves shareholders interests by increasing the value of holding but also ensures security to lenders also. According to wealth maximization objective, the primary objective of any business is to maximize share holders wealth. It implies that maximizing the net present value of a course of action to shareholders.

According to Solomon, net, present – value or wealth of a course of action is the difference between the present value of its benefits and the present value of its costs. The objective of wealth maximization is

The Necessity of a Valuation Model portend has shown how the attainment of the objective of maximising the market value of the firm’s shares (i.e. wealth maximisation) requires an appropriate Valuation model to assess the value of the shares of the firm in Question. The Financial Manager should realise or at least assume the extent of influence various factors are capable of wielding upon the market price of his company’s shares. If not he may, not be able to maximise the value of such shares.

Financial management is concerned with mobilization of financial resources and their effective utilization towards achieving the organization its goals. Its main objective is to use funds in such a way that the earnings are maximized. Financial management provides a framework for selecting a proper course of action and deciding a viable commercial strategy. A business firm has a number of objectives. Peter Driven has outlined the possible objectives of a firm as follows.

1. Market standing

2. Innovation

3. Productivity

4. Economical use of physical and financial resources

5. Increasing the profitability

6. Improved performance

7. Development of worker’s performance and co-operatives

8. Public responsibility

The wealth maximizing criterion is based on the concept of cash flows generated by the decision rather than according profit which is the basis of the measurement of benefits in the case of profit maximization criterion. Measuring benefits in terms of cash flows avoids the ambiguity associated with accounting profits.

Presently, maximisation of present value (or wealth) of a course of action is considered appropriate operationally flexible goal for financial decision-making in an organisation. The net present value or wealth can be defined more explicitly in the following way:

Where A1 and A2 represent the stream of benefits expected to occur if a course of action is adopted. Co is the cost of that action and K is the appropriate discount rate, and W is the Net present worth or wealth which is the difference between the present worth or wealth of the stream of benefits and the initial cost.

The management of an organisation maximises the present value not only for shareholders but for all including employees, customers, suppliers and community at large. This goal for the maximum present value is generally justified on the following grounds:

i. It is consistent with the object of maximising owners’ economic welfare.

ii. It focuses on the long run picture.

iii. It considers risk.

iv. It recognises the value of regular dividend payments.

v. It takes into account time value of money.

vi. It maintains market price of its shares

vii. It seeks growth is sales and earnings.

Maximizing the shareholders’ economic welfare is equivalent to maximizing the utility of their consumption every time. With their wealth maximized, shareholders can afford their cash flows in such a way as to optimize their consumption. From the shareholders point of view, the wealth created by a company through the actions is reflected in the market value of the company’s shares.

Tags : Financial Management - Finance – An Introduction

Last 30 days 1150 views