Home | ARTS | Financial Management

|

Profit Maximisation versus Shareholder Wealth Maximization - Financial Goals

Financial Management - Finance – An Introduction

Profit Maximisation versus Shareholder Wealth Maximization - Financial Goals

Posted On :

Profit maximization is basically a single-period or, at the most, a short-term goal.

Profit

Maximisation versus Shareholder Wealth Maximization

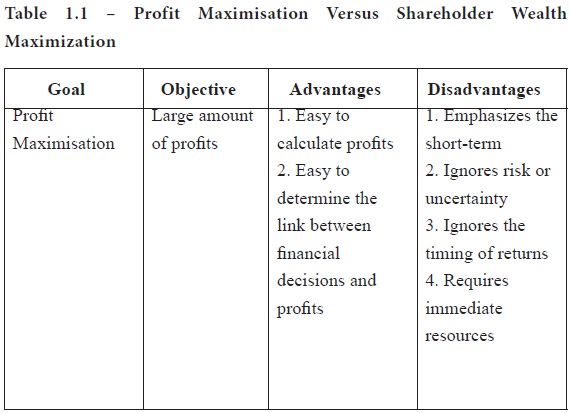

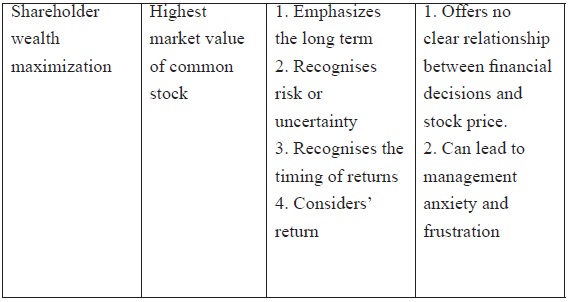

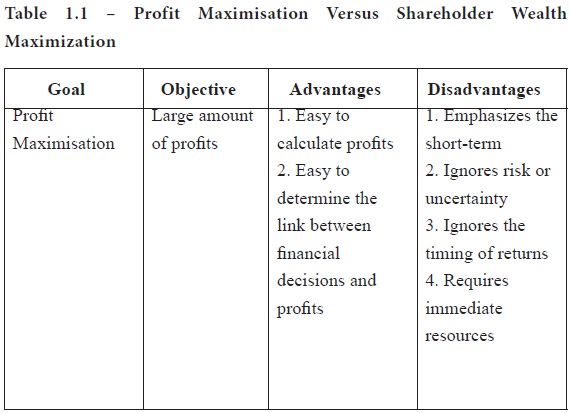

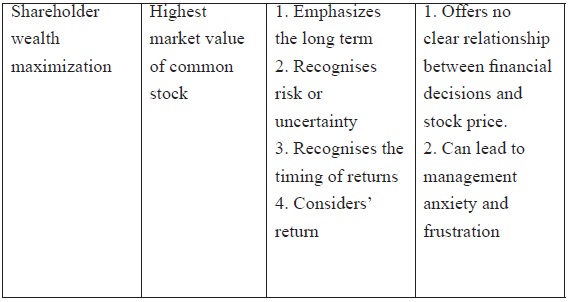

Profit maximization is basically a single-period or, at the most, a short-term goal. It is usually interpreted to mean the maximization of profits within a given period of time. A firm may maximize its short-term profits at the expense of its long-term profitability and still realize this goal. In contrast, shareholder wealth maximization is a long-term goal shareholders are interested in future as well as present profits. Wealth maximization is generally preferred because it considers (1) wealth for the long term, (2) risk or uncertainty. (3) the timing of returns, and (4) the “shareholders’ return. The following table provides a summary of the advantages and disadvantages of these two often conflicting goals

Profit maximization is basically a single-period or, at the most, a short-term goal. It is usually interpreted to mean the maximization of profits within a given period of time. A firm may maximize its short-term profits at the expense of its long-term profitability and still realize this goal. In contrast, shareholder wealth maximization is a long-term goal shareholders are interested in future as well as present profits. Wealth maximization is generally preferred because it considers (1) wealth for the long term, (2) risk or uncertainty. (3) the timing of returns, and (4) the “shareholders’ return. The following table provides a summary of the advantages and disadvantages of these two often conflicting goals

Tags : Financial Management - Finance – An Introduction

Last 30 days 1279 views