MARKETING MANAGEMENT - Pricing Decisions

Factors affecting price decisions - Pricing Decisions

Posted On :

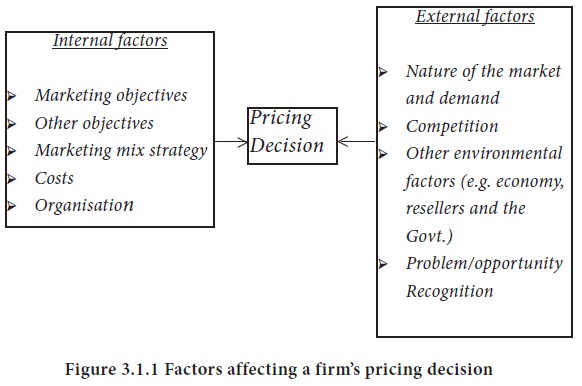

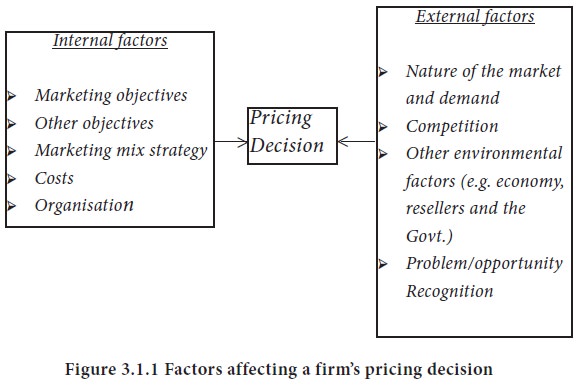

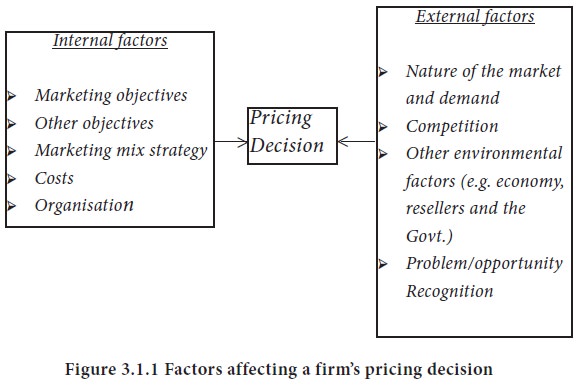

There are a number of factors which influence the pricing decisions of marketers. While some of these are external or environmental factors (such as competition, demand conditions and so on), others are internal factors (like marketing objectives, cost conditions and so on).

Factors affecting price decisions:

There are a number of factors which influence the pricing decisions of marketers. While some of these are external or environmental factors (such as competition, demand conditions and so on), others are internal factors (like marketing objectives, cost conditions and so on).

Figure 3.1.1 represents these factors. The important factors affecting the pricing decision are the following.

The internal factors, as the term implies, are mostly internal to the organization and therefore, largely controllable by the organization. They also have a direct bearing on the firm’s pricing decision. The following are the important internal factors that must considered in pricing a firm’s product/service.

ՖՖ Marketing objectives – Before setting price, the firm must decide on its strategy for the product. This reiterates the idea that the corporate strategy must precede the marketing strategy and then marketing strategy must precede the pricing strategy. If the firm has selected its target market and positioning carefully, then its marketing-mix strategy (i.e. the 4 Ps) will be fairly straightforward.

For example

If the Coimbatore-based Paramount Airways decide to target the corporate/business travelers with its single-class airplanes, this suggests charging a high price. Whereas, a no-frills, low cost carrier would charge a low price, as dictated by its targeting and positioning.

Thus pricing strategy is largely determined by past decisions on marketing strategy. At the same time, the firm may seek additional objectives. The clearer a firm is about its marketing objectives, the easier it is to set price. Some of the common objectives include survival, current profit maximization, market-share leadership and product-quality leadership.

Sometimes a firm might set prices so low as to prevent competition from entering the market as they might lead the competition to regard the market as less attractive. Non-profit organizations may adopt a number of other pricing objectives such as full cost recovery, partial cost recovery or set a social price geared to the distributed income situations of different clients.

Price is only one of the marketing-mix elements that a firm uses to achieve its marketing objectives. Therefore, logically pricing decisions must be coordinated with product design, distribution and promotion decisions to form a consistent and effective marketing program. Decisions made for other marketing-mix elements may affect pricing decisions.

For instance, the decision to position the product on quality plank will imply that the seller must charge a higher price to cover higher costs and/or to match the price-quality perception in the mind of the customers. It is common for marketers to design a price position wherein a target cost is set, then met and the target price is set. However some marketers deemphasize price and use other marketing-mix elements to create non-price positions.

The marketer must consider the total marketing mix when setting prices. If the product is positioned on non-price factors, then decisions about quality, promotion and distribution will strongly affect price. If price is a crucial positioning factor, then price will strongly affect decisions made about the others marketing-mix elements. In most cases, the company will consider all of the marketing-mix decisions together when developing the marketing program.

Though this topic was dealt with earlier in this lesson, some finer aspects related to costs are described here. Costs set the floor for the price that the firm can charge for its product. A firm’s costs may be an important element in its pricing strategy. The firm wants to charge a price that both covers all its costs for producing, distributing and selling the product and delivers a fair rate of return for its effort and risk. The types of costs were explained earlier.

To price wisely, managers need to know how costs vary with different levels of production. The concept of economies of scale comes into play here. Also, costs vary as a function of production experience. There is a drop in the average cost with accumulated production experience and this is attributed to the experience curve or the learning curve.

Consider the semiconductor industry as an example. It has a strong experience curve effect. As a given chip is produced, manufacturing speeds go up, defect rates drop and costs plummet. These effects are seen dramatically in the PC market, where computing power increases and costs drop every year.

Management must decide who within the organization should set prices. Firms handle pricing in a variety of ways. In small firms, prices are often set by top management rather than by the marketing or sales departments. In large firms, pricing typically is handled by product line managers. In industrial markets, salespeople may be allowed to negotiate with customers within certain price ranges.

Even so, top management sets the pricing objectives and policies, and it often approves the prices proposed by lower-level management or salespeople. In industries where pricing is a key factor, companies will often have a pricing department to set the best prices or help others in setting them. Others who have an influence on pricing decisions include sales managers, production managers, finance managers and accountants.

The external factors, as the term implies, are external to the organization and therefore, treated as uncontrollable by the organization. They have an indirect, but definite bearing on the firm’s pricing decision. The following are the important external factors that must considered in pricing a firm’s product/service.

While costs set the lower limit of prices, the market and demand set the upper limit. Buyers balance the price of a product or service against the benefits of owning it. Therefore, before setting prices, the marketer must understand the relationship between price and demand for his product. Price-demand relationship varies for different types of markets and how buyer perceptions of price affect the pricing decision. Economists recognize four types of markets, viz. pure competition, monopolistic competition, oligopolistic competition and pure monopoly. Each presents a different pricing challenge and pricing freedom.

Under pure competition, the market consists of many buyers and sellers trading in a uniform commodity. A seller cannot charge more than the going price because buyers can obtain as much as they need at the going price. Nor would sellers charge less than the market price because they can sell all they want at this price. Example: The prices of vegetables are subject to day-to-day variations because of supply and demand factors.

Under monopolistic competition, the market consists of many buyers and sellers who trade over a range of prices rather than a single market price. A range of prices occurs because sellers can differentiate their product/service offering to buyers. Buyers see differences in sellers’ offerings and will pay different prices for them.

Toilet soaps, shampoos, hair oils, and fairness screams are in this competition. One would find the different brands in popular category in one price range and premium category in another range.

Under oligopolistic competition, the market consists of a few sellers who are highly sensitive to each other’s pricing and marketing strategies. The product may be uniform (as a commodity) or non-uniform. Each seller is alert to competitors’ strategies and moves. An oligopolist is never sure that it will gain anything permanent through a price cut or a price hike. In many a case they come to an agreement in price fixation.

Cement manufacturers offer a particular grade cement at almost similar prices because they have a common understanding to maintain prices.

In a pure monopoly, the market consists of one seller. The seller may be a government monopoly (the Indian Postal service), a private regulated monopoly (a power company) or a private non-regulated monopoly (e.g. Sify, when it introduced Virtual Private Networks for corporate users). Pricing is handled differently in each case.

A government monopoly can set the price below cost to make the product/service affordable, or set price to recover costs or set a high price to slow down consumption (an instance of demarketing). In a regulated monopoly, the government permits the firm to set rates that will yield a fair return. Non-regulated monopolies are free to price at what the market will bear. However, they will be careful not to attract competition nor invite government regulation.

Being government monopolies, Indian Railways and Indian Post and Telegraph fix the tariff keeping in mind the costs and affordability of consumers.

The price-demand relationship must also be studied before taking the price decision. Each price the firm might charge will lead to a different level of demand. The relation between the price charged and the resulting demand level is described as the Demand curve.

In the normal case, demand and price and inversely related. For ‘prestige’ goods, raising the price may result in more sales. In measuring

For example, buyers are less price sensitive when the product they are buying in unique or when it is high in quality, prestige or exclusiveness. They are also less price sensitive when substitute products are hard to find or when they cannot easily compare the quality of substitute products. Buyers are less price sensitive when the total expenditure for a product is low relative to their income or when the cost is shared by another party.

Another external factor affecting the company’s pricing decisions is competitors’ costs and prices and possible competitor reactions to the company’s own pricing moves. For so-called commodities (i.e. virtually undifferentiated products), all competitors generally charge identical prices. If one goes above the market price, sales will drop off sharply; if one goes below, all others are likely to follow or risk significant reductions in market share. How much any individual firm is constrained by competitors’ prices, therefore, depends largely on how differentiated its product is.

A product that is set apart from other market offerings by its functional design, appearance, brand image and the supplier’s reputation for service and availability in ways that have value to customers can command a price premium. There are circumstances, however, in which firms will price over competitive levels even though the price differences are not really justified by superior product quality and service. A company may consciously elect, for example, not to meet competitive prices in a strategy of ‘milking’ the business, that is, yielding market share and gradually withdrawing from the market.

It may continue to sell profitably for some time to its loyal customers, in the mean time gradually cutting back on selling and promotional expenses until it eventually phases out of the market. Some companies may choose not to price competitively because to do so would

In the long run, the smaller competitor encroaches increasingly on the market positions of its major competitors until it becomes, itself, a major factor. Under shortage conditions, some firms may price opportunistically above prevailing market levels, knowing that demand far exceeds available supply and that some buyers will pay the high price. Finally, some firms may unknowingly be underpriced by competitors on some of their products.

These products may be part of a broad line and the reporting system may not allow for monitoring the sales-profit performance of each item on the list. Thus the company may be losing sales and market position because of price and never realize, until too late, that the business has gone to more aggressive competitors. Generally, pricing strategies must inevitably be shaped with regard for present and future competition.

In this respect, there is significant pricing interdependency among firms in an industry with each being heavily influenced by others’ strategies and tactics. Some firms follow price trends; others, the larger ones, seek to lead them. Accordingly, in contemplating price changes, the marketing manager will often seek to anticipate competitive responses.

When setting prices, the firm also must consider other factors in its external environment. Economic conditions can have a strong impact on the firm’s pricing strategies. Economic factors such as inflation, boom or recession, and interest rates affect pricing decisions because they affect both the costs of producing a product and consumer perceptions of the product’s price and value.

The firm also must consider what impact its prices will have on other parties in its environment. How will resellers react to various prices? The firm should set prices that give resellers a fair margin, encourage their support, and help them to sell the product effectively. The government is another important external influence on pricing decisions. In regulated industries such as utilities, transport and so on, the government has the authority to approve or reject price changes. Finally, social concerns may have to be taken into account. In setting prices, a firm’s short-term sales, market share and profit goals may have to be tempered by broader societal considerations.

There are a number of factors which influence the pricing decisions of marketers. While some of these are external or environmental factors (such as competition, demand conditions and so on), others are internal factors (like marketing objectives, cost conditions and so on).

Figure 3.1.1 represents these factors. The important factors affecting the pricing decision are the following.

Internal factors

The internal factors, as the term implies, are mostly internal to the organization and therefore, largely controllable by the organization. They also have a direct bearing on the firm’s pricing decision. The following are the important internal factors that must considered in pricing a firm’s product/service.

ՖՖ Marketing objectives – Before setting price, the firm must decide on its strategy for the product. This reiterates the idea that the corporate strategy must precede the marketing strategy and then marketing strategy must precede the pricing strategy. If the firm has selected its target market and positioning carefully, then its marketing-mix strategy (i.e. the 4 Ps) will be fairly straightforward.

For example

If the Coimbatore-based Paramount Airways decide to target the corporate/business travelers with its single-class airplanes, this suggests charging a high price. Whereas, a no-frills, low cost carrier would charge a low price, as dictated by its targeting and positioning.

Thus pricing strategy is largely determined by past decisions on marketing strategy. At the same time, the firm may seek additional objectives. The clearer a firm is about its marketing objectives, the easier it is to set price. Some of the common objectives include survival, current profit maximization, market-share leadership and product-quality leadership.

Other objectives

Sometimes a firm might set prices so low as to prevent competition from entering the market as they might lead the competition to regard the market as less attractive. Non-profit organizations may adopt a number of other pricing objectives such as full cost recovery, partial cost recovery or set a social price geared to the distributed income situations of different clients.

Marketing-mix strategy

Price is only one of the marketing-mix elements that a firm uses to achieve its marketing objectives. Therefore, logically pricing decisions must be coordinated with product design, distribution and promotion decisions to form a consistent and effective marketing program. Decisions made for other marketing-mix elements may affect pricing decisions.

For instance, the decision to position the product on quality plank will imply that the seller must charge a higher price to cover higher costs and/or to match the price-quality perception in the mind of the customers. It is common for marketers to design a price position wherein a target cost is set, then met and the target price is set. However some marketers deemphasize price and use other marketing-mix elements to create non-price positions.

The marketer must consider the total marketing mix when setting prices. If the product is positioned on non-price factors, then decisions about quality, promotion and distribution will strongly affect price. If price is a crucial positioning factor, then price will strongly affect decisions made about the others marketing-mix elements. In most cases, the company will consider all of the marketing-mix decisions together when developing the marketing program.

Costs

Though this topic was dealt with earlier in this lesson, some finer aspects related to costs are described here. Costs set the floor for the price that the firm can charge for its product. A firm’s costs may be an important element in its pricing strategy. The firm wants to charge a price that both covers all its costs for producing, distributing and selling the product and delivers a fair rate of return for its effort and risk. The types of costs were explained earlier.

To price wisely, managers need to know how costs vary with different levels of production. The concept of economies of scale comes into play here. Also, costs vary as a function of production experience. There is a drop in the average cost with accumulated production experience and this is attributed to the experience curve or the learning curve.

Consider the semiconductor industry as an example. It has a strong experience curve effect. As a given chip is produced, manufacturing speeds go up, defect rates drop and costs plummet. These effects are seen dramatically in the PC market, where computing power increases and costs drop every year.

Organisation for pricing

Management must decide who within the organization should set prices. Firms handle pricing in a variety of ways. In small firms, prices are often set by top management rather than by the marketing or sales departments. In large firms, pricing typically is handled by product line managers. In industrial markets, salespeople may be allowed to negotiate with customers within certain price ranges.

Even so, top management sets the pricing objectives and policies, and it often approves the prices proposed by lower-level management or salespeople. In industries where pricing is a key factor, companies will often have a pricing department to set the best prices or help others in setting them. Others who have an influence on pricing decisions include sales managers, production managers, finance managers and accountants.

External factors

The external factors, as the term implies, are external to the organization and therefore, treated as uncontrollable by the organization. They have an indirect, but definite bearing on the firm’s pricing decision. The following are the important external factors that must considered in pricing a firm’s product/service.

Nature of the market and demand

While costs set the lower limit of prices, the market and demand set the upper limit. Buyers balance the price of a product or service against the benefits of owning it. Therefore, before setting prices, the marketer must understand the relationship between price and demand for his product. Price-demand relationship varies for different types of markets and how buyer perceptions of price affect the pricing decision. Economists recognize four types of markets, viz. pure competition, monopolistic competition, oligopolistic competition and pure monopoly. Each presents a different pricing challenge and pricing freedom.

Under pure competition, the market consists of many buyers and sellers trading in a uniform commodity. A seller cannot charge more than the going price because buyers can obtain as much as they need at the going price. Nor would sellers charge less than the market price because they can sell all they want at this price. Example: The prices of vegetables are subject to day-to-day variations because of supply and demand factors.

Under monopolistic competition, the market consists of many buyers and sellers who trade over a range of prices rather than a single market price. A range of prices occurs because sellers can differentiate their product/service offering to buyers. Buyers see differences in sellers’ offerings and will pay different prices for them.

Toilet soaps, shampoos, hair oils, and fairness screams are in this competition. One would find the different brands in popular category in one price range and premium category in another range.

Under oligopolistic competition, the market consists of a few sellers who are highly sensitive to each other’s pricing and marketing strategies. The product may be uniform (as a commodity) or non-uniform. Each seller is alert to competitors’ strategies and moves. An oligopolist is never sure that it will gain anything permanent through a price cut or a price hike. In many a case they come to an agreement in price fixation.

Cement manufacturers offer a particular grade cement at almost similar prices because they have a common understanding to maintain prices.

In a pure monopoly, the market consists of one seller. The seller may be a government monopoly (the Indian Postal service), a private regulated monopoly (a power company) or a private non-regulated monopoly (e.g. Sify, when it introduced Virtual Private Networks for corporate users). Pricing is handled differently in each case.

A government monopoly can set the price below cost to make the product/service affordable, or set price to recover costs or set a high price to slow down consumption (an instance of demarketing). In a regulated monopoly, the government permits the firm to set rates that will yield a fair return. Non-regulated monopolies are free to price at what the market will bear. However, they will be careful not to attract competition nor invite government regulation.

Being government monopolies, Indian Railways and Indian Post and Telegraph fix the tariff keeping in mind the costs and affordability of consumers.

The price-demand relationship must also be studied before taking the price decision. Each price the firm might charge will lead to a different level of demand. The relation between the price charged and the resulting demand level is described as the Demand curve.

In the normal case, demand and price and inversely related. For ‘prestige’ goods, raising the price may result in more sales. In measuring

For example, buyers are less price sensitive when the product they are buying in unique or when it is high in quality, prestige or exclusiveness. They are also less price sensitive when substitute products are hard to find or when they cannot easily compare the quality of substitute products. Buyers are less price sensitive when the total expenditure for a product is low relative to their income or when the cost is shared by another party.

Competition

Another external factor affecting the company’s pricing decisions is competitors’ costs and prices and possible competitor reactions to the company’s own pricing moves. For so-called commodities (i.e. virtually undifferentiated products), all competitors generally charge identical prices. If one goes above the market price, sales will drop off sharply; if one goes below, all others are likely to follow or risk significant reductions in market share. How much any individual firm is constrained by competitors’ prices, therefore, depends largely on how differentiated its product is.

A product that is set apart from other market offerings by its functional design, appearance, brand image and the supplier’s reputation for service and availability in ways that have value to customers can command a price premium. There are circumstances, however, in which firms will price over competitive levels even though the price differences are not really justified by superior product quality and service. A company may consciously elect, for example, not to meet competitive prices in a strategy of ‘milking’ the business, that is, yielding market share and gradually withdrawing from the market.

It may continue to sell profitably for some time to its loyal customers, in the mean time gradually cutting back on selling and promotional expenses until it eventually phases out of the market. Some companies may choose not to price competitively because to do so would

In the long run, the smaller competitor encroaches increasingly on the market positions of its major competitors until it becomes, itself, a major factor. Under shortage conditions, some firms may price opportunistically above prevailing market levels, knowing that demand far exceeds available supply and that some buyers will pay the high price. Finally, some firms may unknowingly be underpriced by competitors on some of their products.

These products may be part of a broad line and the reporting system may not allow for monitoring the sales-profit performance of each item on the list. Thus the company may be losing sales and market position because of price and never realize, until too late, that the business has gone to more aggressive competitors. Generally, pricing strategies must inevitably be shaped with regard for present and future competition.

In this respect, there is significant pricing interdependency among firms in an industry with each being heavily influenced by others’ strategies and tactics. Some firms follow price trends; others, the larger ones, seek to lead them. Accordingly, in contemplating price changes, the marketing manager will often seek to anticipate competitive responses.

Other environmental factors

When setting prices, the firm also must consider other factors in its external environment. Economic conditions can have a strong impact on the firm’s pricing strategies. Economic factors such as inflation, boom or recession, and interest rates affect pricing decisions because they affect both the costs of producing a product and consumer perceptions of the product’s price and value.

The firm also must consider what impact its prices will have on other parties in its environment. How will resellers react to various prices? The firm should set prices that give resellers a fair margin, encourage their support, and help them to sell the product effectively. The government is another important external influence on pricing decisions. In regulated industries such as utilities, transport and so on, the government has the authority to approve or reject price changes. Finally, social concerns may have to be taken into account. In setting prices, a firm’s short-term sales, market share and profit goals may have to be tempered by broader societal considerations.

Tags : MARKETING MANAGEMENT - Pricing Decisions

Last 30 days 2941 views