Financial Management - Finance – An Introduction

Organization of the Finance Functions

Posted On :

Today, finance function has obtained the status of a science and an art.

Organization of the Finance

Functions

Today, finance function has obtained the status of a science and an art. As finance function has far reaching significance in overall management process, structural organization for further function becomes an outcome of an important organization problem. The ultimate responsibility of carrying out the finance function lies with the top management. However, organization of finance function differs from company to company depending on their respective requirements. In many organizations one can note different layers among the finance executives such as Assistant Manager (Finance), Deputy Manager (Finance) and General Manager (Finance). The designations given to the executives are different. They are

Chief Finance Officer (CFO)

Vice-President (Finance)

Financial Controller

General Manager (Finance)

Finance Officers

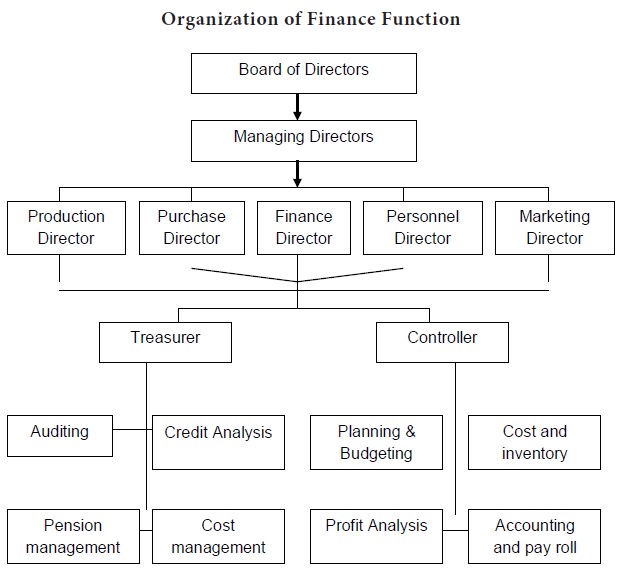

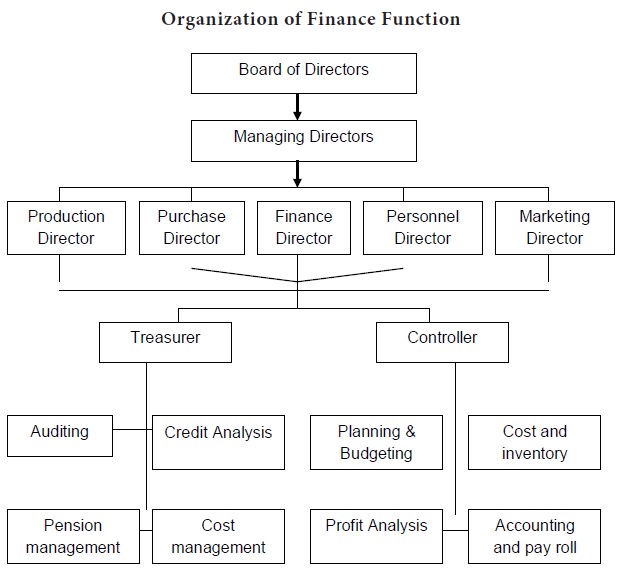

Finance, being an important portfolio, the finance functions is entrusted to top management. The Board of Directors, who are at the helm of affairs, normally constitutes a ‘Finance Committee’ to review and formulate financial policies. Two more officers, namely ‘treasurer’ and ‘controller’ – may be appointed under the direct supervision of CFO to assist him/her. In larger companies with modern management, there may be Vice-President or Director of finance, usually with both controller and treasurer. The organization of finance function is portrayed below:

It is evident from the above that Board of Directors is the supreme body under whose supervision and control Managing Director, Production Director, Personnel Director, Financial Director, Marketing Director perform their respective duties and functions. Further while auditing credit management, retirement benefits and cost control banking, insurance, investment function under treasurer, planning and budgeting, inventory management, tax administration, performance evaluation and accounting functions are under the supervision of controller.

The terms ‘controller’ and ‘treasurer’ are in fact used in USA. This pattern is not popular in Indian corporate sector. Practically, the controller / financial controller in India carried out the functions of a Chief Accountant or Finance Officer of an organization. Financial controller who has been a person of executive rank does not control the finance, but monitors whether funds so augmented are properly utilized. The function of the treasurer of an organization is to raise funds and manage funds. The treasures functions include forecasting the

Today, finance function has obtained the status of a science and an art. As finance function has far reaching significance in overall management process, structural organization for further function becomes an outcome of an important organization problem. The ultimate responsibility of carrying out the finance function lies with the top management. However, organization of finance function differs from company to company depending on their respective requirements. In many organizations one can note different layers among the finance executives such as Assistant Manager (Finance), Deputy Manager (Finance) and General Manager (Finance). The designations given to the executives are different. They are

Chief Finance Officer (CFO)

Vice-President (Finance)

Financial Controller

General Manager (Finance)

Finance Officers

Finance, being an important portfolio, the finance functions is entrusted to top management. The Board of Directors, who are at the helm of affairs, normally constitutes a ‘Finance Committee’ to review and formulate financial policies. Two more officers, namely ‘treasurer’ and ‘controller’ – may be appointed under the direct supervision of CFO to assist him/her. In larger companies with modern management, there may be Vice-President or Director of finance, usually with both controller and treasurer. The organization of finance function is portrayed below:

It is evident from the above that Board of Directors is the supreme body under whose supervision and control Managing Director, Production Director, Personnel Director, Financial Director, Marketing Director perform their respective duties and functions. Further while auditing credit management, retirement benefits and cost control banking, insurance, investment function under treasurer, planning and budgeting, inventory management, tax administration, performance evaluation and accounting functions are under the supervision of controller.

Meaning of Controller and Treasurer

The terms ‘controller’ and ‘treasurer’ are in fact used in USA. This pattern is not popular in Indian corporate sector. Practically, the controller / financial controller in India carried out the functions of a Chief Accountant or Finance Officer of an organization. Financial controller who has been a person of executive rank does not control the finance, but monitors whether funds so augmented are properly utilized. The function of the treasurer of an organization is to raise funds and manage funds. The treasures functions include forecasting the

Tags : Financial Management - Finance – An Introduction

Last 30 days 16633 views