Home | ARTS | Financial Management

|

Liquidity vs Profitability - Working Capital Management Dimension Of Working Capital Management

Financial Management - WORKING CAPITAL MANAGEMENT

Liquidity vs Profitability - Working Capital Management Dimension Of Working Capital Management

Posted On :

An important aspect of a working capital policy is to maintain and provide sufficient liquidity to the firm.

Dimension

1: Liquidity vs Profitability

An important aspect of a working capital policy is to maintain and provide sufficient liquidity to the firm. Like most corporate financing decisions, the decision on how much working capital should be maintained involves a trade-off. Having a large net working capital may reduce the liquidity-risk faced by the firm, but it can have a negative

The risk-return trade-off involved in managing the firm’s working capital is a trade-off between the firm’s liquidity and its profitability. By maintaining a large investment in current assets like cash, inventory etc., the firm reduces the chance of (1) production stoppages and the loss from sales due to inventory shortage and (2) the inability to pay the creditors on time. However, as the firm increases its investment in working capital, there is not a corresponding increase in its expected returns. As a result the firm’s return on investment drops because the profit is unchanged while the investment in current assets increases.

In addition to the above, the firm’s use of current liability versus long-term debt also involves a risk-return trade-off. Other things being equal, the greater the firm’s reliance is on the short-term debts or current liability in financing its current investment, the greater the risk of illiquidity. On the other hand, the use of current liability can be advantageous as it is less costly and is a flexible means of financing. A firm can reduce its risk of illiquidity through the use of long-term debts at the cost of reduction in its return on investment. The risk-return trade-off thus involves an increased risk of illiquidity and profitability.

So, there exists a trade-off between profitability and liquidity or a trade-off between risk (liquidity) and return (profitability) with reference to working capital. The risk in this context is measured by the profitability that the firm will become technically insolvent by not paying current liability as they occur; and profitability here means the reduction of cost of maintaining current assets. The greater the amount of liquid assets a firm has, the less risky the firm is. In other words, the more liquid is the firm, the less likely it is to become insolvent. Conversely, lower levels of liquidity are associated with increasing levels of risk. So, the relationship of working capital, liquidity and risk of the firm is

From the above discussion, it is clear that, in order to increase the profitability, the firm reduces the current assets (and thereby increases fixed assets). Consequently, the profitability of the firm will increase but the liquidity will be reduced. The firm is now exposed to a greater risk of insolvency. The risk return syndrome can be summed up as follows: when liquidity increases, the risk of insolvency is reduced. However, when the liquidity is reduced, the profitability increases but the risks of insolvency also increase. So, profitability and risk move in the same direction. What is required on the part of the financial manager is to maintain a balance between risk and profitability. Neither too much of risk nor too much of profitability is good. This can be explained by means of the balance sheet of PQR Ltd.

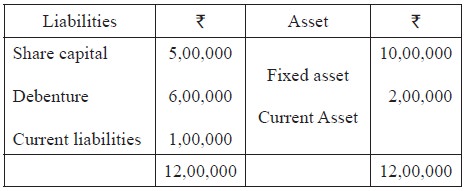

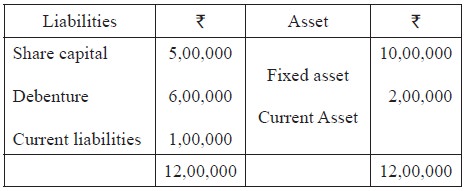

The following is the balance sheet of PQR Ltd. as on 31st Dec 2006:

The firm is earning 10% return on fixed assets and 2% return on current asset. Find out the effect on liquidity and profitability of the firm for the following:

1. Increase in current asset by 25%.

2. Decrease in current asset by 25%

Solution

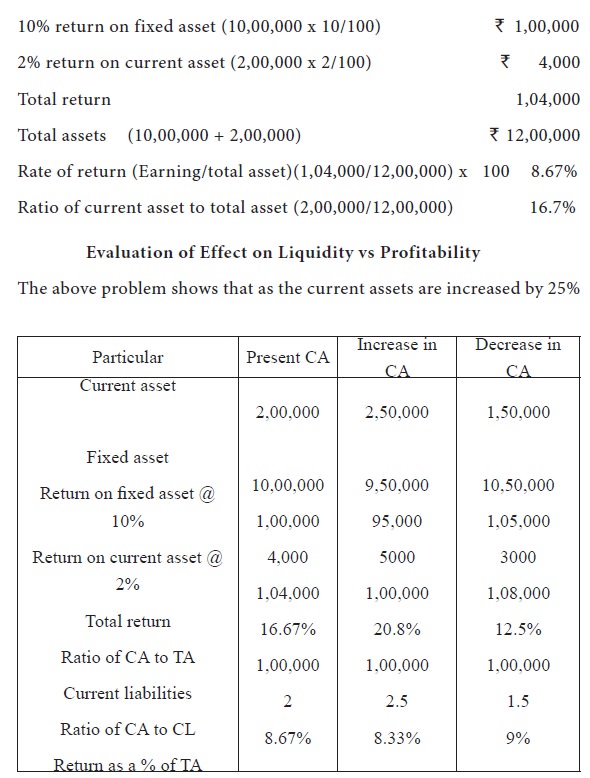

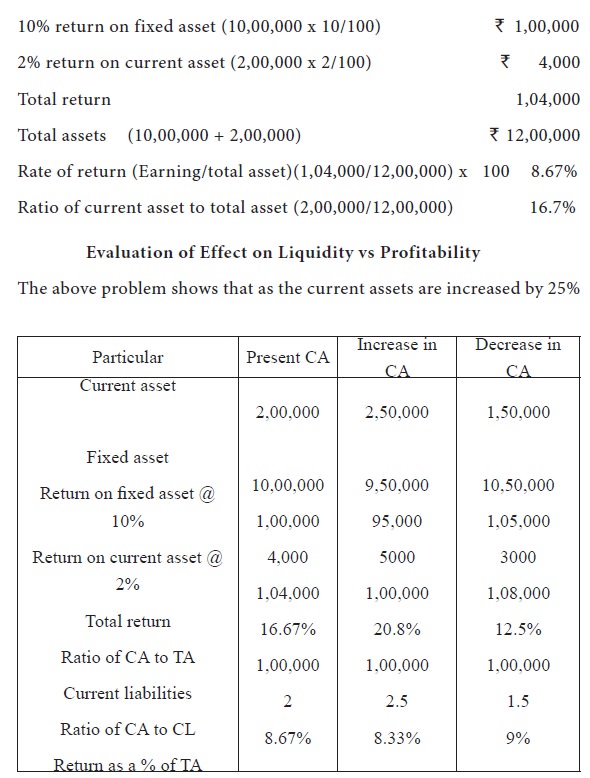

The present earning of the firm may be ascertained as follows:

(from ` 2,00,000 to Rs 2,50,000), the ratio of current asset to total asset also increase from 16.7% to 20.8%. The ratio of current asset to current liabilities also increases from 2 to 2.5 times indicating lesser risk of insolvency. However, with this increase, the overall earning of the firm has reduced from ` 1,04,000 to ` 1,00,000 or from 8.67% to 8.33% of the total assets. Thus, if the firm opts to increase the current assets in order to increase the liquidity, the profitability of the firm also goes down.

In case, the firm opts to reduce the level of current assets by 25% from ` 2,00,000 to ` 1,50,000, the ratio of current asset to total asset will go down from 16.7% to 12.5% and the ratio of current asset to current

Thus the problem shows that liquidity and return are opposite forces and the financial manager will have to find out a level of current asset where the risk as well as the return, both optimum. The firm just cannot decrease the current asset to increase the profitability because it will result in increase of risk also. The firm should maintain the current asset at such a level at which both the risk and profitability are optimum.

An important aspect of a working capital policy is to maintain and provide sufficient liquidity to the firm. Like most corporate financing decisions, the decision on how much working capital should be maintained involves a trade-off. Having a large net working capital may reduce the liquidity-risk faced by the firm, but it can have a negative

The risk-return trade-off involved in managing the firm’s working capital is a trade-off between the firm’s liquidity and its profitability. By maintaining a large investment in current assets like cash, inventory etc., the firm reduces the chance of (1) production stoppages and the loss from sales due to inventory shortage and (2) the inability to pay the creditors on time. However, as the firm increases its investment in working capital, there is not a corresponding increase in its expected returns. As a result the firm’s return on investment drops because the profit is unchanged while the investment in current assets increases.

In addition to the above, the firm’s use of current liability versus long-term debt also involves a risk-return trade-off. Other things being equal, the greater the firm’s reliance is on the short-term debts or current liability in financing its current investment, the greater the risk of illiquidity. On the other hand, the use of current liability can be advantageous as it is less costly and is a flexible means of financing. A firm can reduce its risk of illiquidity through the use of long-term debts at the cost of reduction in its return on investment. The risk-return trade-off thus involves an increased risk of illiquidity and profitability.

So, there exists a trade-off between profitability and liquidity or a trade-off between risk (liquidity) and return (profitability) with reference to working capital. The risk in this context is measured by the profitability that the firm will become technically insolvent by not paying current liability as they occur; and profitability here means the reduction of cost of maintaining current assets. The greater the amount of liquid assets a firm has, the less risky the firm is. In other words, the more liquid is the firm, the less likely it is to become insolvent. Conversely, lower levels of liquidity are associated with increasing levels of risk. So, the relationship of working capital, liquidity and risk of the firm is

From the above discussion, it is clear that, in order to increase the profitability, the firm reduces the current assets (and thereby increases fixed assets). Consequently, the profitability of the firm will increase but the liquidity will be reduced. The firm is now exposed to a greater risk of insolvency. The risk return syndrome can be summed up as follows: when liquidity increases, the risk of insolvency is reduced. However, when the liquidity is reduced, the profitability increases but the risks of insolvency also increase. So, profitability and risk move in the same direction. What is required on the part of the financial manager is to maintain a balance between risk and profitability. Neither too much of risk nor too much of profitability is good. This can be explained by means of the balance sheet of PQR Ltd.

The following is the balance sheet of PQR Ltd. as on 31st Dec 2006:

The firm is earning 10% return on fixed assets and 2% return on current asset. Find out the effect on liquidity and profitability of the firm for the following:

1. Increase in current asset by 25%.

2. Decrease in current asset by 25%

Solution

The present earning of the firm may be ascertained as follows:

(from ` 2,00,000 to Rs 2,50,000), the ratio of current asset to total asset also increase from 16.7% to 20.8%. The ratio of current asset to current liabilities also increases from 2 to 2.5 times indicating lesser risk of insolvency. However, with this increase, the overall earning of the firm has reduced from ` 1,04,000 to ` 1,00,000 or from 8.67% to 8.33% of the total assets. Thus, if the firm opts to increase the current assets in order to increase the liquidity, the profitability of the firm also goes down.

In case, the firm opts to reduce the level of current assets by 25% from ` 2,00,000 to ` 1,50,000, the ratio of current asset to total asset will go down from 16.7% to 12.5% and the ratio of current asset to current

Thus the problem shows that liquidity and return are opposite forces and the financial manager will have to find out a level of current asset where the risk as well as the return, both optimum. The firm just cannot decrease the current asset to increase the profitability because it will result in increase of risk also. The firm should maintain the current asset at such a level at which both the risk and profitability are optimum.

Tags : Financial Management - WORKING CAPITAL MANAGEMENT

Last 30 days 8554 views