Home | ARTS | Financial Management

|

Financing of working capital Short-term Vs long-term financing -

Financial Management - WORKING CAPITAL MANAGEMENT

Financing of working capital Short-term Vs long-term financing -

Posted On :

A firm should decide whether or not it should use short-term financing.

Dimension 3 : Financing of working capital Short-term Vs long-term financing

A firm should decide whether or not it should use short-term financing. If short-term financing has to be used, the firm must determine its portion in total financing. This decision of the firm will be guided by the risk-return trade-off. Short-term financing may be preferred over long-term financing for two reasons: (1) the cost advantage and flexibility. But short-term financing is more risky than long-term financing.

The cost of financing has an impact on the firm’s return. As short-term financing costs less, the return would be relatively higher. Long-term financing not only involves higher cost, but also makes the rate of return on equity lesser. Thus, short-term financing is desirable from the point of view of return

It is relatively easy to refund short-term funds when the need for funds diminishes. Long-term funds such as debenture loan or preference capital cannot be refunded before time. Thus, if a firm anticipates that its requirement for funds will diminish in near future, it would choose to short-term funds because of this flexibility.

The short-term financing involves lesser cost. But it is more risky than long-term financing. If the firm uses short-term financing to finance its current asset, it runs the risk of renewing the borrowing again and again. This is particularly so in the case of the permanent current assets. As discussed earlier, permanent current assets refer to the minimum level of current assets, which a firm should always maintain. If the firm finances its permanent current assets with short-term debt, it will have to raise new short-term funds, as the debt matures. This

Thus, there is a conflict between long-term and short-term financing. Short-term financing is less expensive than long-term financing, but at the same time, short-term financing involves greater risk than long-term financing. The choice between long-term and short-term financing involves a trade-off between risk and return. This trade-off may be further explained with the help of an example.

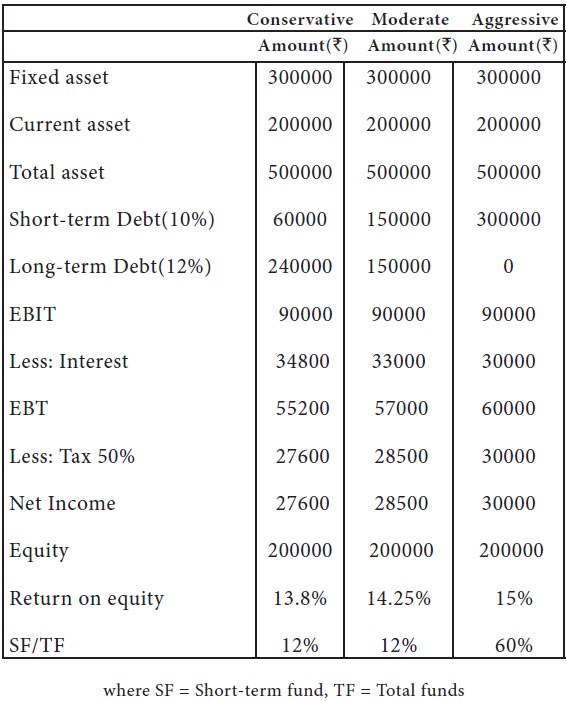

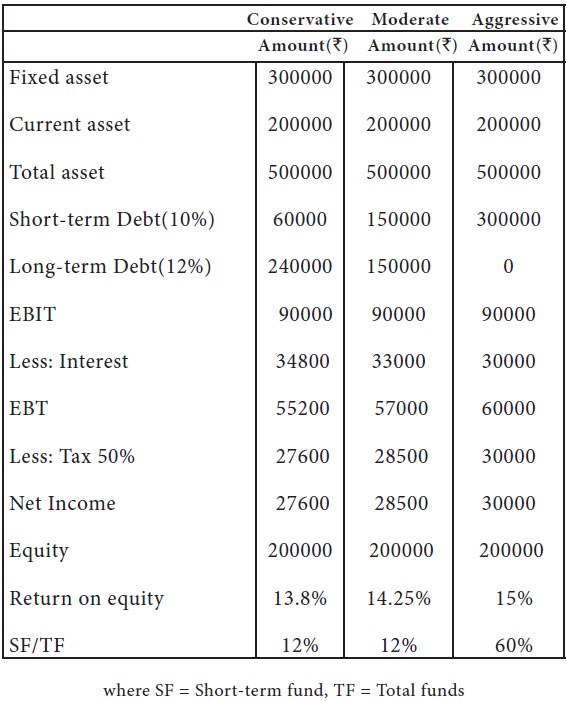

Suppose that a firm has an investment of Rs. 5 lakhs in its assets, Rs 3 lakhs invested in fixed assets and Rs. 2 lakhs in current asset. It is expected that assets yield a return of 18% before interest and taxes. Tax rate is assumed to be 50%. The firm maintains a debt ratio of 60%. Thus, the firm’s assets are financed by 40% equity that is Rs 2,00,000 equity funds are invested in its total assets. The firm has to decide whether it should use a 10% short-term debt or 12% long-term debt. The financing plans would affect the return on equity funds differently. The calculations of return on equity are shown in the following table.

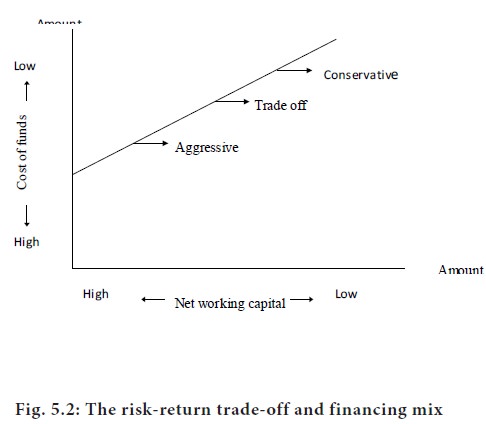

It is clear from the table that return on equity is highest under the aggressive plan and lowest under the conservative plan. The result of moderate plan is in between these two extremes. However, aggressive plan is more risky as, short-term financing as a ratio of total financing, is maximum in this case. The short-term financing to total financing ratio is minimum in case of the conservative plan and, therefore, it is less risky.

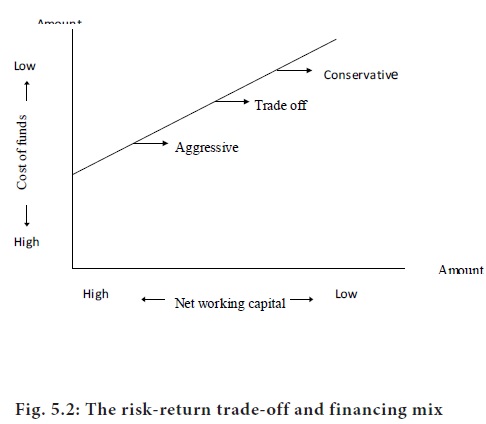

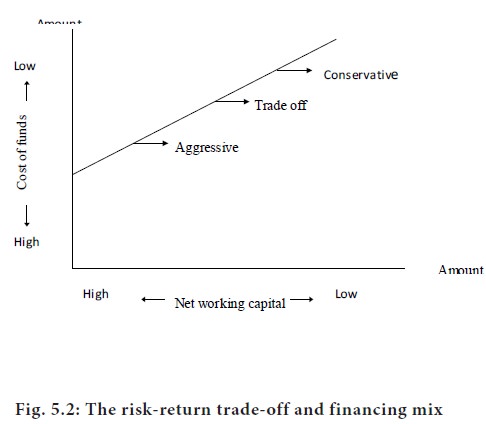

The figure 5.2 shows that the aggressive approach results in a low cost - high risk situation while the conservative approach results in a high cost-low risk situation. The trade-off between risk and return give a financing mix that lies between these two extremes. For this purpose, the risk and return associated with different financing mix can be analyzed and accordingly a decision can be taken up. One way of achieving a

Then this average working capital may be financed by

long-term sources and other requirement if any, arising from time to time may

be met from short-term sources. For example, a firm may require a minimum and

maximum working capital of `

25,000 and `

35,000 respectively during a particular year. The firms have long-term sources

of `

30,000 (i.e. average of `

25,000 and `

35,000) and additional requirement over and above ` 30,000 may out of

short-term sources as and when the need arises.

A firm should decide whether or not it should use short-term financing. If short-term financing has to be used, the firm must determine its portion in total financing. This decision of the firm will be guided by the risk-return trade-off. Short-term financing may be preferred over long-term financing for two reasons: (1) the cost advantage and flexibility. But short-term financing is more risky than long-term financing.

Cost of financing

The cost of financing has an impact on the firm’s return. As short-term financing costs less, the return would be relatively higher. Long-term financing not only involves higher cost, but also makes the rate of return on equity lesser. Thus, short-term financing is desirable from the point of view of return

Flexibility

It is relatively easy to refund short-term funds when the need for funds diminishes. Long-term funds such as debenture loan or preference capital cannot be refunded before time. Thus, if a firm anticipates that its requirement for funds will diminish in near future, it would choose to short-term funds because of this flexibility.

Risk of financing with short term sources

The short-term financing involves lesser cost. But it is more risky than long-term financing. If the firm uses short-term financing to finance its current asset, it runs the risk of renewing the borrowing again and again. This is particularly so in the case of the permanent current assets. As discussed earlier, permanent current assets refer to the minimum level of current assets, which a firm should always maintain. If the firm finances its permanent current assets with short-term debt, it will have to raise new short-term funds, as the debt matures. This

Thus, there is a conflict between long-term and short-term financing. Short-term financing is less expensive than long-term financing, but at the same time, short-term financing involves greater risk than long-term financing. The choice between long-term and short-term financing involves a trade-off between risk and return. This trade-off may be further explained with the help of an example.

Suppose that a firm has an investment of Rs. 5 lakhs in its assets, Rs 3 lakhs invested in fixed assets and Rs. 2 lakhs in current asset. It is expected that assets yield a return of 18% before interest and taxes. Tax rate is assumed to be 50%. The firm maintains a debt ratio of 60%. Thus, the firm’s assets are financed by 40% equity that is Rs 2,00,000 equity funds are invested in its total assets. The firm has to decide whether it should use a 10% short-term debt or 12% long-term debt. The financing plans would affect the return on equity funds differently. The calculations of return on equity are shown in the following table.

Financing plans

It is clear from the table that return on equity is highest under the aggressive plan and lowest under the conservative plan. The result of moderate plan is in between these two extremes. However, aggressive plan is more risky as, short-term financing as a ratio of total financing, is maximum in this case. The short-term financing to total financing ratio is minimum in case of the conservative plan and, therefore, it is less risky.

The figure 5.2 shows that the aggressive approach results in a low cost - high risk situation while the conservative approach results in a high cost-low risk situation. The trade-off between risk and return give a financing mix that lies between these two extremes. For this purpose, the risk and return associated with different financing mix can be analyzed and accordingly a decision can be taken up. One way of achieving a

Tags : Financial Management - WORKING CAPITAL MANAGEMENT

Last 30 days 741 views