Financial Management - Finance – An Introduction

Nature of Financial Management

Posted On :

Financial management is applicable to every type of organization, irrespective of the size, kind or nature. Every organization aims to utilize its resources in a best possible and profitable way.

Nature of Financial

Management

Financial management is applicable to every type of organization, irrespective of the size, kind or nature. Every organization aims to utilize its resources in a best possible and profitable way.

i) Financial Management is an integral part of overall management. Financial considerations are involved in all business decisions. Acquisition, maintenance, removal or replacement of assets, employee compensation, sources and costs of different capital, production, marketing, finance and personnel decision, almost all decisions for that matter have financial implications. Therefore, financial management is pervasive throughout the organisation.

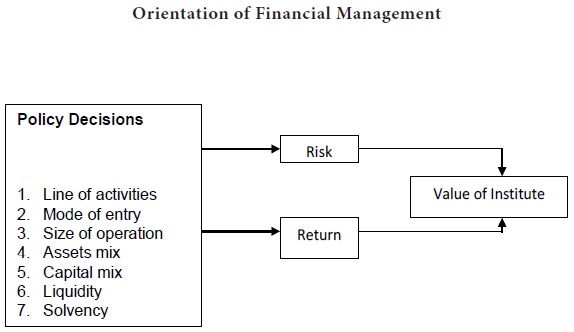

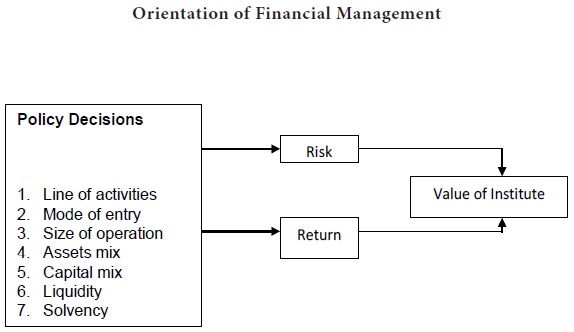

ii) The central focus of financial management is valuation of the firm. Financial decisions are directed at increasing/ maximization/ optimizing the value of the institution. Weston and Brigham depict the above orientation in the exhibit given below:

iii) Financial management essentially involves risk-return trade-off. Decisions on investment involve choosing of types of assets which generate returns accompanied by risks. Generally higher the risk returns might be higher and vice versa. So, the financial manager has to decide the level of risk the firm can assume and satisfy with the accompanying return. Similarly, cheaper sources of capital have other disadvantages. So to avail the benefit of the low cost funds, the firm has to put up with certain risks, so, risk-return trade-off is there throughout.

iv) Financial management affects the survival, growth and vitality of the institution. Finance is said to be the life blood of institutions. The amount, type, sources, conditions and cost of finance squarely influence the functioning of the institution.

v) Finance functions, i.e., investment, raising of capital, distribution of profit, are performed in all firms - business or non-business, big or small, proprietary or corporate undertakings. Yes, financial management is a concern of every concern including educational institutions.

vii) Financial management of an institution is influenced by the external legal and economic environment. The legal constraints on using a particular type of funds or on investing in a particular type of activity, etc., affect financial decisions of the institution. Financial management is, therefore, highly influenced/constrained by external environment.

viii) Financial management is related to other disciplines like accounting, economics, taxation, operations research, mathematics, statistics etc., It draws heavily from these disciplines.

ix) There are some procedural finance functions - like record keeping, credit appraisal and collection, inventory replenishment and issue, etc. It is normally delegated to bottom level management executives.

Financial management is applicable to every type of organization, irrespective of the size, kind or nature. Every organization aims to utilize its resources in a best possible and profitable way.

i) Financial Management is an integral part of overall management. Financial considerations are involved in all business decisions. Acquisition, maintenance, removal or replacement of assets, employee compensation, sources and costs of different capital, production, marketing, finance and personnel decision, almost all decisions for that matter have financial implications. Therefore, financial management is pervasive throughout the organisation.

ii) The central focus of financial management is valuation of the firm. Financial decisions are directed at increasing/ maximization/ optimizing the value of the institution. Weston and Brigham depict the above orientation in the exhibit given below:

iii) Financial management essentially involves risk-return trade-off. Decisions on investment involve choosing of types of assets which generate returns accompanied by risks. Generally higher the risk returns might be higher and vice versa. So, the financial manager has to decide the level of risk the firm can assume and satisfy with the accompanying return. Similarly, cheaper sources of capital have other disadvantages. So to avail the benefit of the low cost funds, the firm has to put up with certain risks, so, risk-return trade-off is there throughout.

iv) Financial management affects the survival, growth and vitality of the institution. Finance is said to be the life blood of institutions. The amount, type, sources, conditions and cost of finance squarely influence the functioning of the institution.

v) Finance functions, i.e., investment, raising of capital, distribution of profit, are performed in all firms - business or non-business, big or small, proprietary or corporate undertakings. Yes, financial management is a concern of every concern including educational institutions.

vi) Financial management is a sub-system of the institutional system which

has other subsystems like academic activities, research wing, etc, In systems

arrangement financial sub-system is to be well-coordinated with others and

other sub-systems well matched with the financial sub-system.

vii) Financial management of an institution is influenced by the external legal and economic environment. The legal constraints on using a particular type of funds or on investing in a particular type of activity, etc., affect financial decisions of the institution. Financial management is, therefore, highly influenced/constrained by external environment.

viii) Financial management is related to other disciplines like accounting, economics, taxation, operations research, mathematics, statistics etc., It draws heavily from these disciplines.

ix) There are some procedural finance functions - like record keeping, credit appraisal and collection, inventory replenishment and issue, etc. It is normally delegated to bottom level management executives.

x) The nature of finance function is influenced by the special

characteristic of the business. In a predominantly technology oriented

institutions like CSIR, CECRI, it is the R & D functions which get more

dominance, while in a university or college the different courses offered and

research which get more priority and so on.

Tags : Financial Management - Finance – An Introduction

Last 30 days 1477 views