Home | ARTS | Financial Management

|

Techniques of Investment Appraisal - Evaluation Of Capital Projects

Financial Management - Capital Budgeting – A Conceptual Framework

Techniques of Investment Appraisal - Evaluation Of Capital Projects

Posted On :

This method is popularly known as pay off, pay-out, recoupment period method also.

Techniques

of Investment Appraisal

Discounted Cash Flow (DCF) Criteria

1. Net present value (NPV)

2. Internal rate of return (IRR)

3. Profitability index (PI)

Non-discounted Cash Flow Criteria

1. Pay-back period

2. Discounted payback period

3. Accounting rate of return (ARR).

This method is popularly known as pay off, pay-out, recoupment period method also. It gives the number of years in which the total investment in a particular capital expenditure pays back itself. This method is based on the principle that every capital expenditure pays itself back over a number of years. It means that it generates income within a certain period. When the total earnings (or net cash-inflow] from investment equals the total outlay, that period is the payback period of the capital investment. An investment project is adopted so long as it pays for itself within a specified period of time — says 5 years or less. This standard of recoupment period is settled by the management taking into account a number of considerations. While there is a comparison between two or more projects, the lesser the number of payback years, the project will be acceptable.

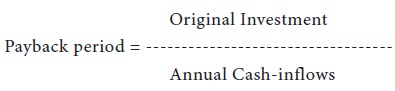

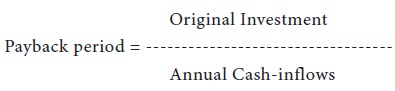

The formula for the payback period calculation is simple. First of all, net-cash-inflow is determined. Then we divide the initial cost (or any value we wish to recover) by the annual cash-inflows and the resulting quotient is the payback period. As per formula:

If the annual cash-inflows are uneven, then the calculation of payback period takes a cumulative form. We accumulate the annual cash-inflows till the recovery of investment and as soon as this amount is recovered, it is the expected number of payback period years. An asset or capital expenditure outlay that pays back itself early comparatively is to be preferred.

The payback period method for choosing among alternative projects is very popular among corporate managers and according to Quirin even among Soviet planners who call it as the recoupment period method. In U.S.A and U.K. this method is widely accepted to discuss the profitability of foreign investment. Following are some of the advantages of pay back method:

1. It is easy to understand, compute and communicate to others. Its quick computation makes it a favorite among executive who prefer snap answers.

2. It gives importance to the speedy recovery of investment in capital assets. So it is useful technique in industries where technical developments are in full swing necessitating the replacements at an early date.

3. It is an adequate measure for firms with very profitable internal investment opportunities, whose sources of funds are limited by internal low availability and external high costs.

4. It is useful for approximating the value of risky investments whose rate of capital wastage (economic depreciation and obsolescence rate) is hard to predict. Since the payback period method weights only return heavily and ignores distant returns it contains a built-in hedge against the possibility of limited economic life.

5. When the payback period is set at a large “number of years and incomes streams are uniform each year, the payback criterion is a good approximation to the reciprocal of the internal rate of discount.

This method has its own limitations and disadvantages despite its simplicity and rapidity. Here are a number of demerits and disadvantages claimed by its opponents:-

1. It treats each asset individually in isolation with the other assets, while assets in practice can not be treated in isolation.

2. The method is delicate and rigid. A slight change in the division of labour and cost of maintenance will affect the earnings and such may also affect the payback period.

3. It overplays the importance of liquidity as a goal of the capital expenditure decisions. While no firm can ignore its liquidity requirements but there are more direct and less costly means of safeguarding liquidity levels. The overlooking of profitability and over stressing the liquidity of funds can in no way be justified.

4. It ignores capital wastage and economic life by restricting consideration to the projects’ gross earnings.

5. It ignores the earning beyond the payback period while in many cases these earnings are substantial. This is true particularly in respect of research and welfare projects.

6. It overlooks the cost of capital which is the main basis of sound investment decisions.

In perspective, the universality of the payback criterion as a reliable index of profitability is questionable. It violates the first principle of rational investor behaviour-namely that large returns are preferred to smaller ones. However, it can be applied in assessing the profitability of short and medium term capital expenditure projects.

It is also known as Accounting Rate of Return Method / Financial Statement Method/ Unadjusted Rate of Return Method also. According to this method, capital projects are ranked in order of earnings. Projects which yield the highest earnings are selected and others are ruled out. The return on investment method can be expressed in several ways a follows:

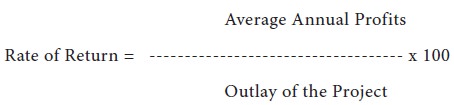

Under this method we calculate the average annual profit and then we divide it by the total outlay of capital project. Thus, this method establishes the ratio between the average annual profits and total outlay of the projects.

As per formula,

Thus, the average rate of return method considers whole earnings over the entire economic life of an asset. Higher the percentage of return, the project will be acceptable.

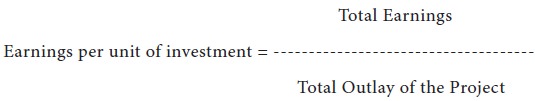

As per this method, we find out the total net earnings and then divide it by the total investment. This gives us the average rate of return per unit of amount (i.e. per rupee) invested in the project. As per formula:

The higher the earnings per unit, the project deserves to be selected.

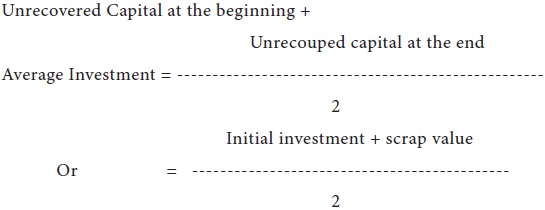

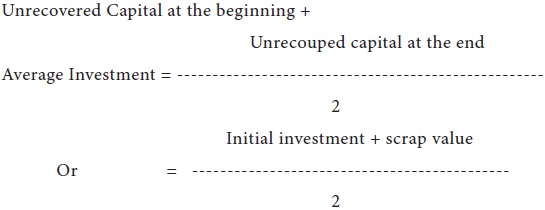

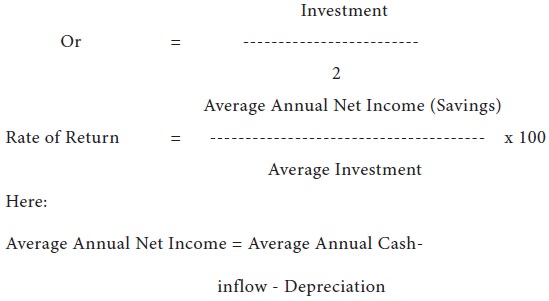

Under this method the percentage return on average amount of investment is calculated. To calculate the average investment the outlay of the projects is divided by two. As per formula:

Thus, we see that the rate of return approach can be applied in various ways. But, however, in our opinion the third approach is more reasonable and consistent.

2. It takes into consideration the total earnings from the project during its entire economic life.

3. This approach gives due weight to the profitability of the project.

4. In investment with extremely long lives, the simple rate of return will be fairly close to the true rate of return. It is often used by financial analysis to measure current performance of a firm.

1. One apparent disadvantage of this approach is that its results by different methods are inconsistent.

2. It is simply an averaging technique which does not take into account the various impacts of external factors on over-all profits of the firm.

3. This method also ignores the time factor which is very crucial in business decision.

4. This method does not determine the fair rate of return on investments. It is left to the discretion of the management.

Discounted Cash Flow (DCF) Criteria

1. Net present value (NPV)

2. Internal rate of return (IRR)

3. Profitability index (PI)

Non-discounted Cash Flow Criteria

1. Pay-back period

2. Discounted payback period

3. Accounting rate of return (ARR).

Non-discounted Cash Flow Criteria

Payback period Method

This method is popularly known as pay off, pay-out, recoupment period method also. It gives the number of years in which the total investment in a particular capital expenditure pays back itself. This method is based on the principle that every capital expenditure pays itself back over a number of years. It means that it generates income within a certain period. When the total earnings (or net cash-inflow] from investment equals the total outlay, that period is the payback period of the capital investment. An investment project is adopted so long as it pays for itself within a specified period of time — says 5 years or less. This standard of recoupment period is settled by the management taking into account a number of considerations. While there is a comparison between two or more projects, the lesser the number of payback years, the project will be acceptable.

The formula for the payback period calculation is simple. First of all, net-cash-inflow is determined. Then we divide the initial cost (or any value we wish to recover) by the annual cash-inflows and the resulting quotient is the payback period. As per formula:

If the annual cash-inflows are uneven, then the calculation of payback period takes a cumulative form. We accumulate the annual cash-inflows till the recovery of investment and as soon as this amount is recovered, it is the expected number of payback period years. An asset or capital expenditure outlay that pays back itself early comparatively is to be preferred.

Payback Method – Merits

The payback period method for choosing among alternative projects is very popular among corporate managers and according to Quirin even among Soviet planners who call it as the recoupment period method. In U.S.A and U.K. this method is widely accepted to discuss the profitability of foreign investment. Following are some of the advantages of pay back method:

1. It is easy to understand, compute and communicate to others. Its quick computation makes it a favorite among executive who prefer snap answers.

2. It gives importance to the speedy recovery of investment in capital assets. So it is useful technique in industries where technical developments are in full swing necessitating the replacements at an early date.

3. It is an adequate measure for firms with very profitable internal investment opportunities, whose sources of funds are limited by internal low availability and external high costs.

4. It is useful for approximating the value of risky investments whose rate of capital wastage (economic depreciation and obsolescence rate) is hard to predict. Since the payback period method weights only return heavily and ignores distant returns it contains a built-in hedge against the possibility of limited economic life.

5. When the payback period is set at a large “number of years and incomes streams are uniform each year, the payback criterion is a good approximation to the reciprocal of the internal rate of discount.

Payback Method – Demerits

This method has its own limitations and disadvantages despite its simplicity and rapidity. Here are a number of demerits and disadvantages claimed by its opponents:-

1. It treats each asset individually in isolation with the other assets, while assets in practice can not be treated in isolation.

2. The method is delicate and rigid. A slight change in the division of labour and cost of maintenance will affect the earnings and such may also affect the payback period.

3. It overplays the importance of liquidity as a goal of the capital expenditure decisions. While no firm can ignore its liquidity requirements but there are more direct and less costly means of safeguarding liquidity levels. The overlooking of profitability and over stressing the liquidity of funds can in no way be justified.

4. It ignores capital wastage and economic life by restricting consideration to the projects’ gross earnings.

5. It ignores the earning beyond the payback period while in many cases these earnings are substantial. This is true particularly in respect of research and welfare projects.

6. It overlooks the cost of capital which is the main basis of sound investment decisions.

In perspective, the universality of the payback criterion as a reliable index of profitability is questionable. It violates the first principle of rational investor behaviour-namely that large returns are preferred to smaller ones. However, it can be applied in assessing the profitability of short and medium term capital expenditure projects.

Accounting Rate of Return Method

It is also known as Accounting Rate of Return Method / Financial Statement Method/ Unadjusted Rate of Return Method also. According to this method, capital projects are ranked in order of earnings. Projects which yield the highest earnings are selected and others are ruled out. The return on investment method can be expressed in several ways a follows:

(i) Average Rate of Return Method

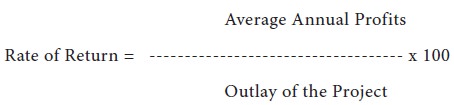

Under this method we calculate the average annual profit and then we divide it by the total outlay of capital project. Thus, this method establishes the ratio between the average annual profits and total outlay of the projects.

As per formula,

Thus, the average rate of return method considers whole earnings over the entire economic life of an asset. Higher the percentage of return, the project will be acceptable.

(ii) Earnings per unit of Money Invested

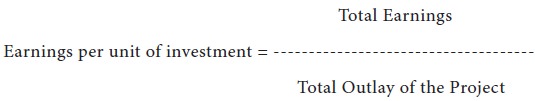

As per this method, we find out the total net earnings and then divide it by the total investment. This gives us the average rate of return per unit of amount (i.e. per rupee) invested in the project. As per formula:

The higher the earnings per unit, the project deserves to be selected.

(iii) Return on Average Amount of Investment Method

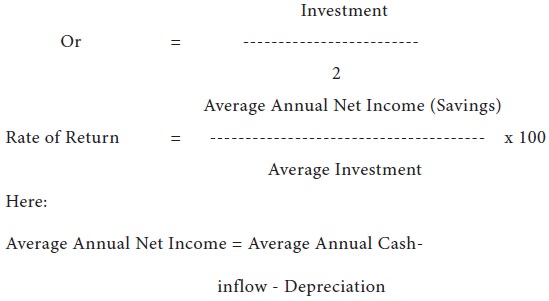

Under this method the percentage return on average amount of investment is calculated. To calculate the average investment the outlay of the projects is divided by two. As per formula:

Thus, we see that the rate of return approach can be applied in various ways. But, however, in our opinion the third approach is more reasonable and consistent.

Accounting Rate of Return Method – Merits

This

approach has the following merits of its own:

1. Like payback method it is also simple and easy to understand.

1. Like payback method it is also simple and easy to understand.

2. It takes into consideration the total earnings from the project during its entire economic life.

3. This approach gives due weight to the profitability of the project.

4. In investment with extremely long lives, the simple rate of return will be fairly close to the true rate of return. It is often used by financial analysis to measure current performance of a firm.

Accounting Rate of Return Method – Demerits

1. One apparent disadvantage of this approach is that its results by different methods are inconsistent.

2. It is simply an averaging technique which does not take into account the various impacts of external factors on over-all profits of the firm.

3. This method also ignores the time factor which is very crucial in business decision.

4. This method does not determine the fair rate of return on investments. It is left to the discretion of the management.

Tags : Financial Management - Capital Budgeting – A Conceptual Framework

Last 30 days 1281 views