Managerial Economics - Cost Analysis

Break Even Analysis - Cost Analysis

Posted On :

Break even analysis helps to identify the level of output and sales volume at which the firm ‘breaks even’.

Break

Even Analysis

Break even analysis helps to identify the level of output and sales volume at which the firm ‘breaks even’. It means the revenues are sufficient to cover all costs of production. Various managerial decisions of firms are taken by the managers based on the break- even point.

It is a study of cost, revenues and sales of a firm and finding out the volume of sales where the firm’s costs and revenues will be equal. There is no profit and no loss. The total revenue is equal to the total cost of production. The amount of money which the firm receives by the sale of its output in the market is known as revenue.

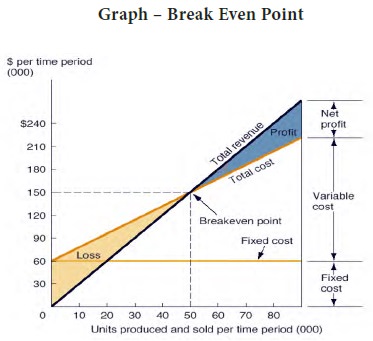

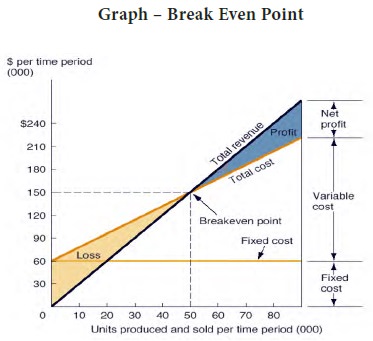

The above graph shows the break- even point of an organization. The total revenue curve (TR) and total cost curve (TC) is given. When they produce 50 units the total cost and total revenue are equal that is $ 150’000 which is at the intersecting point of the curves. Break even point always denotes the quantity produced or sold to equalize the revenue and cost.

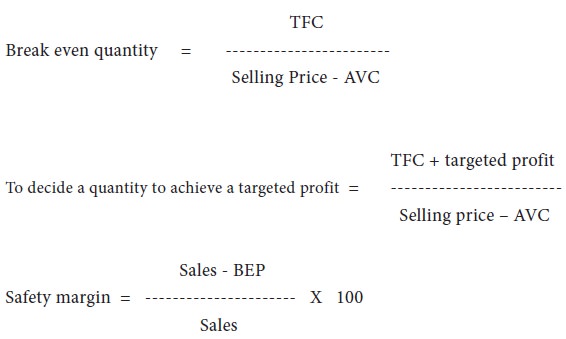

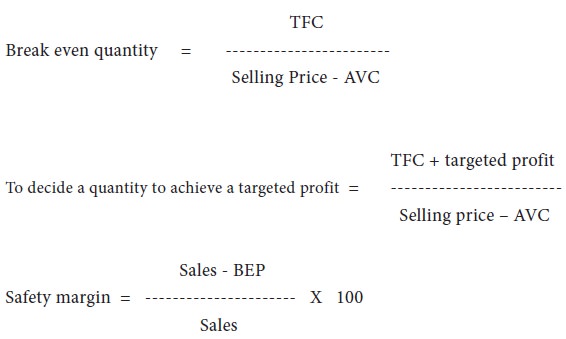

When the firm produces less than 50 units the revenue earned is less than the cost of production (TR<TC) therefore in the initial period the firm incurs loss which is shown in the graph. Through selling more than 50 units the revenue increases more than the cost of production therefore the difference increases and provides profit to the organization (TR>TC). It can be calculated with the help of the following formula.

1. Product planning: it helps the firm in planning its new product development. Decisions regarding removal or addition of new products in their product line.

2. Activity planning: the firm decides the expansion of production capacity.

3. Profit planning: this helps the firm to plan about their profit well in advance and at the same time it helps to identify the quantity to be sold to achieve the targeted profit.

4. Target capacity: the targeted sales quantity helps to decide the purchase, inventory and management.

5. Price and cost decision: Decision regarding how much the price of the commodity should be reduced or increased to cover their cost of production.

6. Safety margin: it helps to understand the extent to which the firm can withstand their fall in sales.

7. Price decision: the selling price can be fixed based on its expected revenue or profit.

8. Promotional decision: the firm can decide the kind of promotion required and how much amount could be spent.

9.

Distribution decision: Break even analysis helps to improve the distribution system and for

business expansion.

10. Dividend decision: firm can decide the dividend to be fixed for their shareholders.

11. Make or buy decision: break even analysis helps to decide on whether to make or buy the product. It means outsourcing or in house production.

We can conclude that the break – even analysis is a useful tool for decision making at various levels of a business firm in the short and long run. Therefore it is an essential tool to be used by the Managers.

Break even analysis helps to identify the level of output and sales volume at which the firm ‘breaks even’. It means the revenues are sufficient to cover all costs of production. Various managerial decisions of firms are taken by the managers based on the break- even point.

It is a study of cost, revenues and sales of a firm and finding out the volume of sales where the firm’s costs and revenues will be equal. There is no profit and no loss. The total revenue is equal to the total cost of production. The amount of money which the firm receives by the sale of its output in the market is known as revenue.

The above graph shows the break- even point of an organization. The total revenue curve (TR) and total cost curve (TC) is given. When they produce 50 units the total cost and total revenue are equal that is $ 150’000 which is at the intersecting point of the curves. Break even point always denotes the quantity produced or sold to equalize the revenue and cost.

When the firm produces less than 50 units the revenue earned is less than the cost of production (TR<TC) therefore in the initial period the firm incurs loss which is shown in the graph. Through selling more than 50 units the revenue increases more than the cost of production therefore the difference increases and provides profit to the organization (TR>TC). It can be calculated with the help of the following formula.

Managerial Uses Of Break-Even Analysis:

1. Product planning: it helps the firm in planning its new product development. Decisions regarding removal or addition of new products in their product line.

2. Activity planning: the firm decides the expansion of production capacity.

3. Profit planning: this helps the firm to plan about their profit well in advance and at the same time it helps to identify the quantity to be sold to achieve the targeted profit.

4. Target capacity: the targeted sales quantity helps to decide the purchase, inventory and management.

5. Price and cost decision: Decision regarding how much the price of the commodity should be reduced or increased to cover their cost of production.

6. Safety margin: it helps to understand the extent to which the firm can withstand their fall in sales.

7. Price decision: the selling price can be fixed based on its expected revenue or profit.

8. Promotional decision: the firm can decide the kind of promotion required and how much amount could be spent.

10. Dividend decision: firm can decide the dividend to be fixed for their shareholders.

11. Make or buy decision: break even analysis helps to decide on whether to make or buy the product. It means outsourcing or in house production.

We can conclude that the break – even analysis is a useful tool for decision making at various levels of a business firm in the short and long run. Therefore it is an essential tool to be used by the Managers.

Tags : Managerial Economics - Cost Analysis

Last 30 days 1217 views